Amidst China’s recent unveiling of robust stimulus measures aimed at invigorating its economy, the Shanghai Composite Index and CSI 300 have experienced significant gains, reflecting a positive shift in market sentiment. In this context, identifying high growth tech stocks with potential for expansion involves looking at companies that can leverage these economic tailwinds to innovate and capture emerging opportunities within the dynamic Chinese market landscape.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi’an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.61% | 31.78% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. focuses on the development and sale of micro-electromechanical systems (MEMS) products in China, with a market cap of CN¥14.04 billion.

Operations: The company specializes in micro-electromechanical systems (MEMS) products, primarily targeting the Chinese market. Revenue streams are derived from the development and sale of these MEMS products.

Sai MicroElectronics, amidst a turbulent market, showcases robust potential with its revenue forecast to surge by 23.5% annually, outpacing the broader Chinese market’s growth of 13.2%. This leap is mirrored in its earnings projections, expected to rocket by 53.4% each year, significantly higher than the market average of 23.2%. However, it’s crucial to note that these figures are influenced by a substantial one-off gain of CN¥111.9M which skews recent financial outcomes. Despite this anomaly and a highly volatile share price recently, Sai’s aggressive R&D spending aligns with its ambitious growth targets, positioning it as a resilient contender in China’s competitive tech landscape.

The company’s commitment to innovation is evident from its considerable investment in research and development—critical for staying ahead in the fast-evolving tech sector. While current financial health shows signs of strain with a net loss reported in the latest half-year results (CN¥42.67M), Sai MicroElectronics’ strategic focus on enhancing technological capabilities may well set the stage for improved future performance as it continues navigating challenges inherent to high-growth environments.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation technology and has a market capitalization of CN¥19.43 billion.

Operations: Huace Navigation generates revenue primarily through its navigation technology solutions. The company’s operations are focused on developing and providing advanced navigation systems, which contribute significantly to its financial performance.

Shanghai Huace Navigation Technology Ltd. has demonstrated a compelling growth trajectory, with revenue surging by 25% annually, significantly outpacing the broader Chinese market’s expansion of 13.2%. This growth is complemented by an earnings increase of 23.9% per year, reflecting robust operational efficiency and market demand. The company’s commitment to innovation is underscored by substantial R&D investments, which are crucial for maintaining competitive advantage in the fast-paced tech sector. Recent half-year results from June 2024 show a notable improvement in net income to CN¥251.24 million from CN¥175.74 million the previous year, indicating effective management and promising future prospects despite intense market competition.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, sale, and marketing of electronic connectors and interconnection system products globally with a market cap of CN¥18.49 billion.

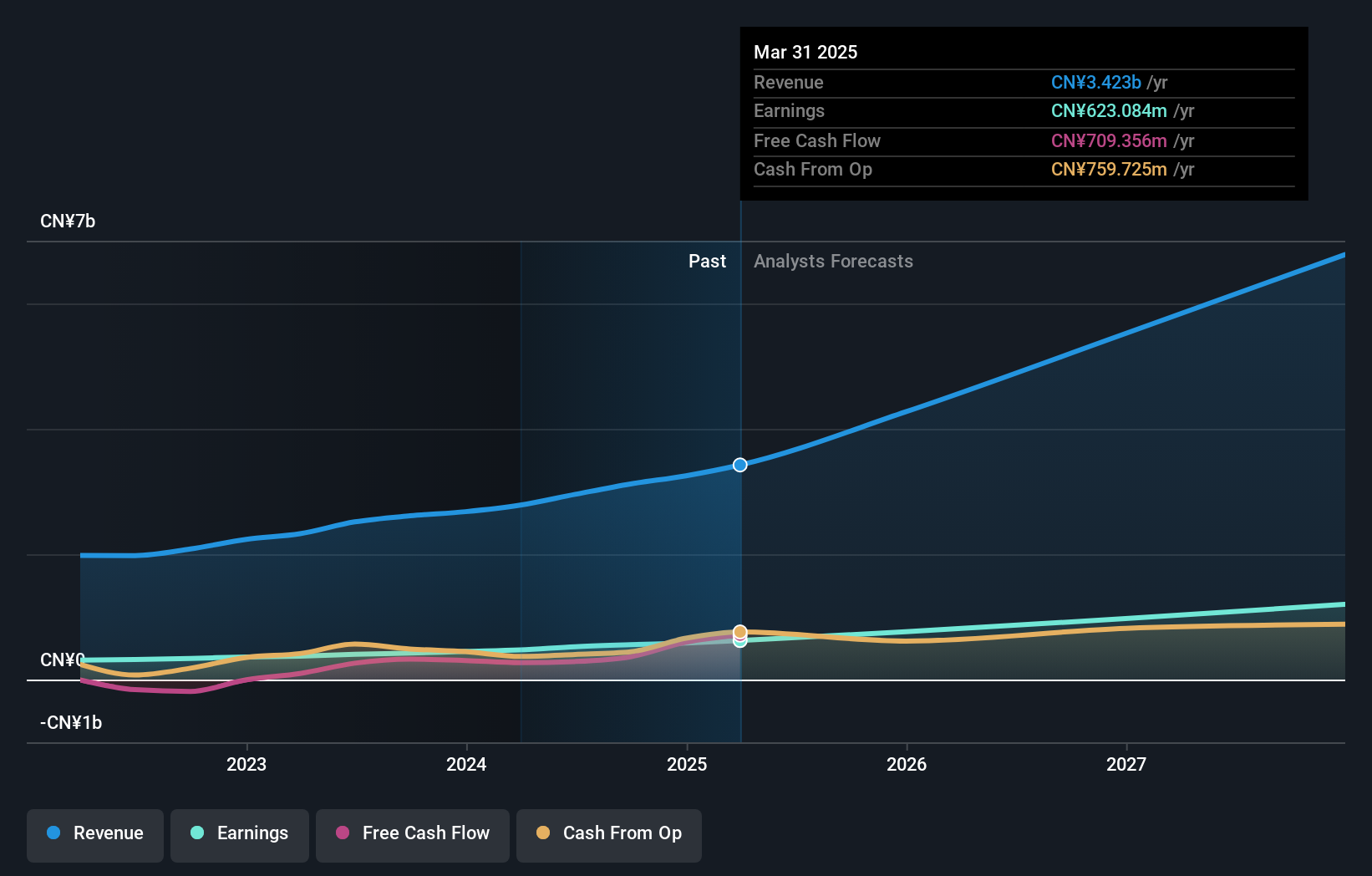

Operations: Electric Connector Technology Co., Ltd. primarily generates revenue from the connector industry, amounting to CN¥3.55 billion. The company focuses on technical research and development in electronic connectors and interconnection systems for a global market.

Electric Connector Technology Co., Ltd. is shaping up as a dynamic contender in China’s tech sector, with recent financials highlighting a substantial uptick in performance. The company reported a remarkable 60% increase in revenue to CN¥2.14 billion and more than doubled its net income to CN¥307.57 million for the first half of 2024, compared to the previous year. These figures are underpinned by aggressive R&D spending aimed at fostering innovation and securing market share, aligning with an industry-wide pivot towards enhanced technological capabilities and efficiency improvements. Moreover, Electric Connector Technology’s strategic adjustments during their latest shareholders meeting suggest proactive governance poised to leverage emerging market opportunities effectively.

Taking Advantage

- Access the full spectrum of 256 Chinese High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com