As global markets navigate economic shifts, Chinese stocks have faced recent declines amid weak inflation data and ongoing concerns about a downward price-wage spiral. Despite these challenges, certain high-growth tech stocks in China continue to attract investor attention due to their potential for innovation and resilience in the face of broader market fluctuations.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi’an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.08% | 31.98% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 32.38% | 31.76% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.63% | 28.58% | ★★★★★★ |

| T&S CommunicationsLtd | 34.68% | 39.62% | ★★★★★★ |

| Eoptolink Technology | 44.39% | 42.88% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. provides smart utility services and IoT solutions in China and internationally, with a market cap of CN¥16.87 billion.

Operations: Willfar Information Technology focuses on delivering smart utility services and IoT solutions both domestically and internationally. The company operates with a market cap of CN¥16.87 billion, generating revenue primarily from its advanced technology offerings in these sectors.

Willfar Information Technology, a prominent player in China’s tech sector, reported a robust 37.1% earnings growth over the past year, significantly outpacing the electronic industry’s -4% decline. The company’s revenue is projected to grow at an impressive 23% annually, surpassing the broader Chinese market’s expected growth of 13.2%. Recent contracts worth RMB 233.43 million and RMB 78.16 million highlight its expanding footprint in smart distribution networks, while R&D expenses have been strategically allocated to drive innovation and maintain competitive advantage.

Simply Wall St Growth Rating: ★★★★☆☆

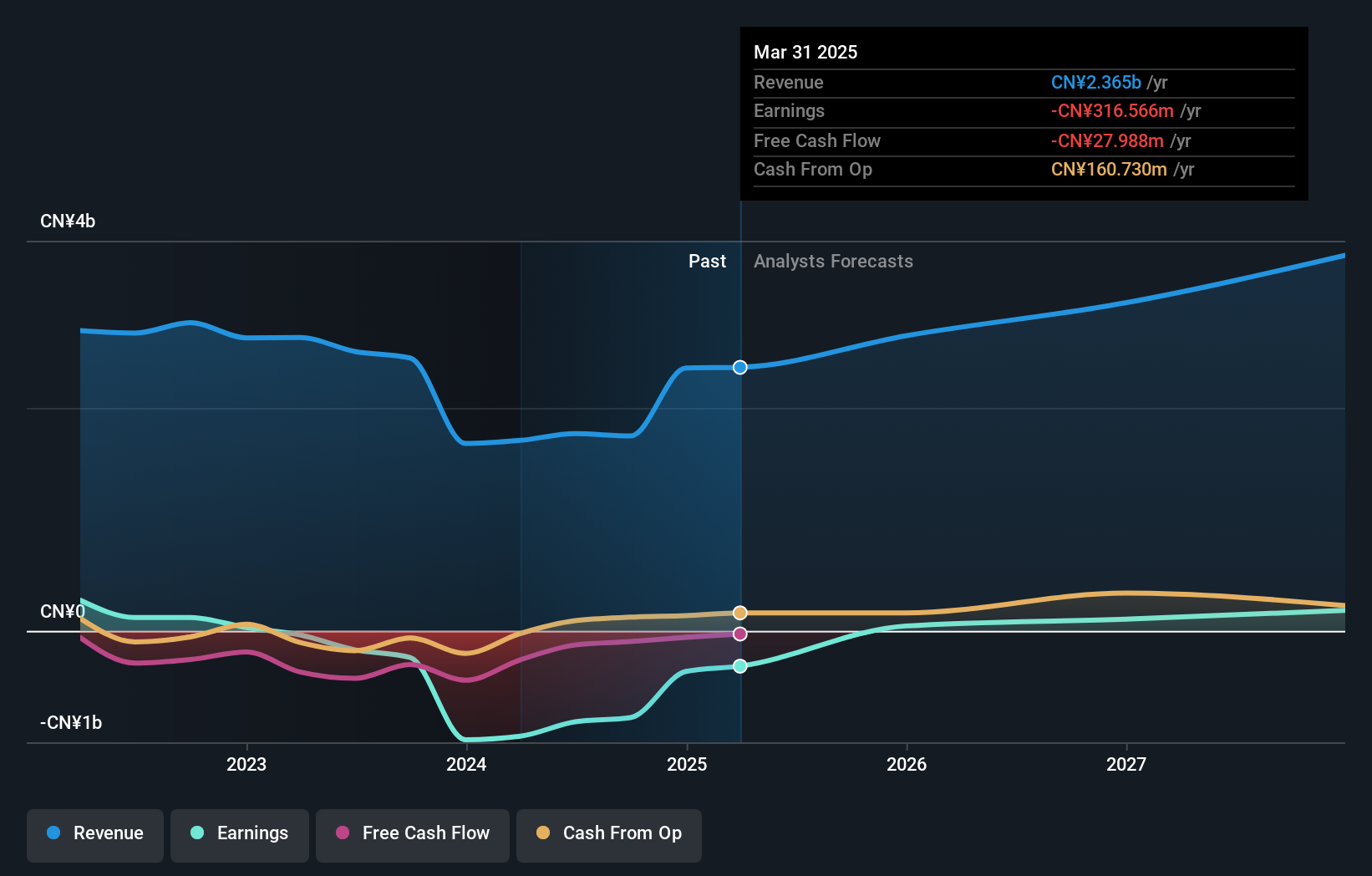

Overview: NSFOCUS Technologies Group Co., Ltd. provides Internet and application security services worldwide and has a market cap of CN¥4.34 billion.

Operations: NSFOCUS Technologies Group derives its revenue primarily from the Information Security Industry, amounting to CN¥1.77 billion. The company focuses on providing specialized Internet and application security services globally.

NSFOCUS Technologies Group has shown notable growth, with revenue increasing to ¥800.27 million from ¥712.05 million year-on-year, reflecting an 18% rise. Despite a net loss of ¥254.64 million for the half-year ending June 30, 2024, the company’s projected annual earnings growth of 130.87% indicates significant potential for future profitability. The company has strategically invested in R&D to drive innovation and maintain competitive advantage in cybersecurity solutions, spending approximately ¥144 million annually on research initiatives.

Simply Wall St Growth Rating: ★★★★☆☆

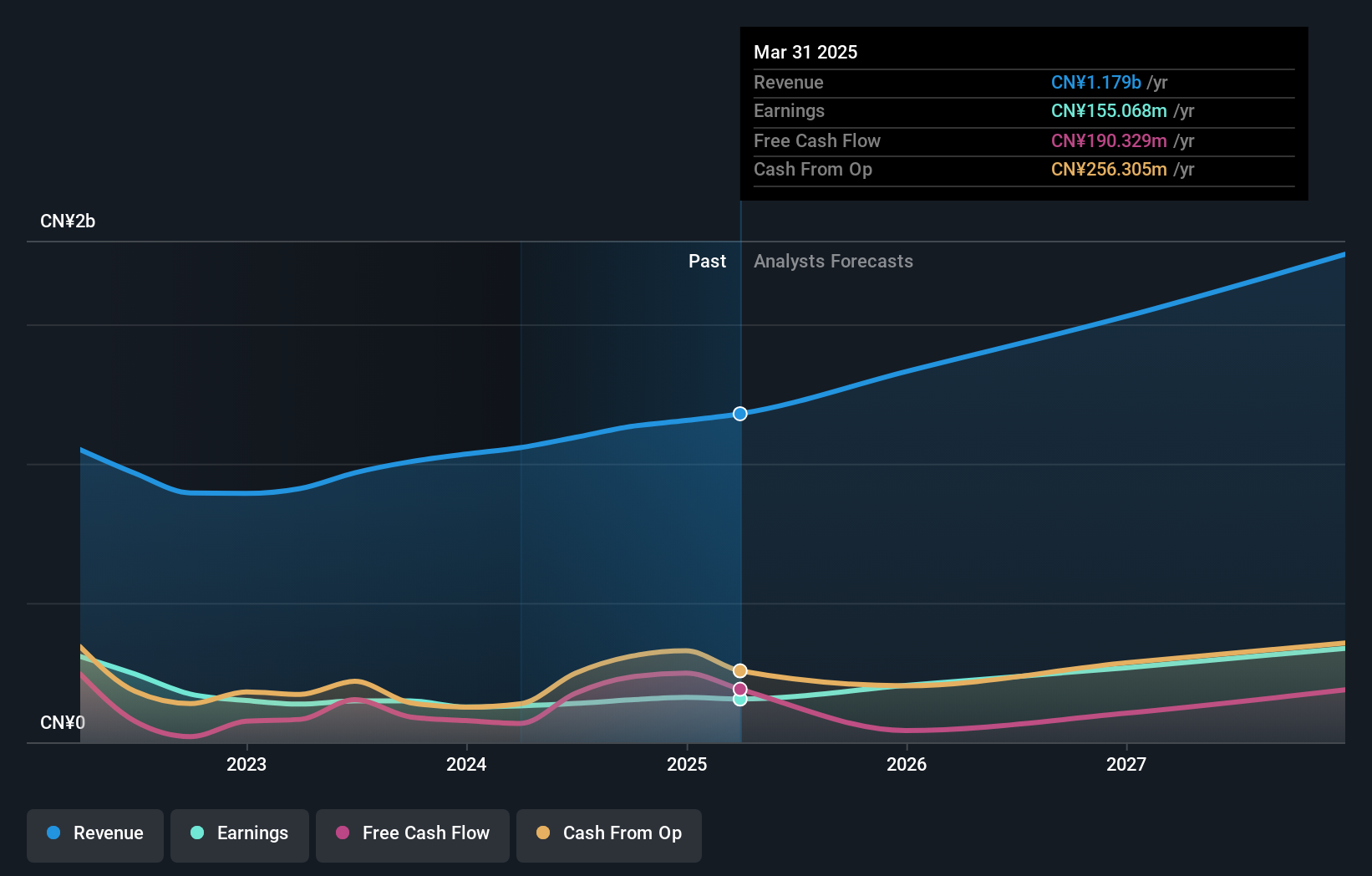

Overview: Hangzhou DPtech Technologies Co., Ltd. focuses on the research and development, production, and sale of network security and application delivery products in China and internationally, with a market cap of CN¥7.85 billion.

Operations: DPtech Technologies specializes in the development, production, and sale of network security and application delivery products. The company operates both domestically in China and internationally.

Hangzhou DPtech Technologies Ltd. reported a half-year revenue increase to ¥502.46 million from ¥442.2 million, reflecting a 13.6% rise, while net income grew 32% to ¥52.06 million. The company’s R&D expenses of approximately ¥94 million annually underscore its commitment to innovation in network security solutions, which is crucial given the increasing complexity of cyber threats globally. With earnings projected to grow at 29.3% annually and revenue expected at 19%, DPtech’s strategic focus on advanced cybersecurity technologies positions it well for future growth in China’s tech sector.

Make It Happen

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Willfar Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com