As global markets witness fluctuations, China’s tech sector remains a focal point, with recent declines in major indices like the Shanghai Composite and CSI 300 reflecting tempered optimism about Beijing’s stimulus measures. In this dynamic environment, identifying high growth tech stocks involves assessing factors such as innovation potential, market adaptability, and resilience in navigating economic shifts.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi’an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.62% | 31.72% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Yanmade Technology Inc. focuses on the research, development, design, production, and sale of automated and intelligent test equipment primarily in China with a market cap of CN¥4.29 billion.

Operations: The company specializes in automated and intelligent test equipment, targeting the Chinese market. Its operations encompass research, development, design, production, and sales.

Shenzhen Yanmade Technology, amidst a challenging market landscape, demonstrated resilience with its recent half-year earnings. Despite a dip in net income from CNY 27.37 million to CNY 24.38 million, the company managed to boost its revenue by approximately 44%, from CNY 120.06 million to CNY 172.89 million year-over-year. This growth is underpinned by an aggressive R&D strategy, where expenses surged significantly to fuel innovations that are expected to propel future revenue streams; this aligns with forecasts predicting a robust annual growth rate of 25.3% in revenue and an even more impressive 40.3% in earnings over the next three years.

The firm’s investment in technology and product development may well position it favorably against competitors despite current profit margin pressures—evidenced by a decrease from last year’s 26.6% to this period’s 17.3%. With such strategic financial management and promising growth projections, Shenzhen Yanmade appears poised for substantial market impact if it continues on its current trajectory of expanding both its technological capabilities and market reach.

Simply Wall St Growth Rating: ★★★★★☆

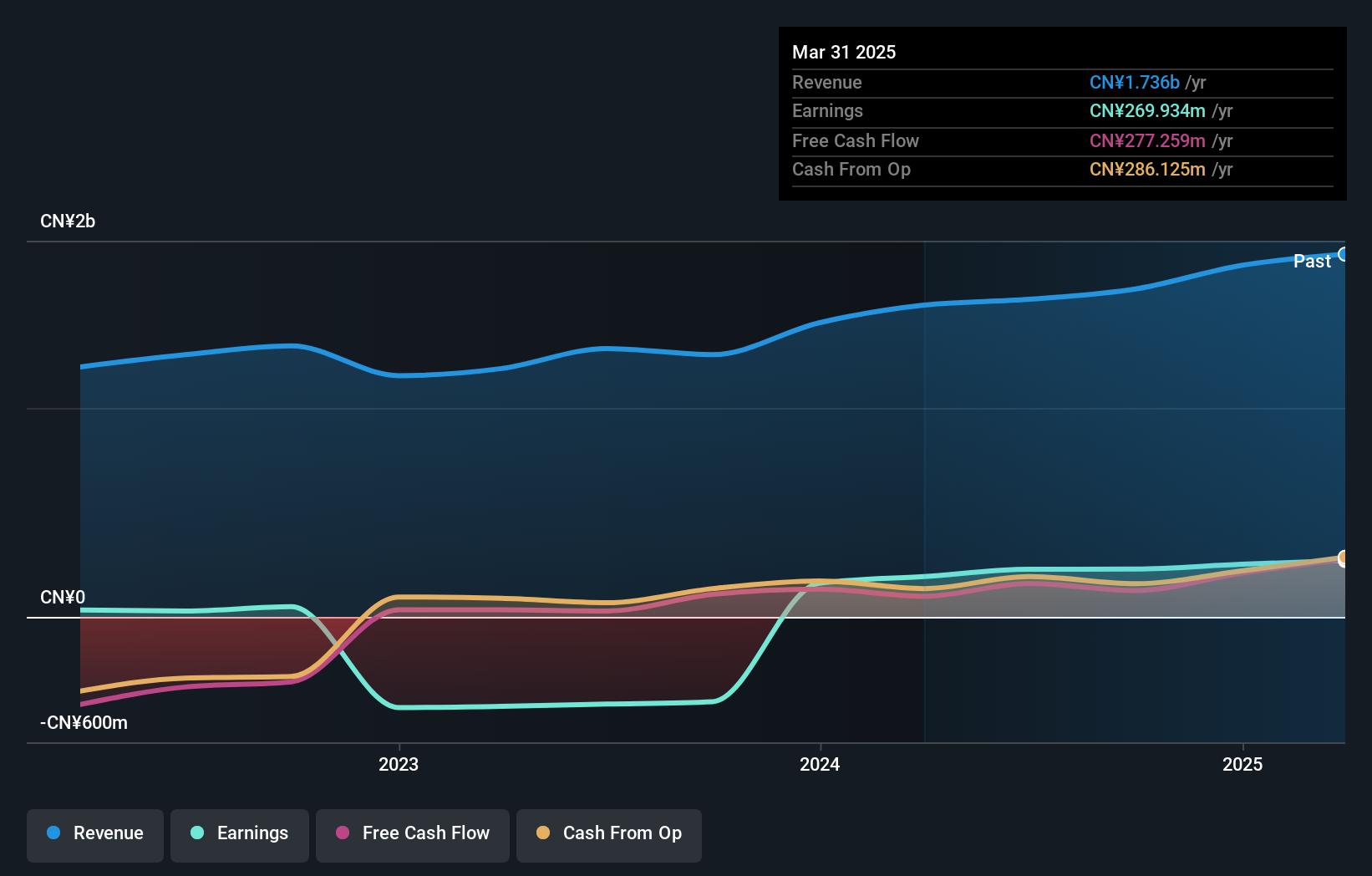

Overview: Nanjing Sciyon Wisdom Technology Group Co., Ltd. operates in the technology sector and has a market cap of CN¥4.91 billion.

Operations: Sciyon Wisdom Technology focuses on providing intelligent automation and information solutions primarily for industrial applications, generating revenue through software and hardware products. The company experiences fluctuations in its net profit margin, reflecting varying operational efficiencies over time.

Nanjing Sciyon Wisdom Technology Group has demonstrated a robust financial trajectory, with its half-year sales soaring to CNY 805.11 million from CNY 692.65 million, marking a significant increase. This growth is complemented by an impressive jump in net income from CNY 43.51 million to CNY 110.33 million, reflecting strong operational efficiency and market acceptance of their offerings. The company’s commitment to innovation is evident in its substantial R&D investments, aligning with the industry’s shift towards high-value software solutions and AI applications that promise sustainable revenue streams in a competitive landscape. With expected annual revenue and earnings growth rates of 31.8% and 28.9%, respectively, Sciyon is well-positioned to capitalize on emerging tech trends while enhancing its market footprint significantly.

Simply Wall St Growth Rating: ★★★★★☆

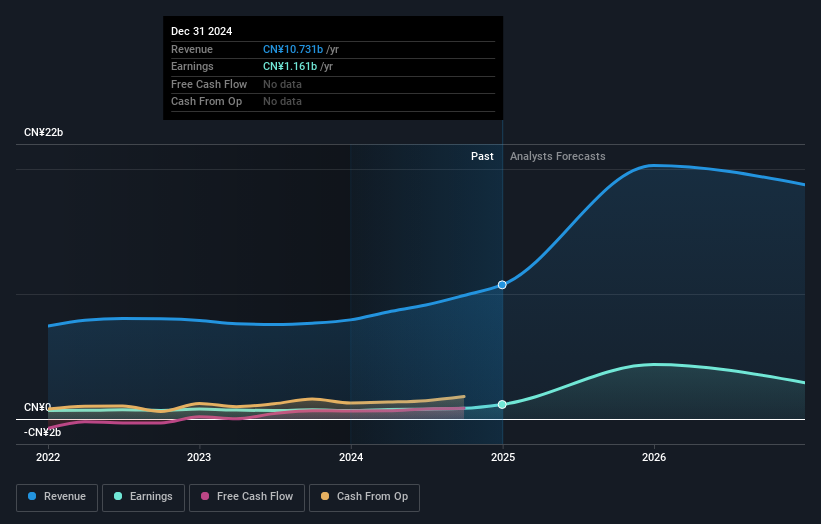

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. engages in the manufacturing of printed circuit boards and holds a market capitalization of approximately CN¥34.61 billion.

Operations: Victory Giant Technology generates revenue primarily from its printed circuit board manufacturing segment, which accounted for CN¥8.64 billion. The company has a market capitalization of approximately CN¥34.61 billion, reflecting its significant presence in the industry.

Victory Giant Technology (HuiZhou) Co., Ltd. has recently demonstrated robust financial growth, with its half-year sales climbing to CNY 4.55 billion, a substantial increase from the previous year’s CNY 3.45 billion. This surge in revenue is complemented by a notable rise in net income to CNY 459 million from CNY 345 million, underscoring the company’s operational efficiency and market acceptance of its offerings. The firm is aggressively investing in R&D, dedicating significant resources to foster innovation; these investments are pivotal as they align with the industry’s shift towards high-value software solutions and AI applications that promise sustainable revenue streams in a competitive landscape. With expected annual revenue and earnings growth rates of 21.4% and 33.2%, respectively, Victory Giant is strategically positioned to capitalize on emerging tech trends while enhancing its market footprint significantly.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nanjing Sciyon Wisdom Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com