ByteDance’s dilemma is a taste of what is to come, as more firms would get pinched by both sides

-

By Catherine Thorbecke

/ Bloomberg Opinion

ByteDance Ltd’s options for TikTok in the US are looking increasingly desolate, as the tech war between Washington and Beijing boils over. The mutual distrust and tit-for-tat animosity lays bare the new reality, where more firms would be pinched from both sides.

China’s market regulators are now targeting Nvidia Corp in a probe stemming from a deal Beijing approved years ago. The move against the Santa Clara-based chipmaker follows other recent escalations; Beijing halted exports of certain minerals with tech applications to the US after Washington intensified chip curbs to China last week. China is also cutting off drone supplies to the US and Europe that have become a vital part of Ukraine’s defense.

A US federal appeals court on Friday last week upheld a law forcing TikTok to divest from Chinese parent ByteDance or face a ban. That makes Nvidia an especially interesting fresh target for Beijing, in part because it exposes how interconnected supply chains still are. ByteDance has become Nvidia’s largest customer in China and amid the TikTok uncertainty it has been reportedly going all-in on artificial intelligence (AI) ambitions in search of its next growth engine.

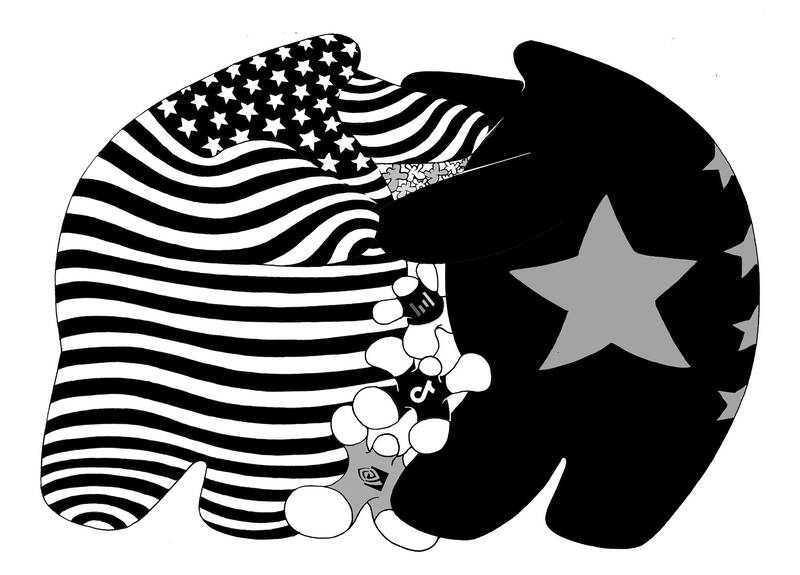

Illustration: Mountain People

ByteDance is wise to start thinking beyond its short-form video app. The US saga that has raged for years has now put the Chinese company in an impossible position. When founder Zhang Yiming (張一鳴) first publicly explored the possibility that TikTok would have to be sold to a US buyer or face a ban back in 2020, he was dragged on Chinese social media and called a traitor and a coward.

Beijing changed its export laws to be able to block the sale of TikTok’s algorithm, with state-backed media labeling it as “institutional plunder.” A spokesperson for the Chinese Ministry of Foreign Affairs at the time said that the precedent the US set would be the opening of “Pandora’s Box.”

Stateside, ByteDance received no reprieve, either. TikTok was able to navigate the first round of scrutiny unscathed after a court challenge. However, US President Joe Biden signed a law earlier this year — with bipartisan support — to once again force TikTok to divest from the parent or face being prohibited to operate in the US. It is now looking more likely than ever that the platform’s days in the US are numbered, despite US president-elect Donald Trump campaigning on saving the app. TikTok filed an emergency motion seeking to stop the law until the case could be heard by the US Supreme Court. However, Beijing making it clear that it would oppose a sale leaves few good options for ByteDance.

It seems like Pandora’s Box has indeed opened, and tech companies with global ambitions would likely have to start choosing sides and staying in their lanes.

The appellate court judges on Friday last week sent a clear message to the Chinese tech industry that its commercial successes are not welcome in the US. The ruling doubled down on the government’s national security concerns for apps from China’s private sector, saying they pose a “particularly significant hybrid commercial threat.” The judges said that the national security risks — such as Beijing influencing content and collecting sensitive US user data — outweigh free speech arguments and the livelihoods of US TikTok creators.

At a time when other Chinese tech firms are looking abroad for growth amid tightened spending domestically, that sends a chilling message not to make it too big in the US.

Beijing has shown that it is willing to retaliate. Nvidia still gets about 15 percent of its revenue from Chinese customers, despite Washington barring the company from selling its most-advanced equipment in that market. Other technology firms that still have exposure to China should start bracing for a fallout.

TikTok’s innovative algorithm and video-first format forced US tech titans from Meta Platforms Inc to Alphabet Inc to roll out copycat products such as Instagram Reels and YouTube Shorts. Despite being an industry leader, ByteDance’s private valuation (reportedly US$300 billion) is just a fraction of the market cap of its Silicon Valley peers.

Blocking Chinese tech companies and budding entrepreneurs from launching consumer products in the US would not only let Big Tech titans expand their power, but would also lead to less vibrancy and creativity. ByteDance weathered a 2020 TikTok ban in India, which was then its biggest user base. That spurred major growth for Instagram and YouTube there, but something special was lost for consumers, especially for small-time creators and niche communities. A US ban would be devastating for ByteDance, but also for the more than 170 million Americans on the app.

Finding a compromise for TikTok could be a first step toward the de-escalation of the tech war. US lawmakers should focus on comprehensive social media regulation that prevents any apps from potential security risks. In the meantime, the battle is only slated to get uglier. Companies would be forced to choose sides with costly results and consumers would feel the crunch.

Catherine Thorbecke is a Bloomberg Opinion columnist covering Asia tech. Previously, she was a tech reporter at CNN and ABC News.