- Euro bulls attempted to push the EUR/USD pair back toward breaking the psychological resistance at 1.1800 and are stabilizing around their gains at the start of Wednesday’s session.

- This comes as the annual holiday season begins, a period marked by lower market liquidity and investors’ desire to open positions for the new year to avoid any surprises once full activity returns to global financial markets.

- In general, as mentioned previously, maintaining price action above the psychological 1.1800 level remains crucial for bulls to advance toward higher highs and confirm control.

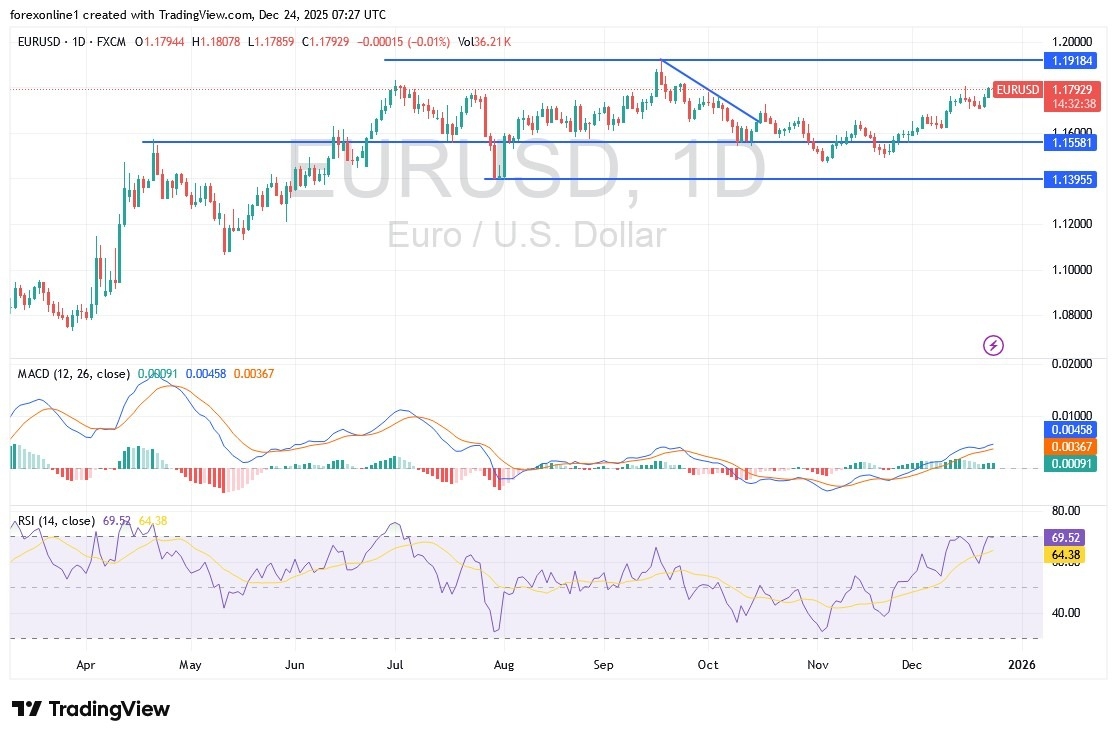

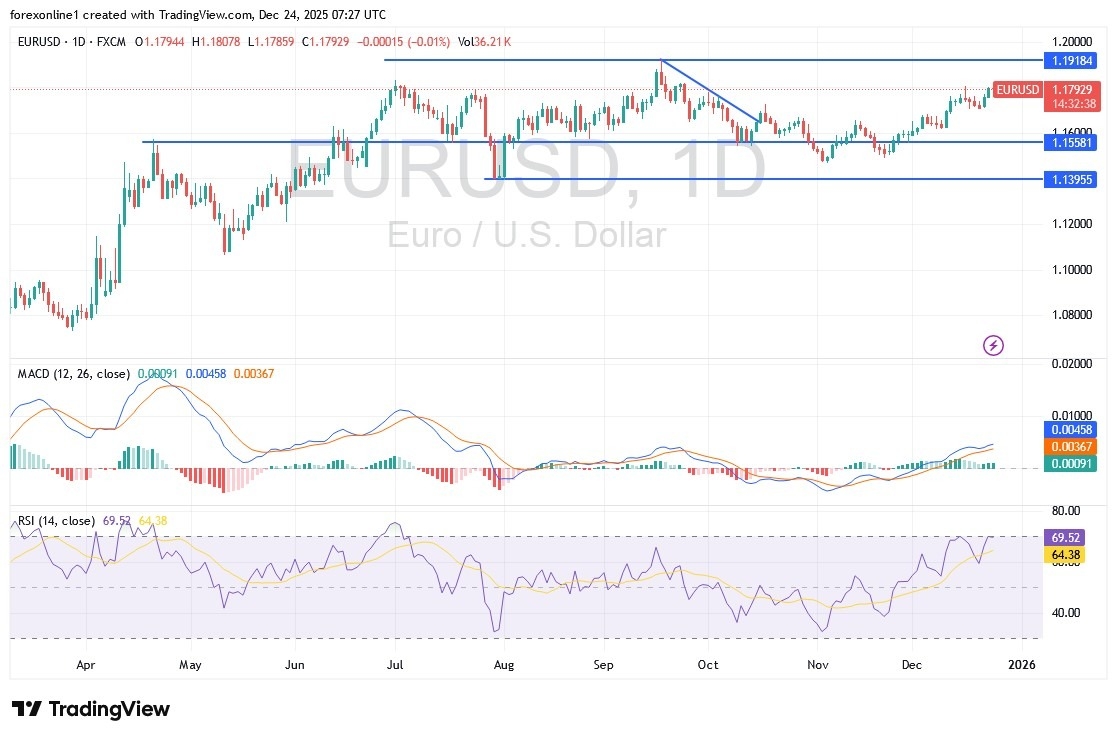

According to technical indicators on the daily chart and across trusted trading platforms, a break above the 1.18 resistance would push the 14-day Relative Strength Index (RSI) toward the overbought level at 70. Unless the euro receives fresh positive momentum, EUR/USD may face profit-taking selling pressure. Meanwhile, the MACD indicator continues to signal a strong bullish trend. On the other hand, on the same timeframe, the psychological support at 1.1500 remains the most important level for a potential return of bearish control. Today, EUR/USD traders are not awaiting any major economic data from the Eurozone; the main focus will be on the release of US weekly jobless claims at 15:30 Egypt time.

Trading Tips:

Traders recommend waiting for EUR/USD to stabilize above the 1.1800 peak to confirm further upside. Limited, low-risk short positions may also be considered, while keeping in mind that the economic calendar still includes important releases for the remainder of the trading week.

Will the euro rise in the coming days?

According to forex market trading, the euro (EUR) currently lacks a clearly defined direction, although there is relatively positive momentum that still needs confirmation, as subdued Eurozone economic data have failed to provide strong support. On another note, reduced liquidity during the holiday period has slowed trading activity, keeping the euro within a narrow range. As a result, the single European currency has been influenced by overall market sentiment, with moderately positive risk appetite affecting demand for the euro, which is traditionally considered a defensive currency.

On the US side, according to economic calendar data, US durable goods orders for October came in below expectations of -1.5%, recording a decline of -2.2%. Durable goods orders excluding transportation also fell by 0.3%, registering a decrease of 0.2%. In contrast, the preliminary annualized US GDP for the third quarter exceeded expectations, coming in at 4.3% versus forecasts of 3.3%. The preliminary GDP price index for the quarter also surpassed expectations of 2.7%, rising by 3.7%.

In the same context, US industrial production for November rose by 0.2%, beating monthly expectations of 0.1%. This marked a notable improvement compared to the -0.1% recorded in October, which itself had fallen short of the expected 0.1%. Capacity utilization also edged up slightly in November to 76%, from 75.9%, exceeding expectations. Preliminary personal consumption expenditure (PCE) prices for the third quarter rose to 2.8%, up from 2.1%, in line with expectations. Core PCE for the quarter also improved to 2.9%, up from 2.6%, as expected.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.