In brief

- SpaceX has consolidated $153 million worth of Bitcoin into a single on-chain wallet, Arkham Intelligence data shows.

- The private company holds 8,285 Bitcoin, or $990 million worth of the token, on its balance sheet.

-The movement comes as investors raise concerns about SpaceX, particularly following Elon Musk’s public feud with U.S. President Donald Trump.

SpaceX has moved $153 million of its Bitcoin holdings, marking its first blockchain activity in three years, according to on-chain data provider Arkham Intelligence.

The aerospace company moved 1,308 BTC tokens from 16 Pay-to-Public-Key-Hash addresses to a sole SegWit-compatible Pay-to-Witness-Public-Key-Hash wallet address, the data shows. SpaceX currently has 8,285 Bitcoin, or $988.89 million worth of the token, on its balance sheet, according to data from bitcointreasuries.net.

SpaceX last moved its Bitcoin in June 2022, sending more than 3500 tokens to Coinbase.

The firm’s reasons for recently moving its Bitcoin were not immediately clear.

A company representative did not respond to Decrypt’s inquiry into its on-chain activity.

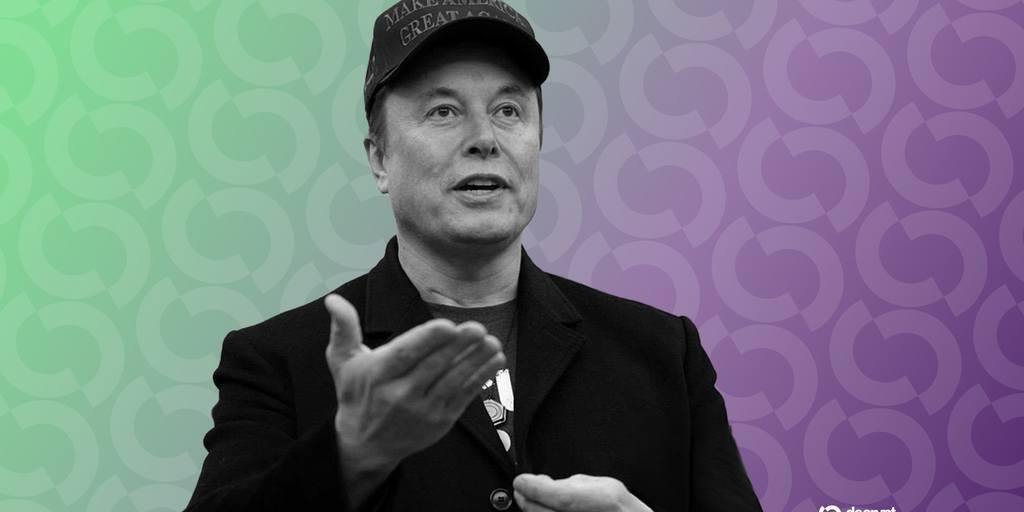

SpaceX was founded by South African-born billionaire Elon Musk in 2002. It first disclosed holding Bitcoin in July 2021. Musk’s electric-vehicle firm Tesla also holds $1.37 billion worth of the cryptocurrency, according to data from bitcointreasuries.net.

The private company’s movement of its Bitcoin comes several days after the Trump administration initiated a review of SpaceX’s government contracts and shortly after a public spat between U.S. President Donald Trump and Elon Musk. Government contracts have served as a major financial lifeline for SpaceX, which has notched at least $1 billion worth of government contracts, loans, subsidies, and tax credits annually since 2016.

SpaceX’s recent issues, including Musk’s leadership, have raised concerns about whether the company will turn to selling its Bitcoin to shore up funds. But, the company may not need to resort to selling its digital assets anytime soon.

The firm is planning to sell about $1 billion of its shares in a deal that could set its valuation at $400 billion, the Financial Times reported in early July, citing several people familiar with the matter.

Bitcoin was recently trading at about $119,800, up more than 2% over the past 24 hours, according to crypto markets data provider CoinGecko. BTC, the largest cryptocurrency by market value, has risen 21% over the past month.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.