Sign up for the Slatest to get the most insightful analysis, criticism, and advice out there, delivered to your inbox daily.

For the past century, Delaware has been a corporate oasis. It’s not the Cayman Islands or Switzerland—a pure tax haven or hub of utmost bank secrecy—but simply a reliable place to do business. In 2023, 80 percent of all U.S. companies launching initial public offerings chose to register in Delaware.

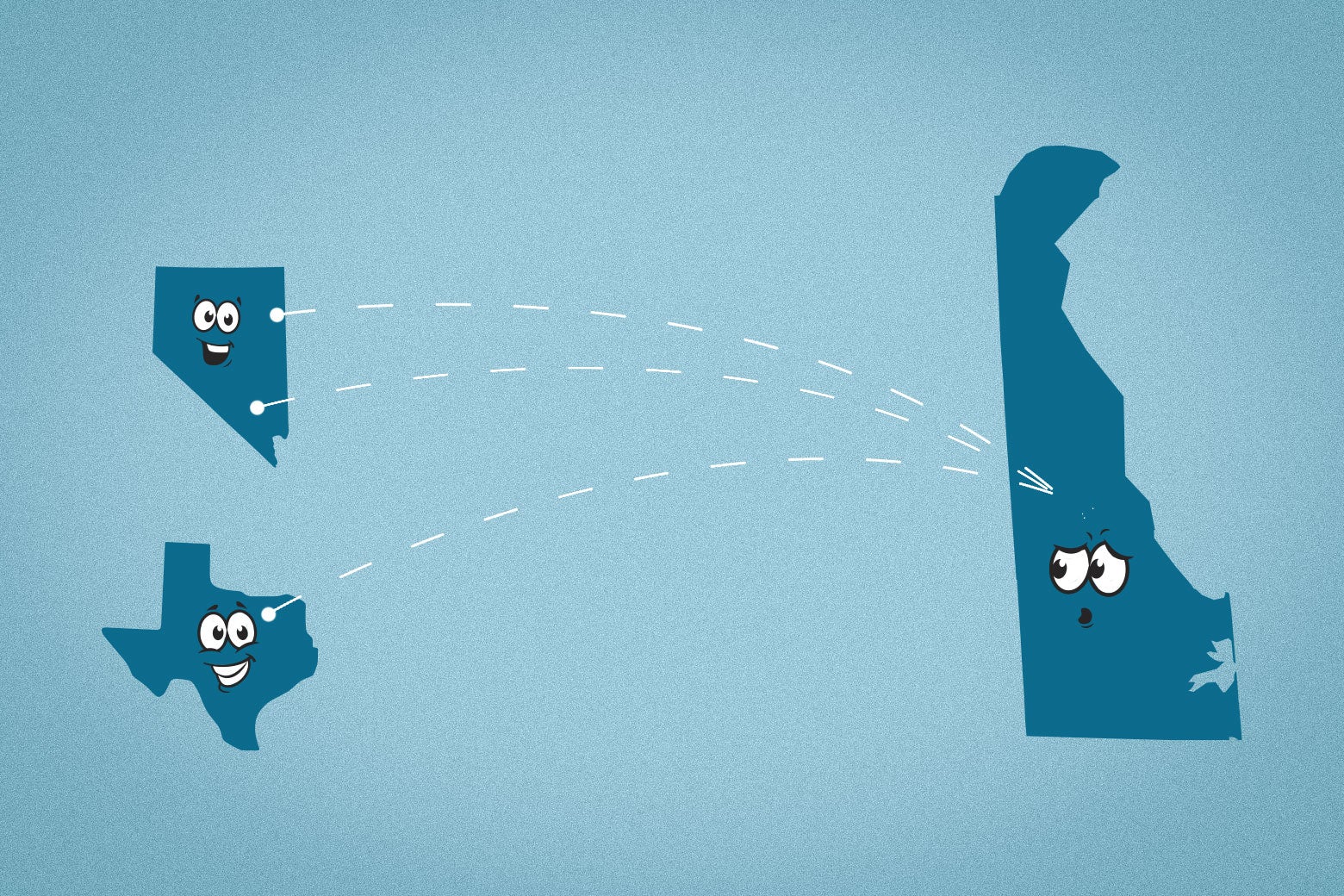

While Delaware has become the center of the business law world, Elon Musk is leading a slow migration away from the First State.

Yes, in addition to running Tesla, SpaceX, Starlink, Neuralink, the Boring Company, X, and President Donald Trump’s Department of Government Efficiency, Musk has been fighting legal battles in Delaware. None has peeved him more than a shareholder dispute over a highly generous executive pay package—a $50 billion bonus from Tesla to its CEO.

So, what makes Delaware special to Big Business? In large part, stability, predictability, and expertise.

“The law on the books is not all that different from state to state,” said Adam Pritchard, a corporate and securities law professor at University of Michigan Law School. “But there’s a herding effect. Because there are so many companies incorporated in Delaware, there are a lot of Delaware decisions on issues that might not come up all that often—but it probably has come up at some point in Delaware.”

Delaware’s state courts are the foremost authority on American corporate law. Because the majority of large publicly traded companies in the United States are incorporated in Delaware, the Delaware Court of Chancery—a specialized business court—and the Delaware Supreme Court have become the most important venues in the country for hashing out shareholder disputes, merger fights, and other corporate litigation.

Because of this, the judges in Delaware are typically considered experts in their field. “If you have a random draw of some judge in Wyoming, you don’t know what you’re gonna get,” Pritchard said.

Amid Musk’s legal squabbles in the state courts, the world’s richest man changed his companies’ incorporation from Delaware to Texas last year—just as he has spent the past few years moving their physical headquarters from California to the Lone Star State.

“Never incorporate your company in the state of Delaware,” Musk wrote on X last year. “I recommend incorporating in Nevada or Texas if you prefer shareholders to decide matters.”

Some companies have followed his lead, including TripAdvisor and Dropbox, which moved to Nevada. Billionaire Bill Ackman also said this week he’d move his hedge fund, Pershing Square Capital Management, to Nevada. And Meta has reportedly discussed moving to Texas, a month after it announced that it’d relocate content moderation employees to the state in some sort of right-wing appeasement.

“Delaware is at serious risk of losing its standing as the leading state of incorporation for American companies,” Coinbase chief legal officer Paul Grewal warned on X.

This so-called Dexit focuses on two states. “They’re either moving to Nevada, where there are essentially no rights for shareholders, or they’re moving to Texas,” said Ann Lipton, a business law professor at Tulane Law School. “Texas’ law is not, on the books, terribly dissimilar from Delaware’s, but there isn’t a whole lot of case law.”

But it’s a reasonable gamble for Musk and Co., she added. Texas has tried to woo corporations with new business courts, and they might be friendlier to Musk. “The judges are appointed by the governor and they have two-year terms, so they’re essentially under the very strict oversight of a very conservative political establishment,” Lipton said. Conservative business leaders might be comfortable trading the current standard-bearer of business courts if a friendlier one emerges—even one without a track record to show its competence.

And if Musk wants to scare Delaware, it’s working. “Delaware’s terrified,” Lipton said, noting that the Delaware Legislature overhauled its corporate laws this summer to become more friendly to corporate managers over shareholders. And the newly inaugurated governor signaled this week that more changes appear to be on the horizon.

“The fact is Delaware is the best location in the world for a company to incorporate, and that’s thanks to our legal expertise dating back to 1792. But let’s be clear: If any entity leaves Delaware, we’re going to work to win them back,” Delaware Gov. Matt Meyer told Business Insider.

Pritchard said that what the state really needs to worry about is not any individual company moving its headquarters, but if newly public companies follow Musk’s lead and incorporate elsewhere. That’s especially true considering that business taxes and incorporation fees brought in $2 billion in fiscal year 2023, 40 percent of the entire $5 billion Delaware state budget.

“That fiscal commitment means the Delaware Legislature can’t afford to screw things up,” Pritchard said.