Market Outlook and Forecast

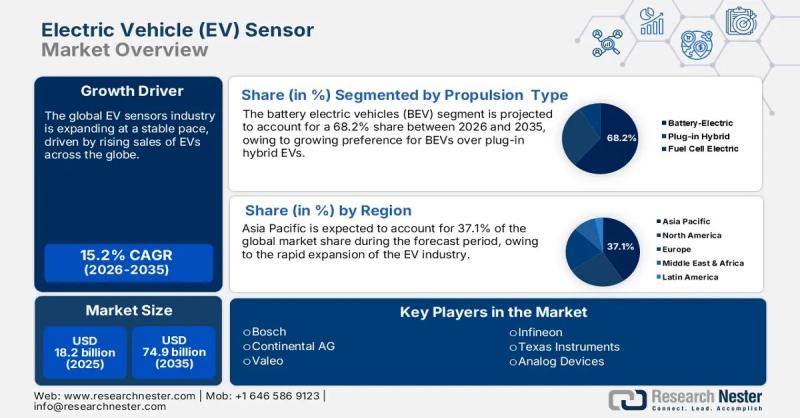

The electric vehicle sensor market stands at a pivotal juncture. Based on available data, the market size is pegged at approximately USD 18.2 billion in 2025, with a projected expansion to USD 74.9 billion by 2035. Over the 2026-2035 interval, this translates to an implied growth trajectory of roughly 15.2% annually.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8145

Regional performance highlights

• Asia Pacific is anticipated to command about 37.1% of the global market share over the forecast period. The region’s large EV ecosystem, favourable governmental policies and component manufacturing strength underpin this dominance.

• North America is expected to register rapid growth toward 2035, driven by increasing EV adoption, regulatory incentives and local sensor-supply chain expansion.

• Europe remains a significant contributor, with strong automotive OEM presence, increasingly stringent emissions/safety regulation and a push toward advanced sensor architectures.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Electric Vehicle (EV) Sensor Market Report Overview here: https://www.researchnester.com/reports/electric-vehicle-sensor-market/8145

Market Segmentation

• By vehicle propulsion type, battery electric vehicles (BEVs) are projected to carry the lion’s share of demand in the EV sensor market – approximately 68.2% between 2026 and 2035. As OEMs shift toward fully electric platforms, demand for sensors tailored for BEV architectures (battery management systems, motors, charging interfaces, thermal control) will dominate.

• By sensor type, the temperature sensor segment is highlighted as commanding a significant market share during the forecast period. For EVs, thermal sensing (battery pack temperature, motor/drive temperature, cabin thermal control) is an increasingly critical function given the performance and durability requirements of high-voltage powertrains.

In aggregate, the market outlook for EV sensors is strongly positive: as vehicle electrification deepens, sensors become not just incremental components but foundational technology enablers.

➤ Explore the complete electric vehicle (ev) sensor market forecast and regional insights in our detailed report. Download our sample report here → https://www.researchnester.com/sample-request-8145

Top Market Trends

Here we explore major currents transforming the EV sensor market, using recent examples to ground each trend.

1. Sensor consolidation & smarter integration

As EV architectures evolve, manufacturers are moving toward consolidation of multiple sensing functions into fewer, smarter sensor modules. This not only reduces component count and cost, but also simplifies wiring/ECU architecture and enables richer data streams. For example, a recent analysis describes how the next-generation chassis sensor from ZF Friedrichshafen AG integrates 3-axis acceleration, wheel height sensing, and ball-joint embedding – turning a mechanical suspension part into a data node.

Similarly, for rotor temperature sensing the jump from estimation (software only) to direct measurement (hardware sensor) by Continental AG demonstrates how sensor innovation is enabling both improved performance and reduced dependency on rare-earth materials.

This trend underscores how the EV sensor market is shifting from simple quantity growth (more sensors) to quality growth (smarter, integrated, higher-value sensors).

2. Electrification meets autonomy: sensor demand multiplier

The push toward electrified vehicles (BEVs, PHEVs) coincides with rising demands for advanced driver-assistance systems (ADAS), connectivity and autonomy. The EV sensor market benefits from this twin-drift: sensors now serve both powertrain/thermal/charging functions and perception/safety functions. Reports note that EV sensor demand is being fuelled by battery monitoring, motor control architectures, and autonomous driving readiness.

Indeed, increasing sensor counts per EV, higher fidelity data requirements and safety/regulation demands are all boosting unit volumes and value per vehicle.

3. Regional supply-chain localisation and sustainability constraints

As OEMs globalise and regionalise EV manufacturing, localisation of sensor supply-chains becomes ever more strategic – especially in Asia Pacific, North America and Europe. At the same time, sustainability factors (reduced rare-earth content, energy-efficient sensor modules, recyclability) are becoming decision-drivers. For example, the direct rotor temperature measurement capability enables reduced safety margins and less reliance on rare-earth inputs.

Given that Asia Pacific is expected to hold over a third of the market share, localisation of sensor manufacturing and logistics will be critical for securing competitive position.

➤ Stay ahead of the curve with the latest Electric Vehicle (EV) Sensor Market trends. Claim your sample report → https://www.researchnester.com/sample-request-8145

Recent Developments

Here is a curated list of key companies (major and emerging) active in the EV sensor market – with notable recent developments in the last 12-18 months:

1. Infineon Technologies AG – On August 14, 2025, Infineon completed acquisition of Marvell Technology, Inc.’s Automotive Ethernet business, strengthening its connectivity and sensor integration capabilities in software-defined vehicles.

2. STMicroelectronics N.V. – Announced July 24, 2025 that it would acquire part of NXP Semiconductors N.V.’s sensor business for up to US$950 million, expanding its MEMS automotive sensor portfolio.

3. Aeva Technologies, Inc. – The LiDAR and sensor specialist sold a 6% stake for US$50 million in May 2025 to a strategic partner who will also help manufacturing.

4. Melexis N.V. – Announced June 6, 2024 (within last 18 months) that it will supply Chinese EV maker NIO Inc. with current-sensor ICs for its traction inverter systems – underlining how EV sensor demand is shifting toward high-voltage electrified powertrains.

5. Continental AG – Has rolled out its e-Motor Rotor Temperature Sensor (eRTS) which directly measures rotor temps with tighter tolerance, enabling motor design optimisation.

➤Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8145

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.