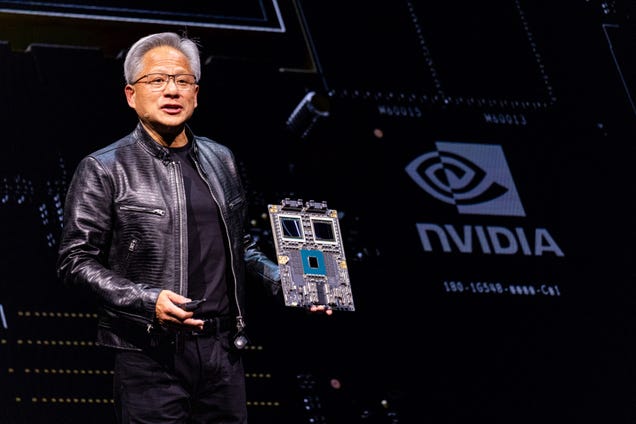

DeepSeek sparked a global tech stock sell-off that cost Nvidia $600 billion in market value. But JPMorgan (JPM) Chase says the AI chipmaker is bound to benefit from the Chinese startup.

The Hangzhou-based artificial intelligence startup sent shockwaves through both Silicon Valley and Wall Street last month after raising questions about Big Tech’s big spending on AI infrastructure.

But despite the AI-driven stock rally losing $1 trillion in value, JPMorgan U.S. Equity Research analysts said in a new report that DeepSeek will likely have a positive impact on companies such as Amazon (AMZN), Meta (META), and Google (GOOGL) parent Alphabet, as well as chipmaking leader Nvidia (NVDA).

The Chinese startup launched its open-source DeepSeek-R1 reasoning models in January that performed on par with similar models from OpenAI and Anthropic, while its open-source DeepSeek-V3 model released in December also performed competitively with AI models from the U.S.-based companies — for far less money and less advanced chips.

According to the V3 technical paper, the model cost $5.6 million to train and develop on just under 2,050 of Nvidia’s reduced-capability H800 chips. U.S. firms, meanwhile, are spending billions on tens of thousands of Nvidia’s more powerful H100 chips, which are not allowed to be sold to China under U.S. export controls.

DeepSeek’s demonstration of cost-efficiency and AI innovation will lead to “strong demand” for higher performance graphics processing units, or GPUs, JPMorgan analysts said Wednesday. “Therefore, Nvidia’s leadership in advanced AI chips “should enable them to unlock new use-cases.” Other chip firms such as Broadcom (AVGO), Marvell (MRVL), and Micron (MU) are also likely to benefit from DeepSeek, according to JPMorgan.

Chip pioneer Intel (INTC), however, stands to lose out from DeepSeek, analysts said, because demand for its central processing units, or CPUs, will decrease as amid the shift to accelerated computing.

JPMorgan analysts also said they “believe the broader Internet ecosystem should benefit” following the open-source AI model advancements demonstrated by DeepSeek and China’s Alibaba (BABA). The improved cost efficiency “should accelerate” AI development and adoption, leading to more consumption, the analysts said, adding that they “expect heavy capital expenditures investment” by Amazon, Alphabet, and Meta to continue in the medium term.

Meta is expected to benefit from increased open-source model adoption as it builds its next-generation open-source Llama 4 model, JPMorgan said. During the company’s fourth-quarter earnings call, Meta chief executive Mark Zuckerberg, who touts open-source AI models as “good for the world,” said DeepSeek’s breakthrough shows the need for a global open-source standard led by the U.S.