According to Ray Dalio’s “Principles for Dealing with the Changing World Order”, a book we encourage you to read, the US is an empire in decline. His theory is that China is going to become the dominant economy in the world and the Chinese yuan is eventually going to become the global reserve currency, dethroning the dollar. And indeed, over a third of China’s trade is now being settled in yuan instead of dollars. In 2016, the IMF recognized it as the third biggest reserve currency behind only the dollar and the euro.

But it has yet to be seen how much further the yuan’s status can rise, given that it is not a free-floating currency. It is carefully managed by China’s central bank in order to support the attractiveness of the country’s exports. According to “Why Nations Fail” by Daron Acemoglu and James Robinson, who won the Nobel Prize in Economics in 2024, unless both a country’s economic and political institutions are democratized, there is a ceiling to its development and prosperity. Nearly five decades after Deng Xiaoping’s reforms began in 1978, this is still not the case in China.

So it is fair to say that the jury is still out when it comes to the yuan’s potential to displace the dollar as the world’s dominant reserve currency. Focusing on the not-so-distant future, however, USDCNH is indeed likely to weaken in the months and years ahead.

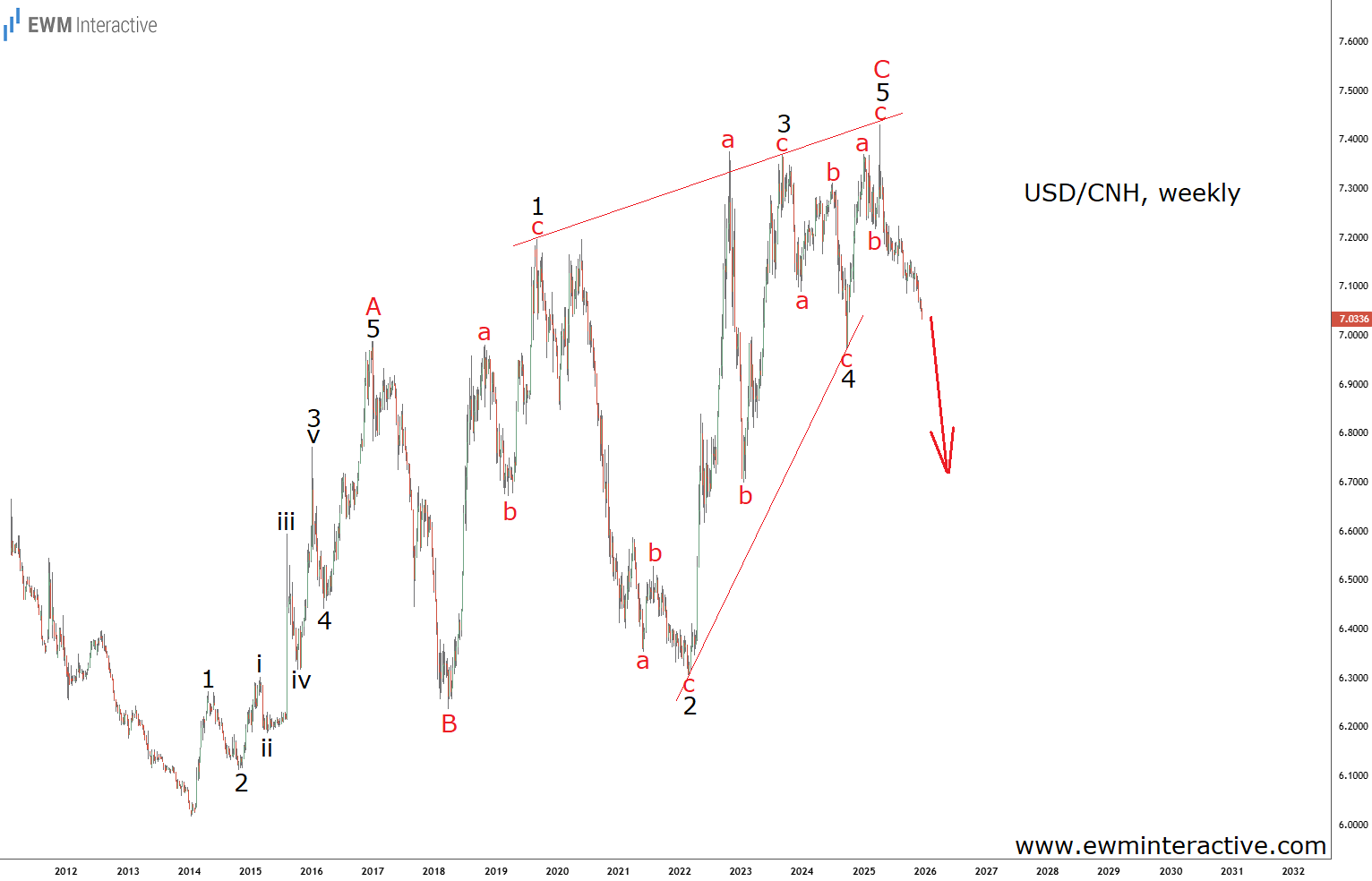

The weekly chart above reveals that the rise from 6.02 in 2014 to 7.43 in April, 2025, can be seen as a simple A-B-C zigzag correction. Wave A is a five-wave impulse, marked 1-2-3-4-5, where the five sub-waves of wave 3 are also visible. Wave B was a deep decline back to 6.24, but it didn’t breach the starting point of wave A.

Similar Elliott Wave setups occur in the crypto, commodity and stock markets, as well. Our Elliott Wave Video Course can teach you how to uncover them yourself!

It was instead followed by what looks like an ending diagonal pattern in wave C. It is labeled 1-2-3-4-5, where all five waves have a corrective a-b-c structure, waves 1 and 4 overlap and the contracting shape of the pattern is unmistakable. If this Elliott Wave count is correct, the bearish reversal near 7.43 marks the resumption of the pre-2014 downtrend. As long as the 2025 top is intact, the US dollar can be expected to keep sliding towards 6.00 and under against the Chinese yuan.

In our Elliott Wave PRO subscriptions we provide analyses of Bitcoin, Gold, Crude Oil, EURUSD, USDCAD, USDJPY and the S&P 500 every Sunday and Wednesday! Check them out now!