(Bloomberg) — Chinese sovereign bonds’ falling yields are driving onshore investors to actively hunt for overseas alternatives with higher returns.

Most Read from Bloomberg

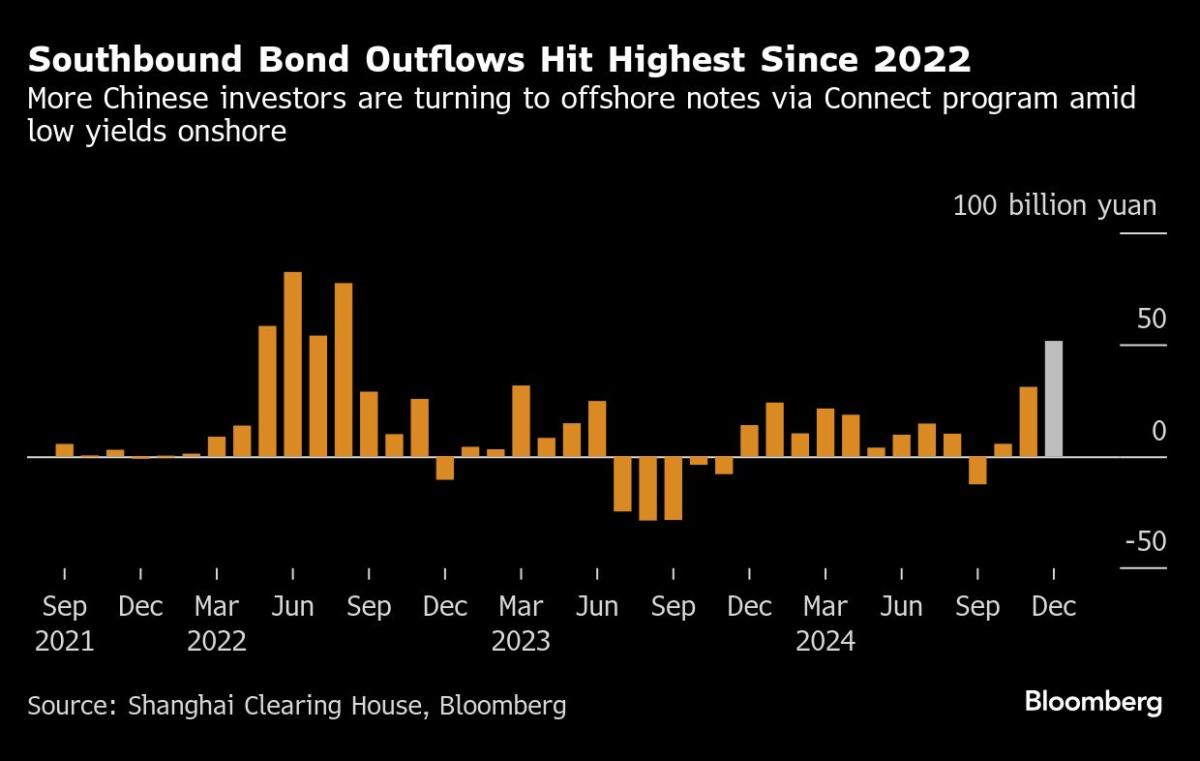

Capital outflows from mainland China via its Southbound Bond Connect program totaled nearly 52 billion yuan ($7.1 billion) in December, the highest since August 2022, according to Bloomberg-compiled data. The program allows mainland investors to invest in the Hong Kong bond market.

“The returns from China’s onshore bonds are so low that investors are forced to diversify their portfolio,” said Qi Sheng, an analyst at Orient Securities Co. Relatively higher yields in dollar bonds and Dim Sum bonds — notes denominated in the yuan but issued in Hong Kong — appear more attractive and will continue to be favored over onshore notes this year, Qi added.

Yields in the nation’s benchmark 10-year bonds have plunged over 30 basis points to around 1.65% since the beginning of December, dragged by poor domestic consumption and expectations for more monetary easing to boost the sluggish economy. China’s yield discount to the US also widened to a record earlier this month, amplifying the allure of foreign assets.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.