China’s economy showed mixed performance in November 2024, with industrial production and exports showing resilience, while retail sales and fixed asset investment underperformed, amid ongoing challenges in the property sector. Policymakers are expected to implement targeted fiscal and monetary measures to boost domestic demand and address deflationary pressures.

The National Bureau of Statistics (NBS) has released China’s economy data for November 2024, revealing a mixed performance across key indicators. Retail sales grew by 3 percent year-on-year, a significant slowdown from October’s 4.8 percent growth and well below the 4.6 percent forecast. Industrial production, however, showed resilience, rising by 5.4 percent and exceeding expectations of 5.3 percent growth.

The property sector continued to drag on the broader economy, with real estate investment contracting by 10.4 percent for the January-to-November period, further highlighting the challenges in stabilizing the sector. Fixed asset investment also fell short of expectations, growing by 3.3 percent year-to-date, down from 3.4 percent in October.

Amid these challenges, policymakers face mounting pressure to shore up domestic demand and counteract deflationary pressures. Analysts anticipate more targeted measures in the coming months, including fiscal expansion and loosening monetary policies, as Beijing signals a shift in focus toward boosting consumption and addressing structural economic weaknesses.

Start exploring

China’s economy in November 2024 at a glance:

- GDP: around 4.8% year-on-year (YoY), for the first three quarters of 2024

- Value added of industrial enterprises above the designated size*: +5.4% YoY

- Value added of services: +6.1% YoY

- Total retail sales of consumer goods: RMB 4.38 trillion (US$608.82 billion), 4.38% YoY, +0.16% from October

- Total import and export: In dollar terms, exports +6.7% YoY and imports -3.9% YoY

- Fixed asset investment: +3.3% YoY, for the period from January to November

- Unemployment rate: 5.1%, for the period January to November

- CPI: +0.2% YoY

*Added value of companies with an annual main business income of over RMB 20 million (US$2.8 million)

Industrial activity further expands

In November, China’s industrial value added (IVA) grew by 5.4 percent year-on-year (YoY), slightly accelerating from the 5.3 percent recorded in October. This modest improvement reflects continued recovery in key industries, supported by recent stimulus measures aimed at stabilizing the economy.

The manufacturing sector led the growth, expanding by 6.0 percent YoY, while the power, heat, gas, and water production and supply sector grew by 1.6 percent. The mining industry posted a 4.2 percent YoY increase. Notably, advanced industries outpaced overall growth, with equipment manufacturing and high-tech manufacturing rising by 7.6 percent and 7.8 percent YoY, respectively, underscoring the resilience of China’s innovation-driven sectors.

Key product categories showed robust output gains in November:

- New energy vehicles: +51.1%

- Industrial robots: +29.3%

- Integrated circuits: +8.7%

From January to November, IVA increased by 5.8 percent YoY, maintaining steady growth over the year despite headwinds from a slowing property market and external uncertainties.

By ownership, shareholding enterprises and private firms drove much of the industrial activity, growing 6.0 percent and 4.5 percent YoY, respectively. State-owned enterprises (SIEs) and foreign-invested enterprises, including those from Hong Kong, Macao, and Taiwan, expanded more modestly at 3.9 percent and 3.4 percent YoY, respectively.

On the demand side, sentiment continued to improve. The manufacturing Purchasing Managers’ Index (PMI) rose to 50.3 percent in November, up by 0.2 percentage points from October, signaling modest expansion. The business activity expectations index climbed to 54.7 percent, reflecting stronger confidence in future production and operations.

The sustained growth in high-tech and green industries, alongside improved manufacturing sentiment, highlights the gradual stabilization of China’s industrial sector as policymakers work to balance short-term recovery with long-term structural adjustments.

Services sector activity eases

China’s services production index grew by 6.1 percent year-on-year (YoY) in November, reflecting steady recovery in the sector. The expansion was led by modern service industries, particularly information transmission, software and IT services, leasing and business services, and financial services.

Several service industries recorded the following growth rates:

- Information transmission, software, and IT services: +9.3%

- Leasing and business services: +9.3%

- Financial services: +8.8%

These sectors outperformed the overall services production index by 3.2, 3.2, and 2.7 percentage points, respectively. Growth in the real estate sector (+2.9 percent) and transportation, warehousing, and postal services (+6.0 percent) also accelerated, gaining 2.1 and 1.3 percentage points compared to October.

From January to November, the services production index increased by 5.1 percent YoY, maintaining momentum in the face of external and domestic challenges. Revenue from service enterprises above designated size grew by 7.4 percent YoY from January to October, signaling sustained expansion in the sector.

The official services business activity index remained at 50.1 percent in November, unchanged from October, indicating steady growth. However, the business activity expectations index rose to 57.3 percent, up by 1.1 percentage points, reflecting heightened optimism for future growth, especially in high-performing industries like telecommunications, internet software, financial services, and capital markets.

Yet, not all indicators were positive. The Caixin/S&P Global Services PMI showed a slight deceleration, falling to 51.5 percent in November from 52.0 percent in October, driven by slower growth in new business and export orders. According to Wang Zhe, Senior Economist at Caixin Insight Group, “Service providers generally expressed confidence in market improvement amid policy support, although concerns over the trade environment and competition linger.”

Despite the positive trends, the services sector faces headwinds, including weakened consumer and business confidence amid the property downturn, local government debt pressures, and global demand uncertainties. Policymakers have responded with fiscal stimulus and monetary easing, and further measures are anticipated to sustain recovery.

Companies in the services sector continued to expand their workforce for a third consecutive month in November, signaling efforts to manage workloads and prepare for anticipated demand.

However, firms reduced selling prices due to competition, while benefiting from lower material costs that eased input pressures.

Retail sales miss expectations

In November, China’s retail sales rose by 3.0 percent year-on-year, reflecting a modest slowdown compared to October but demonstrating continued resilience in consumer spending. On a month-on-month basis, retail sales increased by 0.16 percent, indicating steady momentum in the sector. From January to November, total retail sales reached RMB 44.27 trillion (US$6.08 trillion), up 3.5 percent year-on-year, maintaining the growth rate observed in the January-October period.Key figures for November include:

- Urban retail sales: +2.9% YoY, totaling RMB 37.60 trillion (US$5.16 trillion)

- Rural retail sales: +3.2% YoY, amounting to RMB 6.17 trillion (US$846.98 billion)

- Merchandise retail sales: +2.8% YoY, reaching RMB 37.96 trillion (US$5.21 trillion)

- Dining revenue: +4.0% YoY, totaling RMB 5.80 trillion (US$796.18 billion)

The “old-for-new” replacement policy continued to bolster sales in specific categories, as major consumer upgrades drove growth in November:

- Household appliances and audiovisual equipment: +22.2% YoY

- Furniture: +10.5% YoY

- Automobiles: +6.6% YoY.

- Construction and decoration materials: +2.9% YoY

Online retail remained a key contributor to overall sales:

- Total online retail sales (January-November): RMB 14.03 trillion (US$1.93 trillion), up 7.4% YoY

- Online sales of physical goods: RMB 11.81 trillion (US$1.62 trillion), up 6.8% YoY, accounting for 26.7% of total retail sales

Retail sales of services also maintained steady growth, increasing by 6.4 percent year-on-year during the January-November period, reflecting the ongoing shift towards service-oriented and experience-driven consumption.

The slowdown of retail sales in November should be understood in the context of unique calendar effects that boosted October’s sales figures. The annual Double 11 online shopping festival, which typically spans late October to early November, was concentrated more heavily in October this year, running from October 14 to November 11. This shift likely pulled forward a significant amount of consumer spending into October.

Additionally, the National Day holiday in early October provided an extra day of vacation compared to last year, further inflating October’s figures.

Exports continue, imports decline

In November 2024, China’s foreign trade showed mixed results, with exports continuing to grow, albeit at a slower pace, while imports saw a surprise decline. The total value of imports and exports combined reached RMB 37.51 trillion (US$5.15 trillion), marking a modest 1.2 percent year-on-year increase. Exports, which amounted to RMB 22.22 trillion (US$3.05 trillion), grew by 5.8 percent year-on-year, while imports dropped to RMB 15.29 trillion (US$2.09 trillion), down by 4.7 percent year-on-year.

Despite the lower-than-expected export growth compared to the 12.7 percent increase in October, the performance remained resilient. Exports to key trading partners showed positive results, with exports to the ASEAN region rising by nearly 15 percent, exports to the U.S. increasing by 8 percent, and exports to the European Union rising by 7.2 percent. However, exports to Russia saw a decline of 2.5 percent. The drop in imports was more pronounced, marking the sharpest decline since September 2023.

Analysts had expected a slight increase, but imports fell by 4.7 percent year-on-year. This decline reflects ongoing sluggish domestic demand, despite some positive economy indicators such as growth in manufacturing activity.

Notable export sectors included rare earth minerals, where exports rose by nearly 5 percent year-on-year, and steel exports, which surged by 16 percent. In the first eleven months of 2024, China’s total exports reached RMB 23.04 trillion (US$3.16 trillion), reflecting a 6.7 percent increase compared to the same period in 2023, while imports grew by 2.4 percent.

The mixed trade performance highlights the challenges facing China’s economy, particularly domestic consumption, which remains weak. However, export growth continues to serve as a critical driver of economic activity, aided by strong demand for industrial products like steel and rare earths. Despite some external challenges, including potential U.S. tariffs, China’s trade sector is expected to maintain its momentum, with export growth likely to pick up in the early months of 2025 as U.S. importers front-load orders. The ongoing trade uncertainties, coupled with domestic economic weaknesses, may, however, pose risks for the sustainability of export-driven growth in the second half of the year.

Fixed asset investment stabilizes amid policy support

In the first eleven months of 2024, China’s fixed asset investment (FAI) reached RMB 46.58 trillion (US$6.39 trillion), reflecting a 3.3 percent year-on-year increase. This steady growth highlights the continued stabilization of investment despite the challenging economic environment, supported by government policies aimed at spurring economic recovery.

Excluding the real estate sector, FAI expanded by 7.4 percent year-on-year during the January-November period, underscoring robust performance in other key sectors, while investment in property development saw a decline of 10.4 percent year-on-year.

Breaking down the investment by sector:

- Infrastructure investment: Grew by 4.2 percent year-on-year, maintaining consistent expansion.

- Manufacturing investment: Increased by 9.3 percent year-on-year, indicating strong momentum in industrial production.

- High-tech industries: Investment in high-tech industries rose by 8.8 percent year-on-year.

Within this category:

- High-tech manufacturing grew by 8.2 percent year-on-year;

- High-tech services increased by 10.2 percent year-on-year.

Within high-tech manufacturing, investments in the aerospace and communications equipment sectors saw remarkable growth, with aerospace investment up by 35.4 percent and communications equipment manufacturing rising by 8.8 percent.

By industry, investment in the primary sector grew by 2.4 percent year-on-year, while investment in the secondary sector surged by 12.0 percent, reflecting strong performance in manufacturing. However, investment in the tertiary sector declined by 1.0 percent, largely due to the ongoing challenges in consumer-facing services. Private investment showed a slight decline of 0.4 percent year-on-year, but when excluding real estate development, private investment increased by 6.2 percent, indicating resilience in non-property sectors.

The continued expansion in high-tech and manufacturing sectors reflects China’s ongoing push toward innovation-driven growth.

Overall, the fixed asset investment data for November indicates that, despite challenges in the property market, China’s investment landscape remains relatively stable, with significant growth in manufacturing and high-tech industries. This is consistent with broader economic recovery trends and reflects the effectiveness of targeted policy measures to drive long-term industrial and technological development.

Meanwhile, November’s home sales showed first year-on-year increase in 17 months, with demand in the property market finally starting to recover.

According to the latest data released by NBS:

- Home sales by floor area rose 4.6% YoY, a sharp improvement compared to October’s 1.3% decline and the 10.6% drop recorded in September.

- By transaction value, sales climbed 4.5% YoY, reversing the 0.2% dip seen in October.

This marks the first year-on-year growth in home sales since May 2023, signaling that the positive trends observed in October have gained further momentum.

China’s economy in November 2024, and outlook for the year-end

China’s economy data for November 2024 reveals mixed signals, as the country faces ongoing challenges while seeking to navigate its economic recovery. The sluggishness in retail sales, weaker than expected for the second consecutive month, highlights persistent caution among consumers. Despite a small uptick in industrial production and some positive developments in the property market, sentiment remains fragile. This indicates that the economic stimulus measures implemented so far have had limited impact, particularly on domestic consumption, which continues to lag. The deepening real estate slump, marked by falling property investment, exacerbates the overall drag on economic growth.

Looking ahead, the Chinese government is signaling a stronger commitment to fiscal and monetary support. High-level policy meetings such as the Central Economic Work Conference held in Beijing on December 11-12, 2024, have emphasized the need for “proactive fiscal tools” and a shift toward “moderately loose” monetary policies to stimulate domestic demand. However, the effectiveness of these measures will depend on their scale and implementation. While there is an expectation for gradual improvement in the economy as stimulus takes hold, especially in sectors such as consumer goods, the path to sustained recovery remains uncertain.

The government’s focus on boosting consumption is clear, yet there are challenges ahead. A combination of weak consumer confidence, high youth unemployment, and deflationary pressures, such as the continuing decline in producer prices, indicates a more complex recovery than anticipated.

For now, the economic outlook remains cautious, with expectations that China’s GDP will likely meet the “around 5 percent” growth target for 2024, but it will take time for a more robust and balanced recovery to materialize.

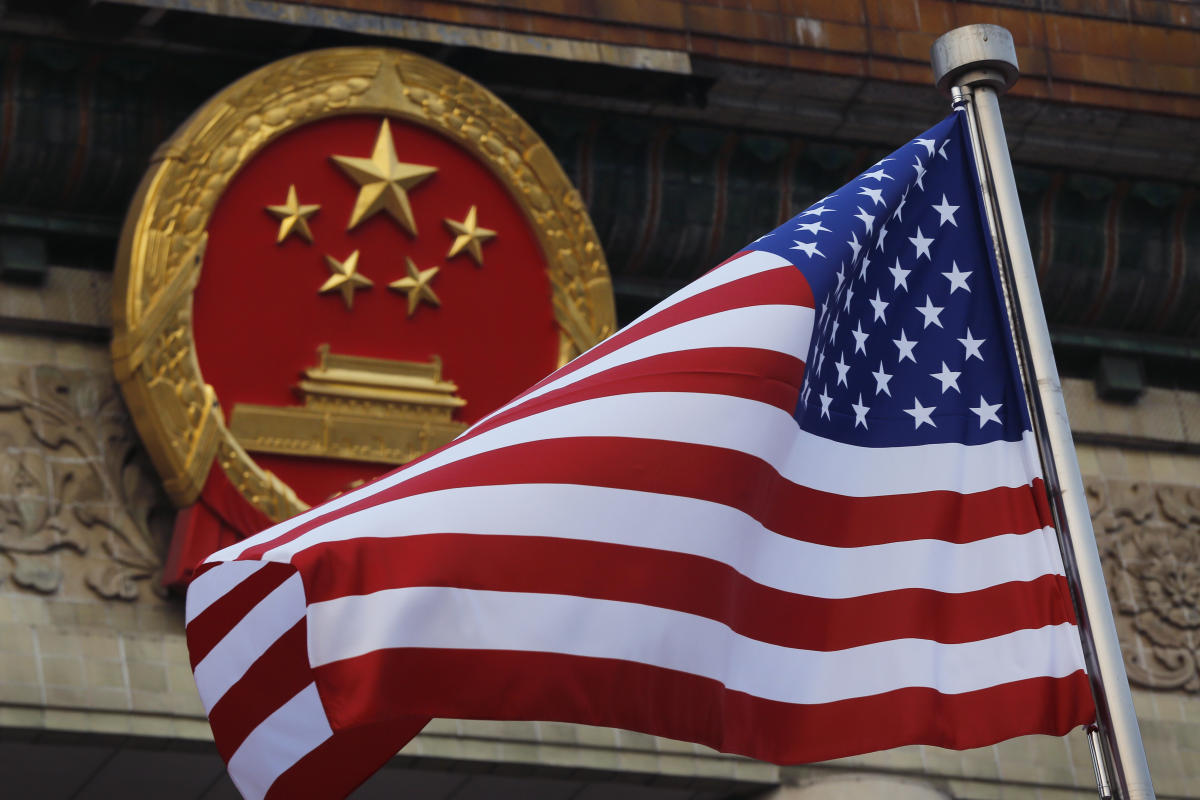

The effectiveness of future policy measures will be pivotal in shaping the trajectory for 2025, with a cautious eye on external pressures such as trade tensions with the US.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.