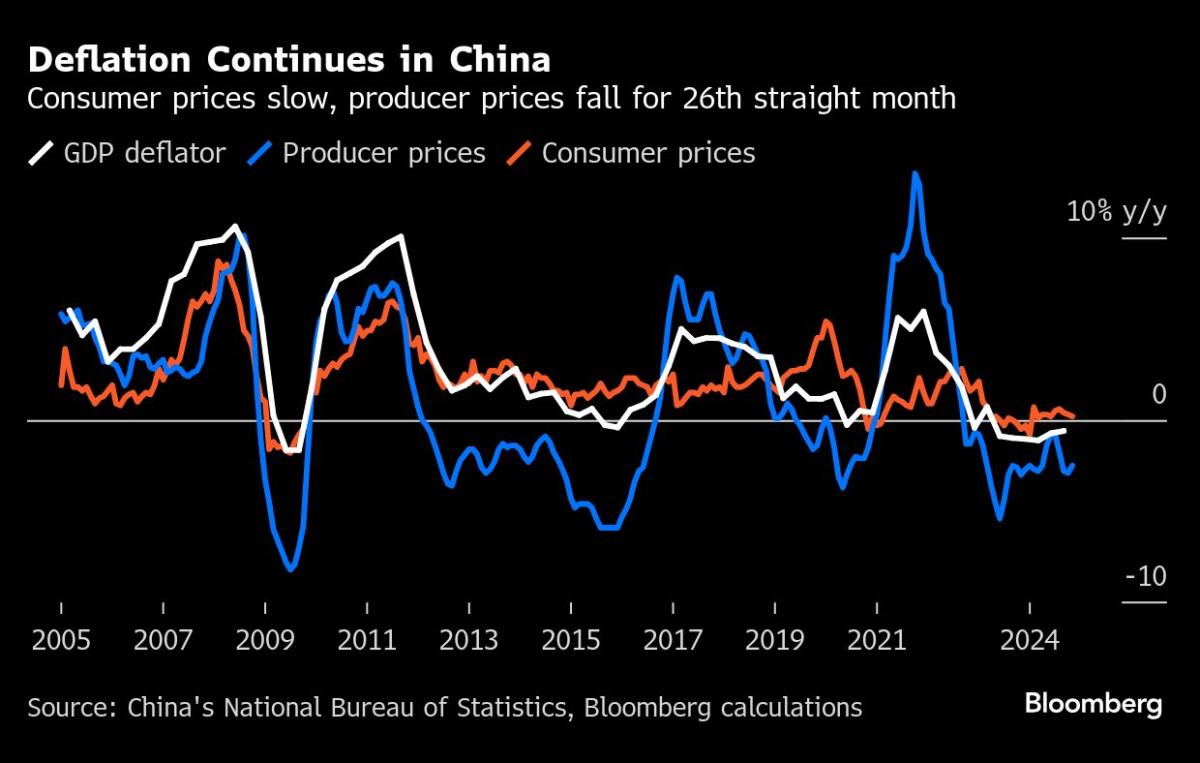

(Bloomberg) — China’s consumer inflation unexpectedly decelerated in November while factory deflation eased, painting a mixed picture of the effects of recent stimulus efforts on the economy ahead of key policy meetings this week.

Most Read from Bloomberg

The consumer price index rose a less-than-forecast 0.2% from a year earlier, the lowest since June, while core inflation picked up slightly. Factory deflation extended into a 26th straight month, though the producer price index recorded a slower drop of 2.5% compared to October.

Taken together, the official data released Monday showed Beijing’s measures stabilized sentiment but have yet to reverse a deflationary trend. The readings came before the Communist Party’s top decision-making Politburo is expected to hold its traditional December huddle on the economy, likely to be followed by the Central Economic Work Conference on Wednesday.

“Weaker inflation may intensify calls for additional policy stimulus in December,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee.

Reaction in the stock market was muted after the data was published. The benchmark CSI 300 Index of onshore shares reversed earlier gains and traded down 0.5% by noon break. The Hang Seng China Enterprises Index, which tracks Chinese stocks traded in Hong Kong, also fluctuated to trade 0.6% down.

Many expect the meetings this week to signal stronger stimulus to achieve a growth target similar to this year’s “around 5%” expansion, after Beijing rolled out a broad policy package from late September to defend that goal. Looming US tariffs following the election of Donald Trump mean China needs to prepare and counter any shock to exports, which have been a key pillar of growth since the pandemic.

Top officials will “surely want to boost domestic consumption in the face of external uncertainties in 2025,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. But any sustained improvement will require an overall turnaround in the economy and property market, he added.

What Bloomberg Economics Says…

“The weak price signals, coming on the heels of sluggish PMIs, reinforce the impression that stimulus delivered so far is failing to revive the economy.”

— David Qu, economist. For full analysis, click here

For next year, officials have hinted at greater fiscal stimulus and vowed to expand a government program to subsidize purchases of home appliances and cars. Consumption growth received a boost from those subsidies in recent months, although the effect is likely temporary.