This report is from this week’s CNBC’s The China Connection newsletter, which brings you insights and analysis on what’s driving the world’s second-largest economy. You can subscribe here.

The big story

While tensions flare with the U.S., China is charting its course for the next five years.

Chinese President Xi Jinping and the country’s top leaders, known as the Central Committee, will meet next week from Monday to Thursday for a planning meeting called the “Fourth Plenum.”

The gathering reminds the U.S. government, on the verge of possibly its longest shutdown in history, that China is a big believer in planning. Beijing has held the strategy-setting meeting twice every decade since the 1950s to rally the country around specific social and economic goals.

This year, China has promoted its achievements under the “14th five-year plan” despite U.S. pressure on tech and trade.

The upcoming “15th five-year plan” is particularly critical as China has laid out even longer-term ambitions for 2035, said Zong Liang, former chief researcher at the Bank of China. By then, China aims to boost per capita gross domestic product to the mid-range of developed countries, while achieving “major breakthroughs” in core technologies.

But that’s getting ahead of the immediate challenges that policymakers will discuss next week: navigating increased U.S. tech restrictions, the possibility of a 100% tariff hike and lackluster domestic demand.

Rather than announce sweeping changes, Beijing is likely to double down on “reforms” to boost domestic demand — from reducing regional business barriers within China to expanding visa access, Zong said.

Following a recent ramp-up of support for high-tech industries, Beijing will likely pledge more support for homegrown semiconductors, artificial intelligence and humanoid robots. Full details aren’t expected until the annual parliamentary meeting in March 2026, although a readout of next week’s meeting should offer an early look at the exact priorities.

“The technology part of the [plan] should focus on two things: AI, where the adoption rate in key areas is required to reach 90% by 2030; and basic scientific research, which remains some way off the official target,” Tianchen Xu, senior economist for Asia for the Economist Intelligence Unit, said in a note.

At a time when the U.S. is scaling back on its climate commitments, China has the next five years to make good on its pledge to start reducing carbon emissions after 2030.

So far, China is falling behind in its aim to reduce its emissions rate, Xu said. “We think that achieving this goal is still possible, but would require more concerted efforts on power market reform, and the weeding out of emission-intensive industries.”

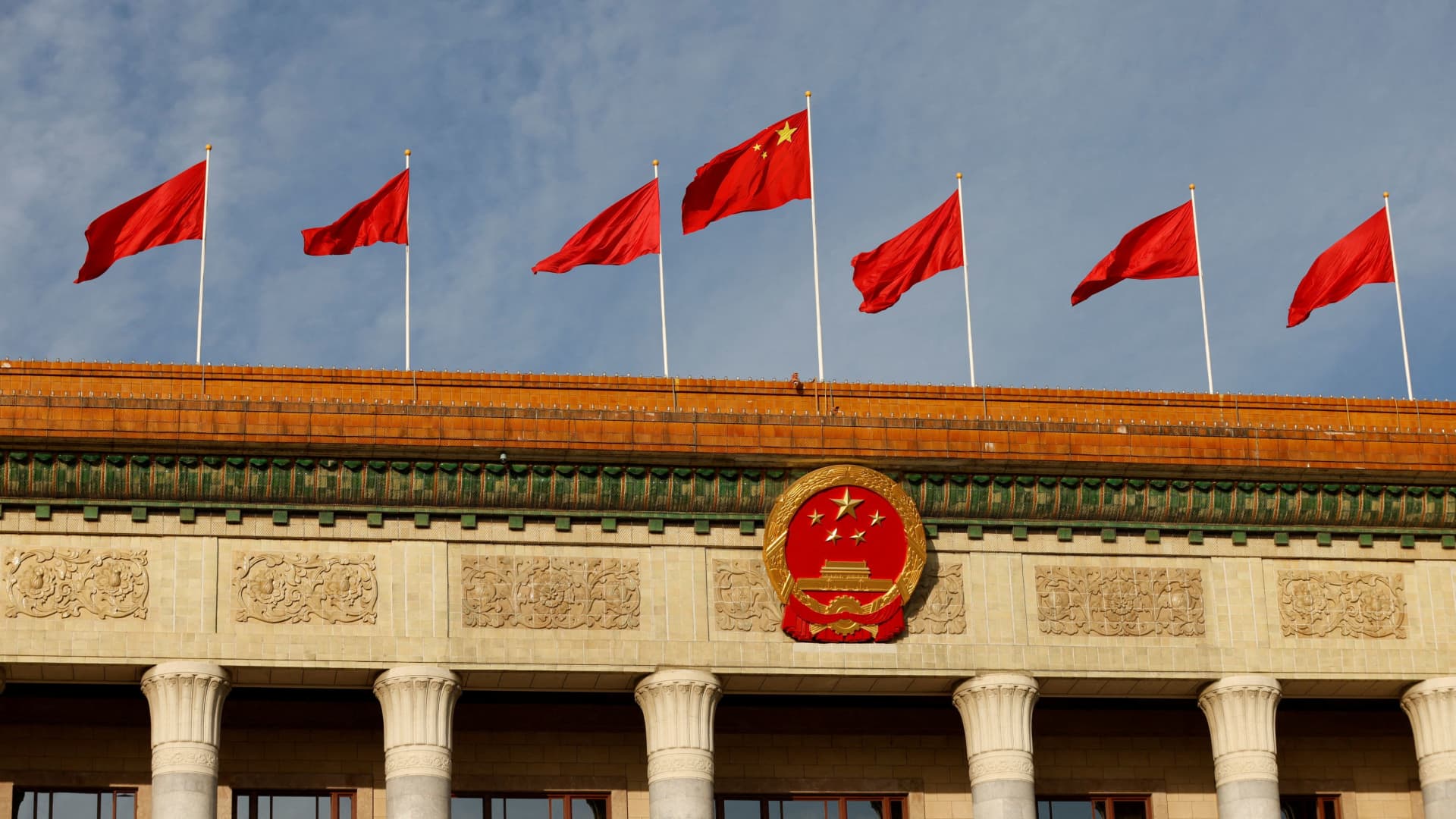

A Chinese flag flutters on top of the Great Hall of the People ahead of the opening ceremony of the Belt and Road Forum (BRF), to mark 10th anniversary of the Belt and Road Initiative, in Beijing, China October 18, 2023.

Edgar Su | Reuters

Planning vs. adapting

It’s still unclear whether China can rely on planning alone to achieve tech breakthroughs and economic growth.

In fact, Macquarie’s Chief China Economist Larry Hu noted that the country’s three most significant economic shifts in the past 25 years “were driven by external demand [changes] rather than the Five-Year Plans.”

These include China’s increased role in global supply chains after joining the World Trade Organization and Beijing’s decision to crack down on the property sector. Hu now expects another major turning point as exports cool, following their recent resilience despite U.S. tariffs.

And sure, China’s electric vehicle ambitions have rocked the global autos industry. But Beijing has also fallen short on several “Made in China 2025” targets that were announced back in 2015.

The domestically built C919 passenger jet, for example, continues to rely on U.S. and European components.

National security

Then there’s the growing concern that China’s emphasis on manufacturing without sufficient domestic demand has forced many companies into a race to the bottom. The resulting oversupply has flooded global markets with cheap goods, pressuring the industrial base of other countries and prompting tariff threats, not just from the U.S., but also from Mexico and the EU.

Beijing’s line is that countries should not blame China, and instead share technology by playing to each nation’s respective strengths.

Some countries, including Russia and other members of the Shanghai Cooperation Organization that met in Tianjin last month, have shown interest in adopting China’s technology, which is often cheaper than U.S. or European alternatives. DeepSeek, for example, has undercut OpenAI on both AI operating costs and accessibility.

But other countries may see China’s rise as a threat. Washington has tightened export controls and expanded tariffs as Beijing continues to challenge U.S. dominance in key industries. China’s economic expansion, meanwhile, continues to threaten Washington’s dominance as the world’s largest economy.

Hence, the Catch-22 in China’s goals: Beijing has underscored the need to balance national security with development. The country is also keen on prioritizing self-preservation and domestic stability.

Next week, China’s leaders will signal how they expect that seemingly contradictory mix of ideals to play out — before seeing whether Xi will meet with Trump in South Korea later this month.

Top TV picks on CNBC

Kenneth Feng, President, Executive Director at MGM China, talked about investing in ‘quality events’ in Macao, as the gaming hub works to diversify its revenue.

Joe Tsai, chairman of Alibaba, spoke exclusively to Emily Tan about the future of AI, and China’s unique advantage – especially as Chinese companies become increasingly prominent in AI innovation and output.

Former Houston Rockets center Yao Ming — also former head of the China Basketball Association — spoke about developing and nurturing the love for basketball in China.

Need to know

Quote of the week

The issue is the [Chinese] leadership has been prioritizing the manufacturing sector, due to economic security concerns, but employment in that sector is not rising. Output is rising rapidly, but a lot of that output is driven by automation, so it’s not really adding to labor demand. So what we’d like to see more of a focus on the service sector, because that can provide more of the jobs that young people need.

— Julian Evans-Pritchard, head of China economics at Capital Economics

In the markets

China’s stock market traded higher on Wednesday after U.S. Federal Reserve Chair Jerome Powell provided a few hints that more interest rate cuts are in the cards.

The Hang Seng Index rose 1.94%, while the CSI 300 added 1.47%. Both indexes have added 29% and around 17% respectively. Yields on China’s 10-year government bond lost around one basis point to 1.757%.

The performance of the Shanghai Composite over the past year.

Coming up

Oct. 16: Alibaba’s Tmall holds Singles Day shopping festival press conference in Shanghai

Oct. 17: Apple opens iPhone Air reservations in mainland China, with sales to begin Oct. 22

Oct. 17 – 19: GT World Challenge Asia holds racing series in Beijing for the first time as China seeks to build up locally hosted sports events

Oct. 20: China to release Q3 GDP, retail sales and other economic data for September

Oct. 20 – 23: China to hold ‘Fourth Plenum’ to discuss development goals for the upcoming five years