Introduction: China says ‘win-win cooperation is the right path’ as Nvidia H20 sales cleared

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Relations between the US and China appear to have warmed, slightly, after chipmaker Nvidia was given a green light by Washington to resume sales of its H20 AI chip to Chinese companies.

Nvidia’s CEO, Jensen Huang, revealed earlier this week that the US government has assured his company that licences for H20 chip sales to China would be granted, and that deliveries could start soon.

That reverses a restriction announced in April, when the White House announced tighter controls on exports of computer chips used for artificial intelligence.

And today, Beijing has welcomed this change of heart, confirming that the US has ‘taken initiatives” to approve H20 sales to China again.

China’s Commerce Ministry said in a statement that “win-win cooperation” was the right path to go down, and that it hopes the two countries can “meet each other half way” and work together.

The ministry also urged the US to abandon its “zero-sum mentality” and cancel ‘unreasonable’ trade restrictions on China, warning that “suppression” will not lead to solutions.

The H20 graphics processing unit, or GPU, is an advanced chip for use in AI systems. But it’s less powerful than Nvidia’s top semiconductors today, as it was designed to comply with US restrictions for exports of AI chips to China.

Earlier this week, commerce secretary Howard Lutnick revealed that the renewed sale of H20 chips to China was linked to a rare earths magnet deal. He also claimed Nvidia would only be selling China its “fourth best” chip.

Even so, the prospect of more sales to China pushed Nvidia’s shares to record highs this week.

Orders from Chinese companies for H20 chips need to be sent by Nvidia to the U.S. government for approval.

The agenda

-

9.30am BST: UK insolvency data

-

10am BST: Eurozone construction output data for May

-

1.30pm BST: US housing starts data for June

-

3pm BST: University of Michigan consumer confidence report

Key events

Goldman Sachs has predicted the Bank of England will take a slightly slower approach to cutting interest rates, following this week’s data.

Goldman still expect a rate cut in August (from 4.25% to 4%), even though inflation rose in June and private sector pay growth in March-May was higher than expected.

But they have now dropped their forecast for a September cut.

Sven Jari Stehn, Goldman’s chief European economist, told clients:

While the hurdle for speeding up cuts in September looks higher after this week’s data, we now expect sequential cuts from November until reaching a 3% terminal rate in March 2026 (versus February before). That is, we now expect a total of five cuts this year (previously six) and two next year (previously one).

That would mean rate cuts in August, November and December this year, and February and March 2026.

The Bank has already cut rates twice this year, at its meetings in February and May.

Shares in pharmaceuticals firm GSK have dropped over 6% in early trading, after its blood cancer drug Blenrep hit a regulatory hurdle in the US.

Yesterday, the US FDA’s panel of independent advisers recommended against Blenrep, citing earlier concerns over eye-related side effects.

GSK told the City that it remains confident in the benefit/risk profile of Blenrep and said it will continue to work closely with the FDA as they complete their review of the drug. The final decision on whether to approve a drug rests with the FDA, which will consider the view of its Oncologic Drugs Advisory Committee (ODAC), which voted 5-3 against Blenrep.

The company added that Blenrep combinations are approved for refractory multiple myeloma (cancer that does not respond to treatment) in several markets including the UK and Japan, and that applications in other markets including the EU and China are being reviewed.

EU approves new Russian sanctions package

The European Union has announced the approval of a fresh sanctions package on Russia over its war against Ukraine, which includes a revised oil price cap and new banking restrictions.

EU member states gave the package the green light this morning after Slovakia lifted its veto.

Kaja Kallas, the EU’s High Representative for Foreign Affairs and Security Policy, says the sanctions package – the EU’s 18th – is one of the strongest put together against Russia so far.

It includes a ban on more Russian banks accessing the SWIFT international payments system, sanctions on the Nord Stream gas pipelines, and a lower cap on Russian oil sales.

We are standing firm.

The EU just approved one of its strongest sanctions package against Russia to date.

We’re cutting the Kremlin’s war budget further, going after 105 more shadow fleet ships, their enablers, and limiting Russian banks’ access to funding. (1/3)

— Kaja Kallas (@kajakallas) July 18, 2025

Nord Stream pipelines will be banned.

A lower oil price cap.We are putting more pressure on Russia’s military industry, Chinese banks that enables sanctions evasion, and blocking tech exports used in drones. (2/3)

— Kaja Kallas (@kajakallas) July 18, 2025

For the first time, we’re designating a flag registry and the biggest Rosneft refinery in India.

Our sanctions also hit those indoctrinating Ukrainian children.

We will keep raising the costs, so stopping the aggression becomes the only path forward for Moscow. (3/3)

— Kaja Kallas (@kajakallas) July 18, 2025

Diplomat have told Reuters that the package will lower the G7’s price cap for crude oil to $47.6 per barrel.

Bloomberg reports that the new price cap, which is currently set at $60 per barrel, will now be set “dynamically” at $15 below market rates.

This follows criticism that Europe has been spending tens of billion on Russian energy since the Ukraine war began, exceeding the cost of it support for Kviv.

BP agrees to sell to sell US onshore wind business

Energy news: BP has continued its push to pivot back to oil and gas, by agreeing a deal to sell its US onshore wind business to LS Power.

The wind business operates nine onshore wind energy assets across seven US states, and are grid-connected and are providing power to customers.

William Lin, bp’s executive vice president for gas & low carbon energy, says:

“We have been clear that while low carbon energy has a role to play in a simpler, more focused bp, we will continue to rationalize and optimize our portfolio to generate value.

The onshore US wind business has great assets and fantastic people, but we have concluded we are no longer the best owners to take it forward.

The price of the deal hasn’t been revealed; BP says it is part of its $20bn divestment program to simplify and focus its business.

In the City of London, consumer goods maker Reckitt Benckiser has agreed to sell a majority stake in its Cillit Bang and Calgon arm to private equity firm Advent International.

The deal is worth up to £3.6bn, and will see Reckitt retain a 30% stake in the essential home business – also including brands such as Air Wick, Woolite, Resolve, Sole and Easy-Off

Kris Licht, Reckitt’s chief executive, says:

“We are executing our strategic plan at pace.

The divestment of Essential Home represents a significant step forward in unlocking the substantial value in our business.

This moves Reckitt towards becoming a simpler, more effective world-class consumer health and hygiene company and it will enable us to focus on a core portfolio of high-growth, high-margin powerbrands.”

Shares in Reckitt have risen 1.5% at the start of trading, putting it among the FTSE 100 top risers.

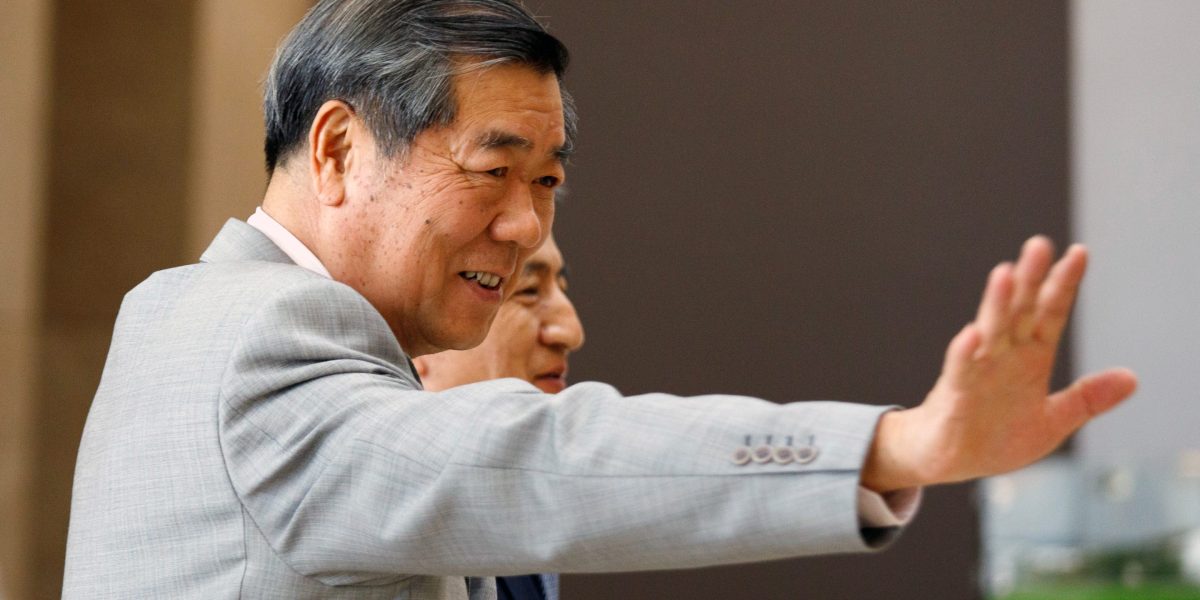

Katsunobu Kato’s criticism of US tariffs come after Japan’s exports to the United States fell for the third straight month.

Data released on Thursday showed that the value of shipments fell 11.4 percent in yen terms in June, compared with the same month last year.

The car sector was hit hard, with exports were down 26.7%. The number of vehicles was up, but their average price was down nearly 30%. That could be a sign that automakers are cutting prices or shipping cheaper models to offset the tariffs.

Japan’s Kato says tariffs not right tool to fix trade imbalances

Donald Trump’s trade war has loomed over the meeting of G20 finance ministers in South Africa this week.

Japan told the gathering of advanced economies in Durban that tariffs aren’t the right way to fix trade imbalances.

Finance minister Katsunobu Kato told reporters at the G20:

“Japan said that tariffs aren’t really the right tool to fix excessive current accounts imbalances.”

Kato argued that countries facing such situations need to address them through domestic efforts, rather than slapping new levies on imports.

The US’s trade balance (rarely the healthiest) has actually worsened this year, as American companies raced to import goods before tariffs were imposed.

However, US Treasury secretary Scott Bessent won’t have heard Kato’s message as he’s not attending the G20.

A finance ministry official accompanying Kato explained that many G20 members argued that market stresses appear to have eased somewhat, Bloomberg reports, as the world economy hasn’t suffered as much as expected from the trade war [although, of course, some of Trump’s new tariffs now don’t start until 1 August].

Introduction: China says ‘win-win cooperation is the right path’ as Nvidia H20 sales cleared

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Relations between the US and China appear to have warmed, slightly, after chipmaker Nvidia was given a green light by Washington to resume sales of its H20 AI chip to Chinese companies.

Nvidia’s CEO, Jensen Huang, revealed earlier this week that the US government has assured his company that licences for H20 chip sales to China would be granted, and that deliveries could start soon.

That reverses a restriction announced in April, when the White House announced tighter controls on exports of computer chips used for artificial intelligence.

And today, Beijing has welcomed this change of heart, confirming that the US has ‘taken initiatives” to approve H20 sales to China again.

China’s Commerce Ministry said in a statement that “win-win cooperation” was the right path to go down, and that it hopes the two countries can “meet each other half way” and work together.

The ministry also urged the US to abandon its “zero-sum mentality” and cancel ‘unreasonable’ trade restrictions on China, warning that “suppression” will not lead to solutions.

The H20 graphics processing unit, or GPU, is an advanced chip for use in AI systems. But it’s less powerful than Nvidia’s top semiconductors today, as it was designed to comply with US restrictions for exports of AI chips to China.

Earlier this week, commerce secretary Howard Lutnick revealed that the renewed sale of H20 chips to China was linked to a rare earths magnet deal. He also claimed Nvidia would only be selling China its “fourth best” chip.

Even so, the prospect of more sales to China pushed Nvidia’s shares to record highs this week.

Orders from Chinese companies for H20 chips need to be sent by Nvidia to the U.S. government for approval.

The agenda

-

9.30am BST: UK insolvency data

-

10am BST: Eurozone construction output data for May

-

1.30pm BST: US housing starts data for June

-

3pm BST: University of Michigan consumer confidence report