By Antony Currie

BHP’s BHP shareholders seem exceptionally sanguine about a major threat to its biggest product from its largest customer. Last week Bloomberg reportedthat state-run iron ore buyer China Mineral Resources Group has told major steelmakers and traders to pause purchases from the A$213 billion ($140 billion) miner. Yet the stock fell no more than 2.5% on the news and has since recovered almost half of that. Perhaps investors are right not to worry this time – the directive may just be a tactic for price negotiations. The spat is a reminder, though, of one of the reasons why the mining industry is so keen on mergers: concentration risk.

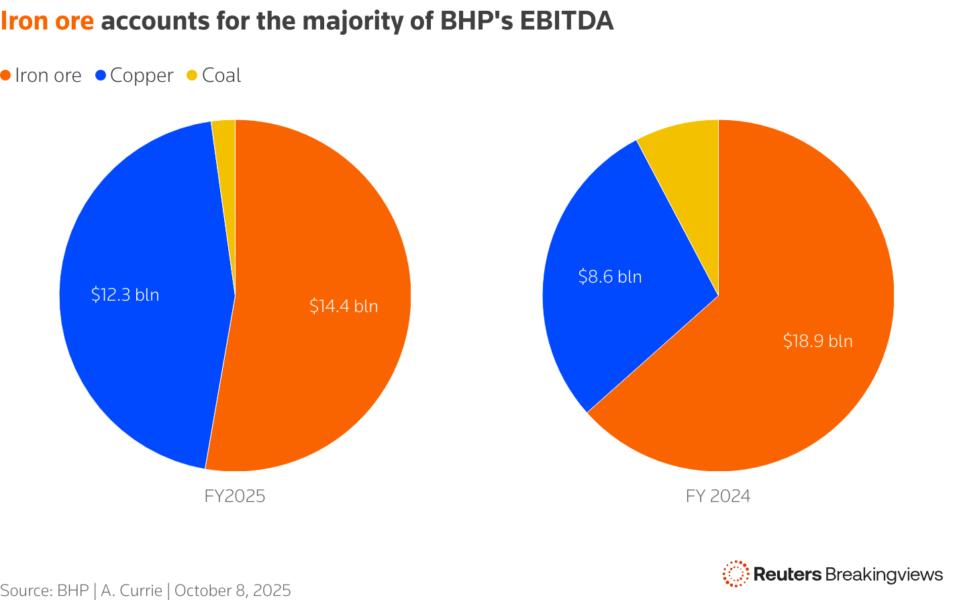

Under CEO Mike Henry, BHP has started to tackle this. It’s developing a potash business, and its copper production has increased 28% over the past three years, thanks in part to its 2023 purchase of Oz Minerals. That and a slight bump in the price of the red metal helped reduce iron ore’s contribution to the company’s underlying EBITDA in the 12 months to the end of June by 10 percentage points.

But the roughly one-quarter drop in the iron ore price had a bigger impact. And the key ingredient in steelmaking still accounts for a whopping 55% of BHP’s EBITDA; rival Rio Tinto RIO notched up a similar percentage for the first six months of 2025, down from 73% a year earlier.

Moreover, it’s a double concentration risk: Beijing buys the vast majority of the two miners’ iron ore. Reducing that dependence isn’t the only motive to diversify: China’s steelmaking needs may well have peaked; longer term, most Australian iron ore is not as suitable for making green steel as higher grades from Brazil, Guinea and elsewhere; and copper is a key way to play the energy transition.

The prospect of its top client routinely putting the squeeze on pricing, to the point of halting purchases, offers compelling grounds to go in search of new deals, too. Granted, Henry is picky, wanting, as he outlined in August, only targets that are large, low on the cost curve, have expansion potential and offer synergies. And though there has been a surge of M&A in the sector of late, including Anglo American’s AAL $54 billion tie-up with Teck Resources

TECK , increased government involvement is complicating dealmaking, BHP’s strategy chief toldthe Financial Times. But none of that dims the appeal.

Follow Antony Currie on Bluesky and LinkedIn.

CONTEXT NEWS

BHP shares were trading at A$41.93 a piece in afternoon trading on October 8, 1.4% lower than before Bloomberg reported on September 30 that China’s state iron ore buyer China Mineral Resources Group told major steelmakers and traders to temporarily pause purchases of dollar-denominated seaborne iron ore cargos from Australia-based miner, citing people familiar with the matter.

The standoff follows failed negotiations earlier this year over the renewal of contract terms. BHP had insisted on an annual pricing model while Chinese buyers demanded quarterly terms linked to spot levels, Bloomberg reported.