On the face of it, it’s a straightforward transaction. CK Hutchison Holdings Ltd plans to sell two of its ports near the Panama Canal as part of a broader $19 billion divestment. But in geopolitics, nothing is just what it seems. With President Donald Trump hailing the sale as a reclamation of American influence over the Panama Canal and China condemning it as a betrayal, what might have been a quietly lucrative exit has become an international flashpoint.

Driving the news

- CK Hutchison Holdings Ltd, the flagship conglomerate of Hong Kong billionaire

Li Ka-shing , is pressing forward with a high-stakes deal to sell two ports on the Panama Canal to a consortium led byBlackRock Inc — despite growing backlash from Beijing. - As per a Bloomberg report, people familiar with the matter say the agreement, part of a broader $19 billion global port sale, remains on track for signing by April 2. Final due diligence, tax and accounting terms are being finalized.

- The deal will hand over control of 43 ports in 23 countries, including the strategic Balboa and Cristobal terminals in Panama.

- Li’s firm has kept ports in mainland China and Hong Kong off the table — a decision that has done little to defuse Beijing’s anger.

Why it matters

- The port sale, once hailed as a savvy business move, has escalated into a geopolitical firestorm. It pits one of Asia’s most iconic tycoons against the full weight of Chinese state media, regulators and political sentiment — with US President Trump cheering from the sidelines.

- “It is not an exaggeration to say that the transaction will cause endless troubles to China’s economy and national interests,” Beijing-backed newspaper Ta Kung Pao warned in a recent commentary, another Bloomberg report said.

- China does not run the canal, but Li’s presence—through a Cayman Islands-registered firm with strategic assets—offered Beijing a foothold in the region. With the proposed sale, that leverage is seen to be slipping.

- The blowback against Li Ka-shing underscores how China under President Xi Jinping expects political loyalty from high-profile business figures, particularly those based in Hong Kong, which Beijing now treats as a tightly controlled extension of its system post-2019 protests.

- Trump, meanwhile, is reveling in the symbolism: He hailed the deal as evidence of the US regaining leverage in Latin America. Trump’s inaugural promise to “take back the Panama Canal” has now been echoed in headlines—even if the deal was brokered not by Washington, but by Goldman Sachs bankers.

The big picture: Strategic asset, symbolic battleground

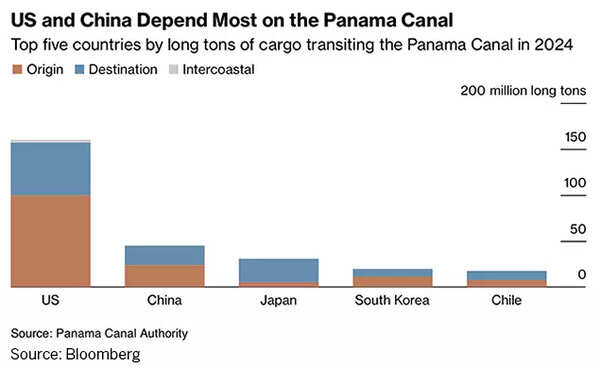

The Panama Canal carries nearly 3% of global shipping trade. Though operated by the Panamanian government, the ports at either end—Balboa and Cristobal—have become strategic flashpoints in the broader US-China contest for influence in Latin America.

CK Hutchison first entered Panama in 1998 under a 25-year concession, quietly anchoring Li’s global ports network. That arrangement had attracted little attention until recently, when Trump began framing the canal as a metaphor for American decline—and China’s rise.

In the current global climate, ports are not just ports. They are nodes of influence, supply chain leverage points, and potential tools of coercion. And the sale of those ports to a US-led consortium has prompted Beijing to treat what was once a business matter as a national affront.

Victor Li, Li Ka-shing’s son and CK Hutchison’s current chairman, made no mention of the deal in the company’s latest earnings statement. But he did caution about a “volatile and unpredictable” global business environment—likely an understatement given the firestorm that has followed.

After enjoying cordial relations with previous Chinese leaders, Li’s ties to the mainland appear to have weakened since Xi took the top job in 2013. He’s earned a new moniker too: dubbed ‘Cockroach King’ for what critics called his closet support of Hong Kong’s pro-democracy movement.

An Bloomberg report titled ‘Why Billionaire Li Ka-shing’s Panama Ports Deal Infuriates China’

What they’re saying

- Ta Kung Pao, a pro-Beijing newspaper, has slammed CK Hutchison’s “spineless groveling” and “betrayal of all Chinese.” “This is a concrete manifestation of US attempts to put pressure on China’s supply chain by controlling key ports,” Ta Kung Pao argued, warning that the sale “will cause endless troubles to China’s economy and national interests.”

- “Those who emphasize freedom of contract are too naive and confused,” Ta Kung Pao wrote.

- Chinese regulators, including the state administration of market regulation, are reportedly probing the deal for national security and antitrust issues.

- Beijing’s Hong Kong office has reposted harsh critiques, amplifying the signal that this isn’t just a media outburst — it reflects central government displeasure.

- Cancelling the deal would be risky, George Chen, managing director for Hong Kong at The Asia Group, told AP. “Strictly speaking, you just let Trump take credit for it, then you later say ‘Sorry, I’m canceling the deal.’ You can imagine what Trump’s reaction would be,” he said, adding that would also affect how the outside world views Hong Kong businesses.

- CK Hutchison and BlackRock? Radio silence: Neither company has responded publicly.

- BlackRock’s spokesperson declined comment, and Li Ka-shing has not made a public appearance since the backlash began, the Bloomberg report said.

Zoom in: Who is Li Ka-shing?

- As per an AP report, nicknamed “Superman” for his rags-to-riches story and business prowess, Li is one of Asia’s most influential tycoons. Born in mainland China in 1928 and raised in Hong Kong, he built an empire that spans ports, real estate, telecom, retail, and energy.

- At 96, he’s largely stepped back from public roles — his son Victor Li now chairs CK Hutchison — but his shadow still looms large over Hong Kong’s business and political scene.

- His fortune, estimated at over $30 billion, includes stakes in CK Asset, CK Hutchison, Zoom, and Cenovus Energy. But despite decades of balancing between East and West, this may be his toughest political test yet.

- Beijing once saw Li as a stabilizing pillar of Hong Kong’s capitalist system. Now, he’s derided in Chinese media as the “Cockroach King.”

Between the lines

- CK Hutchison has been quietly reducing its exposure to China for years. Its latest earnings show just 12% of revenue comes from Greater China. The bulk now flows from Europe, Australia, and Canada.

- The port sale helps CKH shed volatile assets and gain liquidity — but it’s being framed as a snub to Beijing at a sensitive time.

- China’s top brass, according to media reports, had hoped to use the Panama port assets as leverage in negotiations with Washington. Li’s surprise deal, allegedly struck without notifying Beijing, disrupted that calculus.

- The exclusivity clause in CK Hutchison’s negotiations effectively blocks any last-minute bids from Chinese state-owned enterprises — another point of friction.

What’s next

- The deadline to sign is April 2, and there’s little indication the deal will be delayed — barring a sudden political U-turn.

- Analysts say Beijing has limited legal recourse since the assets lie outside Chinese jurisdiction. But retaliation through regulatory pressure in Hong Kong or the mainland remains a real risk.

- Hong Kong chief executive John Lee has tried to walk a tightrope, saying the deal would be evaluated “in accordance with the law” while echoing Beijing’s broader concerns about foreign coercion.

- Panama’s government must still approve the sale. If Beijing applies pressure there — diplomatically or economically — it could pose the biggest risk to the transaction.

(With inputs from agencies)