(Bloomberg) — Wall Street had a lot riding on whether this week’s big-tech earnings would meet increasingly high expectations. By and large, the companies delivered.

Most Read from Bloomberg

Yes, the stock market finished the week on a down note with Friday’s selloff, which was in part sparked by mixed results from Amazon.com Inc. after the market closed Thursday, as well as a weak jobs report and fears about the economic impact of President Donald Trump’s sweeping global tariffs. But for the most part, investors looking for strength from technology companies to justify their market leadership found plenty of it in their reports.

“The sector is proving itself to have something like Teflon status, as fundamentals look strong, revenue growth has come in quite significantly higher than expected, and margins remain relatively healthy,” said Kevin Gordon, senior investment strategist at Charles Schwab & Co. “While things aren’t perfect, and valuations are nearing a level that has acted as a ceiling in the past, we still have a high degree of optimism, especially as we go up the market-cap spectrum.”

Alphabet Inc. started the season off last week by reporting strong sales, lifted by artificial intelligence. This week, Apple Inc. posted its strongest revenue growth in more than three years, while Meta Platforms Inc. spiked to a record as it beat expectations and outlined aggressive spending on AI. Microsoft Corp. reported robust strength in its cloud business on the back of AI demand, enough to temporarily lift it to a $4 trillion market capitalization, only the second company ever to do so. The stock has risen for 10 straight weeks, its longest streak since 2023.

Amazon was the exception, offering a tepid forecast due to relatively slow growth in its cloud-computing division and heavy investments into AI. From here, investors will turn to chip behemoth Nvidia Corp., which reports at the end of the month.

Stretched Valuations

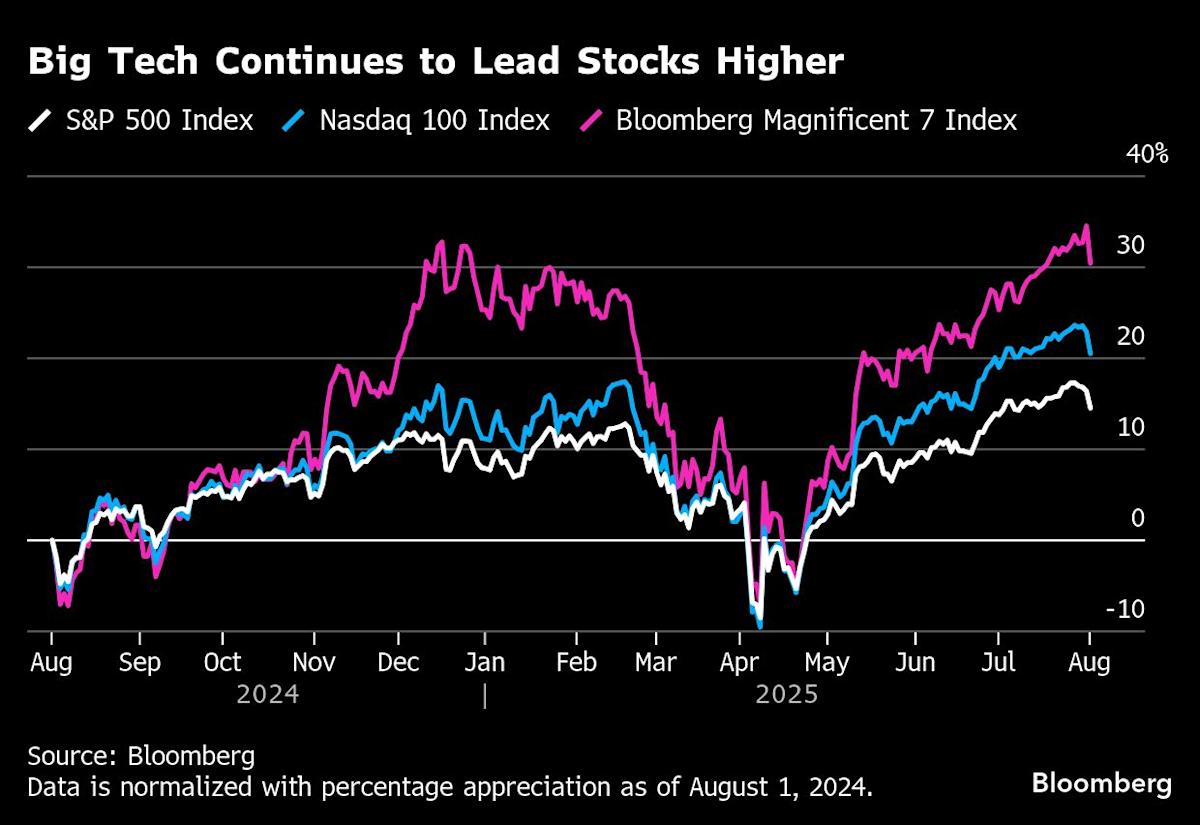

The Nasdaq 100 Index finished the week down 2.2%, with much of the drop coming on Friday. And a Bloomberg gauge of the Magnificent Seven stocks — which includes all of these companies and Tesla Inc. — declined 1.5% over the five sessions.

However, the Nasdaq 100 remains up more than 30% off its low from early April, while the Mag Seven Index is up more than 40%. Those gains are raising questions among some Wall Street pros about whether the rally in tech has become overly stretched. The Nasdaq 100 is trading at nearly 27 times estimated earnings, well above its 10-year average of 22.

Overall, however, none of the companies that have reported are showing dramatically weakening fundamentals, which is particularly important as uncertainty continues to swirl around the impact of trade policy and tariffs. More than 96% of tech firms in the S&P 500 Index have topped expectations for profits, while roughly 93% have for revenue, according to data compiled by Bloomberg. For the index overall, the beat rates stand at 82% for earnings and 68% for revenue.

While Wall Street has long been broadly positive on big tech, this week’s results reinforced it’s continuing potential. The Magnificent Seven are expected to see earnings growth of 24.2% this year, a dramatic increase from the 21.4% pace that was predicted just a month ago, according to Bloomberg Intelligence data. Revenues are anticipated to rise 13.4%, up from the 11.5% pace seen in early July.

Of course, that level of growth would represent a deceleration from last year, when the Mag Seven’s net income rose 36% and revenue gained 14%. But the group continues to outgrow the broader market, which is expected to see earnings expand by 8.9% in 2025 on revenue growth of 5.5%.

“This slowing is understandable given how quickly these names were growing, and for how long,” said Michael Nell, a senior investment analyst and portfolio manager at UBS Asset Management. “We’re not seeing the kind of dramatic deceleration that would be a cause for concern, just a reflection that these large companies can’t grow to the sky forever.”

Waiting For Nvidia

Now investors are waiting on Nvidia, the chipmaker at the heart of the AI boom and the world’s biggest company, which is scheduled to release its earnings on Aug. 27. Advanced Micro Devices Inc., its much-smaller rival in AI processors, reports on Tuesday.

The bottom line for both is that big tech reaffirmed their intention to continue spending on AI, as Meta, Microsoft, Alphabet and Amazon all increased their plans for capital expenditures. That represents a cluster of encouraging data points for Nvidia, which derives more than 40% of its revenue from those four companies, according to supply chain data compiled by Bloomberg.

“Use cases for AI are emerging and some companies are already seeing a payoff, meaning this isn’t speculative anymore,” Nell said. “That doesn’t mean big tech can’t get ahead of themselves and pull back, but tech is on an inexorable march to be a larger and larger part of the market. That’s been the trend my whole career, and I don’t know why it would stop now.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.