Asia-Pacific’s private capital sector could get support from Chinese government stimulus as well as greater development of other financial markets in the region, according to data provider Preqin.

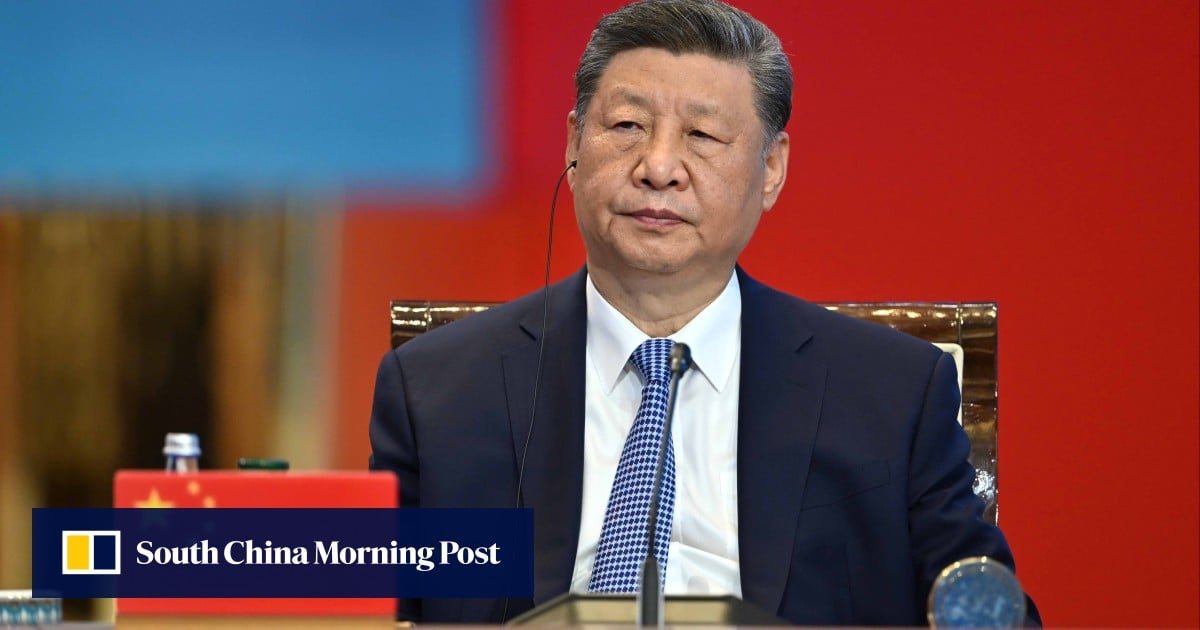

“China remains a heavyweight in APAC’s private capital market, and a major comeback in its economy could present further upside to our regional forecasts,” said Lai. However, “a deterioration may warrant reviews to the downside.”

She said China’s gross domestic product growth is one of the highest among the world’s major economies, adding that the next few years could bring “critical changes” as Beijing rolls out policy support and reforms targeting the property sector. A focus on technological development and value-added production is also important, she said.

“If well executed, all this could improve the long-term resilience of the market, and the benefits could extend beyond its investors to its neighbouring trade partners,” she said.

Preqin believes private market fundraising in APAC bottomed out in 2023 and will gradually improve, with an annualised growth rate of 6.7 per cent between the end of last year and 2029, according to its note.