For two years, the United States has been attempting to stifle China’s technological growth with sweeping restrictions. Antonia Hmaidi, a senior analyst at the Merics think tank, offers her assessment.

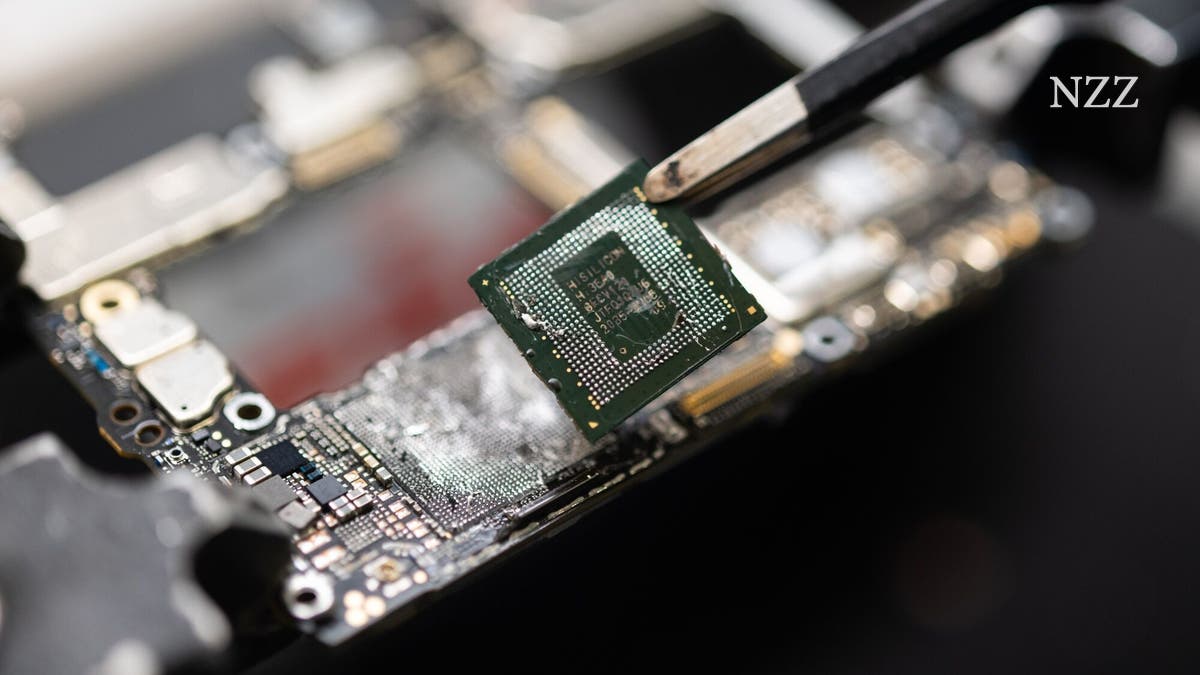

Huawei’s Kirin 9000s chip powers its smartphones with 5G capabilities, despite U.S. sanctions aimed at curbing the Chinese tech giant’s advances.

If the United States gets its way, China’s tech sector will remain stuck in the past. That’s the objective of the broad export controls the Biden administration has been enforcing on China for the past two years. The goal is to freeze China’s technological progress – or, at the very least, slow it down and make it more costly. And, crucially, to keep American high-tech out of Chinese military hands.

The United States and its allies defend the export controls, claiming they need the extra time to rebuild critical industries and secure their technological edge over China.

But is it working? Antonia Hmaidi, a senior analyst at the Berlin-based Merics think tank, focuses on China’s push for tech independence. According to her assessment, the American measures have created challenges in some areas.

Antonia Hmaidi, have U.S. efforts succeeded in slowing China’s tech progress over the past two years?

When it comes to computer chip technology, two years is a relatively short time. The current effects we’re seeing are from measures the United States implemented more than two years ago.

Which measures are you referring to?

In 2018, the United States moved to block China’s access to cutting-edge chip manufacturing equipment. In response, Chinese companies, like Huawei and chipmaker SMIC, began adapting early. Despite the export restrictions, SMIC is now producing 7-nanometer chips, which usually require state-of-the-art machinery. Instead, SMIC has been using older machines, repeating certain production steps to make these advanced chips. Huawei, for instance, uses them in its 5G smartphones.

So, are U.S. measures falling short?

Not exactly. The controls are definitely having an impact. China’s 7-nanometer chips are more expensive due to longer production times and higher defect rates. And so far, China hasn’t managed to manufacture 5-nanometer chips. In that sense, U.S. measures have slowed down China’s progress. But the United States can’t completely halt China’s tech development. What they’ve done is slowed the pace and increased the costs. Still, the Chinese have adapted to some extent, finding alternatives or stopgap solutions to push ahead.

Antonia Hmaidi, senior analyst at Merics.

What do you mean?

Chips restricted by export controls still make their way into China, though through indirect routes. Moreover, some companies bypass restrictions by using cloud services from providers like Amazon, renting foreign data centers instead of building their own. And finally, Chinese alternatives are beginning to surface. For instance, Huawei has developed its own chip for AI applications. While it falls short of the latest models from American manufacturer Nvidia, it’s still better than the chips Chinese companies can legally acquire from the West.

For China, technologies like computer chips are deeply tied to national security. How do you obtain information about Huawei’s AI chip?

In the past, there was a lot of open, even boastful, reporting on technological advances. That changed when some of these reports triggered American sanctions. Chip manufacturer SMIC publicly celebrated a breakthrough in chip technology in 2020. Soon after, the U.S. Department of Commerce took action against SMIC, requiring U.S. firms to obtain special licenses to work with the company. Since then, gathering information has become more complex and time-consuming.

How do you go about it now?

I rely, for example, on company announcements, research papers and patent filings to get an idea of what’s going on. Companies still have an interest in showcasing their progress, though increasingly, they only do so in Chinese. However, some of these claims can be exaggerated.

What about research publications?

A significant amount of research is still being published, as funding bodies often evaluate institutes based on their output. To secure funding, these institutes must continue publishing their work. Some papers are now deliberately withheld from English-language journals, but they remain accessible in Chinese publications.

How valuable are patent applications in this context?

It’s not uncommon for patents to be classified as secret if the Chinese government deems them critical to national security. Nonetheless, many patents, including those for key technologies like computer chips, are still made public. Last year, for instance, Huawei filed a patent for advanced lithography technology, which is essential for chip manufacturing. Sometimes I wonder: Does China really want the United States to know about this?

Based on your research, where are U.S. sanctions creating the most challenges for China?

China’s biggest hurdle lies in the equipment needed for chip manufacturing. Different machines are required for each step in the complex production process, and China remains heavily reliant on foreign machinery impacted by U.S. sanctions. Less than 20% of the equipment used in each step of the Chinese manufacturing process is domestically produced. This dependency explains why the United States has zeroed in on chipmaking machinery.

Where else is China struggling?

Generative artificial intelligence (AI), such as language models, is another key area. The most advanced chips, known as GPUs, typically used for these applications, cannot be exported to China under current U.S. restrictions.

How is China responding?

China is centralizing its available GPUs into shared data centers, where they can be continuously used. Access to computing power is then allocated based on government decisions, which sometimes lead China to prioritize differently from Western nations.

Can you give an example?

Chinese AI models are typically trained on smaller datasets and are less complex. As a result, these models are often task-specific. For instance, one model might assist a worker in maintaining machinery but would be less versatile for other purposes. Chinese models are worse than those developed by companies like OpenAI, Meta or Alphabet, which are known for their adaptability.

What impact are U.S. chip sanctions having on China’s military developments?

That’s harder to gauge. Over time, however, U.S. sanctions could increasingly affect even standard technologies. As technology advances, the chips found in ordinary laptops may eventually match the capabilities of the AI chips the United States is currently withholding from China. If high-performance chips become widespread in the West while China struggles to access or produce them, this will pose growing challenges for China.

What would that mean for China’s military?

Better chips could make a difference in areas like drone technology, for example. Right now, drone operations rely on calculations performed on the ground, which are then transmitted to the drone. As long as this is the case, you can theoretically disable a drone by severing its communication link. But with more powerful chips on board, a drone could process calculations independently, making it much harder to neutralize. In other words, there are many scenarios in which the United States’ current measures could drive substantial changes in the future. But I don’t think they have much influence today.

You mentioned earlier that after two years, it’s difficult to assess the full impact of U.S. measures on China. What about the goal of the United States and its allies to bolster their own technological capabilities?

That objective is so broad and involves so many different technologies. It’s impossible to say when it will be achieved.

Latest articles

Global reporting. Swiss-quality journalism.

In today’s increasingly polarized media market, the Switzerland-based NZZ offers a critical and fact-based outside view. We are not in the breaking-news business. We offer thoughtful, well-researched stories and analyses that go behind the headlines to explain relevant events in the U.S., in Europe and worldwide. To produce this work, the NZZ maintains an industry-leading network of expert reporters around the globe who work closely with our main newsroom in Zurich.

Sign up for our free newsletter or follow us on Twitter, Facebook or WhatsApp.