Bulls are more optimistic than ever, but there’s a lot of skepticism.

Artificial intelligence has reenergized the tech sector, and semiconductor stocks in particular have enjoyed huge gains. The standard-bearer for the chip revolution is Nvidia (NVDA 2.21%), which has found valuable applications for semiconductors that it initially used to power graphics processing capabilities. Now, Nvidia stock is the envy of the stock market.

My Voyager Portfolio aims to look beneath the surface of these key trends, though, to find companies that have gone unnoticed. Unfortunately, when it comes to semiconductor makers, the market has been unusually diligent in unearthing just about every possible opportunity to benefit. Indeed, even long-suffering Intel (INTC +0.61%), which many abandoned as having failed to keep up with the times after its initial success during the PC boom, has made its way back to prominence. Yet many still feel that the same problems that landed Intel in the scrap heap in the 2010s haven’t really gone away. In the first of a three-article series on Intel, you’ll learn more about the boom and bust that put Intel in the position it finds itself today.

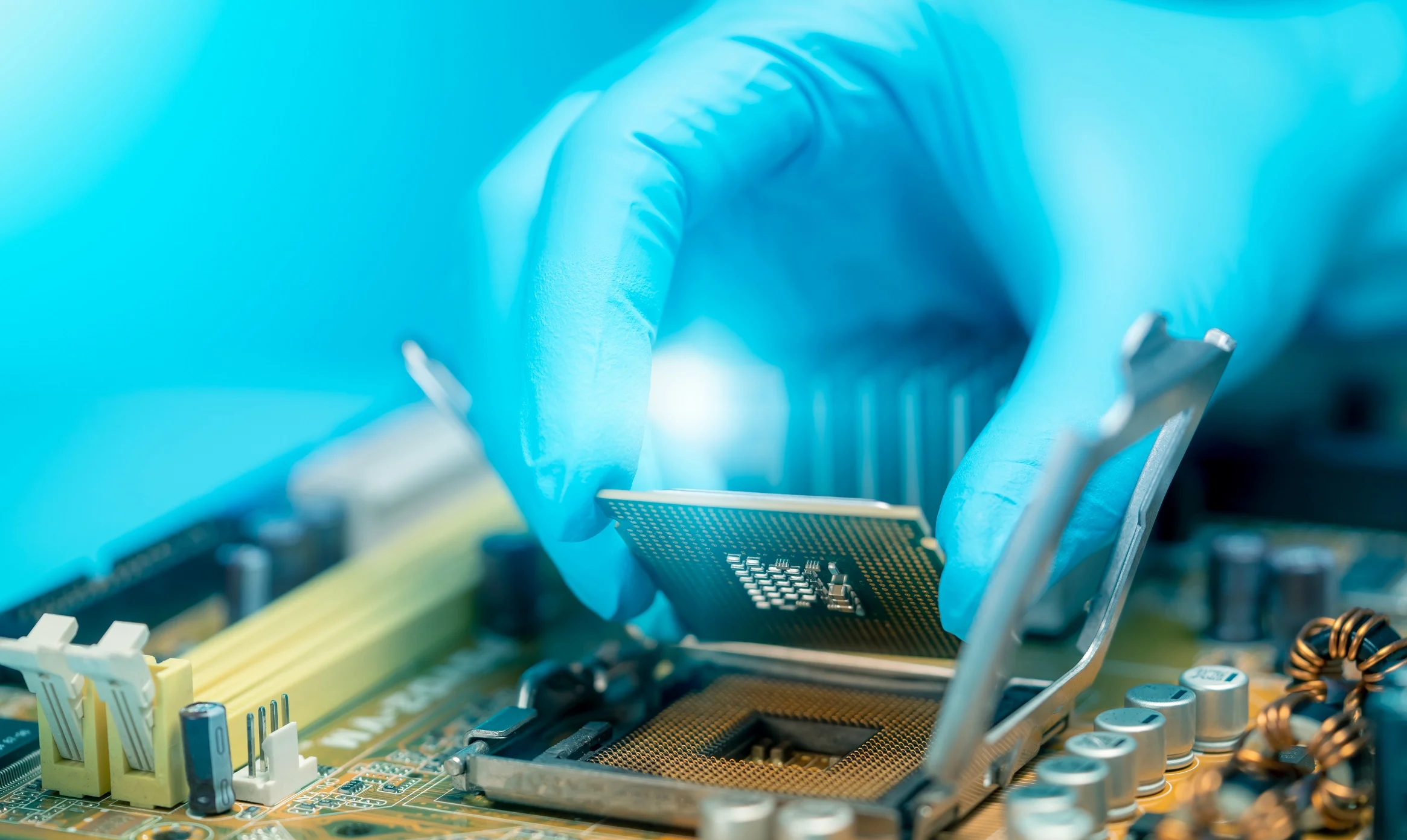

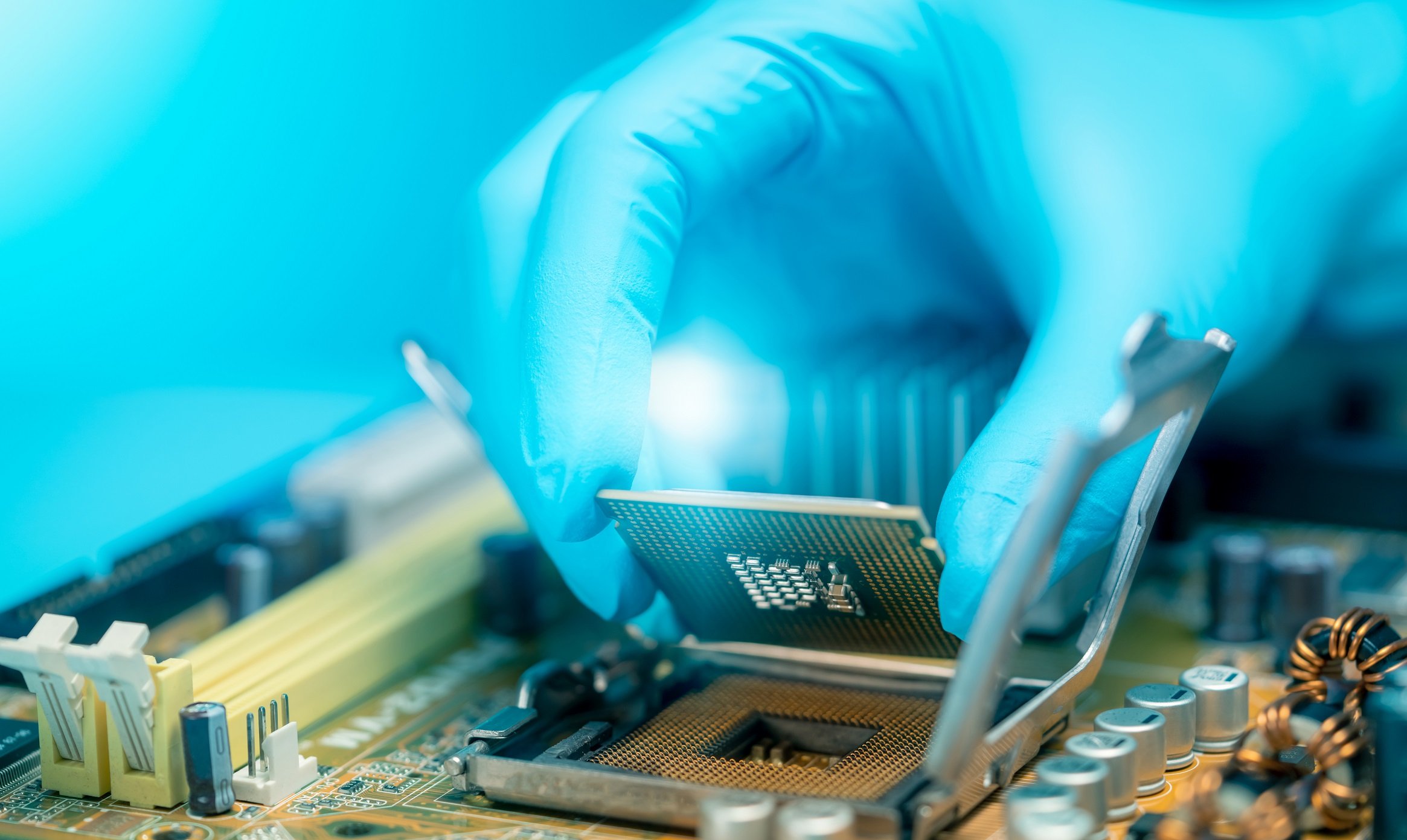

Image source: Getty Images.

A disruptor in its own time

Intel began in 1968, when Silicon Valley pioneers Robert Noyce and Gordon Moore decided to leave their employer and set off on their own. It wasn’t long before Intel had made its mark, creating the first dynamic random access memory chip that marked the first departure from alternative memory devices using magnetic cores.

What really put Intel on the map was its work in microprocessors, where it was instrumental in making products that would eventually find their way into the earliest personal computers. In 1978, Intel released its 8086 chip, the first in a series of microprocessors that would mark the first stage of exponential growth in the PC era of the 1980s and 1990s. With subsequent releases of ever-faster semiconductors that continued to follow the law that carries one of its co-founder’s names, Intel became a household name, and its products made their way into the vast majority of PCs sold during that key period for computing.

Where Intel fell off the pace

Intel’s problems, though, came largely from assuming that it could stay focused on the technology that initially powered its rise to prominence. In particular, Intel failed to recognize the value of extending its dominating chip market share to the mobile device market. As a result, smartphones largely used rival chips, leaving Intel out of a lucrative market.

Intel also failed to recognize the threat that graphics processing units represented to its microprocessor technology. Nvidia and Advanced Micro Devices (AMD +0.61%) initially justified investment in GPUs in order to serve the relatively small video game market. However, as tech experts realized the potential for using GPUs in applications that went far beyond video gaming, Nvidia and AMD pulled away from Intel. Now, when hyperscaler companies look for the products that are best able to help them with their AI aspirations, Intel is definitely not the first company they think of to help them.

Even once Intel identified the need to get more heavily involved in AI chip development, it wasn’t able to get up to speed fast enough to be a competitive threat. Acquisitions allowed Intel to start making its own chips for generative AI and similar applications, but the performance of Intel products hasn’t matched what Nvidia has achieved.

Today’s Change

(0.61%) $0.28

Current Price

$46.77

Key Data Points

Market Cap

$234B

Day’s Range

$44.98 – $47.69

52wk Range

$17.66 – $54.60

Volume

2.6M

Avg Vol

103M

Gross Margin

35.24%

Why the newfound optimism then?

As a result of that loss of business momentum, Intel stock has never managed to return to the highs it set in 2000. Still, investors haven’t given up on the company just yet, and share prices have actually doubled just in the past year. In the second article of this three-part series on Intel, you’ll see more of the financial ups and downs that Intel has seen, along with the reasons for bulls to come out of the woodwork.