Key Points

Investing in an S&P 500 ETF like the Vanguard S&P 500 ETF or the SPDR S&P 500 ETF (NYSEMKT: SPY) can be one of the best financial decisions you make in your lifetime.

After all, the S&P 500 has historically returned an annual average of 9% a year, and the broad-market index even beats most hedge funds most years. With its holdings diversified among the top 500 U.S. stocks, and a quarterly rebalancing to make sure that the collection stays up to date, the S&P 500 has a proven formula to deliver long-term gains.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

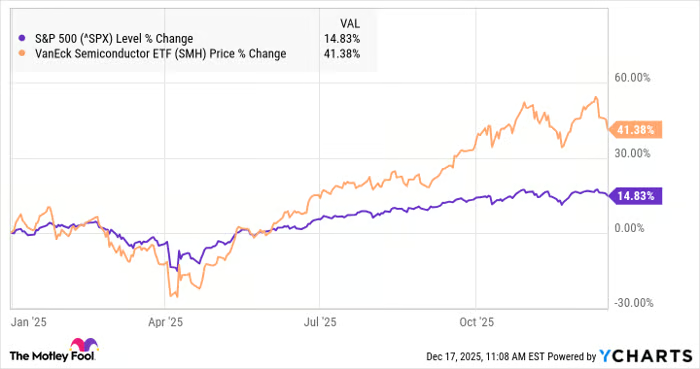

However, an S&P 500 index fund isn’t necessarily the best-performing ETF in a given year, and several ETFs have outperformed in 2025. In fact, one has delivered more than double the S&P 500’s gains this year. That’s the VanEck Semiconductor ETF (NASDAQ: SMH), which is up 39.5% year-to-date through Dec. 17. The chart below shows how the semiconductor ETF’s performance this year compares to the S&P 500.

In the third year of the AI boom, semiconductor stocks, led by Nvidia (NASDAQ: NVDA), have continued to surge, so perhaps it’s not a surprise that the SMH has beaten the S&P 500 by such a wide margin. Let’s take a closer look at the VanEck Semiconductor ETF and why it’s a good candidate to outperform the S&P 500 again this year.

Image source: Getty Images.

What’s in the VanEck Semiconductor ETF

The ETF seeks to replicate the performance of the MVIS U.S. Listed Semiconductor 25 Index, which is designed to track the overall performance of the semiconductor production and equipment sector.

The VanEck Semiconductor ETF’s top three holdings include Nvidia, Taiwan Semiconductor Manufacturing (NYSE: TSM), and Broadcom (NASDAQ: AVGO), three stocks that have been among the biggest winners in the AI boom and continue to set the pace for the sector.

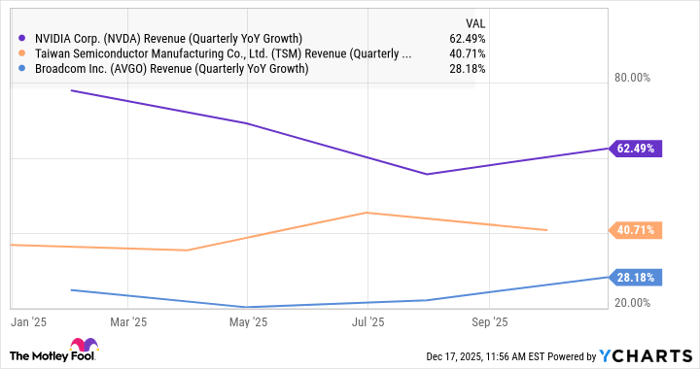

All three stocks are growing briskly heading into 2026. The chart below shows how fast revenue growth has been for all three companies over the last year.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

As you can see, all three of these stocks, which make up more than a third of the ETF, are delivering strong growth, and two of the three of them reported accelerating revenue growth in their most recent quarters. Those results seem to push back on the narrative of an AI bubble, and Nvidia CEO Jensen Huang said as much in the company’s most recent earnings report, saying he sees AI at a tipping point, implying that demand and usage were about to accelerate.

Why the VanEck Semiconductor ETF could beat the S&P 500 next year

The strength of the VanEck Semiconductor ETF will depend on the AI boom, but the same could be said for the S&P 500.

The SMH does trade at a premium to the S&P 500, but it’s not by as much as you might think. The semiconductor ETF currently trades at a price-to-earnings ratio of 38.6, which compares to the Vanguard S&P 500 ETF at 28.5.

Even with that premium, the risk/reward in the VanEck ETF looks attractive considering the growth rates of its top three holdings and other major holdings like Micron and Advanced Micro Devices.

The buildout of AI data centers is continuing, and demand for semiconductors, which are becoming an essential component in everything from medical equipment to automobiles, will keep growing.

The ETF is vulnerable to an AI bubble, and valuations could eventually catch up to the semiconductor sector, but as Jensen Huang believes, the facts on the ground seem to point in the opposite direction. That’s a good reason to bet on its outperformance next year as well.

Should you buy stock in VanEck ETF Trust – VanEck Semiconductor ETF right now?

Before you buy stock in VanEck ETF Trust – VanEck Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and VanEck ETF Trust – VanEck Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $506,935!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,067,514!*

Now, it’s worth noting Stock Advisor’s total average return is 958% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of December 20, 2025.

Jeremy Bowman has positions in Advanced Micro Devices, Broadcom, Micron Technology, Nvidia, Taiwan Semiconductor Manufacturing, and VanEck ETF Trust-VanEck Semiconductor ETF. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, Taiwan Semiconductor Manufacturing, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

![[China Tech] Local Pediatric Hospital's Research Ward Attracts Overseas Patients](https://news.charm-retirement.com/wp-content/uploads/2025/12/985a6d2b-4f83-44d8-943a-f00ce098c5ab_0-scaled.jpeg)