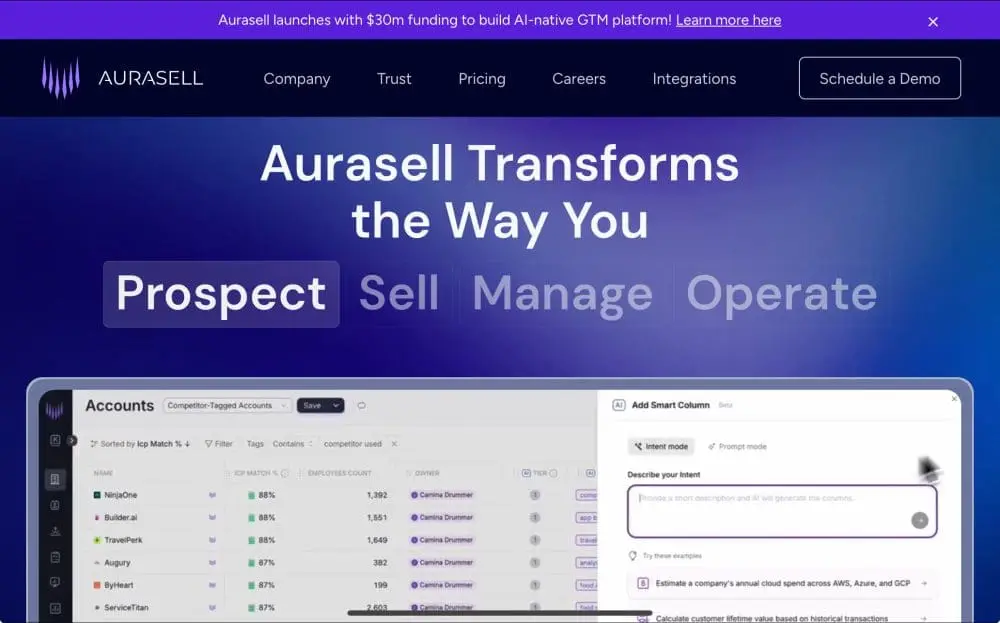

The tl;dr: Aurasell launched in August 2025 as the first AI-native CRM platform, raising $30 million in seed funding that closed in 28 hours. Founded by former VMware, Nutanix, and Twilio operators who were fed up with tool sprawl, the company is consolidating 15+ sales tools into one platform and claiming to cut GTM tech stack costs by 50% while saving reps 30-40% of their admin time.

And you can meet the team in person at 2026 SaaStr Annual + AI Summit May 11-13 in SF Bay!!.

The Problem They’re Actually Solving

Here’s the thing about modern GTM teams: CROs have been turned into CIOs, spending more time managing software than building pipeline. The average sales org is running Salesforce plus HubSpot plus Outreach plus Gong plus ZoomInfo plus Apollo plus Clari plus a CPQ tool plus six other things I’m forgetting. Each one costs money, none of them talk to each other properly, and your reps are stuck doing data entry instead of selling.

The result? Tool sprawl that would make a CFO cry. Fractured data that makes forecasting a joke. And sales productivity that’s been declining for years despite all this “enabling” technology.

Aurasell’s founders, CEO Jason Eubanks and CTO Srinivas Bandi, experienced this pain as operators at hypergrowth companies and decided to rebuild the entire stack from scratch with AI at the core, not bolted on.

What Actually Makes It Different

Most “AI CRMs” are just Salesforce with a ChatGPT wrapper. Aurasell is genuinely different because it was built post-2022 with AI-native architecture. Here’s what that means in practice:

Data Model Built for LLMs: Instead of retrofitting AI onto a database designed in 1999, Aurasell designed its data model specifically to operate with large language models and AI agents. The platform enriches your data automatically, building out ideal customer profiles, buyer personas, account research, and contact signals without manual work.

AI Agents That Actually Work: The platform includes AI agents that handle territory planning, prospecting workflows, deal coaching, forecasting, and more. These aren’t just chatbots – they’re autonomous agents that execute GTM workflows while humans focus on selling.

Full Stack Consolidation: This is the real value prop. Aurasell replaces your CRM, sales engagement platform, conversation intelligence tool, forecasting software, CPQ, data enrichment, and about ten other things. The platform claims to replace 12 major tools and cut GTM tech stack costs in half.

The Features That Matter

AI brings it all together in one:

- Intelligent Prospecting: The AI automatically aligns with your ICP, optimizes territory coverage, pinpoints best opportunities, and predicts likelihood to engage. It’s doing the research and prioritization your SDRs used to spend hours on.

- AI-Powered Sequences: Outbound sequences that write, adapt, and personalize at scale. Not just mail merge – actual contextual personalization based on account intelligence.

- Real-Time Forecasting: Monte Carlo simulations that incorporate macroeconomic signals and live pipeline updates. This is forecasting that actually factors in leading indicators, not just stage-weighted deal totals.

- Conversation Intelligence (Whisper): Their agent captures what matters from every conversation and automatically generates deal signals, actions, and tasks. You can even talk to it after in-person meetings to update the CRM without typing.

- CPQ Built In: No more spreadsheet gymnastics or approval bottlenecks. The AI ingests your catalog, applies pricing rules, and generates quotes instantly within the deal workflow.

- Sales-Ready Analytics: Out-of-the-box pipeline health, stage velocity, win rates, and trends. No waiting on BI teams or exporting to spreadsheets.

The Business Model & Traction

Aurasell operates a B2B SaaS model targeting mid-market companies, charging annual subscription fees starting at $20,000 per year for smaller customers. The value prop is tool consolidation – by replacing 10-15 separate subscriptions, they capture more wallet share while still reducing total GTM software costs by roughly 50%.

The economics work because once you’ve migrated your sales processes and data into the platform, switching costs are high. Plus, the AI-native architecture generates network effects as increased customer data enhances the quality of insights and automation for all users.

The VC round itself tells you something about market appetite. The $30 million seed round closed within 28 hours, with $25 million secured in the first 12 hours, and was actually scaled back from $40 million. Investors included N47 (led), Menlo Ventures, and Unusual Ventures.

The company hired 40 engineers, with half dedicated to AI development, showing serious technical ambition from day one.

The Competition & Market Dynamics

The CRM market has been a sleepy oligopoly for 25 years. Salesforce owns enterprise. HubSpot owns SMB. Microsoft has Dynamics for the Microsoft shops. Nobody’s really innovated on the core model since cloud happened.

Now there’s a wave of AI-native challengers:

Attio raised €44 million for a programmable CRM platform. They emphasize customization and flexibility but have narrower out-of-the-box functionality than Aurasell’s full sales suite.

Gong has pivoted from conversation intelligence to a full Revenue AI Platform doing $300M+ ARR. But Gong still sits on top of Salesforce or Microsoft as the system of record – it’s not replacing the core CRM.

ServiceNow launched a CRM in May 2025 with $1.4 billion in contract value and 30% growth. They compete on workflow orchestration but lack sales-specific features like prospecting sequences.

Aurasell’s bet is that AI-native platforms will disrupt traditional cloud solutions the same way cloud disrupted on-premise. Just as nobody builds new on-premise CRMs today, maybe nobody will build new non-AI-native CRMs in five years.

Why This Matters for B2B

Aurasell is validating a massive thesis: that the entire classic SaaS stack is getting re-platformed for AI. Not AI features added on. Not AI co-pilots bolted to the side. Full AI-native rebuilds that make the old tools obsolete.

For founders, the lesson is that incumbents with 25-year-old architectures can be attacked even in the most entrenched markets. For sales leaders, it’s a bet that you can finally get out from under the tool sprawl and actually use technology to make selling easier instead of harder.

For VCs, the speed of that seed round (28 hours!) shows there’s real appetite for backing AI-native rebuilds of massive software categories.

The next 12-24 months will tell us whether this is the future of GTM software or just a well-funded attempt that runs into the realities of enterprise sales cycles, data migration, and incumbent switching costs. But the ambition is undeniable, the team has real operating chops, and the problem they’re solving is painfully real.

If you’re a CRO spending more time managing your tech stack than managing your team, Aurasell is worth a serious look.