The Chinese government expressed diplomatic discontent to the United States after the Biden administration finalized a set of rules to restrict American individuals and companies from investing in China’s three high technology sectors.

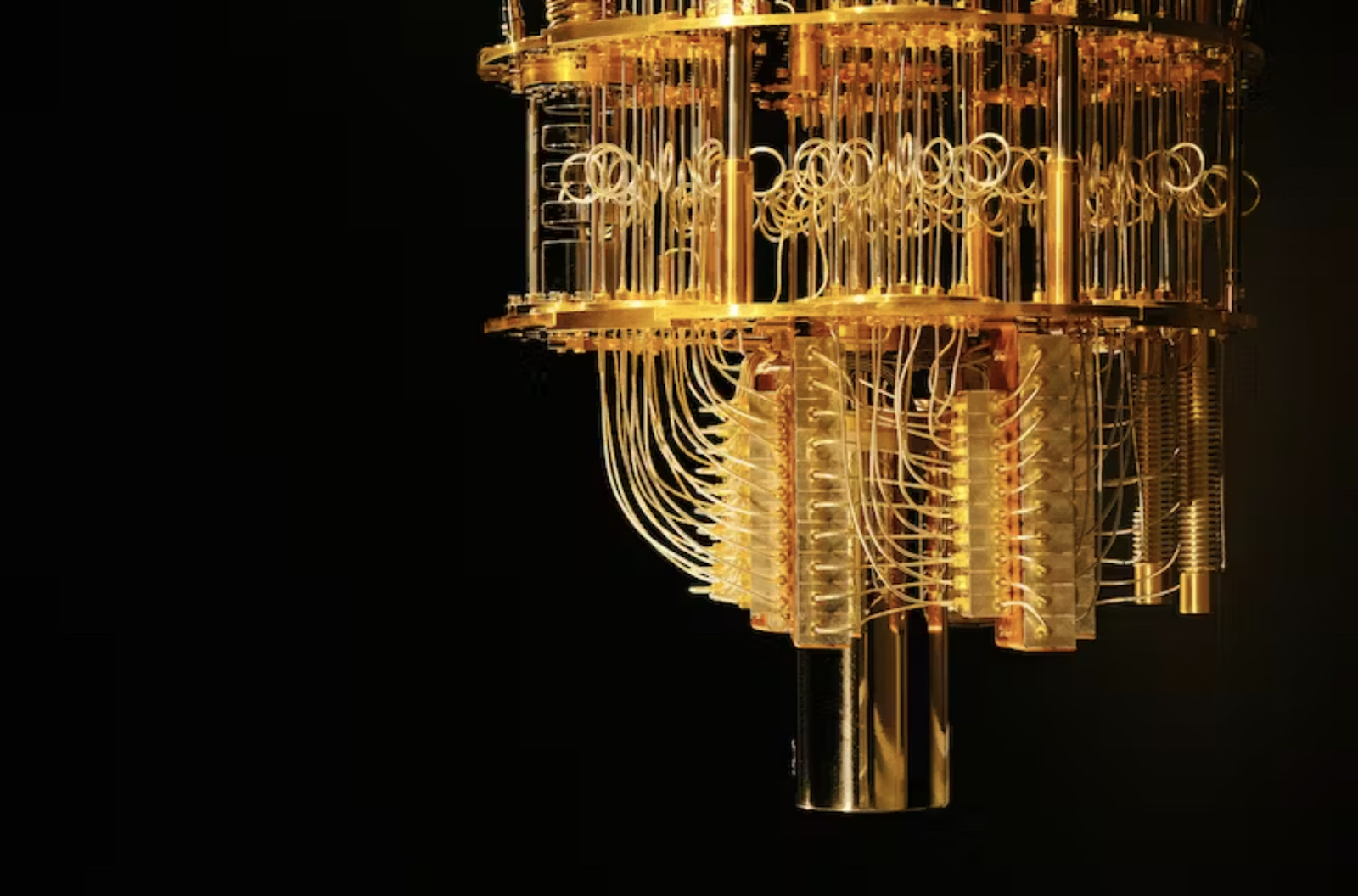

The Final Rule, which aims to implement the Executive Order signed by US President Joe Biden in August 2023, will limit US investments in the semiconductor, artificial intelligence and quantum computing sectors in mainland China, Hong Kong and Macau, the Treasury Department said Monday. The rules will take effect on January 2.

US investors will also be required to inform the Treasury about their investments in some less advanced technologies that may lead to the threat to the national security of the US, according to the Treasury Department.

“China expresses strong dissatisfaction and firm opposition to the United States’ announcement of investment restriction rules against China,” Lin Jian, a spokesperson of the Chinese Foreign Ministry, said in a media briefing on Tuesday.

Lin said China has lodged representations with the US and will take all necessary measures to firmly safeguard its legitimate rights and interests.

“It once again shows that American politicians seek their own political interests, undermining normal investment and trade, the free market and economic order. This will harm the global supply chain,” Hong Kong Chief Executive John Lee said Tuesday.

“This harms the interests of others,” he said, as well as those of “the US as a nation, its people and its companies. They will reap what they sow.”

The Hong Kong government on Monday issued a policy statement, which clearly sets out the government’s policy stance and approach to promote the development of AI adoption by the financial services sector.

Prohibited and notifiable transactions

Washington’s Final Rule, officially called “Addressing US Investments in Certain National Security Technologies and Products in Countries of Concern,” specifically directs the Treasury Secretary to issue regulations that prohibit US persons from engaging in certain transactions involving certain technologies and products that pose a particularly acute national security threat to the US.

It prohibits US investment in transactions related to China’s development of:

- electronic design automation software, certain fabrication and advanced packaging tools; the design, fabrication, or packaging of certain advanced integrated circuits; and supercomputers;

- quantum computers and production of critical components, certain quantum sensing platforms, and quantum networking and quantum communication systems;

- any AI system designed to be exclusively used for, or intended to be used for, certain end uses; any AI system that was trained using a specified quantity of computing power, and trained using a specified quantity of computing power using primarily biological sequence data.

If the transactions in the three categories are not covered by the prohibited transaction definition, US investors will be subject to the notification requirement.

”US investments are often more valuable than their capital alone, because they can also include the transfer of intangible benefits,” said the Treasury Department’s Office of Investment Security (OIS).

“Intangible benefits that often accompany US investments and help companies succeed include: enhanced standing and prominence, managerial assistance, access to investment and talent networks, market access, and enhanced access to additional financing.”

The OIS said certain investments by US persons into a country of concern can be exploited to accelerate the development of sensitive technologies or products – including military, intelligence, surveillance, or cyber-enabled capabilities – in ways that negatively impact the national security of the US.

”The US has taken frequent actions to suppress and slow the rapid growth of China’s high technology sectors,” Li Haidong, director of Center for American Studies, China Foreign Affairs University, told the Global Times.

“This deviates from the United States’ basic stance of maintaining stable relations with China, and also deviates from the American public’s hope that political elites will focus their energy on domestic issues, instead of creating external conflicts,” Li said.

His comments came ahead of the US presidential election, which will take place on November 5.

AI computing power

On August 9 last year, President Biden signed an Executive Order to declare a national emergency to address the threat to the US posed by countries of concern that seek to develop and exploit sensitive technologies or products critical for military, intelligence, surveillance or cyber-enabled capabilities.

On June 21 this year, the Treasury Department proposed a set of rules on outbound investment screening. It said it would set the AI computing power thresholds for a prohibited transaction and a notifiable transaction.

The Final Rule now sets the AI computing power’s speed threshold for a prohibited transaction at 1025 floating point operations (FLOPs) for an AI system generally, and at 1024 FLOPS for an AI system using primarily biological sequence data.

It also sets the threshold for a notifiable transaction involving the development of AI systems at 1023 FLOPS. All these thresholds are the lowest in the government’s proposed ranges, meaning that the Final Rule has broad coverage.

Jack Clark, former policy director of OpenAI, writes in his blog that the notifiable threshold general-purpose AI systems is set at 1026 FLOPS in the US and 1025 FLOPS in the European Union.

To illustrate what this means in practice, he said H100 SXM, Nvidia’s latest graphic processing unit, can train AI systems at different speeds but the cost for training at a speed of 1026 is 10 times that for 1025.

He said A100, a slower AI chip, can also run at a speed of 1026 but it would cost even more.

He said the 1025 threshold in the EU will eventually hit more companies than regulators anticipated.

Read: Beijing: new Treasury rules amount to ‘decoupling’

Follow Jeff Pao on X: @jeffpao3