A Bank of England policymaker has urged for three additional interest rate cuts in 2025, warning that the inflation outlook faces heightened risks from global trade difficulties.

Alan Taylor, an external member of the Bank’s Monetary Policy Committee, cautioned that rates must fall more rapidly given the “deteriorating outlook” for the economy.

Speaking at the European Central Bank Forum in Portugal on Wednesday, Taylor expressed concern that the UK’s prospects for a soft landing were now in jeopardy due to mounting demand weakness and trade disruptions that could push inflation “off track”.

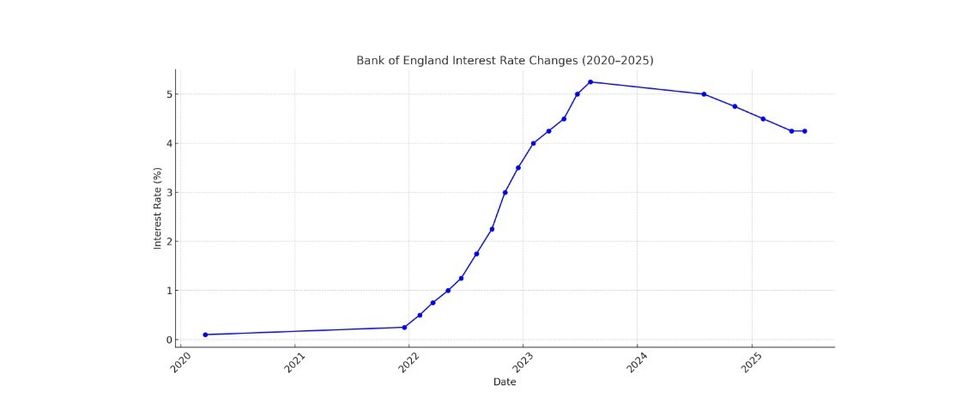

Taylor was outvoted when he advocated for a quarter-point reduction at the June meeting, with the MPC majority opting to maintain rates at 4.25 per cent.

Bank of England policymakers are calling for more interest rate cuts this year

GETTY

The Bank had previously lowered rates in May by a quarter point from 4.75 per cent, though Taylor had supported a more aggressive half-point reduction.

He stated: “Previously, I had seen a UK soft landing in the cards, with some remaining upside risks to inflation from the bump in 2025.

“Now I see that soft landing as being at risk, and greater probability of a downside scenario in 2026 pushing us off track, as demand weakness and trade disruptions build.”

Taylor acknowledged that whilst energy prices “remain a big unknown”, they are not the “only factor in play” affecting the economic outlook.

The central bank has raised rates to ease inflation GETTY

The central bank has raised rates to ease inflation GETTY He noted that the inflationary effects of increased national insurance contributions and price rises should “fade out” in the new year, but emphasised that economic weakness is accumulating.

Regarding his June vote for consecutive rate cuts, Taylor explained: “My reading of the deteriorating outlook suggested to me that we needed to be on a lower rate path, needing five cuts in 2025 rather than the market-implied quarterly pace of four.”

David Morrison, a senior market analyst at FCA-regulated fintech and financial services provider Trade Nation, outlined why rate cuts are likely not to happen until later in the year.:

Morrison said: “The Bank of England has held interest rates at 4.25 per cent, pausing after May’s cut as it monitors slowing economic growth and still-elevated inflation, which stood at 3.4% in the year to May.

The Bank of England has made changes to interest rates in recent years GETTY

The Bank of England has made changes to interest rates in recent years GETTY “While further rate reductions have been signalled, most analysts now expect these to come later in the year, as the Bank weighs the need to support growth against its two per cent inflation target.

“Sterling fell sharply on the news. This reflects the fact that one more member of the MPC voted to cut rates than expected, thereby increasing the probability of another rate cut at the Bank’s next meeting in August.

“But there’s a lot of economic data due before then. So overall, investors will be wary of reading too much into this.”

The Bank of England’s next MPC meeting is due to take place on August 7, 2025.