The Hong Kong market has seen a notable uptick, with the benchmark Hang Seng Index gaining 2.14% recently, despite broader concerns about China’s economic outlook and corporate earnings missing expectations. In this environment, identifying high-growth tech stocks becomes crucial as these companies often demonstrate resilience and potential for significant returns amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.23% | ★★★★★★ |

| Akeso | 32.52% | 55.08% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 25.22% | 9.81% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 44 stocks from our SEHK High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in China with a market cap of HK$173.41 billion.

Operations: Kuaishou Technology generates revenue primarily from its domestic market, amounting to CN¥117.32 billion, with a smaller contribution from overseas operations at CN¥3.57 billion.

Kuaishou Technology’s recent earnings report shows a significant uptick in financial performance, with Q2 2024 sales rising to CNY 30.98 billion from CNY 27.74 billion the previous year, and net income jumping to CNY 3.98 billion from CNY 1.48 billion. The company’s R&D expenses have been robust, contributing to innovations like Kling AI, which now offers enhanced video generation features and subscription models tailored for diverse user needs. With an expected annual profit growth of 18.8%, Kuaishou is poised for continued expansion in the interactive media sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally, with a market cap of HK$28.59 billion.

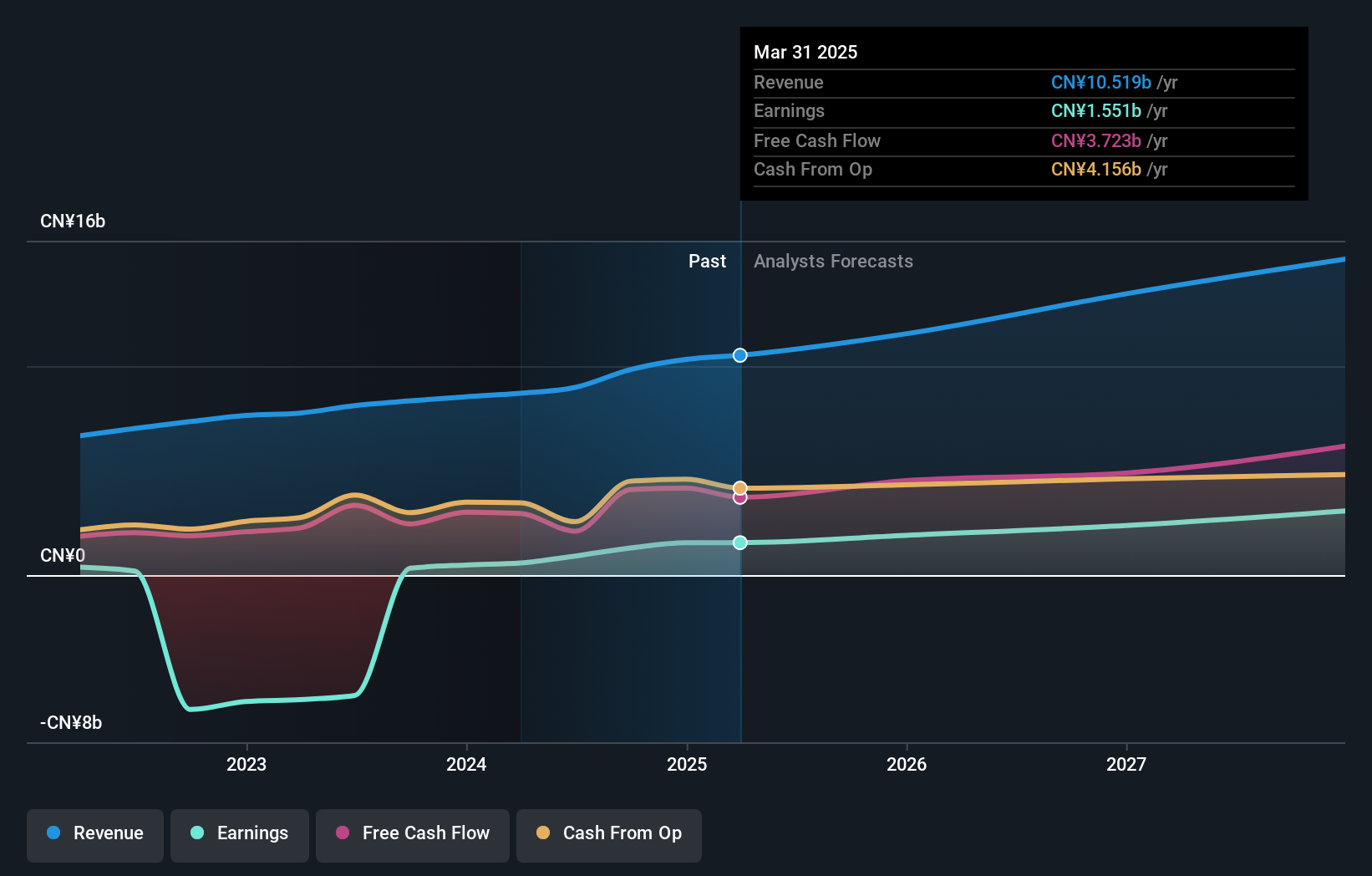

Operations: Kingsoft generates revenue primarily from its office software and services segment, which brought in CN¥4.80 billion, and its entertainment software segment, contributing CN¥4.18 billion. The company operates in Mainland China, Hong Kong, and internationally.

Kingsoft’s revenue surged to CNY 2.47 billion in Q2 2024 from CNY 2.19 billion a year ago, while net income leaped to CNY 393.35 million from CNY 57.19 million, showcasing robust financial health. The company has been investing significantly in R&D, with expenses contributing to innovative software solutions and AI advancements; this strategic spending positions Kingsoft well for future growth, especially as earnings are forecasted to grow at an impressive annual rate of 24.5%. Additionally, the company repurchased shares starting June 2024 under a mandate allowing up to approximately 133.92 million shares buyback, potentially enhancing shareholder value further.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$37.64 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, which reported CN¥1.88 billion. The company focuses on developing innovative drugs to meet unmet medical needs both in China and internationally.

Sichuan Kelun-Biotech Biopharmaceutical’s recent earnings report for the half-year ending June 30, 2024, revealed a significant revenue increase to CNY 1.38 billion from CNY 1.05 billion last year, while net income surged to CNY 310.23 million from a net loss of CNY 31.13 million previously. The company’s strategic investment in R&D is noteworthy; with expenses representing approximately 25% of revenue, it underscores their commitment to innovation and long-term growth potential in the biotech sector. Additionally, their new drug application for sacituzumab tirumotecan (sac-TMT) being accepted by China’s NMPA highlights promising advancements in treating advanced NSCLC and TNBC, potentially driving future revenue streams and market positioning.

Key Takeaways

- Gain an insight into the universe of 44 SEHK High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com