To print this article, all you need is to be registered or login on Mondaq.com.

At a glance

Across the board, restaurants and hospitality companies face

greater scrutiny from consumers over whether they want to spend

their money. More than 4 in 10 consumers say they feel significant

financial anxiety. Shifting lifestyles are influencing how often

they travel and dine out.

While a third of consumers say they are reducing restaurant

spending due to financial constraints, nearly 70% report cutting

back for other reasons. Many feel the quality of food isn’t

there for the price. Some are happy to pay more despite a tight

budget to get the experience they desire, cutting back on frequency

even when they aren’t trading down.

While travelers are also cutting back on the frequency of trips,

they continue to value quality and comfort when they do spend,

fueling strong performance in the luxury segment. High-end hotel

groups such as Four Seasons and Aman are seeing robust demand,

while budget and midscale properties—often reliant on

cost-conscious leisure guests and business travel—face more

uneven results.

This bifurcation underscores a broader trend: consumers are

prioritizing experiences over goods, with a clear preference for

premium stays and memorable meals, even as overall travel and

dining volumes soften.

To adapt, brands are leaning on menu innovation, sharpened value

platforms, digital engagement, third-party delivery, and refreshed

service models. Investments in staff—whether through

training, scheduling, or added support—are also proving

critical, as stronger service can enhance guest satisfaction and

reinforce overall value.

While challenges remain, recent earnings illustrate that those

who evolve quickly—balancing value, experience, and

operational discipline—are well-positioned to capture loyalty

and growth in a shifting landscape.

At the same time, cost pressures from commodities and labor

remain significant. Margins are thin, and the future state of the

consumer is opaque. Operators have their work cut out for them.

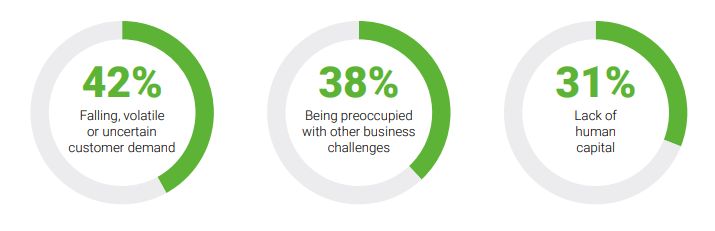

Seven in 10 operators report high disruption since 2023 and

worry about inflation and regulatory or policy changes in the

near-term, but many are concerned they cannot adapt fast enough,

primarily due to uncertain or volatile consumer demand, existing

business challenges, and a lack of human capital.

Restaurants are the top target for discretionary cutbacks

The consumer is only willing to spend more for a

“worth-it” experience. A lack of perceived value is both

a reason to ditch a night out, and an opportunity for operators who

can deliver a meaningful experience to customers. As it stands,

travel seems more inured to cutbacks than retail, leisure, and

restaurant spending.

Of course, customer touchpoints—service— come down

to talent, 33% of whom reported that “insufficient staffing

and a large workload” was a significant problem in 2025, a

jump of 18 percentage points. On the upside though, 79% of workers

see equal opportunity for career advancement at their company.

The underlying story is one of a shift: operators know they need

to innovate around service and their value proposition, while

consumers don’t want to trade down; they want to save their

money for an experience that really counts.

Here we highlight key dynamics from our operator,

worker, and consumer surveys, and look at what the industry needs

to do in response.

Consumer insights

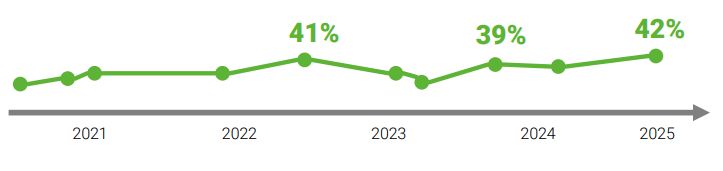

Financial anxiety is at a record high, with 42% of consumers

saying they are “very” or “extremely” worried

about their financial health. The number one tactic for reducing

debt load? Cutting experiential spending.

Retail, for example, has held up better in 2025 when consumers

who intended to cut back were asked which discretionary sectors

they would target, and grocery spending is a non-negotiable for

two-thirds of respondents. Travel also fared well, with just 34% of

cost-cutters intending to snip spending, while restaurants were the

top target.

While consumers are reducing restaurant spending due to

financial constraints, it’s not just about debt. Nearly 70%

report cutting back for other reasons: lack of value and a

preference for home cooking are top motives—the consumer

price index for food at home rose 2.2% year-over-year in July, while that

for food away from home increased by 3.9%. No wonder then that 40%

of respondents said they could make better food in their own

kitchen.

49%

Of consumers deem price is now too expensive for the value

offered at restaurants

Consumers who are very or extremely concerned regarding

financial health

This has hurt limited-service operators. Even typically strong

performers such as Chipotle (comparable restaurant sales down 4% year-over-year in the second quarter)

and Wingstop (1.9% YOY decline in domestic same store sales)

have not been immune to the challenges of consumer behavior, cited

by Wingstop CEO Michael Skipworth as “concerns about elevated

prices, future job prospects and general anxiety about the

future.”

On the other hand, there are bright spots in the casual dining

space, with Chili’s figuring out the recipe for value and

experience. As CEO Kevin Hochman recently said in an earnings call,

“It is very difficult for [competitors] to replicate the total

value proposition given the amount of time and investment we have

put into improving the experience.”

The overall trend toward prioritizing experiences has not

changed: while debt loads are greater, a higher share of consumers

say that reducing dining visits is a top strategy (78%, up from 75%

in 2024) while eating at cheaper restaurants continues to be one of

the least-attractive strategies (cited by 32%, down from 36% last

year).

Aside from the wallet crunch, we see a gap between consumer

desire for a worthwhile dining experience and the value they

receive. Post-pandemic, restaurants are competing with at-home

meals and battling the effects of high inflation and price

pass-through on consumer sentiment. Tellingly, fine-dining and

coffee-focused restaurants score highest on perceived value,

suggesting that cheaper or faster aren’t what wins over

today’s consumer.

Nearly 80% of consumers say restaurant brands can entice them to

increase visits. They say they are most susceptible to better food

quality (the top tactic, cited by 57%) and better menu pricing

(cited by just over half). Menu engineering is now the top

recommendation for operators to thwart rising cost pressures in

lieu of passing on pricing to consumers.

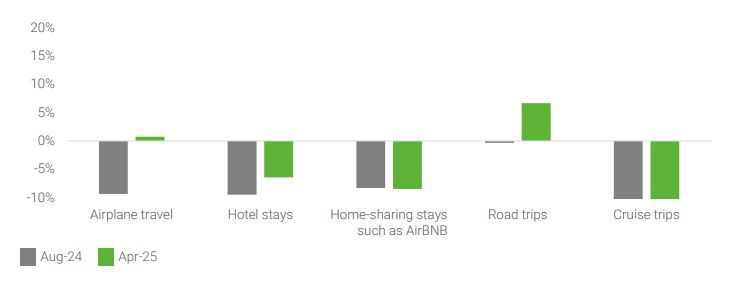

The analog for travel versus the pandemic-tested

“staycation” is more protective of hotel services, which

some consumers equate with wellness, but again, there is a

focus on quality of experience. Our 2025 Global Consumer Outlook

found that younger consumers were ready to spend more (if on a

smaller budget), while 31% of highincome consumers expected to

increase their spending in 2025, particularly on travel and

leisure.

The catch is that premium experiences can’t be

merely premium-ish. They need to deliver the goods.

Consumers are more interested in traveling, especially air and

road travel

Net more interest change this year vs. last year

Operator insights

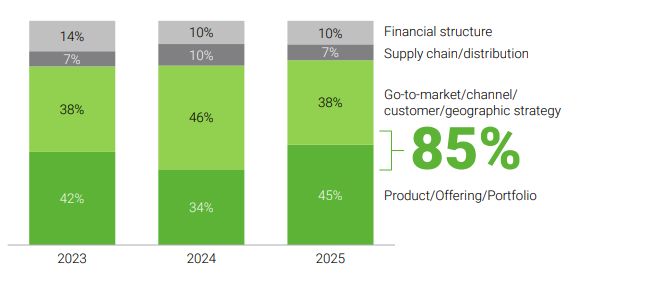

Nine in 10 operators expect to shift their business model over

the next three years, led by product or portfolio, but only half

believe their current pace of change is fast enough to achieve

their goals—a decline from prior years.

The wider macroeconomic turbulence is crystallized in

uncertainty over consumer demand six or twelve months from now.

“Falling, volatile, or uncertain consumer demand” was the

most commonly stated obstacle to business change, felt by 42% of

respondents. Around 85% of operators think their company should

invest more time and resources in product offering and go-to-market

strategy, but those changes are difficult when you don’t know

what people’s appetite will be.

Companies know what they need to adapt… but change is

slow

Top three obstacles to business model

change

To view the full article click here

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.