Key Takeaways

- Analysts expect the group of tech giants to continue to benefit from their size and position in the AI race.

- They also warn that their earnings growth relative to other leading companies may slow. And even in AI, analysts warn, investors may start to look to other stocks in search of gains.

- Three of the Mag 7—Nvidia, Microsoft, and Meta—are up double digits since the start of 2025 and are currently trading at or near record highs.

The Magnificent Seven entered 2025 on a high note. Since then, the tune has meandered all over the place.

Looking ahead, analysts expect the group of tech giants to continue to benefit from their size and position in the AI race, which could both fuel future growth and offer protection for investors concerned about trade-fueled uncertainty. But they also warn that their earnings growth relative to other leading companies may slow—and even in artificial intelligence, investors may start to look to other stocks in search of gains.

Below, we’ll catch you up on the year so far for the Magnificent Seven—and go into more detail about some of the likely drivers of their performance that await in the months to come.

How We Got Here

xExcitement about AI propelled the tech giants—Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOG), Meta (META), and Tesla (TSLA)—to two years of outsized gains. The stocks, like the broader market, were pushed higher by post-election optimism about President-elect Donald Trump’s promises to cut taxes, roll back regulations, and welcome the business community to Washington with wide-open arms.

No company stood to benefit more than Tesla, whose CEO Elon Musk was expected to wield immense influence within the White House after publicly, and expensively, supporting Trump’s campaign. Instead, Tesla’s sales–and stock–crashed as Musk took a public role in Trump’s administration that led to both political opposition and concern about his work with the carmaker.

Meanwhile, Trump’s tariffs sparked panic on Wall Street that pummeled high-flying tech stocks. By the time Trump paused the tariffs, the Roundhill Magnificent Seven ETF (MAGS) was trading more than 30% below its December high.

Things have recovered since. Easing trade tensions, a strong U.S. economy, and resilient businesses helped the “Mag 7” claw back nearly all of those losses in the second quarter, with the Roundhill ETF having edged into the green year-to-date.

Three of the Mag 7—Nvidia, Microsoft, and Meta—are up double digits since the start of 2025 and are currently at or near record highs. Amazon and Alphabet remain slightly off their records. Apple and Tesla are down 14% and 19%, respectively, year-to-date.

These tech titans face plenty of risks—including high valuations, ongoing tariff negotiations, and geopolitical tensions that could threaten their businesses—in the second half. But experts say they also have the opportunity to use their size and deep pockets to bolster their positions in AI, which could lead to both long-term gains and near-term share-price benefits.

Hyperscalers Continue To Spend Big on AI

At times in the first half of 2025, it looked like tech giants might scale back their AI investments.

The success of China’s DeepSeek and its efficient AI reasoning model raised questions about whether hyperscalers needed to add as much computing capacity as expected. Trump’s implementation of sweeping tariffs threatened to plunge the U.S. into a period of stagflation and suppress consumer and business spending.

Hyperscalers stood by plans to continue spending big on AI. Microsoft, Amazon, Alphabet, and Meta this year all indicated that their cloud and AI businesses were constrained by insufficient computing capacity. Cumulatively, the four companies are expected to spend more than $300 billion on infrastructure in 2025, with much of that earmarked for data centers and equipment required to train and deploy AI.

That spending is expected to continue benefitting the companies that design, make, and market the most advanced semiconductors, including Nvidia and Broadcom (AVGO). It should also boost sales of networking technology companies like Arista Networks (ANET), Amphenol (APH), and Coherent (COH).

Earnings Growth Could Moderate

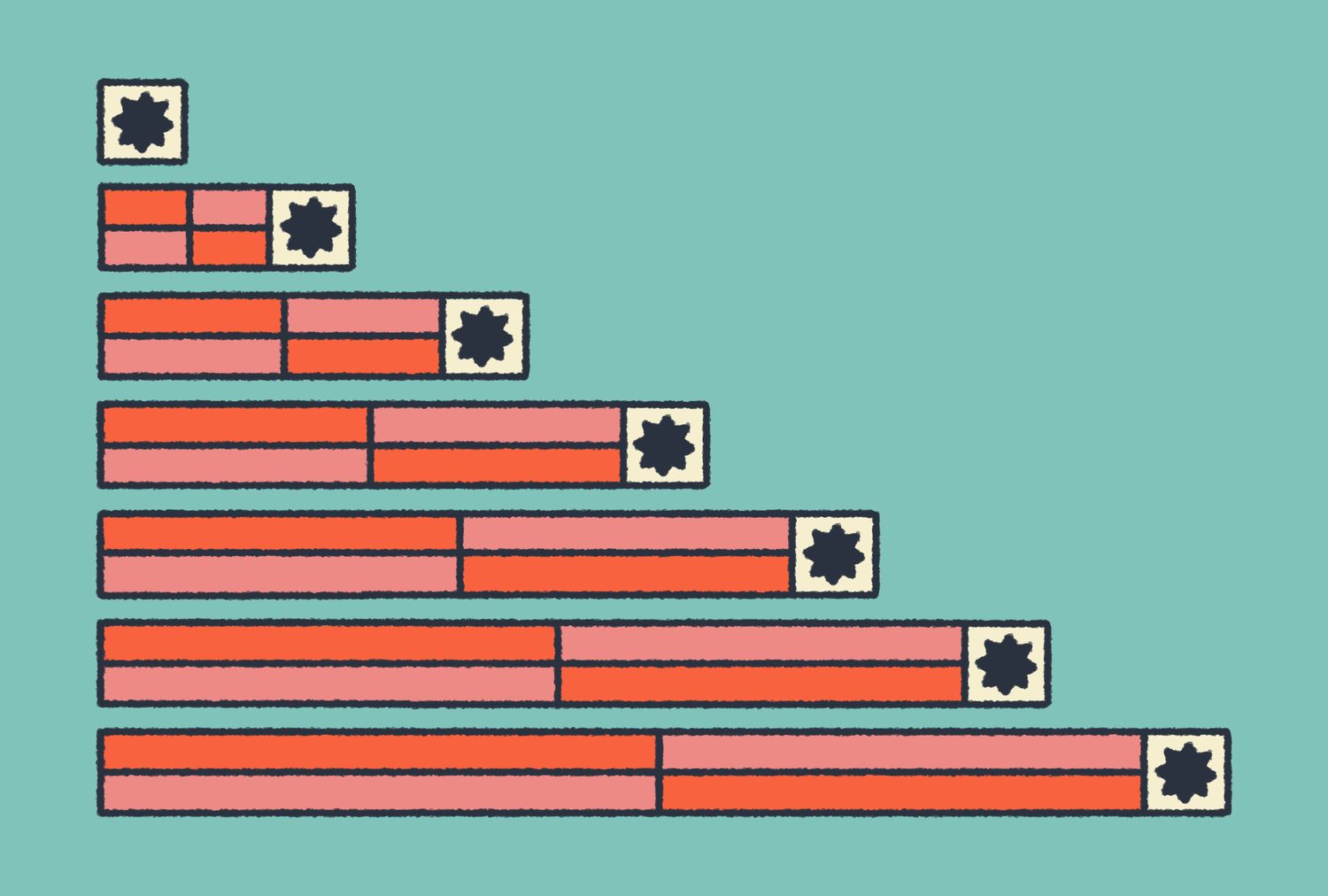

The Mag 7 have been the main drivers of S&P 500 earnings growth in the last two years.

The group’s profits grew nearly 28% in the first quarter, slightly below their average over the prior three quarters. The remainder of the S&P 500 reported growth of about 9%. The gap between the two groups, now 19 percentage points, was nearly 30 percentage points as recently as the second quarter of 2024.

That gap is expected to narrow further over the next year, with FactSet projecting the rest of the index’s growth will be on par with the Mag 7’s by the first quarter of 2026.

A possible caveat: Over the past year, analysts have consistently overestimated how quickly the broader market would catch up with the Mag 7.

Size Should Be a Bulwark Against Volatility

Tariffs and economic uncertainty could help the Magnificent 7 in the second half.

Analysts at Janus Henderson expect second-quarter U.S. earnings, which kick off with big bank results in mid-July, will come under pressure from tariff anxiety before rebounding later in the year as the trade outlook becomes clearer and mitigation strategies take effect.

“Companies with strong balance sheets, scale, pricing power, and supply chain flexibility could weather this earnings pressure and recover faster,” they wrote.

Most of the Mag 7 operate high-margin businesses. All have scale that should give them a competitive advantage in times of uncertainty.

Against “a backdrop of sluggish interim growth and higher-for-longer rate environment, we are likely to see a repeat of the 2023-2024 playbook of unhealthy narrow market leadership and high market concentration,” JPMorgan analysts expect.

But The AI Trade Is Broadening

The extent to which the Mag 7 companies are synonymous with the AI trade could decline and take some of the wind out of their stocks’ sails.

JP Morgan analysts expect “a broadening AI theme” that could “accelerate further with the potential for greater productivity and efficiency gains.” Semiconductor, power, data center, and cybersecurity are their preferred AI themes outside the Mag 7.

To be sure, the Mag 7 are still some of Wall Street’s favorite AI stocks. “Our preferred way to play the AI theme are the hyperscalers,” particularly Microsoft, “and key data/analytics consumption names,” including Snowflake (SNOW) and MongoDB (MDB), said Citibank application software analyst Tyler Radtke.

Citi analysts covering systems and back-office software have also emphasized the importance of AI monetization in the coming months. Companies that can develop AI programs that improve their customers’ efficiency—like Cyberark (CYBR) in the cybersecurity space and Monday.com (MNDY) in project management software—are best positioned to lead the AI rally, some argue.