Explore how fund structure, cost, and portfolio breadth shape the risk and diversification profiles of these two tech ETFs.

Roundhill Investments – Generative AI & Technology ETF (CHAT +3.18%) stands out for its active, AI-driven focus and recent outperformance, while Vanguard Information Technology ETF (VGT +2.02%) offers broader tech exposure, lower costs, and greater liquidity.

Both funds target the technology sector, but with distinct approaches: CHAT is an actively managed, concentrated bet on generative artificial intelligence and related technologies, while VGT passively tracks a much wider swath of the U.S. tech market. Here’s how they stack up for investors comparing specialized innovation with established sector breadth.

Snapshot (cost & size)

| Metric | CHAT | VGT |

|---|---|---|

| Issuer | Roundhill Investments | Vanguard |

| Expense ratio | 0.75% | 0.09% |

| 1-yr return (as of 2025-12-11) | 49.3% | 21.3% |

| Beta | 1.63 | 1.25 |

| AUM | $1.1 billion | $116.3 billion |

Beta measures price volatility relative to the S&P 500; beta is calculated from five-year weekly returns. The 1-yr return represents total return over the trailing 12 months.

VGT is dramatically more affordable on fees, charging just 0.09% versus CHAT’s 0.75% expense ratio—a substantial difference for cost-conscious investors.

Performance & Risk Comparison

| Metric | CHAT | VGT |

|---|---|---|

| Max drawdown (5 y) | -31.34% | -35.08% |

| Growth of $1,000 over 5 years | $2,401 | $2,297 |

What’s Inside

Vanguard Information Technology ETF (VGT) is a nearly-22-year-old, passively managed fund holding 316 stocks across the U.S. technology sector. It is heavily weighted toward tech leaders, with NVIDIA (NVDA +3.80%), Apple (AAPL +0.17%), and Microsoft (MSFT +0.40%) making up a significant portion of assets. The fund’s near-total allocation to technology companies (98%) delivers broad, diversified exposure to the sector without major thematic tilts or screens.

Roundhill Investments – Generative AI & Technology ETF (CHAT), by contrast, is actively managed, holds only 47 stocks, and applies an environmental, social, and governance (ESG) screen. Its portfolio is concentrated in technology (83%) and communication services (11%), with Alphabet (GOOGL +1.47%), NVIDIA, and Microsoft among its top holdings. CHAT’s focus on generative AI and related technologies, plus its ESG overlay, results in a more specialized and thematically narrow portfolio than VGT.

For more guidance on ETF investing, check out the full guide at this link.

What This Means for Investors

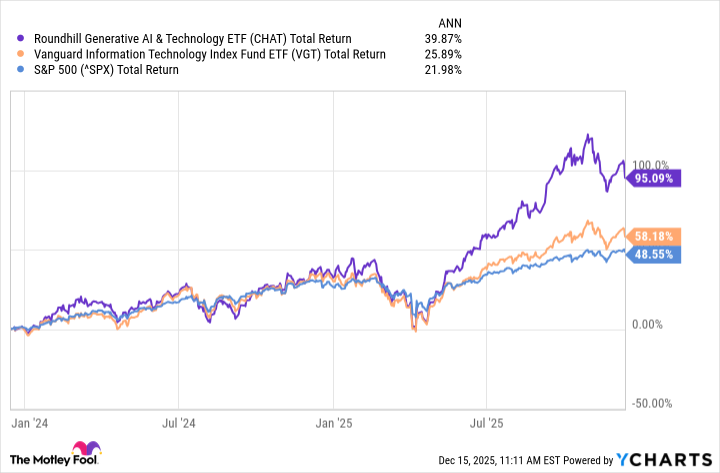

While there are some major differences between these two funds (CHAT and VGT), there are also many similarities. Most significantly, both have been top-performing ETFs in recent years. Indeed, both CHAT and VGT have outperformed the S&P 500 by a sizable margin over the past two years. That said, CHAT takes the top spot, with an astounding 95% total return, equating to a compound annual growth rate (CAGR) of 39.9%. Meanwhile, VGT sports a still impressive 58% total return, with a CAGR of 25.9%.

CHAT Total Return Level data by YCharts

As for differences, there are a few. First, CHAT has a more narrow focus on the AI subsector. Consequently, it has fewer holdings and greater overall volatility — as indicated by its higher beta value. In addition, CHAT is actively managed, meaning that portfolio managers actively determine the weighting of its holdings, which is more costly. As a result, CHAT has higher fees, as evidenced by its expense ratio of 0.75%. That means someone who invests $10,000 in CHAT should expect to pay $75 per year in fees. VGT, by comparison, has an expense ratio of 0.09%, resulting in about $9 in annual fees.

Another key difference worth noting is how long each fund has been around. VGT dates back to 2004, giving investors more than 20 years of performance history to chew on. This can be very important, as VGT has a two-decade history of outperforming the S&P 500. CHAT, on the other hand, was only begun in July 2023. Therefore, investors don’t have as much proof that CHAT’s investing philosophy will deliver results in the long term.

In summary, while both of these ETFs have demonstrated excellent performance, they have done so in different ways. CHAT is an ETF for the aggressive investor, who doesn’t mind paying higher fees for an actively-managed fund with a strict focus on the AI subsector. In contrast, VGT is a passively-managed ETF with lower fees and 6x the number of holdings compared to CHAT. It dates back 20 years and has outperformed the benchmark S&P 500 during that time. It appeals to long-term investors who want broad-based tech exposure at a low cost.

Glossary

ETF: Exchange-traded fund; a pooled investment fund traded on stock exchanges, holding a basket of assets.

Expense ratio: The annual fee, as a percentage of assets, that a fund charges to cover operating expenses.

Actively managed: A fund where managers make investment decisions and trades, aiming to outperform a benchmark.

Passively managed: A fund that aims to replicate the performance of a specific index, with minimal trading.

Liquidity: How easily and quickly an asset or fund can be bought or sold without affecting its price.

Beta: A measure of an investment’s volatility compared to the overall market, often the S&P 500.

Max drawdown: The largest percentage drop from a fund’s peak value to its lowest point over a specific period.

AUM: Assets under management; the total market value of assets a fund or manager oversees.

ESG screen: Criteria that filter investments based on environmental, social, and governance factors.

Thematic tilt: A fund’s focus on a specific trend or theme, such as artificial intelligence, rather than broad diversification.

Sector: A group of companies with similar business activities, such as technology or healthcare.

Total return: The investment’s price change plus all dividends and distributions, assuming those payouts are reinvested.