Market Size & Trends

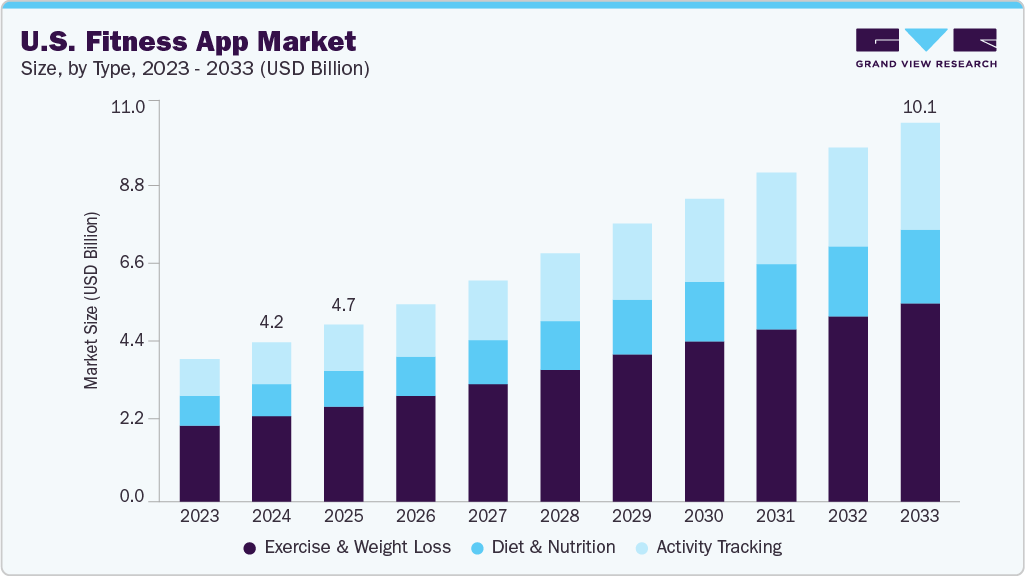

The U.S. fitness apps market size was estimated at USD 4.23 billion in 2024 and is projected to reach USD 10.10 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The growth is attributed to the evolving consumer health priorities and technological advancements. Rising health awareness and a growing focus on preventive healthcare have led individuals to actively seek tools for managing fitness and well-being. This shift is further supported by the widespread adoption of smartphones and improved internet accessibility, making fitness apps easily available and convenient to use. In addition, the increasing usage of wearable devices such as smartwatches and fitness bands enables real-time health tracking and enhances user engagement. Moreover, the shift toward at-home workouts and virtual coaching, especially following the COVID-19 pandemic, as consumers continue to prefer flexible, on-demand fitness solutions over traditional gym routines.

Rising Adoption of Fitness Apps in the U.S.: A Growing Trend

Growing awareness around physical fitness and preventive healthcare has significantly boosted the adoption of fitness apps in the U.S. Consumers are increasingly turning to digital platforms to monitor their health, manage weight, reduce stress, and maintain an active lifestyle. With rising concerns about chronic conditions such as obesity, diabetes, and cardiovascular diseases, many individuals are proactively using fitness apps to track exercise routines, diet plans, and overall wellness.

Rising Obesity Rates in the Country

This shift is particularly urgent given the rising obesity rates in the country. According to the CDC, in 2022, 22 U.S. states reported adult obesity rates above 35%, underscoring the critical need for accessible and effective health management tools.

Some stats related to Obesity

-

Obesity prevalence was slightly higher in men (43.0%) than women (41.9%), but severe obesity was more common in women (11.5%) than men (6.9%).

-

More than 2 in 5 adults have obesity, and the prevalence has increased from 30.5% in 1999-2000 to 41.9% by 2017-2020.

-

Recent data from 2021-2023 shows the obesity rate among adults was about 40.3%, with severe obesity at 9.4%.

-

Nearly 3 in 4 U.S. adults are now considered overweight or have obesity, indicating a combined high prevalence of these conditions.

-

The rise in obesity has been linked to lifestyle changes, increased sedentary behavior, larger portion sizes, and higher calorie intake from processed foods.

-

Projections warn that without significant intervention, over 260 million people in the U.S., including more than half of children and adolescents, could be living with overweight or obesity by 2050.

Digital Access Driving Convenience

The widespread availability of smartphones and high-speed internet has created a favorable environment for fitness app adoption. With smartphones now an integral part of daily life, users can conveniently access fitness programs, track performance, and receive personalized feedback anytime, anywhere.

Responding to this demand for personalization and convenience, Peloton launched its standalone Strength+ app in the U.S. in December 2024, transitioning it from beta to full release. The app features personalized, multi-week gym-centric strength programs, a workout generator, audio coaching, progress tracking, and equipment tutorials-further expanding the capabilities and appeal of mobile fitness solutions.

The Role of Wearables in Enhancing Engagement

Wearable fitness devices such as Apple Watches, Fitbits, and Garmin trackers are also critical in driving app engagement. These devices provide real-time data on steps, heart rate, calories burned, and sleep patterns. Syncing with fitness apps enhances user insights, improves tracking accuracy, and enables more effective goal-setting.

Key Advantages:

-

Device-Agnostic Architecture: Supports both consumer and medical-grade wearables, offering flexibility without vendor lock-in.

-

Normalized Metrics: Converts diverse data formats into a consistent structure, easing analysis across devices.

-

Real-Time Data Flow: Enables continuous live streaming during workouts for immediate feedback and adjustment.

-

Reduced Development Overhead: Streamlines development by eliminating the need to manage multiple device SDKs through a single API endpoint.

Example:

A user starting a guided strength training session with a smartwatch benefits from Thryve’s real-time data streaming. If the user’s heart rate exceeds a threshold, the app recommends rest; if the intensity drops, it encourages increased effort. This dynamic feedback, based on physiological data, makes workouts safer, more engaging, and effective.

By providing real-time insights and reducing technical complexity, Thryve empowers fitness apps to offer truly personalized workout experiences responsive to individual user needs.

For instance, in response to this growing demand for deeper integration, Fitbit launched the Charge 6 fitness tracker in the U.S. in September 2023. It featured the company’s most accurate heart-rate sensor to date, Bluetooth gym-equipment connectivity, more than 40 exercise modes, on-wrist YouTube Music controls, and accessibility enhancements, demonstrating how hardware innovations are fueling the evolution of fitness apps.

Top Fitness Apps in the U.S.

|

App name

|

Best for

|

Key Features

|

Platforms

|

|

Apple Fitness+

|

Integrated workouts on Apple

|

Apple Watch sync, guided workouts, metrics

|

iOS, Apple Watch

|

|

Fitbit

|

Daily activity & health tracking

|

Steps, heart rate, sleep, fitness score

|

Android, iOS, Fitbit wearables

|

|

Google Fit

|

Simplicity & Android integration

|

Move Minutes, Heart Points, integration with other apps

|

Android, iOS

|

Which Features Set the Best Fitness Apps Apart?

As user expectations grow, fitness app developers must innovate around these core elements to maintain relevance in the fast-evolving digital wellness market.

Fitness Apps in Preventive Healthcare & Lifestyle Management

The integration of fitness and healthcare is accelerating, particularly through:

-

Corporate Wellness Programs: Real-time challenges and team leaderboards based on wearable data to increase workplace engagement.

-

Preventive Health Monitoring: Wearables detect early signs of overtraining, stress, or poor recovery, prompting timely interventions.

-

Adaptive Coaching: Machine learning-driven coaching that responds to real-time biofeedback to optimize sleep, training, and nutrition.

This combination of biometric data and coaching allows B2B platforms to deliver outcome-focused engagement.

Challenges, Opportunities & Future Outlook

Challenges:

-

Data Privacy & Compliance: Handling sensitive data in accordance with regulations like GDPR and HIPAA while maintaining user trust.

-

Device Compatibility: Keeping integrations updated across diverse devices, operating systems, and firmware versions.

-

Engagement Fatigue: Avoiding user burnout from excessive alerts or gamification, ensuring a meaningful and sustainable experience.

Opportunities:

-

5G & Edge Computing: Faster connectivity enables low-latency, seamless real-time feedback during workouts and coaching.

-

Deeper Personalization: Combining metrics such as heart rate variability, sleep, and activity to deliver highly tailored and evolving experiences.

-

Hybrid Wellness Models: Platforms integrating physical activity, mental health, and nutrition provide comprehensive value to users and organizations.

Future Outlook:

-

Biofeedback-Driven Training: Increasing use of metrics like heart rate variability, skin temperature, and electrodermal activity for customized performance and recovery programs.

-

Mental Wellness Integration: Growing overlap between physical fitness and emotional well-being, with features like mood tracking and meditation.

-

Platform Convergence: Health, fitness, and medical care platforms will merge into holistic, data-driven services involving insurers, wellness providers, and primary care.

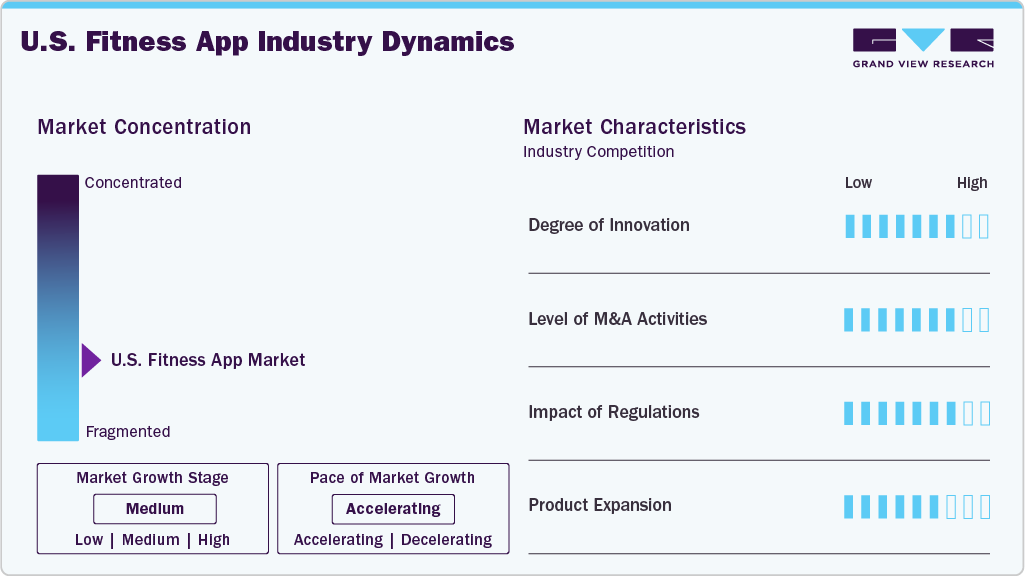

Market Concentration & Characteristics

The U.S. fitness apps market exhibits a high degree of innovation, driven by rapid technological advancements, evolving consumer expectations, and increased competition among developers. Companies continuously improve app functionalities by integrating artificial intelligence (AI), machine learning, and real-time data analytics to offer personalized workout plans, nutrition tracking, and health insights. Augmented reality (AR) and gamification elements are being adopted to create more immersive and engaging fitness experiences. For instance, in June 2023, Zwift launched its Zwift Play game controllers across the U.S., offering cyclists handlebar-mounted directional pads, shortcut buttons, and paddles for steering and braking, enhancing virtual riding immersion and gameplay control.

The U.S. fitness apps market is experiencing a moderate level of merger and acquisition (M&A) activity, driven by the need for strategic expansion, technological advancement, and competitive positioning. Major tech and fitness companies have actively acquired emerging fitness app startups to broaden their digital health offerings and enhance user engagement. For instance, in August 2024, Outside Interactive, Inc. acquired the MapMyFitness suite, including MapMyRun, MapMyRide, and MapMyWalk, from Under Armour in the U.S., integrating over 80 million registered users into its ecosystem to bolster mapping capabilities, expand community features, and enhance its outdoor services offering. These M&A activities often aim to integrate complementary services, accelerate innovation, and expand market reach, reflecting a dynamic and consolidating industry landscape.

Regulations significantly impact the U.S. fitness apps market, particularly concerning data privacy, user consent, and health information security. As many fitness apps collect sensitive personal data, such as heart rate, location, and exercise habits, compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) and the California Consumer Privacy Act (CCPA) has become increasingly important.

Product expansion in the U.S. fitness apps market is moderate as companies strive to meet diverse consumer needs and differentiate themselves in a competitive landscape. Developers continuously broaden their offerings by integrating features such as personalized workout plans, mental wellness content, nutrition tracking, sleep analysis, and live virtual classes.

Type Insights

The exercise & weight loss segment dominated the U.S. fitness app market with a revenue share of 53.76% in 2024. This dominance is attributed to the growing consumer focus on physical fitness, increasing rates of obesity and lifestyle-related diseases, and the rising popularity of structured workout programs accessible through mobile apps. To cater to this increasing demand and improve user engagement within the exercise-focused segment, companies are forming strategic partnerships and expanding content offerings. For instance, in September 2023, Strava launched an integration with Nike Run Club and Nike Training Club in the U.S., enabling users to sync workouts, access Nike-curated content, participate in Strava-hosted challenges, and engage with a broader fitness community.

Activity Tracking is expected to grow at the fastest CAGR over the forecast period due to increasing consumer demand for real-time health and fitness monitoring, driven by the widespread adoption of wearable devices such as smartwatches and fitness bands. The growing awareness of daily physical activity, step count, heart rate, and calorie tracking has made activity monitoring a key feature for users aiming to maintain an active lifestyle. Moreover, integrating activity tracking with other health apps and platforms enhances user convenience and motivates sustained engagement, making it a rapidly expanding segment in the U.S. fitness apps market.

Platform Insights

The iOS segment dominated the U.S. fitness app market with a revenue share of 52.33% in 2024, owing to the high penetration of Apple devices in the U.S. and strong consumer spending on premium apps and in-app subscriptions. The seamless integration of fitness apps with Apple’s HealthKit and Apple Watch ecosystem has enhanced user experience and encouraged greater adoption. In January 2025, iOS expanded its Fitness+ service in the U.S., introducing progressive strength training, pickleball conditioning, yoga peak‑pose workshops, breath meditation, enhanced “Time to Walk” and Artist Spotlight sessions, plus a deeper integration with Strava for enriched workout sharing. In addition, iOS users typically demonstrate higher engagement and willingness to pay for health and wellness services, contributing significantly to the platform’s leading market share.

Android is anticipated to grow at the fastest CAGR over the forecast period owing to its wider user base, affordability, and increasing adoption across mid-range and budget smartphones. The growing availability of fitness apps on the Google Play Store and rising smartphone penetration among diverse demographic groups are driving the platform’s expansion. Moreover, improvements in Android’s health integration features and compatibility with a broad range of wearable devices enhance user engagement and contribute to its rapid market growth.

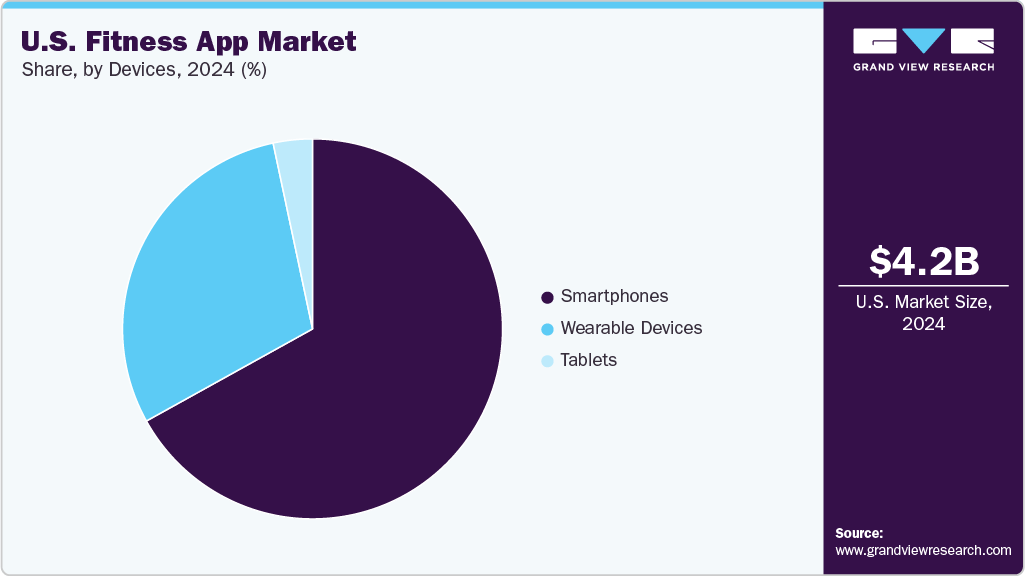

Devices Insights

The smartphones segment held the largest market share of 66.94% in 2024. The growth is attributed to the widespread penetration of smartphones across all age groups, ease of app accessibility, and the convenience of using mobile devices for on-the-go fitness tracking and virtual workouts. Smartphones also offer seamless integration and easy interface with fitness wearables, enable personalized app experiences, and support a wide range of fitness functionalities, from activity tracking and workout videos to diet planning and progress monitoring, making them the primary device for fitness app users.

Wearable devices segment is forecasted to grow at the fastest CAGR over the forecast period due to increasing consumer preference for real-time health monitoring and the rising adoption of smartwatches, fitness bands, and other connected wearables. These devices continuously track key health metrics such as heart rate, sleep patterns, steps, and calorie burn, improving user engagement with fitness apps. In addition, wearable technology advancements, improved health sensor accuracy, and greater compatibility with mobile platforms are further driving demand, positioning wearables as a key growth driver in the fitness apps market.

Key U.S. Fitness App Company Insights

Key players operating in the U.S. market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key U.S. Fitness App Companies:

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Peloton Interactive, Inc.

- Azumio, Inc.

- MyFitnessPal, Inc.

- Nike, Inc.

- Under Armour, Inc.

- Zwift Inc.

- Strava, Inc.

- Calm.com, Inc.

These trends highlight key shifts for digital wellness players

-

App developers need to ensure their products work seamlessly across platforms and integrate wearables using APIs.

-

Fitness brands should shift from passive content to interactive, real-time experiences guided by users’ health data.

-

Healthcare providers and insurers are using fitness data to guide preventative care and personalize engagement.

Recent Developments

-

In February 2025, MyFitnessPal acquired Intent, a personalized meal-planning app integrating its AI‑driven meal sequencing, grocery lists, and add‑to‑cart capabilities into its Premium+ offering.

-

In February 2025, MyFitnessPal introduced the “Weekly Habits” feature, allowing users to set manageable one‑week goals (e.g., drinking more water, increasing protein), track progress, and celebrate achievements, reinforcing sustainable, habit‑based wellness practices.

-

In February 2025, MyFitnessPal launched its 2025 Winter Release, introducing Premium voice‑logging, free weekly habit goals, U.S. dietitian‑curated food suggestions, and database improvements to streamline nutrition tracking and promote sustainable habits.

-

In January 2025, Strava and Apple Fitness+ established a collaboration across the U.S. The partnership enabled rich sharing of Fitness+ workouts into Strava feeds, offered Strava subscribers a three-month Fitness+ trial, and featured prominent Strava athletes in Fitness+ sessions.

-

In November 2023, Anytime Fitness and Apple Fitness+ partnered across the U.S. Starting December 1, gym members gained complimentary Apple Fitness+ access, free trials were offered to prospective members, and Fitness+ content was integrated into the Anytime Fitness app.

U.S. Fitness App Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 4.71 billion

|

|

Revenue forecast in 2033

|

USD 10.10 billion

|

|

Growth rate

|

CAGR of 10.0% from 2025 to 2033

|

|

Actual data

|

2021 – 2024

|

|

Forecast data

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, platform, and devices

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Apple Inc.; Google LLC (Alphabet Inc.); Peloton Interactive, Inc.; Azumio, Inc.; MyFitnessPal, Inc.; Nike, Inc.; Under Armour, Inc.; Zwift Inc.; Strava, Inc.; Calm.com, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Fitness Apps Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. fitness apps market report based on type, platform, and devices:

-

Type Outlook (Revenue, USD Billion, 2021 – 2033)

-

Exercise & Weight Loss

-

Diet & Nutrition

-

Activity Tracking

-

-

Platform Outlook (Revenue, USD Billion, 2021 – 2033)

-

Devices Outlook (Revenue, USD Billion, 2021 – 2033)

-

Smartphones

-

Tablets

-

Wearable Devices

-

Frequently Asked Questions About This Report

b. The U.S. fitness apps market size was estimated at USD 4.23 billion in 2024 and is expected to reach USD 4.71 billion in 2025.

b. The U.S. fitness apps market is expected to grow at a compound annual growth rate of 9.99% from 2025 to 2033 to reach USD 10.10 billion by 2033.

b. The exercise & weight loss segment dominated the U.S. fitness app market with a revenue share of 53.76% in 2024. This dominance is attributed to the growing consumer focus on physical fitness, increasing rates of obesity and lifestyle-related diseases, and the rising popularity of structured workout programs accessible through mobile apps.

b. Some key players operating in the U.S. fitness apps market include Apple Inc., Google LLC (Alphabet Inc.), Peloton Interactive, Inc., Azumio, Inc., MyFitnessPal, Inc., Nike, Inc., Under Armour, Inc., Zwift Inc., Strava, Inc., and Calm.com, Inc.

b. The growth is attributed to the evolving consumer health priorities and technological advancements. Rising health awareness and a growing focus on preventive healthcare have led individuals to actively seek tools for managing fitness and well-being. This shift is further supported by the widespread adoption of smartphones and improved internet accessibility, making fitness apps easily available and convenient to use.