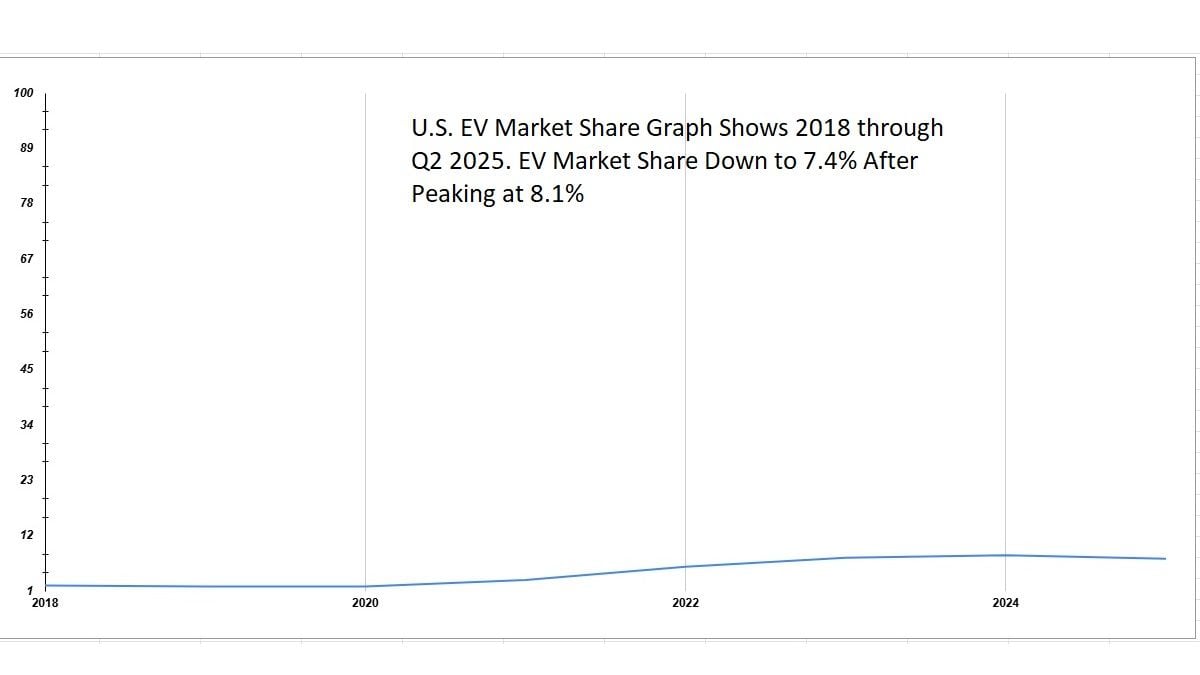

Electric vehicle market share in America has been declining now for about two years. Here is the latest data and a look forward to what will happen on October 1st when federal government subsidies stop.

Over the past few years, electric vehicles have had a firm push from the federal government, state and local governments, automakers, and a strong EV-advocacy media. Despite all of these efforts, battery-electric vehicle market share in America has steadily declined after hitting a peak of around 8.1% in 2024. For both the first and second quarters of 2025, with subsidies in full effect, the EV market share in the U.S. was lower than in 2023.

Here Is the U.S. EV market Share Percentage From 2018 to Q2 2025:

2018 2.1

2019 1.9

2020 1.9

2021 3.2

2022 5.8

2023 7.6

2024 8.1

2025 7.4 (Q2)

In 2023, the EV market share reached 7.6%. However, it has now dropped below that level. For Q1 2025, it was 7.55%, and in Q2, it was lower at 7.4%. Overall, 93% of Americans opted not to buy an EV, and a supermajority of Americans opted not to buy an EV, even in states with the most EV interest and support, such as California.

EVs Today – Something For Every Buyer

In 2025, there are about 70 battery-electric vehicle models on sale. These include trucks, SUVs (two and three row), sedans, crossovers, performance vehicles, and affordable vehicles with sticker prices under $30K. Virtually every brand offers EVs, some are 100% EV, and all the major brands have multiple offerings in multiple segments and price ranges. EVs represent roughly 30% of all available models on sale today. Plug-in hybrids, hybrids, and conventional models make up the remainder of the choices. At brands offering a mix of green vehicles, such as Toyota, Ford, and Hyundai, hybrids are outselling the battery-only models, and hybrids are increasing in market share.

EV Cost Parity Was Achieved If EV-Advocacy Media Can Be Believed

Price is not the reason that EVs have peaked and started to decline in popularity. At least, if pro-EV publications can be believed. For years, these publications have told readers that EVs are priced equal to or better than conventional vehicles and have a lower cost of ownership. We did a spotlight highlighting just how hard these publications went at this topic to try to convince the buying public that buying an EV was a financially clever move.

EVs Have Longer Warranties

If battery replacement concerns were an initial barrier to entry, this seems illogical today. Report after report says that EVs last as long or longer than conventional cars, and every EV has a very long warranty. EVs have the longest warranties of any vehicle type.

EV Charger Locations Passed Gas Pumps Last Year

If charging hassles were the main barrier for buyers, that problem seems to have vanished. Every pro-EV publication touted the fact that there are more EV chargers in California than gas pumps.

Federal and State EV Subsidies Were Active and Available To Most Buyers For Most EVs

Over the past year or two, most popular EVs came with a big federal tax incentive. To make it easier for buyers to take advantage of the tax incentive, an EV lease loophole was created. This allowed new car shoppers to benefit immediately from the “free” money. States continued to pour money on EV dashboards as well. Last year, numerous EV outlets highlighted leases for electric cars under $20 per month in Colorado.

EV Trucks Have Failed Entirely

EV trucks have been on sale now for many years, and based on the tiny number of overall deliveries, it is easy to call them all failures. One manufacturer offers three EV trucks. There are actually more full-size EV truck models than there are gas-powered truck models on sale. Yet, none have earned any meaningful sales. Rivian, the EV truck trailblazer, has seen its R1T truck deliveries drop by double-digit percentages and is struggling to maintain a 500-truck-per-month delivery rate. Tesla’s Cybertruck has failed so dramatically that it will likely be studied in marketing programs for years to come. With trucks comprising a significant percentage of the overall U.S. vehicle market, the failure of EV trucks had a profound impact on the failure of EVs to achieve the hockey stick adoption curve that many EV advocates had predicted.

Only Three “Successful” EV Models

The news that rarely gets reported by the media is that, in terms of deliveries, there have only been three “successful” EV models in America – ever. This is despite hundreds of EV models attempted in America since the modern age of EVs kicked off in 1996. They are the Tesla Model 3, the Tesla Model Y, and the Chevrolet Bolt. Unfortunately, the Bolt suffered from a recall of historic proportions. The new Chevrolet Equinox EV is still not reaching the former Bolt delivery peaks, but we are rooting for it to be successful and to help GM achieve profitability for EVs for the first time.

The Road Ahead For EVs

With EV market share now lower than it was in 2023, the road ahead looks pretty bumpy for BEVs. The federal government is stopping the decades-long gravy train and has officially ended the federal income tax incentive and lease loophole that was so popular. Gas prices are now as low as in 1965 when adjusted for inflation, so hybrids are the most affordable vehicles to fuel in many places where EVs are popular. Where EVs are unpopular, many shoppers do the math and find that conventional vehicles and EVs have no meaningful difference in cost per mile of energy.

Our Forecast For EVs in 2025 and Beyond

It may surprise you to know that we predict EVs will see a bump in market share in Q3 of 2025. This will be the last gasp for EVs before EV tax incentives destroy any hope of EV market share growth for the coming year or two. Q4 will likely drop to about a 5% level for EVs, and in 2026, we expect it to drop even further. One thing helping keep EVs from having a much larger drop is the addition of new models that are coming to market.

Based on the market share data of EVs, do you agree with our forecast, or do you see some hope that EVs will somehow rise to levels above 2023 in the near future and into 2026?

Click the red Add New Comment link below and share your thoughts with us.

About our EV market share data. We have long used Cox Automotive’s EV market share data. You can find this data at the company’s website under Market Insights. We also enjoy the support of the Cox Automotive team when we have questions or require clarification on this and similar topics. We feel this is the best publicly available data in existence.

John Goreham is a long-standing member of the New England Motor Press Association and an expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his eleven years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on LinkedIn and follow his work on his personal X channel or on our X channel. Please note that stories carrying John’s by-line are never AI-generated, but he does employ grammar and punctuation software when proofreading and he also uses image generation tools.