(Bloomberg) — Investors can rely on one crucial day of the week to deliver strong dip-buying opportunities for the S&P 500 Index (^GSPC) thus far in 2025: Wednesdays.

Most Read from Bloomberg

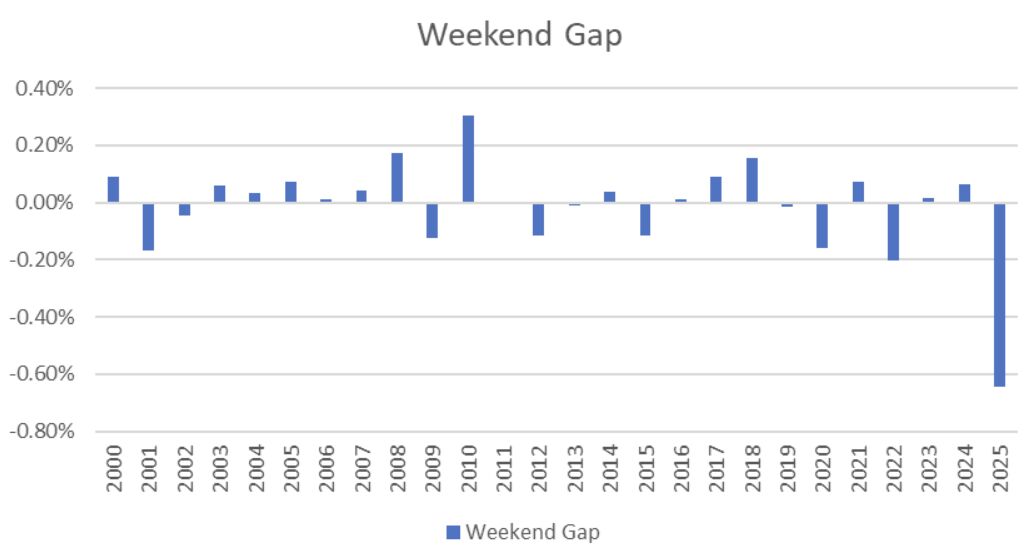

Traders lately have been selling first and asking questions later to lock in gains ahead of the weekend as stocks zig-zag on President Donald Trump’s tariff plans. That’s why Wednesdays this year have racked up gains that — if annualized — would reach 127%, according to data compiled by Ryan Detrick, chief market strategist at Carson Group. The weeks generally start and end badly, with Mondays and Fridays delivering annualized losses that exceed 40%.

“To see jitters ahead of the weekend on Fridays is not normally a sign of a healthy market,” said Detrick, a widely-followed stock bull. “It shows that there is indecision among investors, given there’s so much news from tariffs to DeepSeek coming over the weekends now.”

While there have been just a handful of observations so far in 2025, it marks an about-face from the stock-market rally in 2023 and 2024, when traders typically piled into equities at the start of the week.

But this year, traders are often capitalizing on potential market fluctuations mid-week due to earnings reactions or increased trading activity that may occur as investors react to news and developments out of Washington from earlier in the week, potentially creating opportunities to buy dips on other days.

For one thing, Wednesdays have a strong historical track record of delivering dip-buying opportunities for the S&P 500. From 1980 to February 2024, the stock market generated a positive gain on 53% of trading sessions, according to data compiled by Jacob Manoukian, US head of investment strategy at JPMorgan Private Bank & Wealth Management. Through 2023, Wednesday was the day of the week with the highest share of positive days at 55%.

It’s evident that traders have been using Friday’s session to take profits and consolidate positions ahead of what could be an eventful weekend of trade developments, with the S&P 500 closing lower in four of the past six Fridays. “The market hates tariffs,” said Thomas Thornton, founder of Hedge Fund Telemetry, who is shorting the S&P 500 and the Nasdaq 100 Index. “It is getting harder and trigger fingers to sell are quicker.”