Report Overview

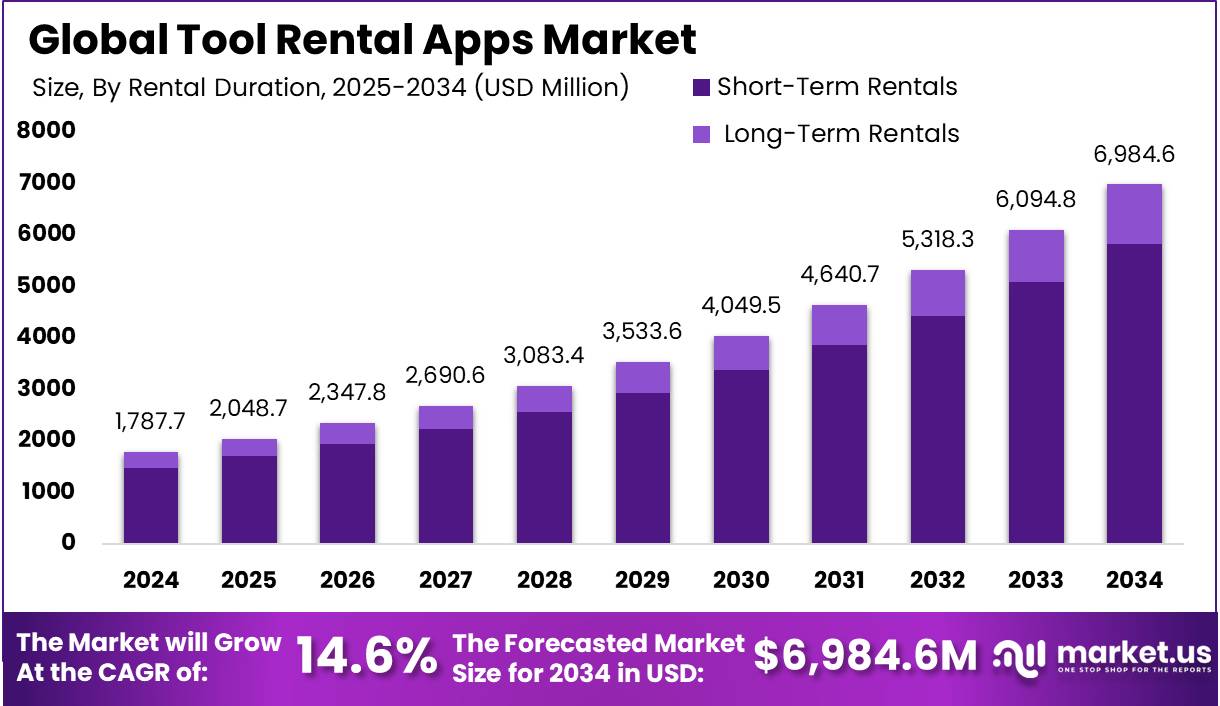

The Global Tool Rental Apps Market size is expected to be worth around USD 6,984.6 Million By 2034, from USD 1787.7 Million in 2024, growing at a CAGR of 14.60% during the forecast period from 2025 to 2034. In 2024, North America held a leading position in the global tool rental apps market, representing more than 36.1% of the market share, with revenues totaling approximately $645 million.

Tool rental apps represent a digital advancement in the equipment rental industry, enabling users to lease various tools and machinery via mobile platforms. These applications simplify the process of renting, managing, and returning tools, from heavy machinery for construction to smaller devices for home improvement. These apps simplify logistics and boost user engagement by offering easy access to various equipment with flexible rental terms.

The global tool rental market is characterized by a diversified inventory ranging from hand tools and power tools to large construction machinery and gardening equipment. The market’s growth is driven by the increasing demand across various sectors including construction, landscaping, and home improvement. Significant drivers of the tool rental market include the surging urbanization and subsequent infrastructural developments which necessitate a broad array of equipment.

![]()

The market is witnessing a shift towards more specialized equipment rentals, such as those for on-site sanitation and temporary mobile structures, indicating a broadening of the market to include niche segments. This expansion is coupled with technological advancements in rental platforms that improve the efficiency of transactions and equipment management.

There is a notable opportunity for stakeholders and new entrants to innovate in the digital and smart solution spaces within the tool rental industry. The introduction of more user-friendly platforms and the integration of technologies like AI and IoT can enhance the user experience and operational efficiency. Moreover, expansion into emerging markets like Asia-Pacific, where urbanization is rapidly increasing, could be highly lucrative

The rise of tool rental platforms is also driven by the increasing popularity of the sharing economy, which promotes resource sharing to reduce waste. Additionally, advancements in mobile app technology have led to more efficient and user-friendly platforms, making it easier for consumers to access and engage with tool rental services.

Tool rental apps are becoming increasingly popular due to the advantages they offer, such as lower ownership costs, less storage space required, and no maintenance responsibilities. Additionally, their environmental benefits, as a more sustainable alternative to buying equipment for infrequent use, are driving further growth in demand.

Key Takeaways

- The Global Tool Rental Apps Market size is expected to reach USD 6,984.6 Million by 2034, up from USD 1,787.7 Million in 2024, growing at a CAGR of 14.60% during the forecast period from 2025 to 2034.

- In 2024, the Construction Tools segment dominated the market, holding more than 49.2% of the tool rental apps market share.

- The Business-to-Consumer (B2C) segment also had a dominant market position in 2024, capturing more than 66.1% of the tool rental apps market share.

- The Short-Term Rentals segment led the market in 2024, commanding more than 83.4% of the market share.

- The Businesses & Organizations segment captured a dominant market share of over 72.8% in the tool rental apps market in 2024.

- In 2024, North America held a leading position in the global tool rental apps market, representing more than 36.1% of the market share, with revenues totaling approximately $645 million.

- The tool rental apps market in the United States was valued at $580.7 million in 2024 and is projected to grow at a CAGR of 13.3%.

Analysts’ Viewpoint

The tool rental app market is witnessing significant growth, driven by the shift towards more efficient and cost-effective solutions within the DIY and construction sectors. This market presents a promising area for investment due to its expanding user base and the increasing adoption of digital platforms for rental services.

Technological innovation is at the core of the expansion and improved efficiency of tool rental apps. Advanced features such as augmented reality for visualizing tools in the workspace, and AI-driven algorithms for optimizing inventory management and pricing strategies are enhancing user experiences.

Moreover, the integration of mobile technologies facilitates easier and more efficient interactions between rental services and users, with apps increasingly offering features like real-time availability updates and geolocation to streamline the rental process.

The regulatory landscape for tool rental apps involves navigating various local and international regulations that pertain to digital transactions, consumer safety, and data protection. Companies operating in this space must ensure compliance with these regulations to avoid legal pitfalls and build trust with users.

Additionally, as the market grows, there is potential for more stringent regulations focusing on the sharing economy, which could impact how rental platforms operate, particularly in terms of data handling and consumer privacy.

Impact of AI

The integration of Artificial Intelligence (AI) into tool rental apps is significantly enhancing operational efficiencies and customer experiences across the industry.

Here are some key impacts of AI on the tool rental sector:

- Operational Efficiency: AI technologies are being leveraged to improve the efficiency of operations within the tool rental industry. Demand forecasting models powered by AI analyze historical data, market trends, and external factors to predict equipment demand more accurately. This enables rental companies to optimize their inventory levels, reduce equipment downtime, and improve resource allocation.

- Enhanced Customer Service: AI is transforming the customer experience in tool rental applications by facilitating real-time equipment tracking and the use of AI-powered chatbots and virtual assistants. These technologies provide customers with immediate assistance and support, enhancing the overall service quality and efficiency.

- Predictive and Preventive Maintenance: AI-driven predictive maintenance tools are becoming essential in the equipment rental industry. By analyzing historical and real-time data from sensors and monitoring systems, AI can predict potential equipment failures before they occur. This not only helps in reducing downtime but also extends the lifespan of the machinery.

- Safety and Compliance Enhancements: AI technologies such as computer vision and machine learning are being utilized to improve safety at job sites. For example, AI can identify and alert operators about the presence of people or obstacles around construction equipment, enhancing situational awareness and preventing accidents.

US Market Valuation

In 2024, the market for tool rental apps in the United States was valued at $580.7 million. It is projected to grow at a compound annual growth rate (CAGR) of 13.3%. This growth can be attributed to increasing demand from both commercial and residential sectors, where users seek cost-effective solutions for tool access without the need for outright purchase.

The rise of the sharing economy and the increasing penetration of smartphones and mobile internet are key drivers behind this market’s expansion. Consumers and businesses are increasingly comfortable with digital platforms that offer convenience and flexibility, which tool rental apps provide by enabling easy access to a wide range of tools for short-term use.

Environmental concerns and the push for sustainability are fueling the growth of the tool rental market. Renting tools reduces the demand for raw materials and minimizes waste, supporting broader environmental objectives. As more users recognize the economic and environmental advantages, the market is poised for continued expansion.

![]()

![]()

In 2024, North America held a dominant position in the global tool rental apps market, capturing more than a 36.1% share with revenues amounting to approximately $645 million. This leading stance is primarily attributed to the advanced technological infrastructure and high adoption rates of digital solutions within the region.

The growth in North America can also be linked to the region’s thriving construction and home improvement sectors, where tool rental apps are increasingly utilized. The convenience of app-based tool rental is particularly appealing in a culture that values time-saving and cost-effective solutions for both professional contractors and DIY enthusiasts.

Regulatory support in countries like the U.S. and Canada creates a favorable environment for sharing economy platforms, with these nations leading in technological adoption that sets global trends. This, along with significant investments in mobile broadband networks, boosts access to on-demand services such as tool rentals.

Overall, North America’s lead in the tool rental apps market is underpinned by a combination of technological advancement, economic strength, environmental consciousness, and supportive regulatory frameworks. As these trends continue to evolve, the market is expected to see sustained growth, further cementing its position as a leader in the global landscape.

![]()

![]()

Tool Type Analysis

In 2024, the Construction Tools segment held a dominant market position, capturing more than 49.2% of the tool rental apps market share. This leadership can be attributed to the high demand for construction equipment, which is typically expensive to purchase outright, particularly for short-term or one-off projects.

Construction tools are essential for both large-scale commercial projects and individual home construction or renovation tasks, making them a frequent need for renters. With construction projects often being time-sensitive and requiring specialized equipment, renting tools becomes a more cost-effective and flexible alternative for many users.

The growing infrastructure development and increasing construction activities across both developed and developing regions further support the prominence of construction tools in the rental market. Small businesses, contractors, and DIY enthusiasts alike benefit from the opportunity to rent tools like excavators, bulldozers, and power drills, as these items are rarely required for extended periods.

Urbanization and residential construction are increasing demand for construction tools. Homeowners are opting for tool rental services for renovation projects, as it’s more affordable than buying and storing expensive equipment. Rental apps offering delivery and pick-up services further drive market adoption.

Business Model Analysis

In 2024, the Business-to-Consumer (B2C) segment held a dominant market position, capturing more than a 66.1% share of the tool rental apps market. This dominance can be attributed to the growing trend of DIY (Do-It-Yourself) projects among homeowners, where individuals prefer renting tools for short-term or one-off tasks rather than making large investments in purchasing expensive equipment.

B2C tool rental apps lead the market by prioritizing ease of use, with simple navigation, flexible terms, and quick tool booking. As demand for home improvement and personal projects rises, these apps offer convenient, cost-effective solutions, allowing customers to rent tools for specific durations without long-term commitments.

Additionally, B2C tool rental platforms benefit from a highly scalable business model, which can be easily expanded to cater to different regions and customer segments. The rise of e-commerce and mobile-based solutions has further accelerated the adoption of these platforms, as customers can browse, select, and have tools delivered directly to their doorsteps with minimal effort.

The B2C tool rental market benefits from the growing reliance on smartphones and app-based solutions, making it easier for consumers to find and rent tools at competitive prices. As more people embrace these technologies and demand seamless experiences, the B2C model leads the market, surpassing other business models in growth and market share.

Rental Duration Analysis

In 2024, the Short-Term Rentals segment of the tool rental apps market held a dominant position, capturing more than 83.4% of the market share. This segment’s prominence can be attributed to the growing demand for tools on a temporary basis for specific projects.

Short-term rentals dominate due to their cost-effectiveness for users who don’t need long-term tool access. DIY enthusiasts and contractors save on upfront costs and maintenance by renting tools for specific tasks. This on-demand flexibility drives adoption in industries like home improvement, plumbing, and landscaping.

Additionally, short-term rentals offer greater convenience due to the increasing use of mobile apps that allow users to easily browse, book, and return tools with minimal effort. This aligns with the growing preference for instant gratification and on-demand services, particularly in urban areas where time is often a constraint.

In contrast, the long-term rental segment, though growing, remains a smaller part of the market as it is less frequently needed by casual consumers or smaller businesses. Long-term rentals are generally suited for larger projects that require continuous access to specific tools, but these instances are less common compared to short-term needs.

End-Use Analysis

In 2024, the Businesses & Organizations segment held a dominant market position in the tool rental apps market, capturing more than a 72.8% share. This segment’s leadership can be attributed to several key factors that underscore its central role in driving market growth.

Businesses and organizations frequently require a diverse array of tools for short-term projects, leading to higher demand for rental solutions. These entities typically engage in multiple, often large-scale, projects that necessitate specialized tools not commonly held in permanent inventories, thus fostering a reliance on rental solutions for cost efficiency and logistical flexibility.

Renting tools instead of purchasing offers significant economic advantages for businesses, including lower capital expenditures and reduced maintenance costs. This financial efficiency aligns with the strategies of organizations looking to optimize their budgets, making it a key driver of the segment’s market dominance.

Furthermore, the integration of digital technologies within tool rental platforms has significantly enhanced the accessibility and efficiency of renting tools for businesses and organizations. Features such as real-time inventory management, mobile access, and streamlined booking systems have made these platforms more attractive to corporate clients, who prioritize ease of use and time-saving mechanisms.

![]()

![]()

Key Market Segments

By Tool Type

- Construction Tools

- Gardening Tools

- Home Improvement Tools

- Industrial Tools

- Other Tools

By Business Model

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Peer-to-Peer (P2P)

By Rental Duration

- Short-Term Rentals

- Long-Term Rentals

By End-Use

- Individual Consumers

- Businesses & Organizations

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Convenience and Cost-Effectiveness

The proliferation of tool rental applications has been significantly propelled by the dual advantages of convenience and cost-effectiveness. These platforms enable users to access a wide array of tools without the substantial financial burden associated with outright purchases.

This model is ideal for individuals and businesses needing tools for short-term projects, removing the need for hefty capital investments. Its digital format lets users conveniently browse, select, and reserve tools from anywhere, simplifying the procurement process.

The integration of user-friendly interfaces and real-time inventory tracking improves the user experience, making tool rental apps a compelling alternative to ownership. This shift towards a rental economy mirrors broader trends in the sharing economy, emphasizing access over ownership and aligning with growing consumer preferences for flexibility and sustainability.

Restraint

Regulatory and Legal Challenges

Despite the significant growth of the P2P rental apps market, regulatory challenges continue to pose a restraint to its expansion. Governments globally have yet to establish unified regulations for P2P rental platforms.

The rental of properties, vehicles, and tools is often subject to varying legal frameworks by region. For instance, short-term property rentals may have different regulations, including stay duration limits, occupancy caps, or restrictions on property types.

Another challenge arises with the growing scrutiny over safety and insurance policies. Many users are concerned about the safety of the items they rent, and platforms face difficulties in providing sufficient liability coverage.

This has led to a lack of trust, particularly when it comes to high-value goods or properties. Even with insurance options offered by platforms, legal complications regarding liability in case of accidents or damages can often lead to hesitation among potential users.

Opportunity

Expansion into Emerging Markets

The tool rental applications market presents significant growth opportunities, particularly in emerging economies experiencing rapid urbanization and industrialization. As infrastructure development accelerates in regions such as Asia-Pacific, Latin America, and Africa, the demand for construction and maintenance tools is expected to rise substantially.

Tool rental apps can capitalize on this trend by providing affordable and flexible access to necessary equipment, catering to both individual users and small to medium-sized enterprises. By offering localized solutions, including language support and region-specific tool inventories, these platforms can effectively penetrate new markets.

Moreover, partnerships with local businesses and compliance with regional regulations can enhance credibility and user trust. The integration of mobile payment systems prevalent in these regions can further streamline the user experience, making tool rental apps a viable and attractive option for a broader audience.

Challenge

Managing Complex Rental Processes

The management of intricate rental processes poses a significant challenge for tool rental applications. Coordinating bookings, ensuring the timely delivery and return of tools, and maintaining equipment quality require robust systems and processes. Without seamless integration between these functions, inefficiencies can arise, leading to increased operational costs and diminished customer satisfaction.

Additionally, reliance on manual methods, such as spreadsheets, can result in errors and mismanagement. Implementing comprehensive rental management software that automates these processes is essential to address these challenges. Such systems can provide real-time tracking of equipment availability, streamline billing procedures, and facilitate maintenance schedules, thereby enhancing operational efficiency and customer experience.

Emerging Trends

One prominent trend is the integration of artificial intelligence (AI) and advanced inventory management systems. These technologies enable real-time tracking, automated maintenance scheduling, and comprehensive reporting, allowing companies to optimize equipment utilization and minimize downtime.

Another emerging trend is the expansion of mobile capabilities. Rental companies are developing mobile applications that allow customers to browse inventory, make reservations, and manage rentals directly from their smartphones or tablets. This shift not only enhances user experience but also streamlines operations by enabling on-the-go management.

Dynamic pricing models are gaining traction, allowing companies to adjust rental rates in real-time based on demand and market conditions to maximize revenue. Additionally, IoT technology is enhancing equipment tracking and maintenance, with sensors providing data on location, performance, and usage to reduce costs and enable proactive maintenance.

Business Benefits

Effective inventory management is crucial for rental businesses. Tool rental apps facilitate real-time tracking of equipment availability, usage, and maintenance needs, leading to reduced downtime and optimized asset utilization. This efficiency contributes to enhanced customer satisfaction and operational profitability.

The booking and scheduling features of tool rental apps simplify the reservation process for customers, allowing them to view real-time availability and make bookings at their convenience. This ease of use enhances the customer experience and encourages repeat business.

By automating processes such as billing, inventory management, and customer communications, tool rental apps reduce operational costs and minimize errors. This automation leads to improved cash flow management and supports revenue growth.

Environmental Benefits

- Reduction of Waste: Renting tools reduces waste by cutting down on production and disposal. It helps prevent the accumulation of rarely-used items that would otherwise end up in landfills, while also lowering the demand for new products, which is vital for effective waste management.

- Resource Conservation: Tool rental apps promote resource efficiency by enabling shared use of equipment. This reduces the need for manufacturing new tools, conserving raw materials and energy. By maximizing tool utilization, the environmental impact from production processes, like energy use and pollution, is minimized.

- Lower Carbon Emissions: The rental model lowers carbon emissions by sharing tools, reducing the number needed and cutting emissions from manufacturing and transport. Many rental companies also adopt green practices, like offering electric tools, further reducing emissions.

- Extended Tool Lifespan: Rental companies keep tools in good condition through regular servicing and repairs, extending their lifespan and reducing the need for disposal. Well-maintained tools can serve many users, minimizing environmental impact.

- Promotion of a Culture of Reuse: Renting promotes a culture of reuse over ownership, encouraging community sharing and collaboration. This mindset leads to more sustainable consumption and supports a societal shift toward valuing resource sharing and sustainability.

Key Player Analysis

The market is becoming highly competitive, with several key players standing out as industry leaders.

- Home Depot’s tool rental app is one of the most recognized in the market, offering a wide variety of tools for both residential and commercial projects. Home Depot’s app lets users browse equipment, make reservations, and access delivery services. Known for reliable tools and excellent customer service, it holds a strong market advantage in tool rentals.

- Lowe’s tool rental app also caters to both DIY enthusiasts and professionals, offering a wide selection of tools at competitive prices. The app’s user-friendly interface ensures a seamless experience for customers, allowing them to rent tools on-demand. Lowe’s stands out by offering a range of flexible rental options, ensuring that customers can find the right tools for their projects.

- United Rentals is a major player in the heavy equipment rental sector, providing an extensive selection of tools and machinery through their rental app. United Rentals offers industrial-grade equipment rentals, focusing on construction and other industries. The app enables quick rentals and delivery services, ensuring clients get the tools needed for complex projects.

Top Key Players in the Market

- Home Depot Tool Rental

- Lowe’s Tool Rental

- United Rentals

- Herc Rentals

- Sunbelt Rentals

- Acme Tools

- Bunnings

- RentMyTool

- Point of Rental

- EquipmentShare

- Other Major Players

Top Opportunities Awaiting for Players

The Tool Rental Apps Market presents several promising opportunities for industry players to explore and capitalize on.

- Expansion of Rental Categories: The tool rental apps market is ripe for diversification beyond traditional categories like home and vacation rentals. There is significant potential to expand into new categories such as tools, electronics, and even luxury items, which cater to a broad demographic including DIY enthusiasts and professional builders.

- Technological Innovations: Implementing advanced technologies such as AI-powered recommendation engines and blockchain for transaction security can enhance user experiences. These technologies not only improve the efficiency of rental transactions but also help in building trust and reliability among users.

- Sustainability Practices: With growing environmental consciousness, there is an increased demand for sustainable options. Rental tools offer a more eco-friendly alternative to purchasing, reducing overall waste and resource consumption. Emphasizing green practices can attract consumers who value environmental responsibility.

- Targeting Emerging Markets: Expanding services into emerging markets like Asia-Pacific and Latin America offers vast opportunities. These regions show increasing urbanization and a rising middle class, which are key drivers for the adoption of rental services. Mobile apps make accessing these services more convenient, broadening the customer base.

- Enhanced User Experience and Accessibility: Developing more user-friendly app interfaces and mobile access can significantly boost user engagement. As consumers, particularly millennials and Gen Z, prefer versatile and technology-driven solutions, enhancing app functionalities such as real-time availability updates and mobile-friendly interfaces can meet these expectations effectively.

Recent Developments

- In March 2024, United Rentals acquired Yak Access, a provider of temporary matting solutions, for approximately $1.1 billion. This acquisition aimed to enhance United Rentals’ specialty rental offerings.

- In February 2025, Sandbrook Capital acquired intellirent, a provider of electrical-test equipment rentals, from Electro Rent. This acquisition was driven by the increasing demand for modernizing power grids and aging infrastructure.