The dot-com bubble and meme stock frenzy of 2021 are the only times speculative fervor has held a tighter grip over the stock market than it does today, according to Goldman Sachs.

Strategists led by Ben Snider detailed the many ways in which the footprint of exuberant risk-seeking behavior in the stock market is growing, headlined by the sharpest three-month rise in the bank’s “speculative trading indicator” outside of those two high-profile episodes.

This metric — which tracks how much trading activity there is in penny stocks, unprofitable companies, and very expensively valued stocks — has reached historical extremes:

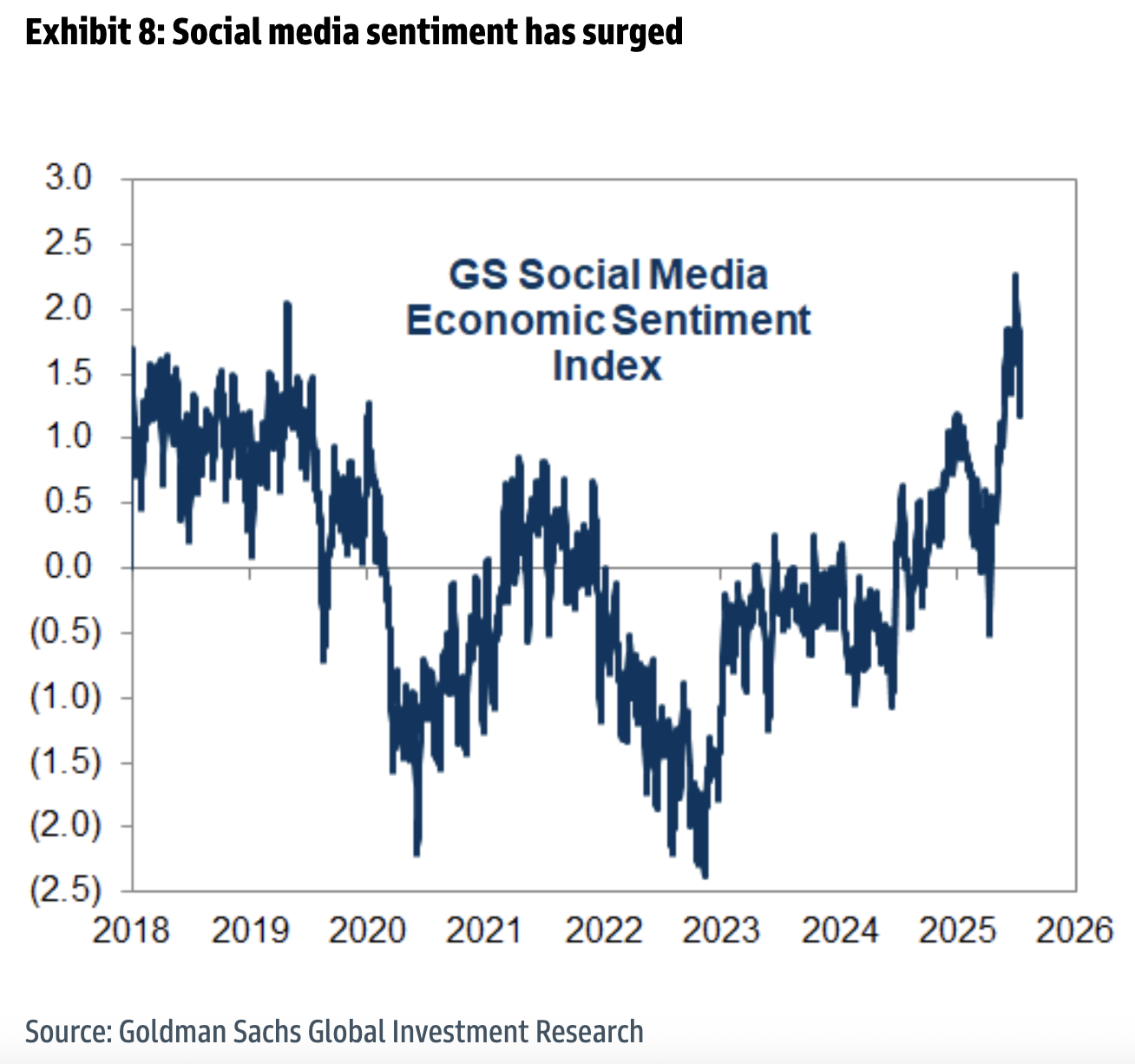

That’s supported by the “good vibes only” message from social media on the stock market:

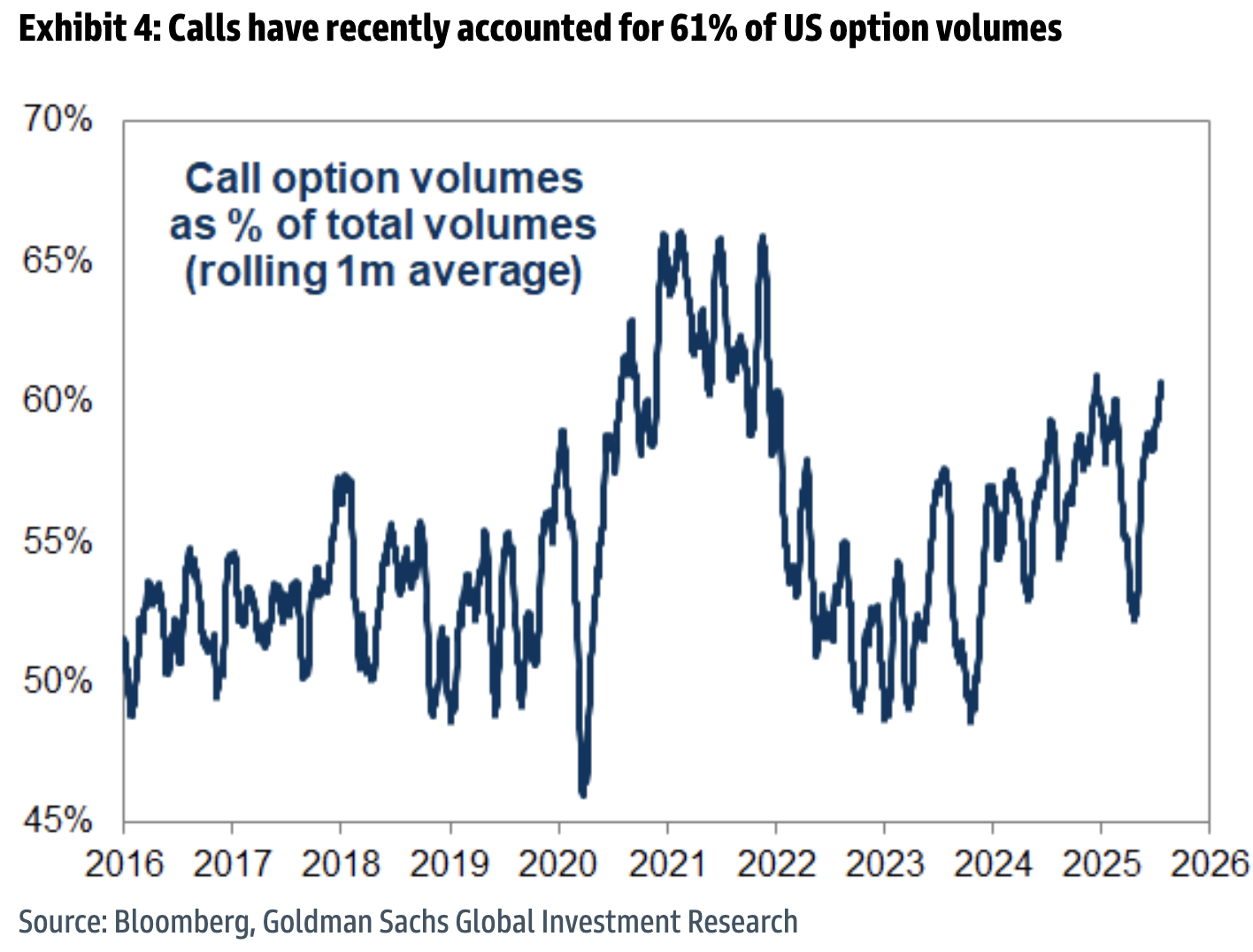

Call options, often the instrument of choice for retail traders piling into a new stock, are dominating options activity:

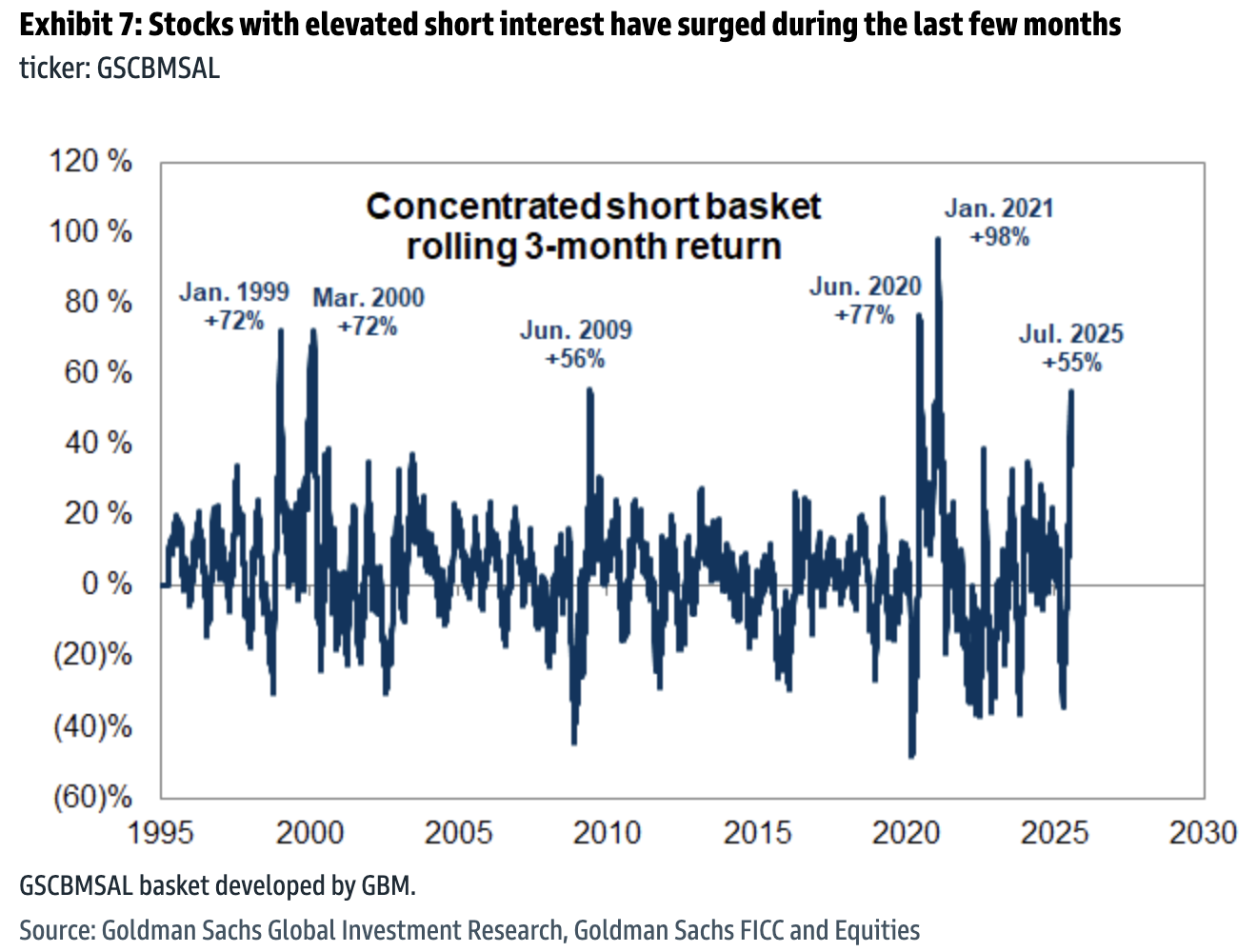

Snider and company note that buyers’ binges have caused some of short sellers’ favorite targets to surge…

…with their peers at JPMorgan pointing out that these squeezes have been amplified by those bearish bets getting closed at a frenzied pace:

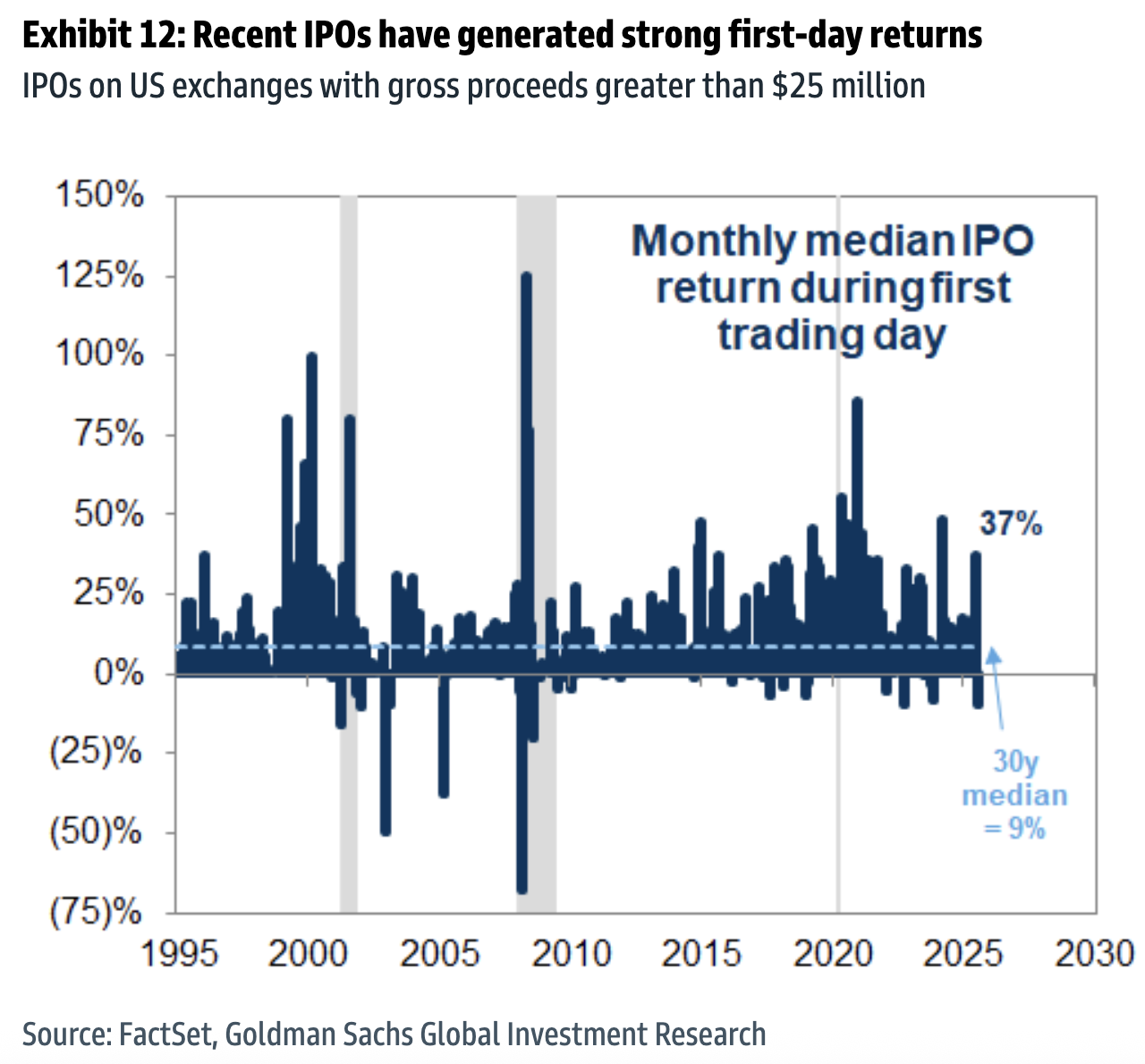

Not only is the index inclusion pop back, but IPOs are enjoying very strong starts relative to history:

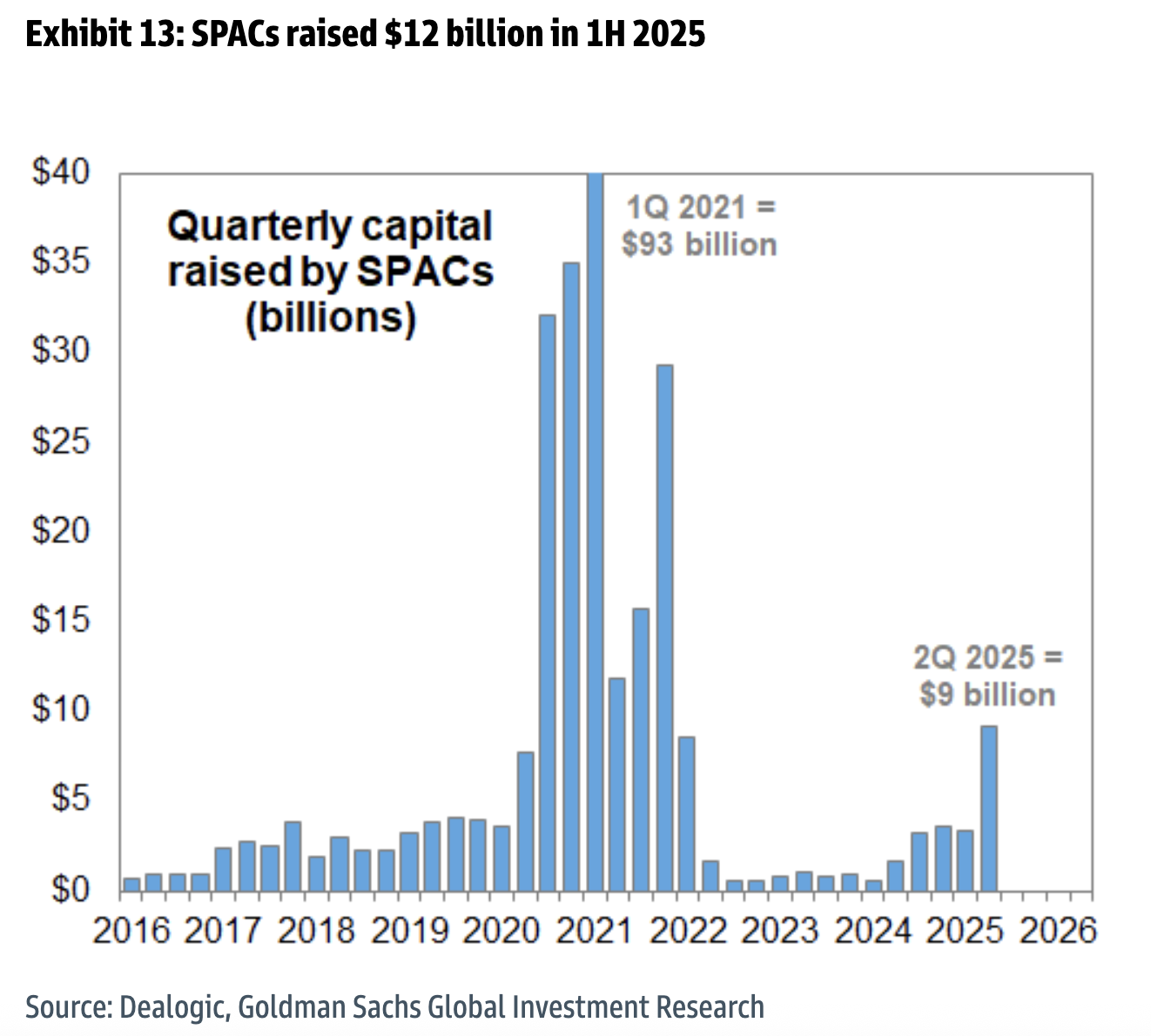

And SPACs are back:

Goldman spotlights BigBear.AI, Lucid, Nvidia, Tesla, and Plug Power as some of the companies with the highest volumes in the Russell 3000 over the past month. That’s indicative of a bit of a barbell strategy in these speculative endeavors, with traders buying smaller tech companies and some of the largest companies in the world. Notably, its list excludes Opendoor, which was booted from the Russell 2000 (and 3000) near the end of June before trading 1.9 billion shares last Monday.

But when we zero in on the stocks with high turnover as a percent of shares outstanding, that list is dominated by smaller, more speculative companies that include thematically intriguing groups like quantum computing or crypto-linked companies.

“The recent rise in speculative trading activity signals near-term upside risk for the broad equity market but also increases the risk of an eventual downturn,” Goldman concludes. “During the last 35 years, other sharp increases in speculative trading activity have signaled above-average subsequent 3-, 6-, and 12-month S&P 500 returns, but returns typically faltered on a 24-month horizon.”