Tesla (TSLA) and BYD (BYDDF) are the world’s largest electric-vehicle makers.

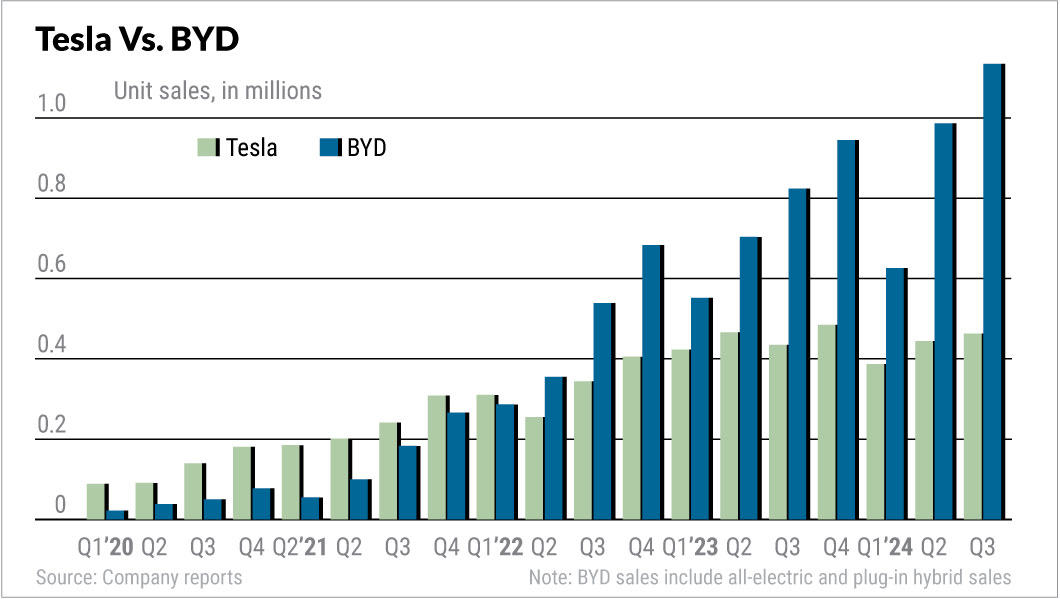

In 2022, China EV and battery giant BYD’s vehicle sales raced ahead of Tesla’s and are now well more than twice as high. For all-battery electric vehicles (BEVs), BYD seized the crown in Q4 2023. However Tesla has regained that title in 2024.

Tesla and BYD reported rising sales in Q3.

↑

X

Elon Musk’s Robotaxi Has Arrived. Here’s What Investors Need To Know.

Tesla has relied on price cuts since late 2022 to offset weaker demand due to an aging lineup and rising competition. New “affordable” EVs may be coming, but they may be variants of existing models.

BYD has also cut prices, but margins remain high. Sales are rising thanks to a next-generation hybrid system and a variety of new and refreshed models. It recently opened its first full assembly plant outside of China, with several more overseas plants coming.

At the much-hyped Oct. 10, robotaxi event, CEO Elon Musk unveiled a Cybercab and Robovan. But Tesla sold off, extending heavy October and triggering a sell rule.

BYD stock has rebounded back into a buy zone, buoyed by its own booming sales and China stimulus hopes.

Tesla Vs. BYD Sales

Tesla delivered 462,890 EVs in Q3, up from Q2’s 433,956 and Q3 2023’s 435,059. That was in line with various analyst estimates but below some whisper numbers. Also, Tesla relied on China sales, which tend to be lower margin.

Tesla also deployed 6.9 gigawatt hours of energy storage products, down from Q2’s record 9.4 GWh.

Meanwhile, BYD sold a record 1,134,892 vehicles in Q3, up 37.3% vs. a year earlier and 7.6% vs. Q2’s 986,720. PHEV sales soared 75.6% vs. a year before to 685,830. BEV passenger sales came in at 443,426, up 2.7% vs. a year earlier and 4.1% vs. Q2.

Tesla, which only makes BEVs, remained No. 1 in that category in Q3.

BYD sold 419,426 EVs in September, up 45.9% vs. a year earlier and 12.4% vs. August. Among passenger vehicles, BYD sold 252,647 and 164,956 fully battery electric vehicles (BEVs). PHEV sales are booming thanks to a longer-range, next-generation hybrid system.

BYD production is ramping up to meet demand, especially for its newer hybrids.

Sales of commercial vehicles, including buses, delivery trucks and more, came in at 1,823, up 231% vs. a year earlier but down 12.2% from August’s record 2,229.

So far in 2024, BYD has sold 2,747,875 vehicles. It should easily pass the company’s official target of 3.6 million EVs, and seems like to reach an unofficial goal of four million.

Tesla, BYD Price Cuts

Tesla has slashed prices worldwide starting in late 2022. The EV giant has had to keep cutting prices or boost other incentives to prop up sales, slashing once-mighty profit margins and earnings.

Tesla has reintroduced Model 3 and Model Y inventory discounts in the U.S. and cut some European prices. It’s also using low- or zero-interest loans to prop up demand.

Earlier in 2024, BYD slashed prices on most of its largely refreshed models, helping to revive sales, but since then has largely eschewed discounts.

Tesla Models

Tesla produces the Model 3, the Model Y, Model X and Model S, as well as the Semi and Cybertruck. The Model Y crossover accounts for the majority of sales.

A Model 3 revamp didn’t provide much of a sales boost in China and Europe and has been lackluster in the U.S.

The Cybertruck has been produced in relatively low volume, but output is improving. The Cybertruck, which probably is not profitable yet, is likely to be largely a North American vehicle.

Tesla has stopped orders of the Foundation series Cybertruck, which started at $100,000. It is now selling non-Foundation versions, starting at $79,990. At that price, the Cybertruck should soon be eligible for IRA tax credits.

As of Oct. 17, anyone can order a Cybertruck, without a reservation, with delivery in October or November. That suggests that the estimated two million reservations didn’t translate into many sales

Along with the Model 3 and Y inventory discounts and other efforts, Tesla appears to be starting a year-end sales push early.

Tesla has delivered a few dozen Semi vehicles to PepsiCo (PEP). By May 2024, a few more customers, including Walmart (WMT), had taken possession of at least one Tesla Semi. But it’s still unclear what the specs and price for the EV big rig are. Tesla recently said it expected mass production in 2026, but Semi timelines have often slipped by years.

Tesla Robotaxi Event

At the Tesla robotaxi event, Elon Musk showed off the two-seat Cybercab, with butterfly doors and no steering wheel.

Musk expects the Cybercab price tag will be below $30,000, with production starting “before 2027.”

Further, he expects “fully autonomous unsupervised FSD in California and Texas next year — that’s with the Model 3 and Model Y.”

However, he admitted, “I tend to be a little optimistic with time frames.”

Elon Musk has said for years that Tesla would achieve self-driving “this year” or “next year,” while production targets often slip considerably. He also didn’t offer new evidence that Tesla FSD was making progress toward actual self-driving.

Musk didn’t offer significant details about business models, such as a ride-hailing service. There had been speculation that Tesla would launch a ride-hailing service with human drivers.

He also showed off a huge Robovan, but with no timing on when that will go into production.

Optimus humanoid robots were on display, but were largely teleoperated.

Tesla EVs Near Term

The Model Y is expected to get a refresh in early 2025. Like the Model S, X and 3 updates — which didn’t boost sales much — the “Juniper” Y likely will have cosmetic exterior changes.

The EV giant this year ditched long-touted plans for a “next-generation” EV and “revolutionary” manufacturing. Tesla now plans “affordable vehicles,” using existing production lines. On the Q2 call, Musk said output would start in the first half of 2025, vs. late 2024 or early 2025 on the Q1 call. That would suggest mass production and deliveries would start in late 2025 or beyond.

The speculation is that Tesla will produce a lower-cost variant of the Model 3 or Model Y, perhaps a hatchback. It’s unclear how a low-end Model 3 might fare outside the U.S., especially in China.

Tesla still hasn’t even shown images for the upcoming “affordable” vehicle. Musk didn’t even mention the upcoming product at the robotaxi event.

BYD Expansion

BYD sells BEVs and PHEVs from around $10,000 to $150,000, with a wide range of models. It’s refreshing much of its lineup, while adding several new models. That includes new models for its premium Denza, FangChengBao and Yangwang brands.

On Sept. 16, BYD disclosed that it had taken full control of Denza, buying the last 10% owned by Mercedes-Benz.

A recently launched fifth-generation hybrid system offers touted 2,100 kilometers (1,305 miles) in combined battery-and-gas range. The system, which is being rolled out to new and existing models, is fueling booming orders.

Improved driver-assist systems and faster charging also reaching more of BYD’s lineup.

Exports are a modest share of overall sales, but growing rapidly as logistics improve. They also carry better margins.

BYD’s brand-new Thailand plant, its first full-assembly plant outside of China, has begun deliveries.

A Brazil factory is due to fully open in early 2025. The EV giant also has plans to build factories in Hungary, Indonesia, Turkey, Cambodia and Pakistan.

Turkey has a customs union with the EU. That, along with the Hungary plant, will be two factories for Europe. The Cambodia and Pakistan plants will likely be knock-down plants, putting together cars that are partially assembled elsewhere, as in a recently opened site in Uzbekistan.

The EV giant also is close to choosing a Mexico site and may set up in Vietnam as well.

BYD makes EV buses in California, but says it has no plans to enter the U.S. passenger EV market, amid import tariffs and political opposition. However, Trump has said he wants Chinese EV makers to build cars in the U.S.

Tesla Vs. BYD Batteries

Tesla traditionally has not mass produced its own batteries. For lithium-ion batteries, its joint venture partner Panasonic makes the cells and Tesla packages them. It also buys lithium-ion batteries from South Korea’s LG. Tesla also buys a lot of lithium iron phosphate (LFP) batteries from China’s CATL as well as some LFP batteries from BYD.

Tesla is working on 4680 batteries, first touted at the 2020 Battery Day. The 4680 batteries are standard lithium-ion chemistry, but the larger form factor offers the potential for various benefits and cost savings. Tesla’s 4680 production has picked up in recent months.

Tesla has hinted at progress on the “dry cathode” problem, but reportedly mass-production issues remain. It appears that the 4680 battery density is only now reaching that of traditional 2170 cells.

If nothing else, the focus on the 4680 batteries meant that Tesla did not focus on expanding production or sourcing of traditional 2170 cells that would comply with IRA tax credit rules.

Tesla is a major battery storage provider, though it gets its batteries from CATL.

BYD, meanwhile, is one of the world’s largest EV battery makers. Its Blade batteries are a specialized form of lithium ferrous phosphate (LFP) or lithium iron phosphate batteries. BYD supplies third-party EV makers, including Xiaomi, XPeng’s Mona sub-brand, Nio’s Orvo brand and Toyota.

BYD supplies some EV batteries to Tesla Berlin.

BYD reportedly will unveil a next-generation Blade battery before year-end. That should revive flagging BEV sales in 2025.

BYD expects solid-state batteries for high-end models by 2027, but not fully reaching lower-end models until 2030-2032.

BYD is a major battery storage provider. It reportedly will be a supplier to Tesla’s upcoming Shanghai Megapack factory.

Tesla’s Other Businesses

Tesla has its own Supercharger network in its markets. That’s especially important in the U.S. and countries like Australia, where third-party charging facilities are limited.

Tesla has deals with most automakers for access to Superchargers in the U.S. They’ll also adopt the charger standard Tesla uses. Those deals, and some related charging subsidies, will boost revenue. But they reduce Tesla’s charging moat in the U.S., which encouraged people to buy its EVs.

Tesla also has a solar installation business, but it’s been struggling for years.

Tesla’s self-driving ambitions continue. Musk is doubling down on FSD as the traditional EV business struggles. However, Tesla recently slashed the FSD prices to $8,000 from $12,000, shortly after halving the FSD subscription price to $99 a month from $199.

Tesla is offering various incentives that essentially cut the FSD price further.

Tesla is moving toward offering FSD in China. But many automakers offer Level 2 systems there, or better, often at no cost.

Tesla also is pursuing a humanoid robot, Optimus, saying he expects it to be a multitrillion dollar business. On the Q2 earnings call, he said Optimus will be doing useful work in Tesla factories by late 2025, pushing back from his Q1 call’s estimate of late 2024.

“We should be thought of as an AI or robotics company,” Musk has told investors. “If somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor.”

BYD’s Other Businesses

BYD, notably, makes its own chips. That, along with in-house batteries and other vertical integrations, help make BYD a low-cost EV maker.

The EV and battery giant also has solar operations.

BYD is introducing Level 2 driver-assistance systems in its premium brand models as well as more mainstream BYD brand offerings. BYD is rolling out advanced ADAS for highways for its Denza line, with city streets coming later this year. Those services will likely be introduced in its higher-end BYD-brand EVs in the coming months.

BYD Co. is largely known for its BYD Auto operations. BYD Electronics, which accounts for an increasingly smaller share of overall revenue, is involved in mostly low-margin businesses such as smartphone components and assembly. But margins are improving there as well.

In December 2023, BYD Electronics acquired the mobility business of Jabil (JBL), increasing its exposure to Apple (AAPL).

EU Hikes Tariffs On Chinese EVs

The European Union has started imposing additional tariffs of up to 35.3% on Chinese BEVs starting July 5. That’s on top of the current 10% duties.

Specifically, the EU will impose an extra 17% tariff on BYD’s BEVs vs. 35.3% for state-owned SAIC. For other automakers, they’ll receive an average duty of 20.7% if they cooperated and 35.3% if they did not.

Notably, the EU will only impose a 7.8% extra tariff on Tesla’s China made-vehicles. Tesla Shanghai exports the Model 3 to the EU. The EV maker in July hiked Model 3 prices in Europe slightly, further weighing on sales there amid big declines in overall EV sales.

Meanwhile, the new duties don’t apply to PHEVs, a big plus for BYD. Also, BYD’s future Hungary and Turkey plants will let it sidestep EU tariffs altogether.

Tesla Earnings

In the second quarter, Tesla earnings plunged 43% to 52 cents a share. It was the fourth straight big year-over-year decline and once again missing analyst estimates. Revenue did rise 2% to $25.5 billion after falling in Q1. Tesla relied on $890 million in regulatory credit revenue, a massive increase vs. Q1 and a year earlier.

Gross margins fell to 17.4% vs. 17.6% in Q4 and 19.3% a year earlier.

Q3 earnings are due Oct. 23.

Analysts, who have been slashing Tesla estimates since the end of 2022, now see 2024 EPS sliding 28% to $2.24 a share after skidding 23% to $3.12 in 2023.

BYD Earnings

BYD’s Q2 earnings rose 32% to 43 cents a share, in line with views. Sales jumped 26% to $24.2 billion, but missed forecasts. Both improved from Q1’s pace.

Gross margins fell to 18.7% from Q1’s record 21.9%, but are still relatively high. BYD Auto margins are still well above 20%.

R&D and capital spending costs continue to climb rapidly.

Q3 earnings will likely come by early November.

Tesla Stock Technicals

Tesla stock is down 11.2% so far in 2024 as of Oct. 18, according to MarketSmith analysis.

Shares forged a 264.86 cup-with-handle buy point in early October, but gapped below their 50-day line on Oct. 10 in heavy volume. That was a major sell signal.

TSLA stock has steadied recently, but remains below it 50-day line. It still has a 264.86 cup-with-handle buy point, but the chart has some flaws.

BYD Stock Technicals

BYD stock is up 33.2% in 2024 through Oct. 18.

Shares broke out past three buy points in late August, late September and early October.

The last two breakouts coincided with a powerful rally in Chinese stocks with Beijing announcing several stimulus measures.

Shares pulled back from a two-year high as further Chinese stimulus plans have disappointed investors, but BYD and other China names roared back on Oct. 18.

The EV giant is once again back above a 36.27 buy point. Investors also could view the recent pullback as a handle to its ultimate consolidation, going back to its all-time high of 43.61 in June 2022.

BYD, listed in Hong Kong and Shenzhen, trades over the counter in the U.S. Its U.S. shares often have mini-gaps as well as opening trade mini-spikes or tumbles before settling down.

Tesla Vs. BYD Market Cap

Tesla stock has a market cap of $705.1 billion as of Oct. 18. It’s far above BYD’s $100,6 billion.

Tesla Stock Vs. BYD Stock

BYD sells far more EVs than Tesla, though the latter still leads in BEVs. More broadly, BYD in many ways is the EV maker Tesla has claimed or aspired to be. BYD makes its own batteries and chips, and sells those batteries to third parties such as Tesla. Musk has talked about making a $25,000 Tesla; BYD makes EVs profitably at far below $25,000.

The Tesla Cybertruck is relatively new, but shipments are still low. Musk has said the vehicle would be a financial drain in 2024. It’s unclear if yet-unseen upcoming “affordable” variants of aging vehicles will have a meaningful impact.

BYD has entered most of the world outside of the U.S. Its model lineup continues to expand dramatically, with big moves upscale and adding tech to its more-affordable offerings.

BYD’s broad lineup and next-generation hybrid system means it’s reaping the benefits of a global shift toward PHEVs over BEVs.

Tesla stock has broken below key support, though it’s still in a buy zone. BYD is in buy range.

Keep your eyes on BYD and Tesla, as well as Tesla stock vs. BYD stock.

Please follow Ed Carson on X/Twitter at @IBD_ECarson and Threads at @edcarson1971 for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Bullish Trend Continues; Two Warren Buffett Stocks In Buy Zones