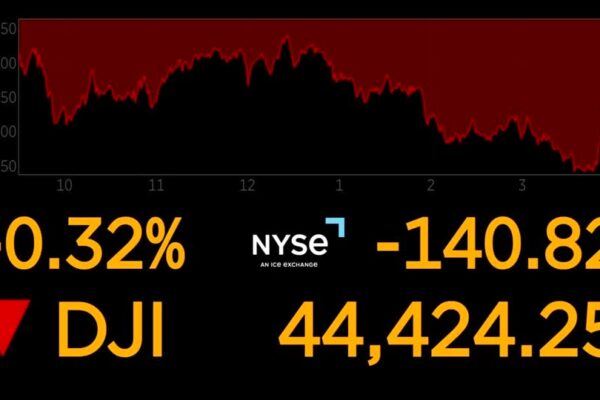

Asia equities slide with US stock futures on China’s AI push; dollar firms

By Kevin Buckland TOKYO (Reuters) – U.S. stock futures and Asian shares outside China slumped on Monday as investors weighed the implications of Chinese startup DeepSeek’s launch of a free, open-source artificial intelligence model to rival OpenAI’s ChatGPT. Meanwhile, the dollar rose after U.S. President Donald Trump slapped Colombia with retaliatory levies and sanctions for…