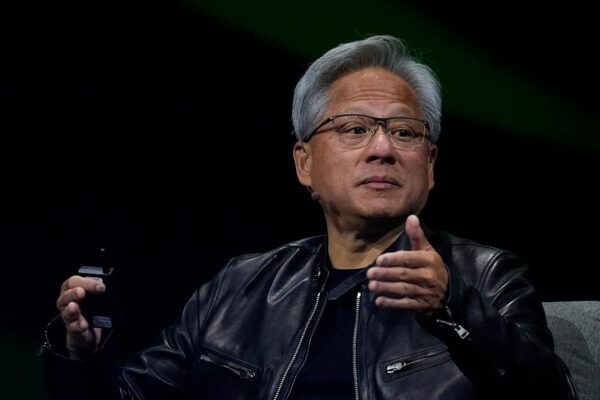

Investor explains why Nvidia stock is hard to sell

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, YouTube, or wherever you find your favorite podcasts. Nvidia (NVDA) deserves to be a top long-term portfolio holding in part because of its lucrative profit margins, one veteran investor says. “I don’t have any company with operating margins as fat as Nvidia — they’re ridiculous,”…