Key events

European shares bounce; dollar slides

European shares have bounced at the open, with major indices rising by more than 2%.

In London, the FTSE 100 index jumped by 130 points, or 1.6%, to 8,090. The German, French and Italian markets rose by more than 2% in early trading.

The US dollar is on the backfoot again, retreating by 0.8% against a basket of major currencies. The pound has gained by 0.7% against the greenback while the euro is 0.55% ahead.

Yields (or interest rates) on eurozone government bonds are rising, after falling on Friday, as the exclusion of Chinese electronics from steep new US import tariffs eased fears about the impact of US trade policy on the global economy.

Germany’s 10-year yield, the eurozone’s benchmark, rose by 4.5 basis points to 2.57%, after declining by 5.5 bps on Friday.

China’s president Xi Jinping has called for stronger ties with Vietnam on trade and supply chains, as he kicked off a three-nation trip to Southeast Asia in the Vietnamese capital of Hanoi.

The visit, which had been planned for weeks, comes as Beijing faces 145% duties on its exports to the United States, while Vietnam is trying to negotiate a reduction of threatened US tariffs of 46% that would apply in July after a global moratorium expires.

Xi said in an article in Nhandan, the newspaper of Vietnam’s Communist Party, posted ahead of his arrival today:

The two sides should strengthen cooperation in production and supply chains.

He also urged more trade and stronger ties with Hanoi on artificial intelligence and the green economy.

China exports jump in March ahead of latest tariffs

China’s exports rose sharply last month as factories rushed out shipments before the latest US tariffs took effect, and because of the timing of the lunar new year holiday.

Exports climbed by 12.4% year-on-year in March, a five-month high, and ahead of economists’ expectations of 4.4% growth. In February, they fell by 3%. The rebound was largely related to the timing of the lunar new year, as the holiday fell in early February this year.

However, economists warned that this will soon be eclipsed by the escalating trade war between the US and China.

Julian Evans-Pritchard, head of China economics at Capital Economics, said:

Export growth accelerated in March, as manufacturers rushed to ship goods to the US ahead of ‘Liberation Day’. But shipments are set to drop back over the coming months and quarters.

We think it could be years before Chinese exports regain current levels.

By destination, exports were supported by a sharp recovery to the G7, especially the US, where shipments rose by 9.1% year-on-year in March, compared to a fall of 9.8% in February. Exports to the UK jumped by 16.3% from a 13.9% drop, while shipments to the EU rebounded to 10.3% following a 11.5% decline in February. Exports to Africa jumped by 37% and shipments to ASEAN countries rose by 11.6% following February’s 8.8% rise (shipments to the region didn’t dip during the festive period as they did elsewhere).

Kelvin Lam, senior China+ economist at Pantheon Macroeconomics, said:

On trade policy, president Trump exempted some electronics imports from tariffs late Friday, later clarifying that it was only a temporary reprieve, with new sector-specific tariffs to be imposed on semiconductors and consumer electronics in the “not too distant future.”

Notably, the suspension does not apply to the existing 20% tariff imposed on China over its role in the fentanyl trade. In any case, the temporary relief for the electronics sector may offer some breathing room for Chinese exporters before the new tariffs come into effect. We expect more clarity on the new tariff rates once the Section 232 Investigation concludes — with a likely range of 10% to 125%, according to US Commerce Secretary Howard Lutnick.

Introduction: Asian markets rise on signs of Trump tariff retreat; British Steel races to keep furnaces burning

Asian shares have risen despite a warning from US officials that an exemption of smartphones, laptops and other electronic products from import tariffs on China would be short-lived. Donald Trump has warned that no one is ‘getting off the hook’, while a Chinese official pronounced that ‘the sky won’t fall’.

Japan’s Nikkei gained 1.4% while Hong Kong’s Hang rose by 2% and the Shanghai and Shenzhen exchanges climbed by 0.7% and 0.4% respectively.

The gains have brought some respite to markets after days of heavy selling when trillions of dollars were wiped off global stock markets, as a wave of US tariffs sent shockwaves around the world.

A Chinese customs official said “the sky won’t fall” for the country’s exports, despite the darkening outlook, according to the state news agency Xinhua, as Beijing released data showing a jump in China’s exports in March.

In recent years, China has made steady progress in diversifying its trade markets and deepening industrial and supply chain cooperation with partners around the world, according to Lyu Daliang, an official at the General Administration of Customs.

These efforts have not only supported our partners’ development but also enhanced our own resilience.

US stocks are also expected to stage a recovery later today, after the US president excluded imports of smartphones and laptops from his tariff regime late on Friday night. However, he said in a social media post on Sunday:

There was no Tariff ‘exception’. These products are subject to the existing 20% Fentanyl Tariffs, and they are just moving to a different Tariff ‘bucket.’

In the post on his Truth Social platform, Trump promised to launch a national security trade investigation into the semiconductor sector and the “whole electronics supply chain”.

Trump told reporters aboard Air Force One, as he travelled back to Washington from his estate in West Palm Beach, that tariffs on semiconductors would be announced this week and a decision on phones made “soon”.

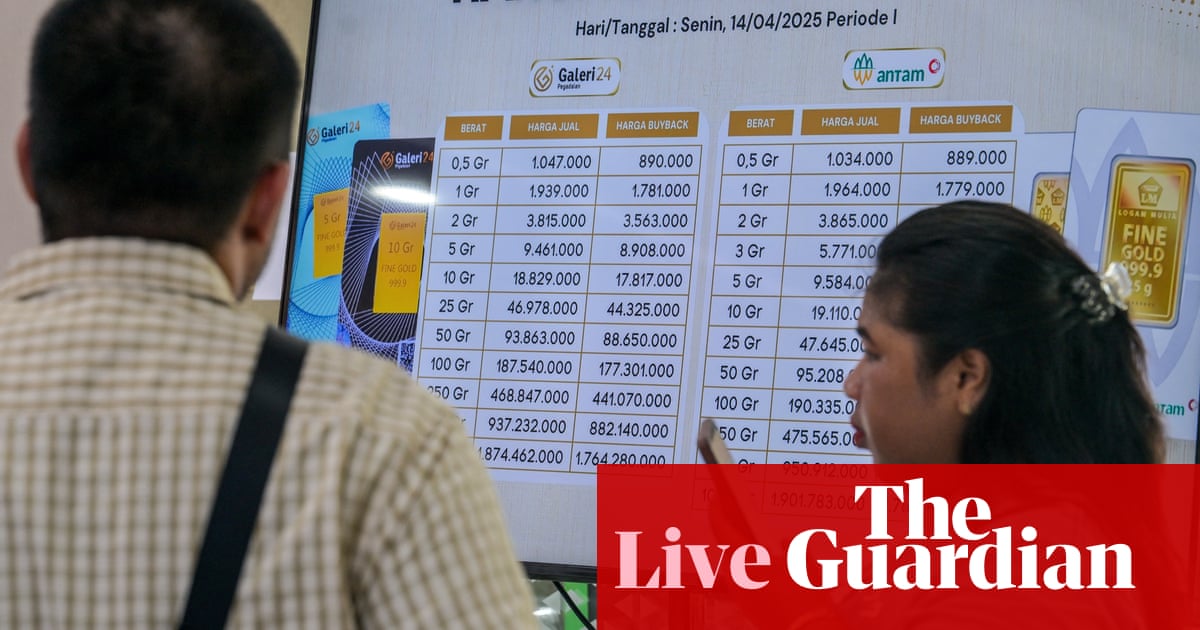

Gold has hit a new record high, of $3,245.42 an ounce, seen as a safe-haven in times of turbulence. It is now traded at $3,232 an ounce, down 0.1% on the day.

Meanwhile in the UK, British Steel is to deploy emergency measures in a race against time to save the blast furnaces at Scunthorpe, while the business secretary, Jonathan Reynolds, declined to guarantee the plant could get what it needed in time.

The company is understood to be looking at offers of help from more than a dozen businesses to obtain materials such as iron ore and coking coal, potentially allowing it to avoid the temporary shutdown of one of the two furnaces.

On Saturday, parliament passed a one-day bill containing emergency powers to gain control of the Scunthorpe site after its Chinese owner, Jingye, declined government support to keep the plant running over the next few weeks. British Steel’s UK management team is now scrambling to buy the materials, with help from government officials.