U.S. stocks were mostly unchanged at the open as investors weighed hot inflation reports earlier in the week, the postponement of reciprocal tariffs and this morning’s weak retail sales report.

Consumers sharply curtailed their spending in January, indicating a potential weakening in economic growth ahead, according to the Commerce Department. Retail sales slipped 0.9% in January from an upwardly revised 0.7% gain in December, and below the Dow Jones estimate for a 0.2% decline.

However, economists say not to be alarmed. The economy is still chugging along and the decline is more a reflection of wildfires and winter storms keeping people home as well as consumers taking a break after spending strongly during year-end holidays.

“Don’t freak out, folks, monthly economic indicators are often volatile during natural disasters and bad winter weather,” said Bill Adams, Comerica’s chief economist. “Retail categories where consumers can put off purchases for a few weeks took a hit in January. Retail sales will likely recover in coming months as Californians pick up the pieces and as winter weather affects the Midwest and East Coast less.”

Around 10:15 a.m. ET, the broad S&P 500 index was up 0.14%, or 8.60 points, to 6,123.38; the blue-chip Dow added 0.025%, or 11.01 points, to 44,722.44; and the tech-heavy Nasdaq gained 0.24%, or 47.63 points, to 19,993.28. The benchmark 10-year yield dipped to 4.472%.

Need a break? Play the USA TODAY Daily Crossword Puzzle.

Inflation, tariffs and more

Weak retail sales data come off the heels of a busy week that saw hotter-than-expected inflation reports and President Donald Trump just stopping short of imposing reciprocal tariffs.

Inflation unexpectedly accelerated in January to 3%, a seven-month high, dashing hopes for another Federal Reserve interest rate cut any time soon. An increasing number of economists are even saying the they think the Fed’s rate cut cycle is over, especially if Trump ends up imposing broad tariffs that last a long period of time.

“A universal tariff has not yet been announced but could only add to higher costs for consumer and retail companies,” said Bea Chiem, retail and consumer managing director at S&P Global Ratings.

Corporate news

Outside of broad economic news, corporate news continues to roll in and whipsaw individual shares. Some of the early movers include:

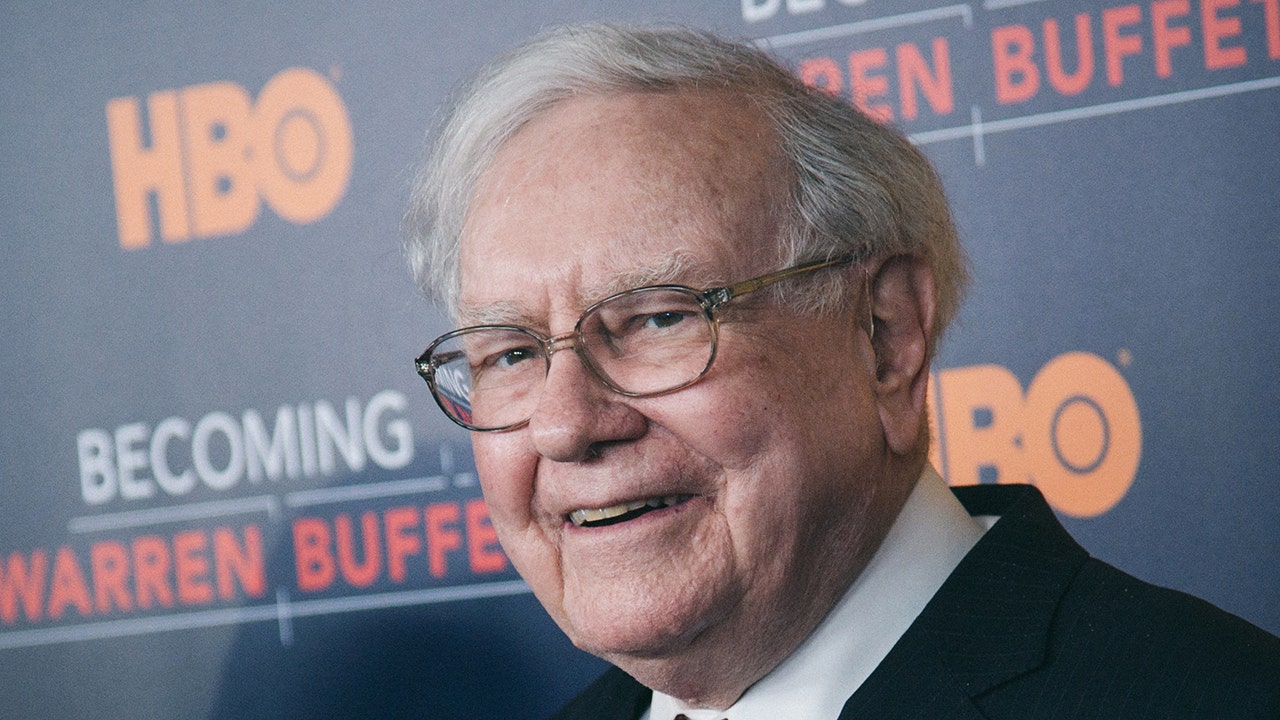

- DaVita expects its full-year earnings to miss analysts’ expectations. Warren Buffett’s Berkshire Hathaway also sold some of its shares in the dialysis company. Shares fell almost 14%.

- Airbnb rallied more than 14% after the vacation home rentals company’s results in the last few months topped analysts’ forecasts.

- Applied Materials slid 5.5% after the chipmaking equipment maker forecast revenue in its second fiscal quarter to miss forecasts.

- Moderna added about 3% even after the vaccine maker reported a larger-than-expected earnings in the last three months of the year amid a drop in Covid vaccine demand.

Bitcoin

Bitcoin prices inched higher after signs showed rising interest in the digital unit.

Video game retailer GameStop jumped more than 5% after CNBC reported the company’s considering investing in bitcoin and other cryptocurrencies.

Digital currency exchange Coinbase said its earnings in the final three months of the year topped Wall Street’s estimates. Results benefitted from a post-election rally amid investor optimism about a crypto golden age under the Trump administration.

Bitcoin was last up 0.31% at $96,757.56.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.