Oppenheimer Cuts Amazon Target Price Amid Tariff Concerns

28 minutes ago

Oppenheimer cut its price target price for Amazon (AMZN) shares by 15%, predicting that tariffs would eat into the profits of the company’s e-commerce arm.

Oppenheimer revised its relatively bullish target price of $260 down to $220—9% below the average estimate among analysts who track Amazon and are polled by Visible Alpha. Still, Oppenheimer analysts issued an “outperform” rating of Amazon stock in a research note Sunday, days before the company is scheduled to release its first-quarter earnings on Thursday.

Paying tariffs likely will result in lower profit margins on e-commerce sales as Amazon protects its market share by keeping prices competitive, the analysts said. They expect investors to remain satisfied with mid- to high-teens growth at AWS, Amazon’s cloud computing platform, “even if margins contract meaningfully” on the e-commerce side of the company, the note said.

Oppenheimer’s target is 16% above where Amazon shares closed Friday. Company shares have fallen nearly 15% over the course of 2025 amid a broad market sell-off spurred by tariffs. Amazon stock remains about 4% above prices a year ago. At close on Monday, the stock was off less than 1% at $187.70.

Analysts have curbed their estimates for Amazon in recent weeks, citing tariffs’ potential to weigh on e-commerce sales and advertising revenue.

The company is scheduled to release its first-quarter results after the bell on Thursday. Analysts expect the company to report about $155 billion in revenue, up 8% year-over-year, according to consensus estimates compiled by Visible Alpha. They anticipate $14.7 billion in profit, a 41% jump from the first quarter in 2024, per Visible Alpha.

Boeing Rises on Double Dose of Good News

1 hr 7 min ago

Boeing (BA) shares rose Monday after the plane maker got two pieces of good news: Its stock was upgraded by Bernstein analysts, and its deal to reacquire Spirit AeroSystems Holdings (SPR) cleared another hurdle.

Bernstein analysts on Sunday upgraded Boeing stock to “outperform,” with a price target of $218, up from $181 previously. That puts Bernstein analysts in line with eight others rating Boeing as a “buy,” compared with three “hold” ratings, according to Visible Alpha data. Their new price target is above the $196.10 analyst consensus.

The analysts said that after Boeing’s latest quarterly report last week, the company is “now making the progress it needed for the growth trajectory we expected” prior to the early 2024 incident in which a door plug detached from a Boeing plane in mid-flight.

“The heavy [Federal Aviation Administration] scrutiny on Boeing operations should insure a much more solid operational process at [Boeing Commercial Airplanes],” the analysts wrote. “Of course, this positive outlook is not without risks. But, we believe the key factors strongly outweigh the risks at this point.”

Early Monday, Spirit AeroSystems and Airbus announced an agreement for Airbus to take control of some of Spirit’s operations that manufacture parts for Airbus. When Boeing announced plans to reacquire Spirit as part of its strategy to solidify the safety of its supply chain, rival Airbus said in 2024 that it would take control of certain assets so it wasn’t reliant on its largest competitor for parts.

Jefferies analysts wrote Monday that the Airbus agreement “opens the way” for Spirit’s reintegration with Boeing to close as expected, likely by the third quarter of this year.

TradingView

Boeing shares rose 2.5% Monday, leading Dow advancers, to close at around $182. The stock stock has gained ground for five consecutive sessions, putting back into positive territory for the last 12 months.

Q1 Earnings Growth Perks Up With a Busy Few Days Ahead

2 hr 10 min ago

More than a third of S&P 500 companies had reported their latest financial results through Friday, according to a FactSet analysis. This week will be busy, with results expected from high-profile companies throughout, especially tomorrow through Thursday. Companies representing more than 40% of the benchmark index’s market cap are set to report this week, according to Goldman Sachs.

Meanwhile, a preliminary analysis of the data suggests that first-quarter results came in strong. FactSet’s blended estimate for total S&P 500 earnings—meaning a combination of numbers already reported and Wall Street expectations for those remaining—as of Friday, pointed to year-over-year growth just above 10%. A week earlier, it was closer to 7%.

Growth of 10.1%, FactSet said, would represent a second straight quarter of double-digit earnings growth for index companies as a whole, and a seventh consecutive quarter of year-over-year earnings growth.

Meanwhile, some market watchers expected fewer companies to offer guidance this season. So far, they seem to have been right, according to a Bank of America analysis that said 16% of companies that reported have offered outlooks, down from 27% at the same time last year.

This week’s schedule is packed with results that will be closely watched. Key results include Coca-Cola (KO) and Pfizer (PFE) on Tuesday; Meta (META) and Microsoft (MSFT) on Wednesday; and Apple (AAPL), Amazon (AMZN) and McDonald’s (MCD) on Thursday.

Meta Levels to Watch Ahead of Earnings Wednesday

3 hr 4 min ago

Meta (META) shares were holding steady Monday as the Facebook and Instagram parent prepares to report first-quarter results after Wednesday’s closing bell.

Investors will be paying close attention to the social media giant’s ad revenue outlook, amid concerns of a broader slowdown in digital advertising spending by Chinese companies as the U.S. and China impose lofty tariffs on one another. Legal and regulatory disputes have nagged Meta, with the E.U. recently fining the tech giant for violating its Digital Markets Act and an antitrust trial getting underway in the U.S.

Coming into the week, Meta shares were down about 7% for so far in 2025, though they have outperformed their Magnificent Seven peers over the period, boosted by the company’s significant investment in AI driving advertising growth and user engagement across its suite of apps.

Meta shares have forged two closely aligned troughs during April, potentially setting the stage for a double bottom, a chart pattern that indicates a bullish reversal.

More recently, the stock has undergone a pre-earnings bounce, with the price forming a doji in Friday’s trading session to signal indecision among buyers and sellers. Meanwhile, the relative strength index (RSI) points to neutral conditions, providing a reading around the 50 threshold.

Investors should watch key support levels on Meta’s chart around $482 and $452, while also monitoring important resistance levels near $588 and $632.

The stock was down fractionally at around $547 in mid-afternoon trading Monday.

Read the full technical analysis piece here.

Nvidia Drops on Report Huawei Developing Rival AI Chip

4 hr 16 min ago

Nvidia (NVDA) shares led losses on the Dow and S&P 500 Monday afternoon following a report China’s Huawei Technologies is preparing to test a rival artificial intelligence chip.

According to The Wall Street Journal, Huawei “is gearing up to test its newest and most powerful artificial-intelligence processor, which the company hopes could replace some higher-end products” from Nvidia.

Citing people familiar with the matter, the Journal said that “Huawei has approached some Chinese tech companies about testing the technical feasibility of the new chip, called the Ascend 910D.”

Shares of Nvidia were down more than 4% in recent trading, and have lost about a fifth of their value since the start of the year. The stock has yet to fully recover from a plunge on Jan. 27 that wiped nearly $600 billion from the company’s market cap, after Chinese startup DeepSeek launched AI models that rivaled the capabilities of OpenAI’s ChatGPT at a fraction of the cost.

Earlier this month, Nvidia said it is expecting to record a $5.5 billion first-quarter charge after the U.S. limited exports of its H20 chips to China

IBM to Invest $150 Billion in U.S. Over Next 5 Tears

5 hr 3 min ago

International Business Machines (IBM) said Monday it plans to invest $150 billion in the U.S. over the next five years, the latest in a string of large companies boosting their presence in the country since President Donald Trump regained the White House.

IBM said its planned outlay includes more than $30 billion in research and development to “advance and continue” making mainframe and quantum computers in the U.S.

“We have been focused on American jobs and manufacturing since our founding 114 years ago, and with this investment and manufacturing commitment we are ensuring that IBM remains the epicenter of the world’s most advanced computing and AI capabilities,” IBM CEO Arvind Krishna said.

Other companies that have announced plans in recent months to increase their U.S. presence as Trump implements tariffs include Apple (AAPL), which said it would spend $500 billion in the country over the next four years; chipmaking giant Taiwan Semiconductor Manufacturing Company (TSM), which said it is planning a $100 billion outlay in U.S.-based manufacturing facilities; and Swiss drugmaker Roche, which said last week it would invest $50 billion over the next five years.

TradingView

IBM shares were up slightly in early-afternoon trading. The Dow component has gained about 6% since the start of the year, while the blue chip index has lost 6% over that period.

MGM Stock Rises on Strong BetMGM Results

6 hr 5 min ago

Shares of MGM Resorts International (MGM) rose Monday morning when the casino and hotel operator reported strong demand for its BetMGM sports betting and online gaming platform.

The company said BetMGM, jointly owned with Isle of Man-based Entain plc, posted first-quarter revenue of $657 million, 34% higher than a year ago. It was driven by a 68% jump in Online Sports to $194 million and 27% rise to $443 million in iGaming. It added that BetMGM had positive Q1 EBITDA, and “underlying trends reaffirm confidence that FY 2025 will be EBITDA positive.”

BetMGM CEO Adam Greenblatt said that the year “is off to an encouraging start,” building on momentum from the second half of 2024 even with “unfavorable sports outcomes during key moments in the quarter.”

BetMGM said that the performance so far in 2025 “provides increased confidence in exceeding guidance, however we remain mindful it is still relatively early in the year.” It reaffirmed its outlook that full–year revenue will come in at $2.4 billion to $2.5 billion.

Shares of MGM Resort International, which reports results Wednesday, were up 2% recenetly but are down about 7% for the year.

Intel Stock Rises Ahead of Foundry Event

7 hr 12 min ago

Shares of Intel (INTC) gained ground in early trading Monday, recovering from a decline the previous session sparked by a weak financial outlook from the company. The stock’s next catalyst might be just around the corner.

Lip-Bu Tan, who presided over the chip company’s quarterly results Thursday for the first time as CEO, will on Tuesday give the keynote address at an event associated with Intel’s Foundry business, which makes chips for other companies. Bank of America analysts in a Friday note said the event could be paired with the announcement of partnerships with other big tech firms.

Intel has sought to grow the Foundry business; early last year, it spoke of ambitions to be the world’s second-largest foundry behind Taiwan Semiconductor Manufacturing Co. (TSM) by 2030. Its 2024 foundry revenue, however, fell from a year earlier—it came in north of $17 billion, roughly 30% of the company’s total—and its operating loss widened.

This year reports have suggested that Intel might look to sell a stake in the Foundry operation to TSMC; that company, however, has denied talks. Investors were tracking the possibility that a spinoff or sale of Foundry might be in the works well before Tan took over.

Investors continue to look for signs of dealmaking. Optimism about a range of possibilities, ranging all the way up to a sale of the entire company, has moved the shares in recent months.

That could still be the case. But Tan has said cost-cutting is also a priority: On Thursday, while not formally announcing layoff plans reported earlier in the week, he made clear they are coming.

Bank of America analysts, who have a neutral rating for Intel’s stock and a $23 price target that is a few cents above the Street consensus compiled by Visible Alpha, said Intel is “too big to turn around quickly, but optionality [is] still there.”

TradingView

Intel shares were recently up nearly 4% at just under $21. The stock has lost about a third of its value over the past 12 months.

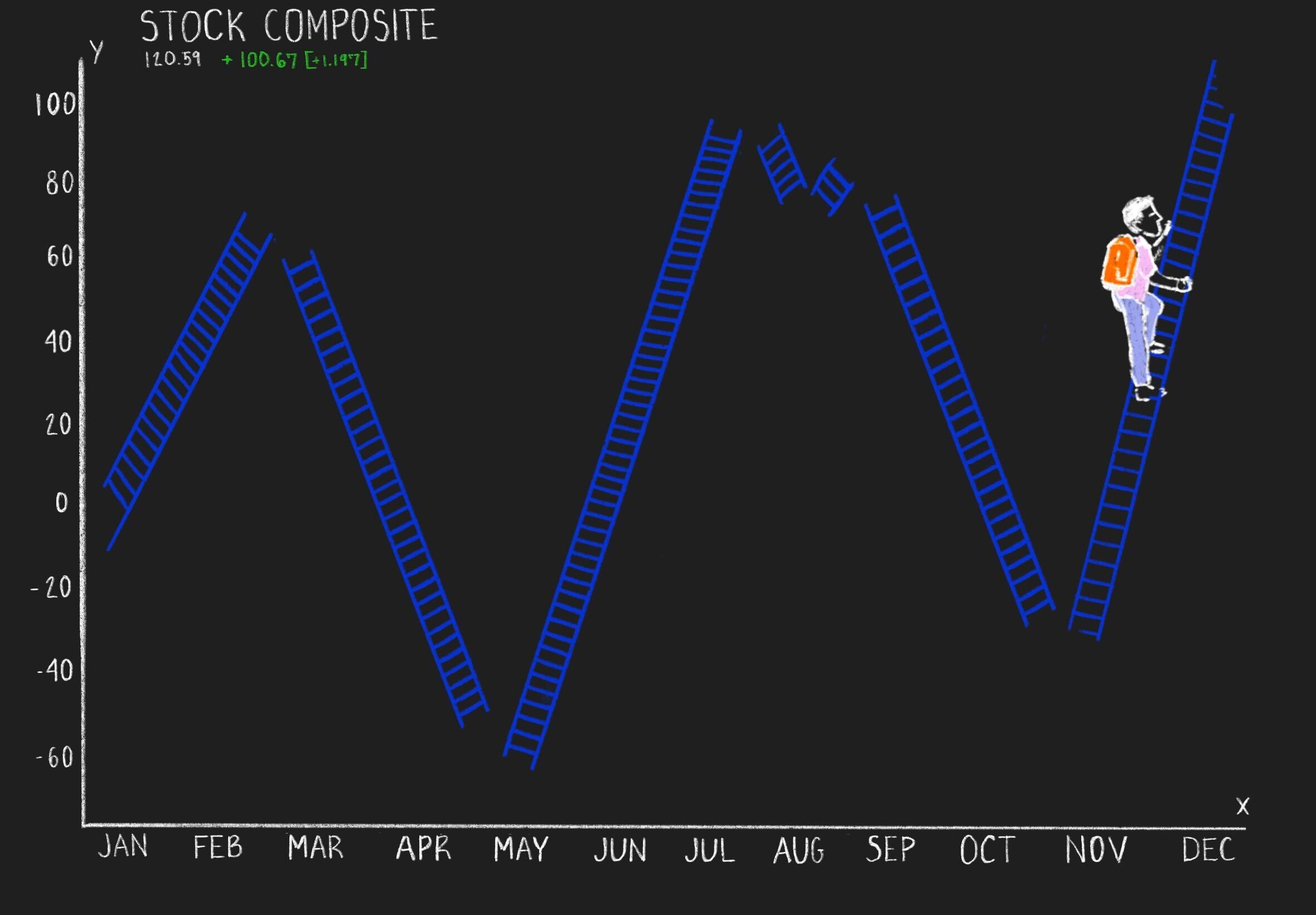

S&P 500, Dow Still Down for the Month

7 hr 40 min ago

Despite gaining ground in two of the last three weeks, the S&P 500 and Dow Jones Industrial Average are still down in April.

The S&P had lost 1.5% so far this month as of Friday’s close, while the Dow was down 4.5% over the period. The Nasdaq Composite entered today’s session up 0.5% for the month.

It’s been an extraordinarily volatile month for U.S. stocks as investors have reacted to a flurry of headlines on tariffs, starting with the April 2 announcement of wide-ranging import taxes, the subsequent pause on those so-called “reciprocal” tariffs, and conflicting reports in recent weeks on the status of negotiations with various countries, notably China.

The major indexes kicked off the month with their worst week in five years, but have gradually clawed back most of those losses.

Watch These Apple Levels Ahead of Earnings Report

8 hr 24 min ago

Apple (AAPL) shares are in focus to start the week ahead of the iPhone maker’s highly anticipated fiscal second-quarter results, due after Thursday’s closing bell.

Wall Street will be paying close attention to the tech giant’s guidance for the current quarter in an effort to determine what impact tariffs and potential price increases have had on consumer demand for the company’s devices.

Investors will also be looking for updates on recent reports that Apple intends to produce most of its U.S.-sold iPhones in India by the end of 2026. The company is aiming to mitigate risks related to the Trump administration’s steep import duties imposed on China, a country where Apple reportedly assembles up to 90% of its iPhones.

Apple shares trade 16% lower year to date as of Friday’s close but have recovered nearly 25% from this month’s low as investors assess the company’s plans to navigate tariff-related challenges.

After staging a dramatic intraday reversal at the 200-week moving average on above-average volume earlier this month, Apple shares have continued to gain ground.

However, while the relative strength index has moved upwards ahead, the indicator remains just below the 50 threshold, signaling lackluster price momentum.

Investors should monitor key support levels on Apple’s chart around $169 and $157, while also watching crucial resistance levels near $220 and $237.

The stock was up 0.4% at around $210 in recent premarket trading.

Read the full technical analysis piece here.

Futures Point to Slightly Lower Open for Major Stock Indexes

9 hr 15 min ago

Futures tied to the Dow Jones industrial Average were down 0.2%.

TradingView

S&P 500 futures also slipped 0.2%.

TradingView

Nasdaq 100 futures were off 0.3%.

TradingView