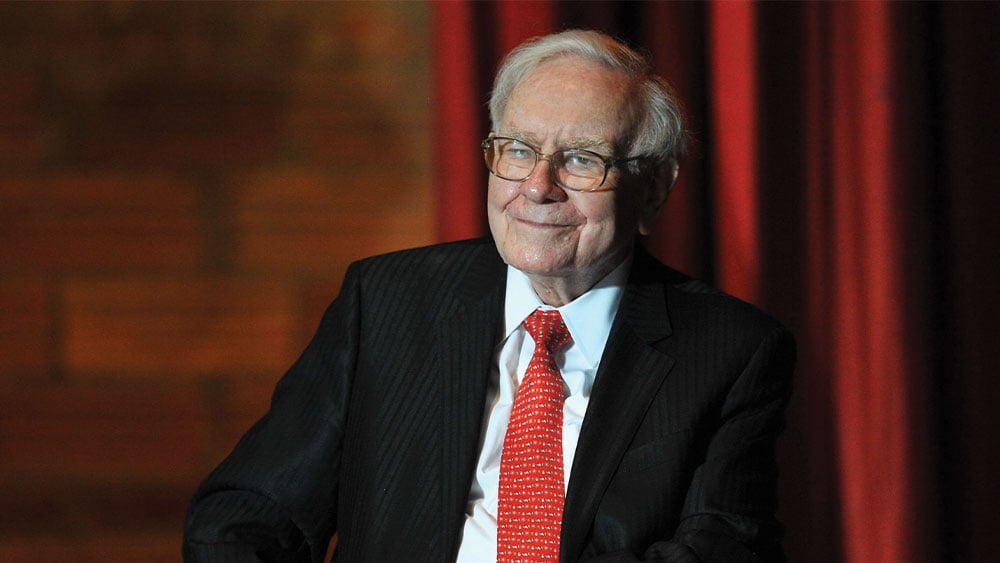

S&P 500 investors are playing it safer in 2025 — so Warren Buffett’s careful stock-picking is in style again. And analysts, too, agree on some of his picks.

↑

X

This Is What Warren Buffett Looks For In Winning Stocks – And Why Tesla Didn’t Make The Cut

Eight of Buffett’s U.S.-listed holdings in Berkshire Hathaway (BRKB), including Liberty Latin America (LILA), Nu Holdings (NU) and Kraft Heinz (KHC), are expected by analysts to jump 20% or more in the next 12 months, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

The analyst-approved Berkshire Hathaway picks highlight what’s in with investors: cash flow.

Analysts’ Favorite Buffett Stock

When it comes to expected gains this year, one Buffett stock rules the rest: Liberty Latin America.

The provider of internet services in Latin America hasn’t been a great stock. Its RS Rating is only 12 and EPS Rating is just 4. But Buffett’s Berkshire Hathaway owns nearly 7% of the company’s stock.

Analysts think the stock will be worth $10.10 a share in 12 months. If that’s right it would mark implied upside of 53%. Shares are already up 3.8% this year. Analysts also think the company will earn 15 cents a share this year, reversing a loss in 2024.

Other Top Buffett Picks

Analysts are also bullish on Nu Holdings, a Brazil-based banking company. Buffett’s Berkshire Hathaway owns roughly 2.3% of the company.

Shares of the stock are seen hitting 15.19 a share in 12 months by analysts. That’s would be a gain of 34.6% in that time. It’s another cash generator. Analysts think the company will make 42 cents a share in 2024, up 100% from 2023. It remains a wait-and-see stock, though, with an RS Rating of just 32.

Some of Buffett’s picks, though, can test patience. Shares of food maker Kraft Heinz are already down 5.6% this year. Even so, analysts think the stock will rise 27% in the next 12 months. Buffett’s Berkshire Hathaway owns 26.9% of the company.

It’s important to note Buffett makes mistakes, too. He panic sold Apple (AAPL) last year. But if slow-and-steady investing makes a comeback, Buffett is the master.

Analysts’ Favorite Warren Buffett Stocks

Based on 12-month estimates for U.S.-listed Berkshire Hathaway positions

| Company | Symbol | Implied upside % |

|---|---|---|

| Liberty Latin America | LILA | 53.0% |

| Atlanta Braves Holdings | BATRK | 43.9% |

| Liberty Latin America | LILAK | 41.8% |

| Nu Holdings | NU | 34.6% |

| Liberty Live Group | LLYVA | 30.7% |

| Liberty Live Group | LLYVK | 27.5% |

| Kraft Heinz | KHC | 27.2% |

| Heico | HEIA | 22.9% |