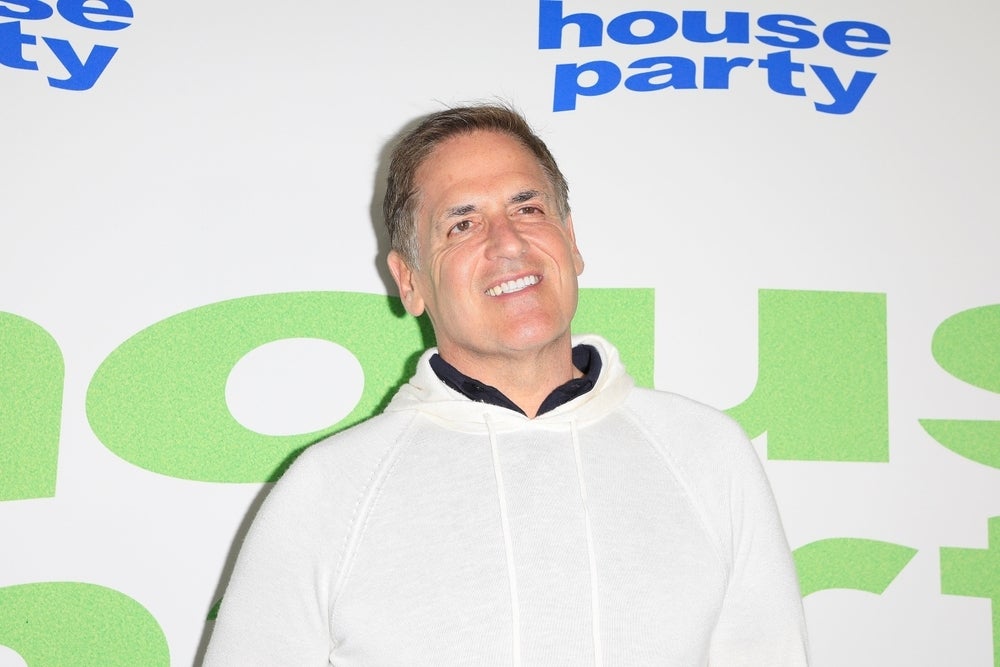

Mark Cuban says that the elimination of billionaires would trigger a stock market crash, potentially erasing the savings of average Americans.

In a post on BlueSky last week, Cuban opposed the idea that wealth inequality could be mitigated by taxing or capping the wealth of billionaires.

Cuban, who has built a $6 billion fortune through tech startups, investments, argued that the existence of extreme wealth is a natural outcome of the market system.

“Billionaires will exist as long as stock markets exist,” he stated.

Billionaires will exist as long as stock markets exist. Should we get rid of the stock market ?

He warned that dismantling the market would have catastrophic consequences for all, not just the wealthy.

In response to a user who noted that about 90% of the stock market is owned by the wealthiest 10% of US households, Cuban concurred but contended that forcing these investors to sell would damage everyone, not just the affluent.

“Absolutely true,” he wrote. “But that 90 percent is trillions and trillions of dollars, owned by everyone else. If you make the top 10 pct sell 90 pct of the market, how close to zero value do you think the ownership of the 90 percent goes? You would wipe out the savings of more than half the country.”

Absolutely true. But that 90 percent is trillions and trillions of dollars, owned by everyone else. If you make the top 10 pct sell 90 pct of the market , how close to zero value do you think the ownership of the 90 percent goes ? You would wipe out the savings of more than half the country

While Cuban maintains that billionaires are an inevitable byproduct of flourishing stock markets that benefit savers, organizations like Oxfam and the World Bank argue that ultra-rich accumulations are primarily driven by inheritance, monopoly power, and exacerbate inequality.

Cuban also expressed skepticism about the practicality of wealth taxes based on stock valuations, posing the question: “If it’s the value of their stock, will you refund the tax if the stock market corrects or crashes?”

Does making enough mean the value of their stock ? Or in cash from stock they sold ? If it’s the value of their stock, will you refund the tax if the stock market corrects or crashes ?