(Bloomberg) — The riskiest nook of the stock market is hot Monday, with the small-capitalization Russell 2000 Index heading for its first closing record in three years. Wall Street lore says traders may be onto something.

Most Read from Bloomberg

This week historically kicks off a run of bullish seasonal patterns for the stock market. More broadly, the S&P 500 Index has risen from the Tuesday before Thanksgiving to the second trading day of the New Year 80% of the time, with an average gain of 2.6%, according to the Stock Trader’s Almanac. And small caps do even better, with the Russell 2000 averaging a 3.3% jump since its inception in 1979.

“It’s hard to go against the market right now, and you can’t fight the tape,” Jeffrey Hirsch, editor of the Stock Trader’s Almanac, said over the phone. “The S&P 500 being up more than 20% so far this year doesn’t preclude the index from seeing a year-end rally.”

The S&P 500 and Russell 2000 are on track for their sixth straight sessions in the green, their longest winning streak since September. The small-cap index has risen 6.2% in that time frame, while the S&P is up 1.8%.

The optimism arrives as bond yields are easing, with investors shrugging off the Middle East conflict and betting that interest rates are peaking with the Federal Reserve continuing to lower borrowing cost. Sentiment is also getting a lift from President-elect Donald Trump’s Treasury Secretary nominee Scott Bessent, who is considered a moderating influence on some of the administration’s more economically challenging trade and economic plans.

Skeptics of the holiday-rally trend point to the current market dynamics — elevated inflation, high interest rates and geopolitical tensions — as reasons to keep a lid on enthusiasm. But Hirsch is focusing on what’s immediately ahead rather than longer-term catalysts and challenges.

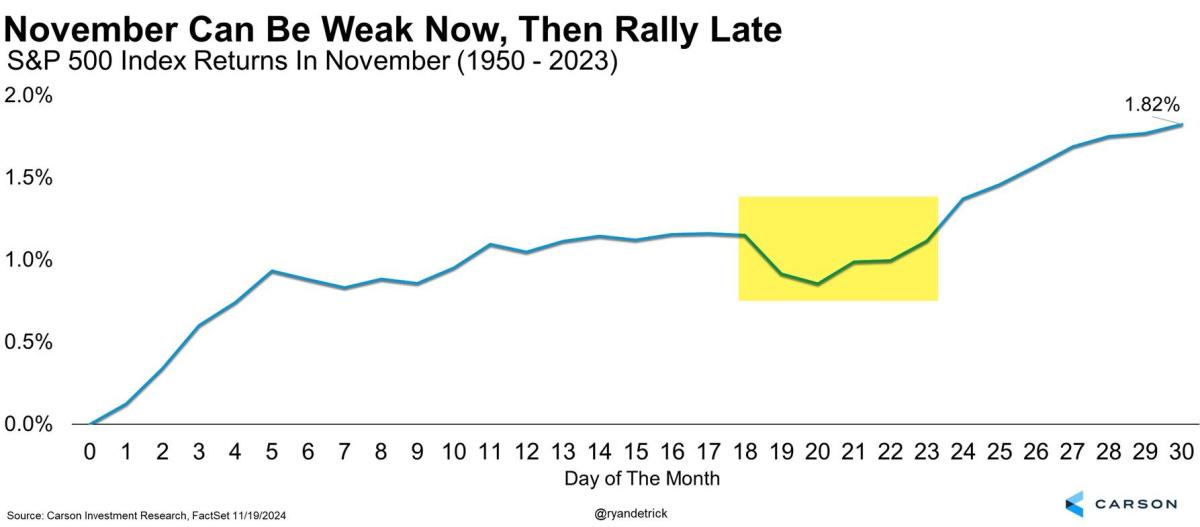

The period from November though January typically is the best consecutive three-month span of the year for the stock market because companies and pension plans tend to increase their stock buying starting on Nov. 1. Looking more granularly, the market tends to drift sideways from the middle of the month into the Thanksgiving holiday before rallying, according to Ryan Detrick, chief market strategist at Carson Group.