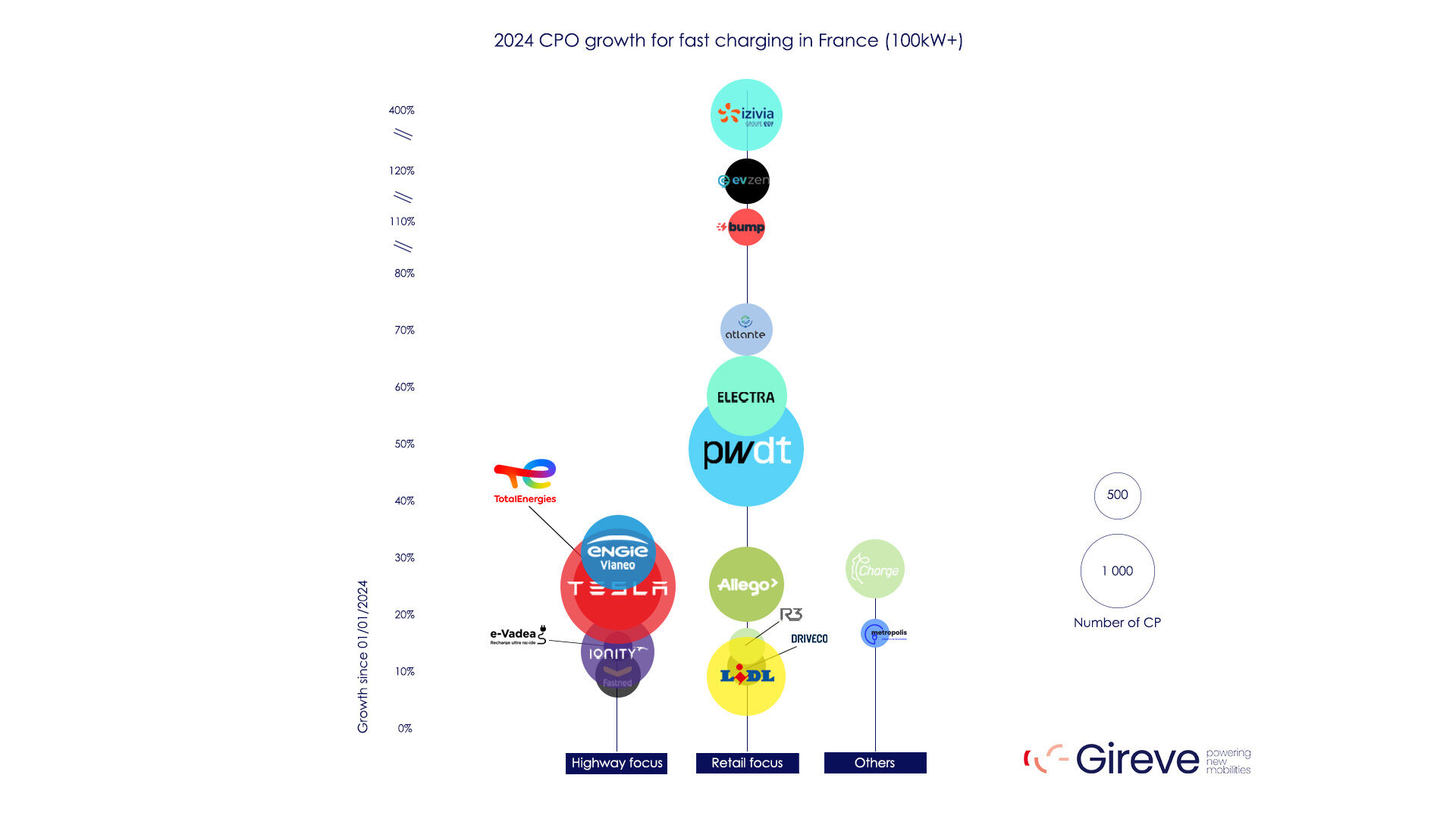

The article notes that the most significant growth is occurring in retail settings. Companies like Powerdot, Electra, and IZIVIA have been quick to install fast chargers in places where people already spend time, such as supermarkets and shopping centres. This marks a shift towards integrating charging into daily life, rather than restricting it to highways or long-distance travel hubs.

Retail-driven CPOs lead the way

In 2024, CPOs focusing on retail locations are driving the fastest growth. Powerdot, in particular, has surged ahead, installing more fast chargers than any other operator in France. Their growth strategy centres on convenience for drivers, placing chargers in locations where people tend to park for extended periods.

Powerdot’s network now exceeds 1.000 charge points, with more being added regularly. Their approach is based on “destination charging,” allowing EV users to top up their vehicles while shopping, running errands, or attending appointments. This makes charging less about planning around availability and more about seamlessly integrating it into daily routines.

Electra and IZIVIA have adopted similar strategies, partnering with major retail brands to roll out charging stations across the country. For instance, Electra has partnered with AccorInvest and Groupe Casino, providing them with access to prime retail real estate for chargers. Similarly, IZIVIA has expanded rapidly through partnerships with retailers like McDonald’s, growing its IZIVIA Express and IZIVIA Fast networks.

Slower growth on highways

While retail-driven CPOs are expanding rapidly, those focused on highway charging, such as TotalEnergies, ENGIE, and Tesla, have seen slower growth in 2024. These companies still play a vital role in supporting long-distance EV travel, but their expansion has been more gradual compared to their retail-focused counterparts.

Building and maintaining fast chargers on highways requires significant investment and long-term planning, leading to slower growth. Additionally, France’s highway charging infrastructure is already relatively developed, reducing the pressure to rapidly install new stations compared to urban and retail areas.

Nonetheless, highway charging remains essential, particularly for long-distance journeys. Tesla, for example, continues to operate one of the most reliable and extensive highway charging networks, offering fast and consistent service for Tesla drivers. However, as more EV drivers focus on short commutes and daily trips, the emphasis on retail-based charging is expected to increase.

New entrants and partnerships drive growth

The fast-charging market in France is becoming more competitive, with new players entering the scene and established operators forming partnerships to accelerate growth. For example, e-Vadea, a newcomer, has quickly gained ground by collaborating with large retail and real estate firms to expand its network.

Such partnerships are crucial for scaling fast-charging infrastructure. IZIVIA’s collaboration with McDonald’s, Electra’s work with Groupe Casino, and Bump’s alliances with brands like Lapeyre and Intermarché are helping CPOs to rapidly expand their networks. By installing chargers where people already spend time, these partnerships make it easier for drivers to incorporate charging into their daily routines.

As competition among CPOs heats up, those that can secure strategic partnerships and quickly roll out chargers are likely to gain an edge.

Rapid growth in numbers

Data from Gireve highlights the impressive growth seen in 2024. Powerdot leads with the most fast-charging points, significantly outpacing other CPOs. This is particularly noteworthy given the size of its existing network and reflects Powerdot’s ability to scale effectively.

Electra and IZIVIA are also expanding rapidly, largely due to their retail-focused strategies. These operators have identified a strong demand for charging stations in everyday locations and have been swift in meeting that need with well-placed chargers.

Meanwhile, more established highway-focused operators like TotalEnergies and Tesla continue to serve long-distance travellers, though their expansion has slowed as they concentrate on maintaining their existing infrastructure.

The future of fast charging

The fast-charging landscape in France is evolving rapidly, with retail locations emerging as the new battleground for charging infrastructure development. Powerdot, Electra, and IZIVIA are leading the way, demonstrating that the future of fast charging is about making it as convenient as possible for everyday drivers.

While highway charging will remain important for long-distance travel, the shift towards retail-based charging is likely to continue as more people adopt EVs for daily use. The convenience of charging while shopping, dining, or working is becoming a key selling point, and CPOs are responding by building more stations in high-traffic areas.

However, challenges remain. Reports from EV drivers in France highlight the need for improvements in the reliability of charging stations, particularly for long-distance journeys. Ensuring that fast chargers are both widely available and dependable will be crucial for maintaining consumer confidence and encouraging further EV adoption.

As 2024 progresses, the expansion of fast-charging infrastructure will play a crucial role in shaping the future of electric mobility in France. With retail-driven CPOs at the forefront, EV charging networks are on a fast track to becoming more accessible and user-friendly.

Source: Gireve