Opendoor Technologies (OPEN) stock continued its wild ride on Monday with the stock up about 30% in late afternoon trading, giving up an intraday rally that reached as much as 115% and triggering a volatility-related trading halt in the stock near 3:00 p.m. ET.

The stock was halted for 10 minutes Monday afternoon after the stock crossed the Nasdaq’s volatility limit, which is triggered when a stock’s share price moves too far, too quickly, depending on the per-share value of the stock.

The long-beleaguered iBuyer platform saw its share price gain 188% last week, bringing the stock from just above $0.50 less than a month ago to above $4.80. Shares still remain far below their all-time high of $39.24 reached in February 2021.

Powering the stock, in part, has been a public bull case from Carvana (CVNA) turnaround spotter EMJ Capital and a ream of speculative bets posted to the subreddit wallstreetbets, a haven for meme stocks, have both added significant fuel to the fire.

Retail trading activity in the stock has surged in recent weeks, according to data from VandaTrack.

Read more about Opendoor’s stock moves and today’s market action.

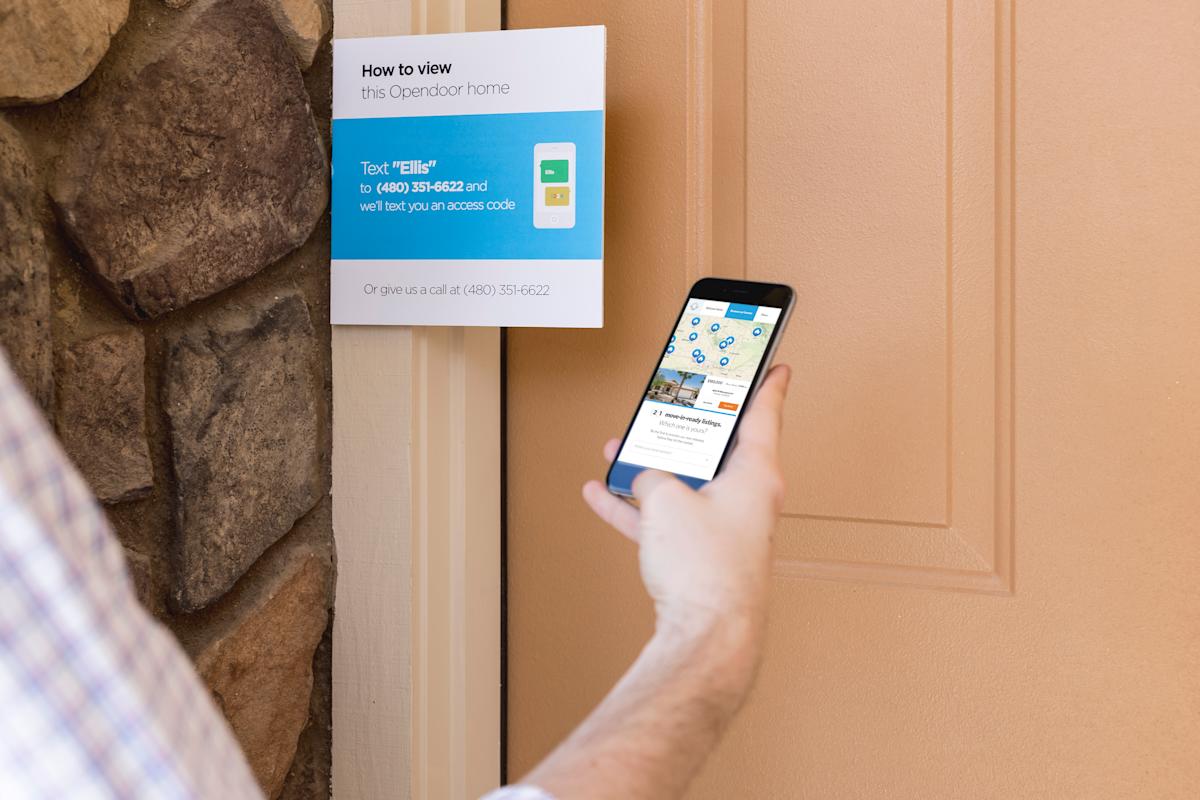

Opendoor uses iBuyer real estate technology to buy homes from owners for cash, make light repairs, then flip them back onto the open market to hopefully resell at a profit. Since going public through a SPAC transaction in December 2020, Opendoor has yet to post a profitable quarter.

But EMJ Capital principal Eric Jackson — who first gained notoriety for being an early believer in turnaround potential at Carvana — predicted in an X thread laying out his bull case on the stock that it would report its first quarter of positive EBITDA in August and that he sees a price target of $82.

The company was served a warning that it faced potential delisting from the Nasdaq in May after trading under $1 for more than 30 days. In June, it settled a class-action lawsuit alleging that the company did not properly disclose its price algorithm’s inability to adapt to changes in the housing market.

As with meme-stock predecessors GameStop (GME) and AMC (AMC) during their own retail-frenzied runs throughout 2021, short bets on Opendoor had hit a record level, accounting for more than 25% of the company’s float by the end of June.

Jake Conley is a breaking news reporter covering US equities for Yahoo Finance. Follow him on X at @byjakeconley or email him at jake.conley@yahooinc.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance