The Liftoff report uses figures provided by AppsFlyer and Sensor Tower.

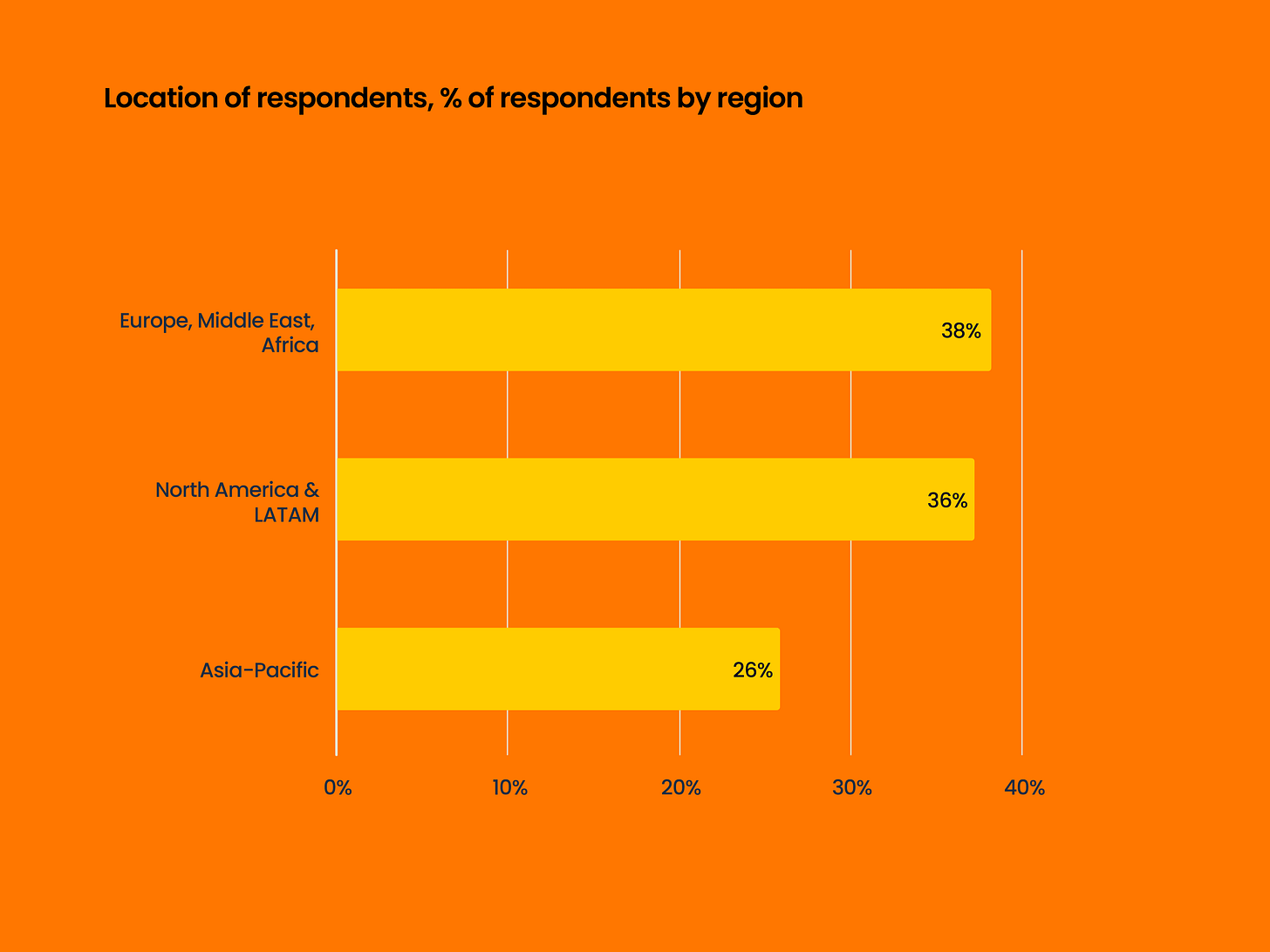

Over 700 marketers from different regions participated in the Liftoff survey.

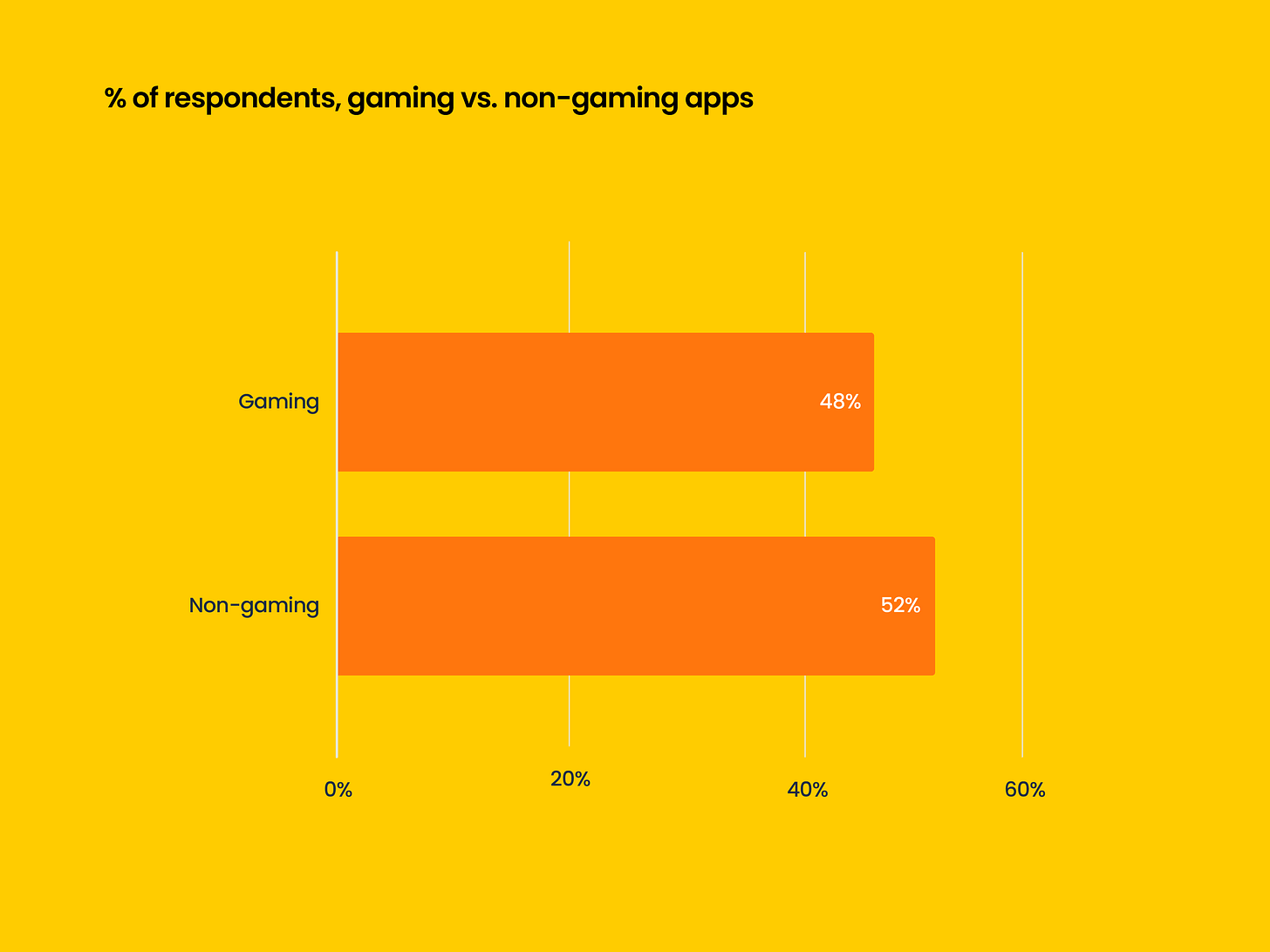

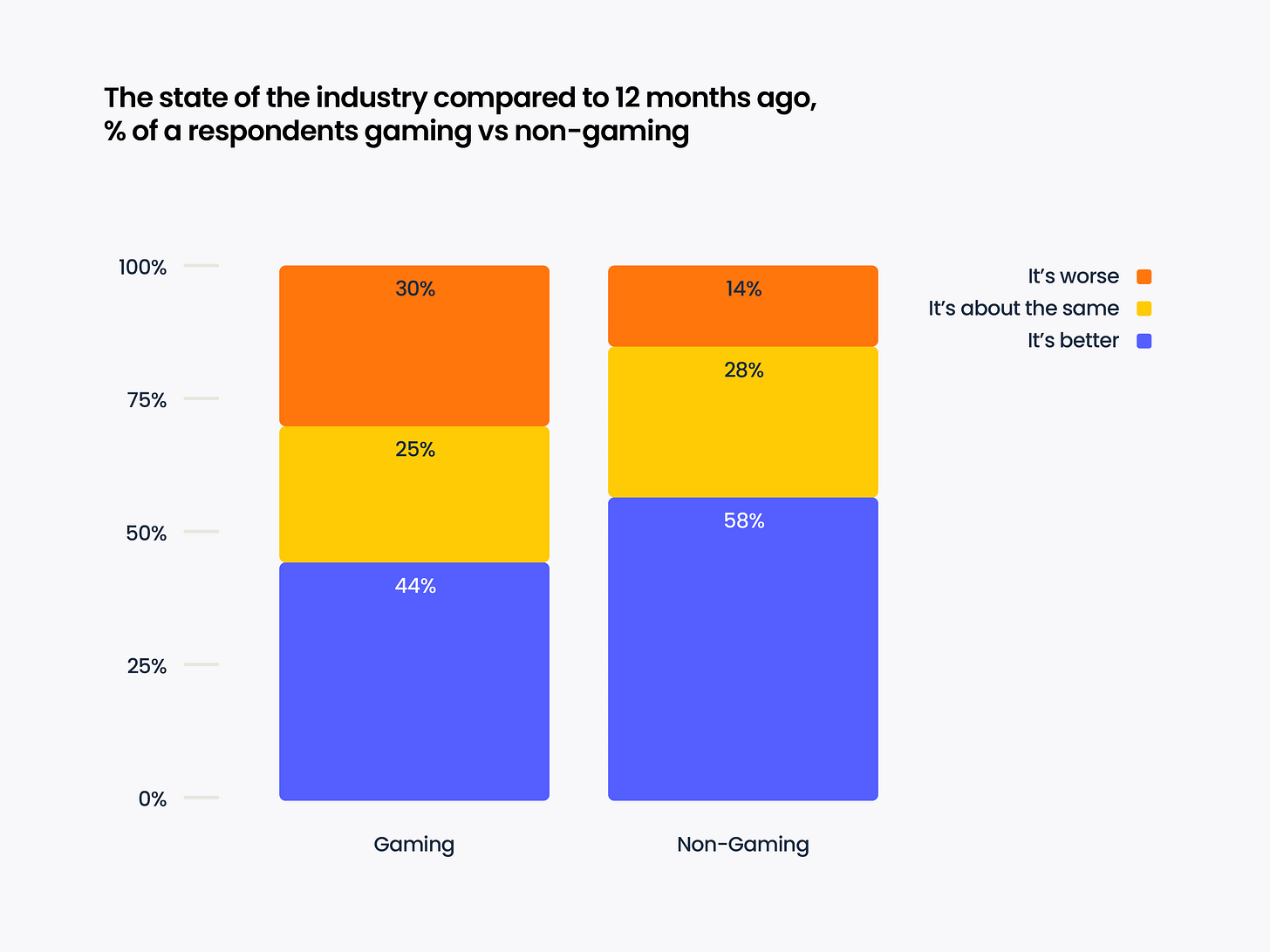

48% of respondents are from the gaming industry, and 52% are from non-gaming segments.

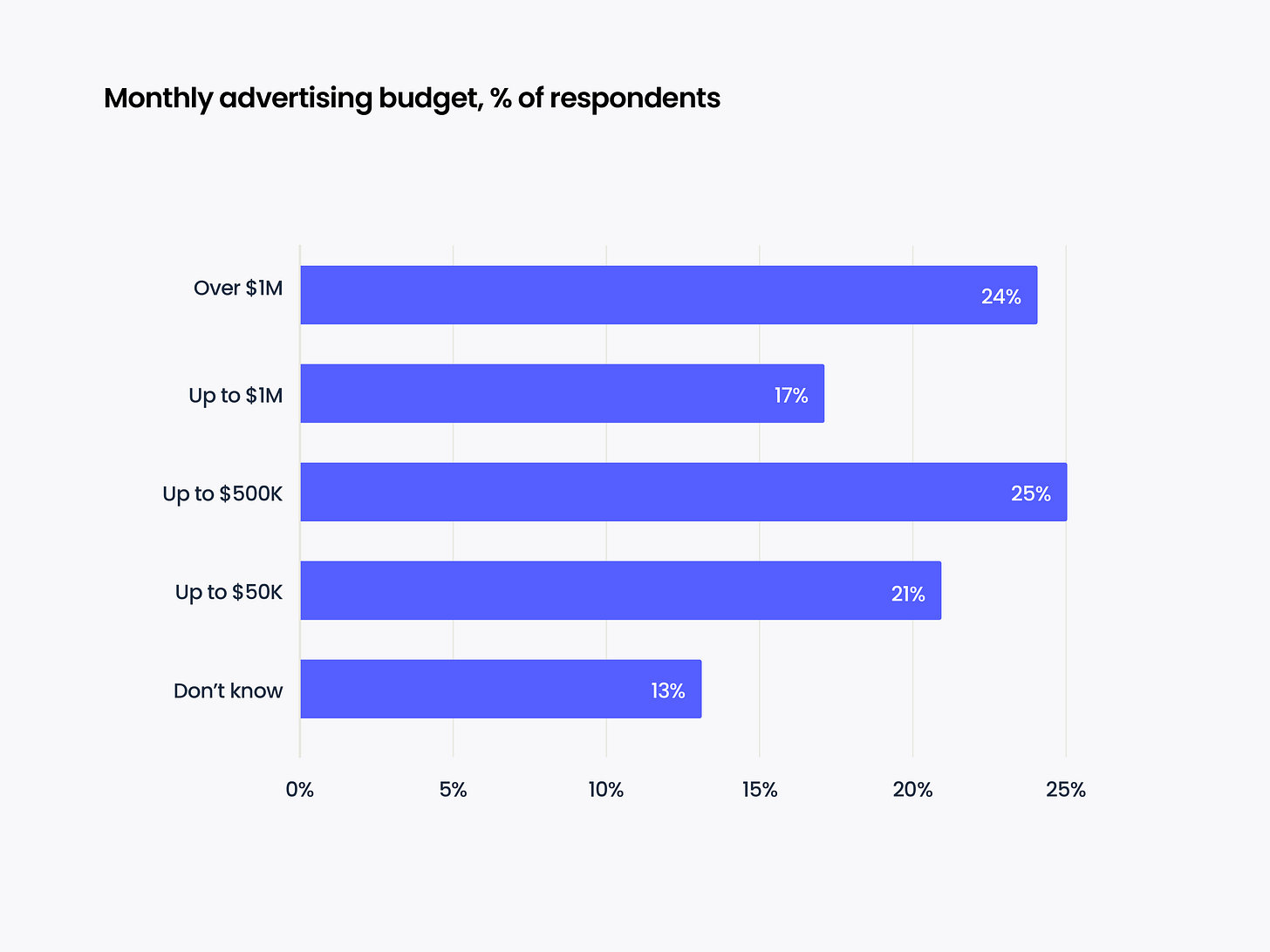

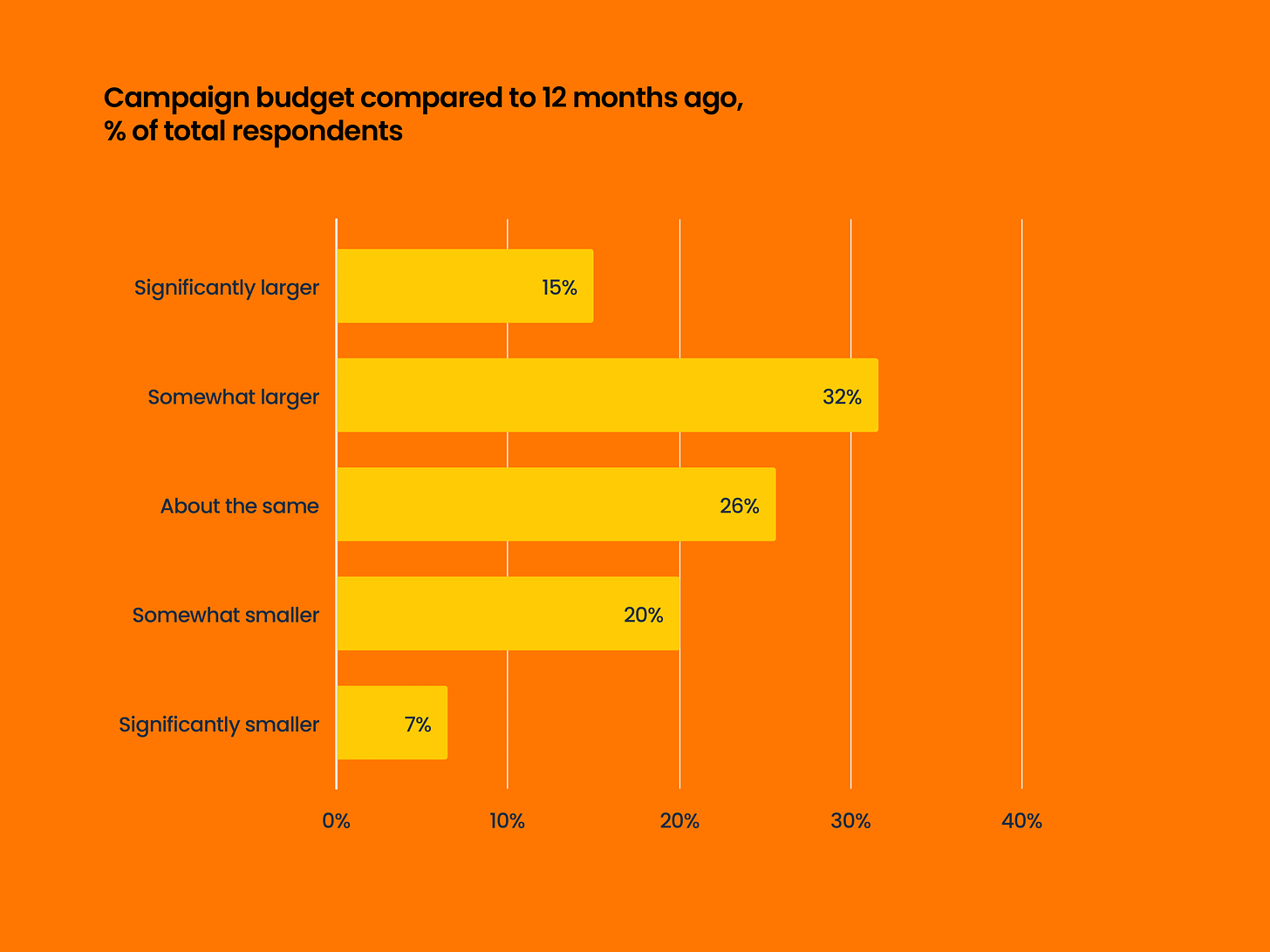

Liftoff surveyed companies of different sizes – 24% of respondents operate marketing budgets of more than $1 million monthly. 63% have a budget less than this amount.

-

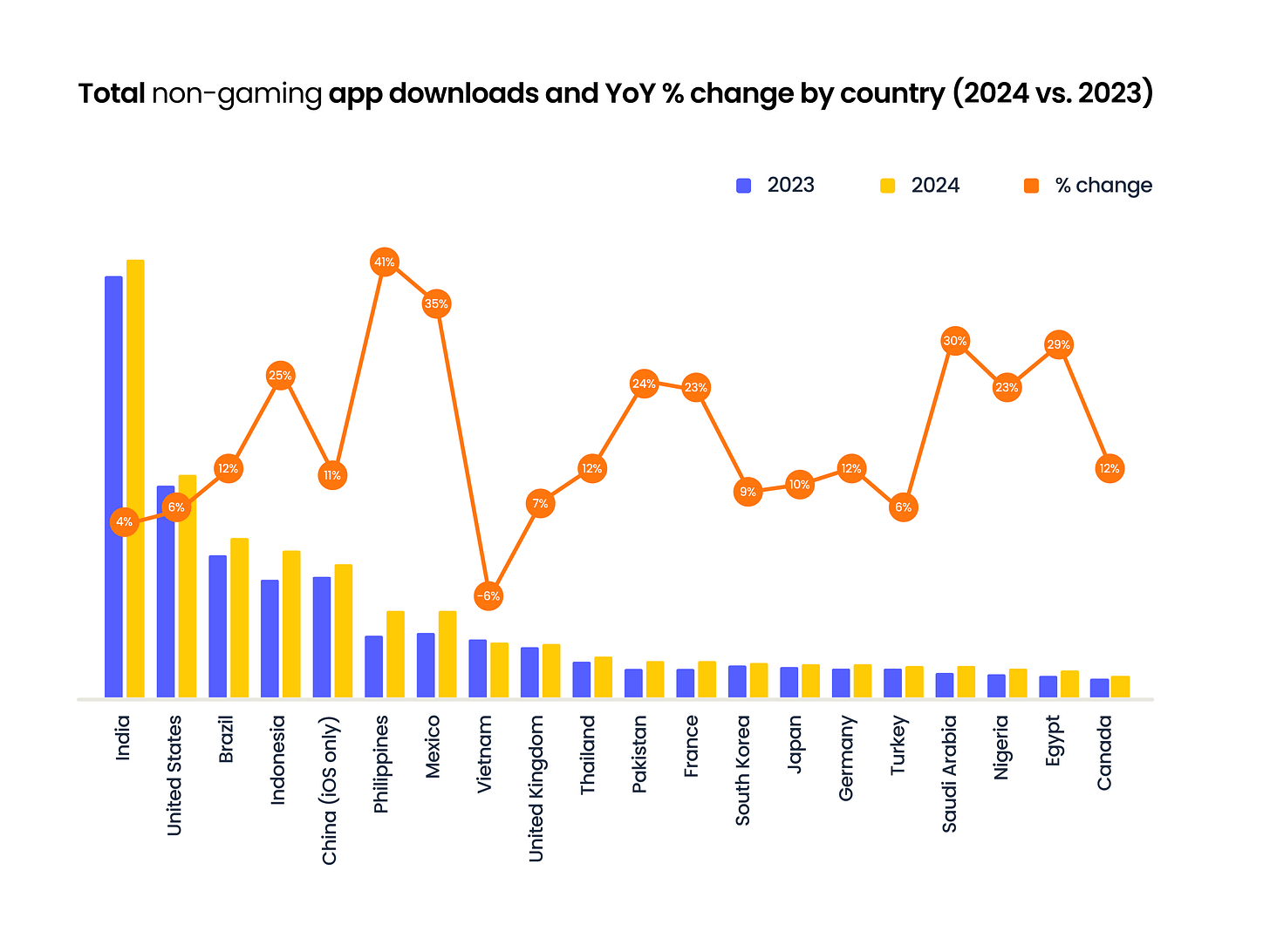

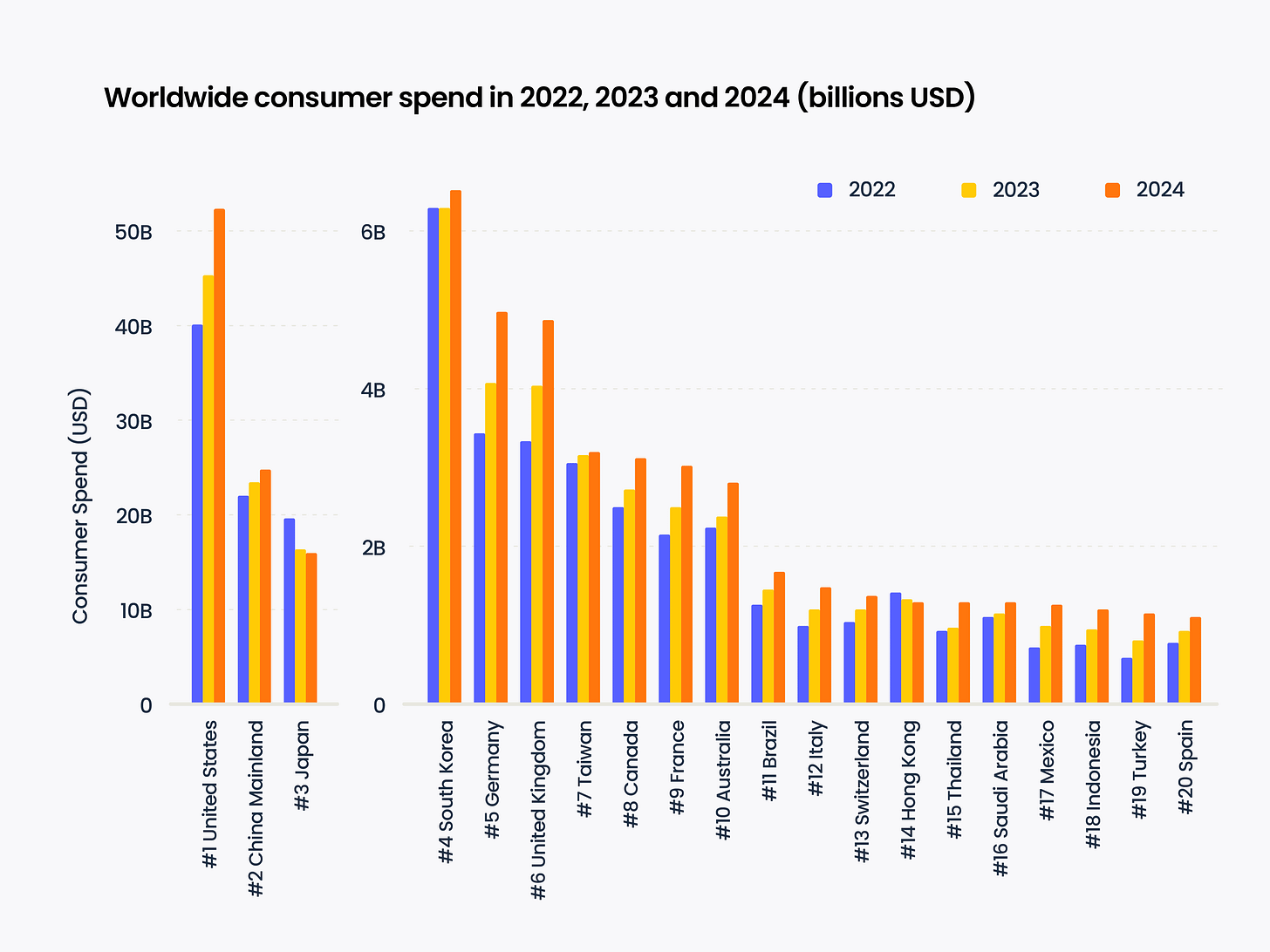

The USA, China, Germany, and the UK are the main beneficiaries of the growth in user spending on non-gaming apps.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

-

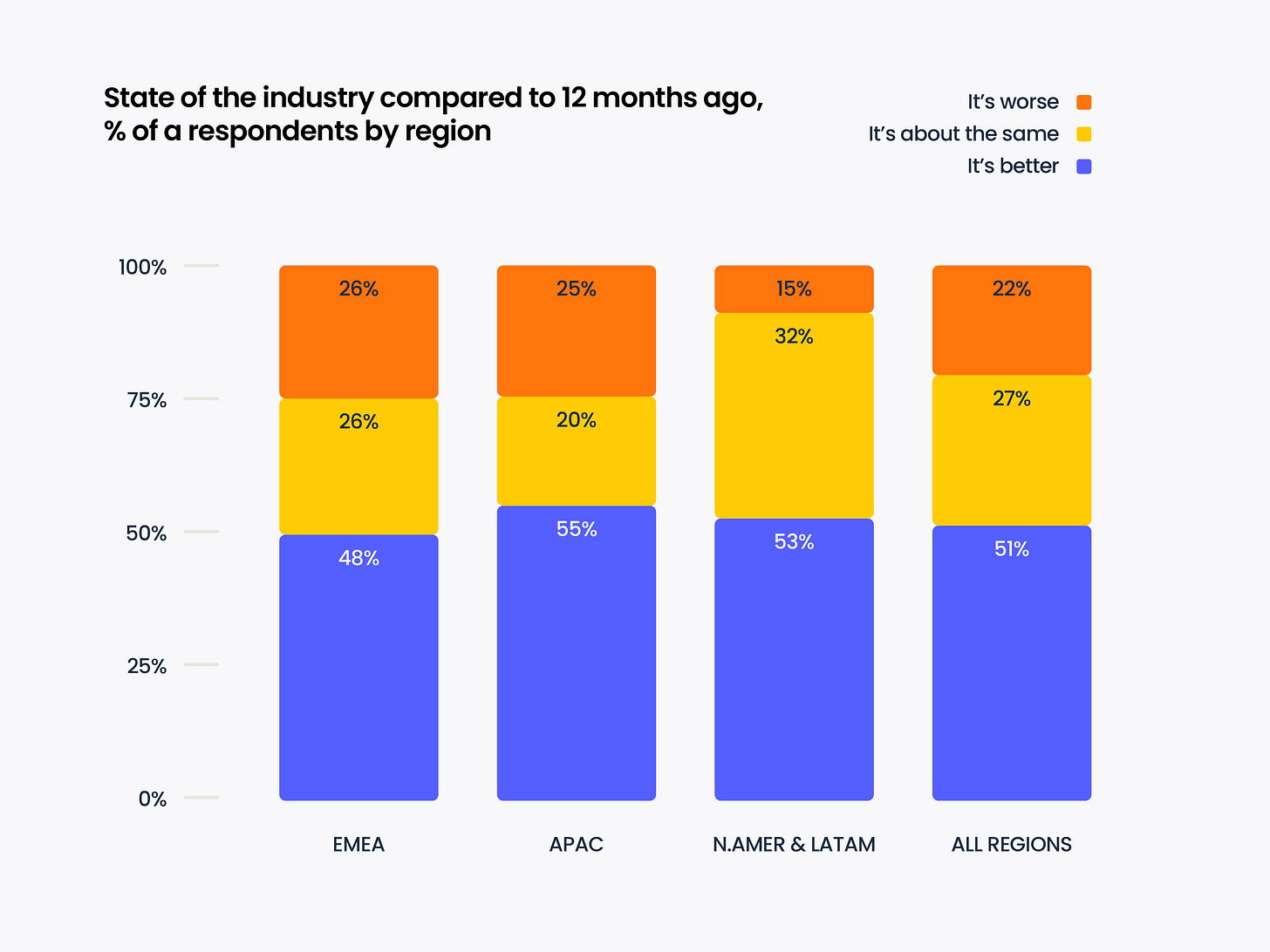

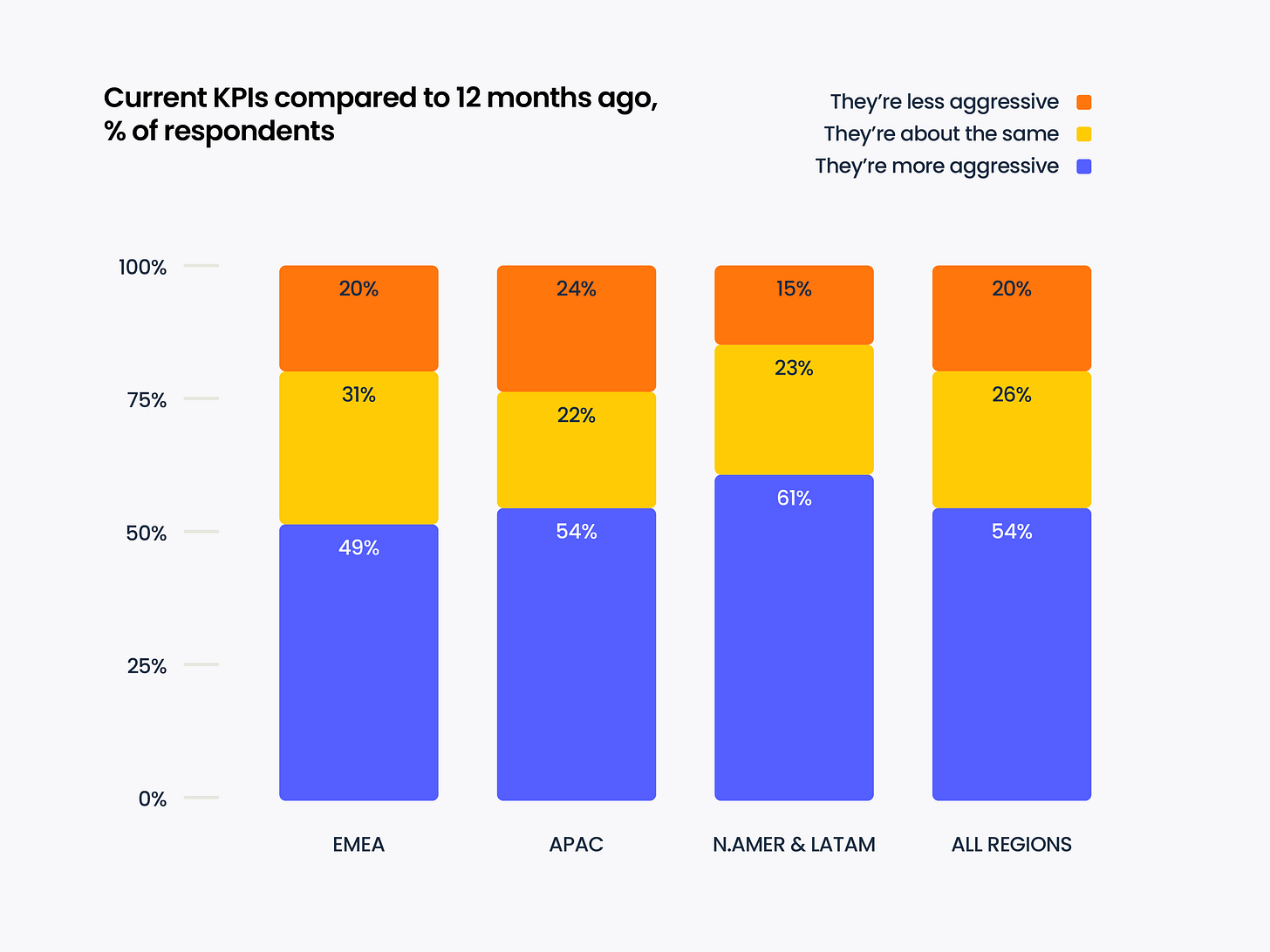

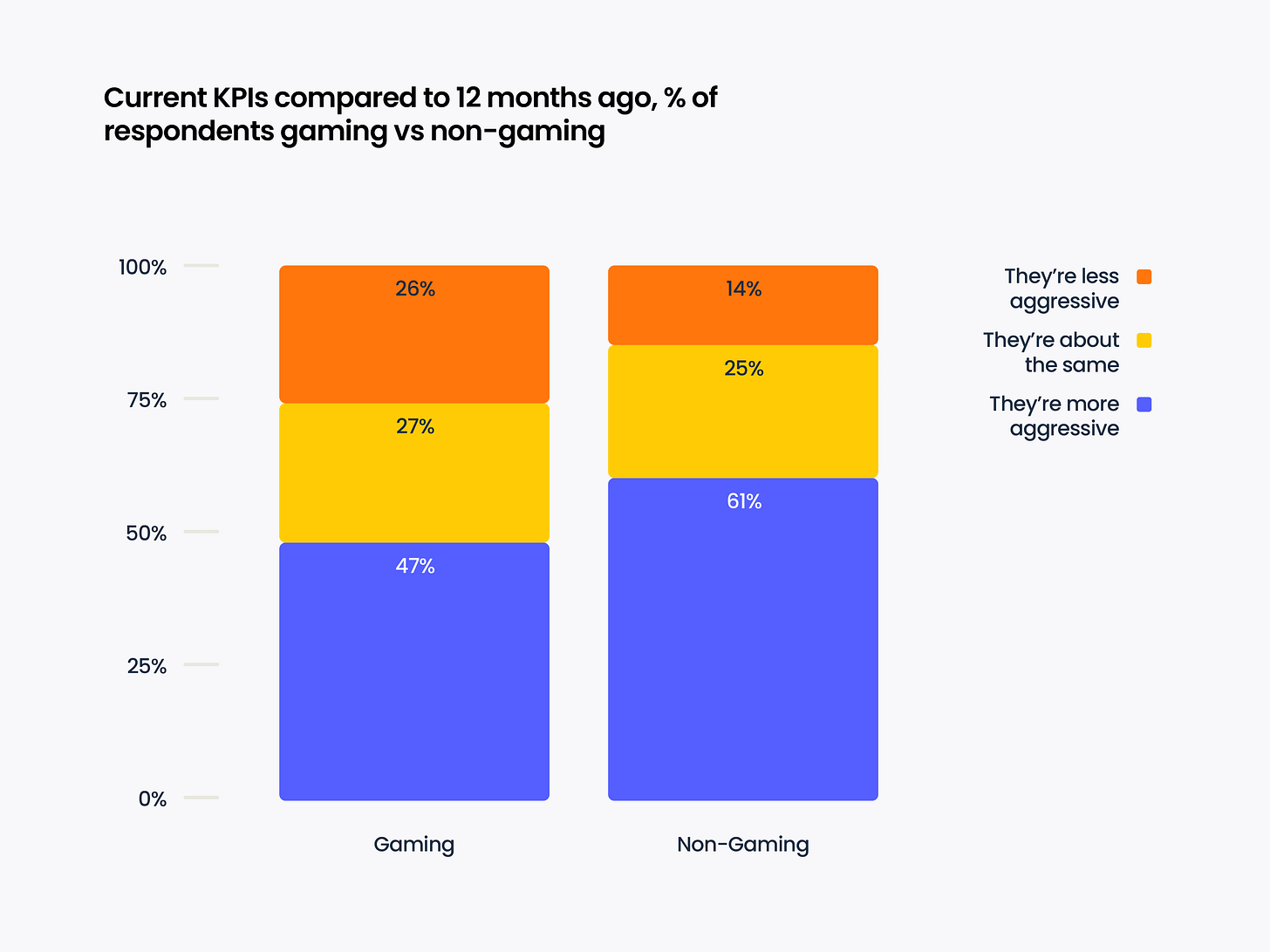

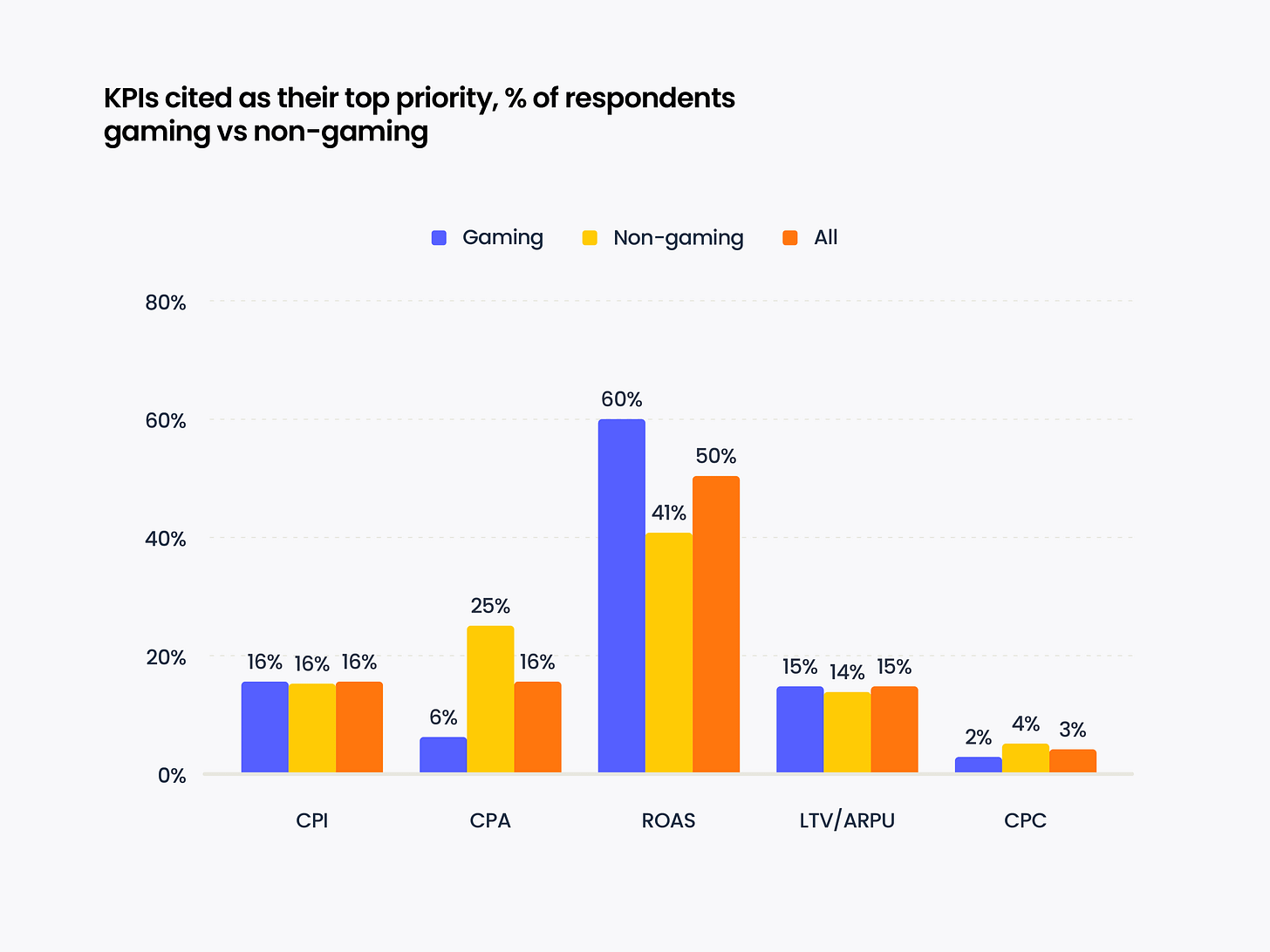

Interestingly, despite the growth of the non-gaming segment, its representatives more often report stricter KPIs.

-

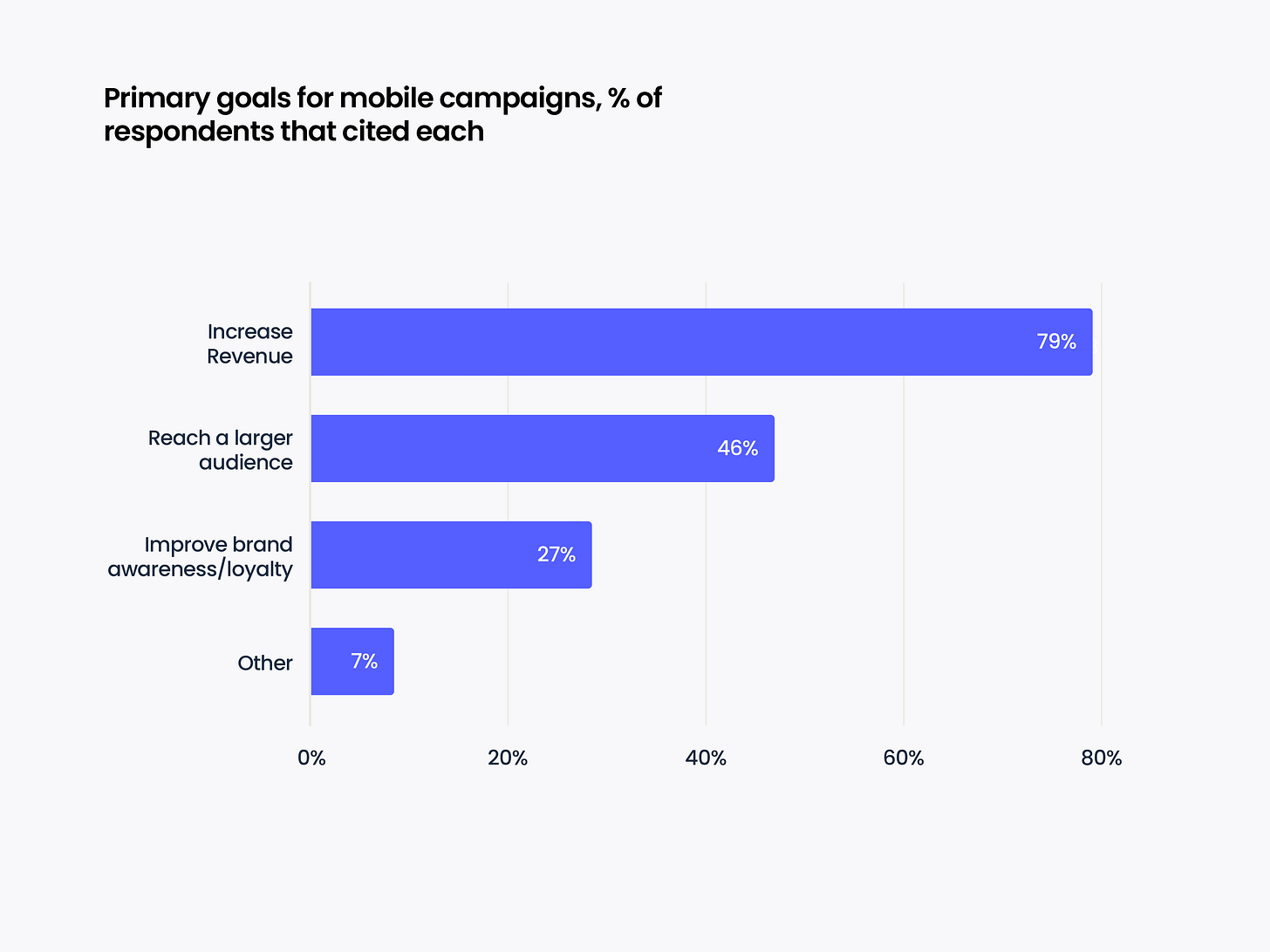

When it comes to KPIs, most game developers (60%) focus on ROAS. They also set CPI (16%), LTV/ARPU (15%), CPA (6%), and CPC (2%) as KPIs. Among non-gaming marketers, CPA KPIs are set much more often (4 times more often).

-

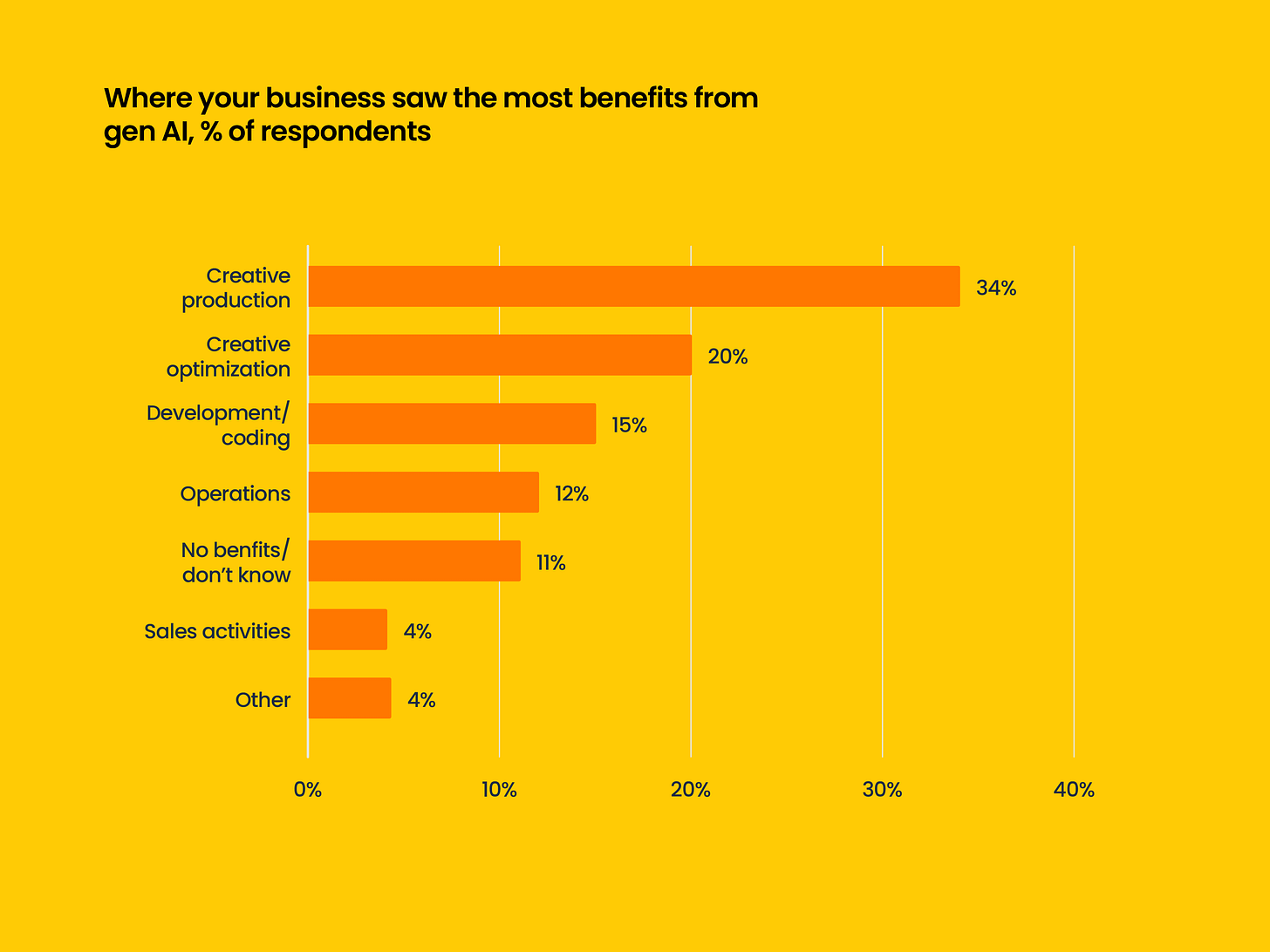

Most respondents see the benefit of AI in creative production. 34% use AI for creative production, 20% use it for creative optimization. AI is less involved in code writing, operational work, and sales.

-

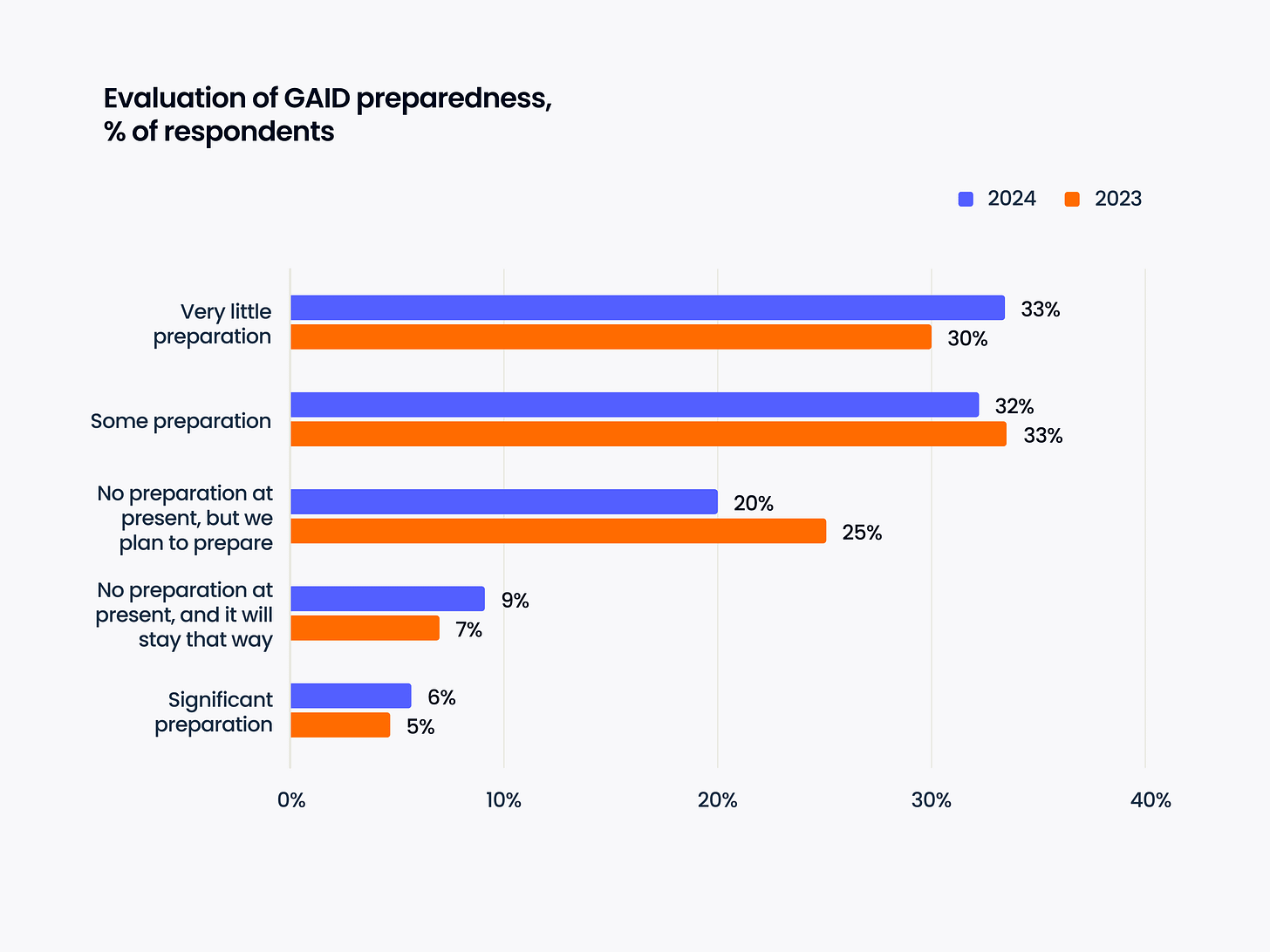

It cannot be said that the market is ready for GAID. Only 6% have prepared, and 32% of the market has done some preparatory work. The majority has not yet prepared for changes from Google. Among the respondents, companies with marketing budgets exceeding $1 million are more prepared for the changes.

-

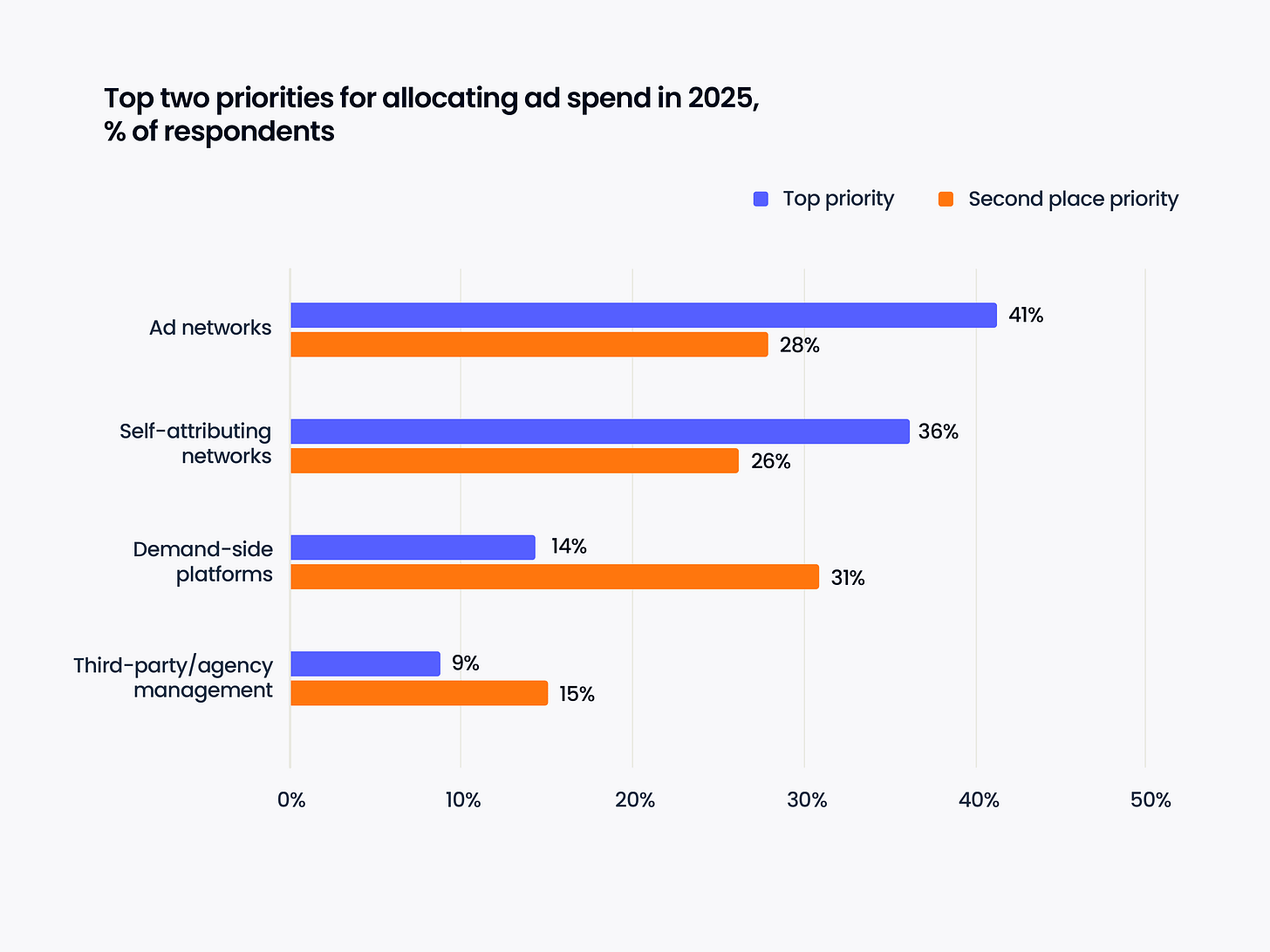

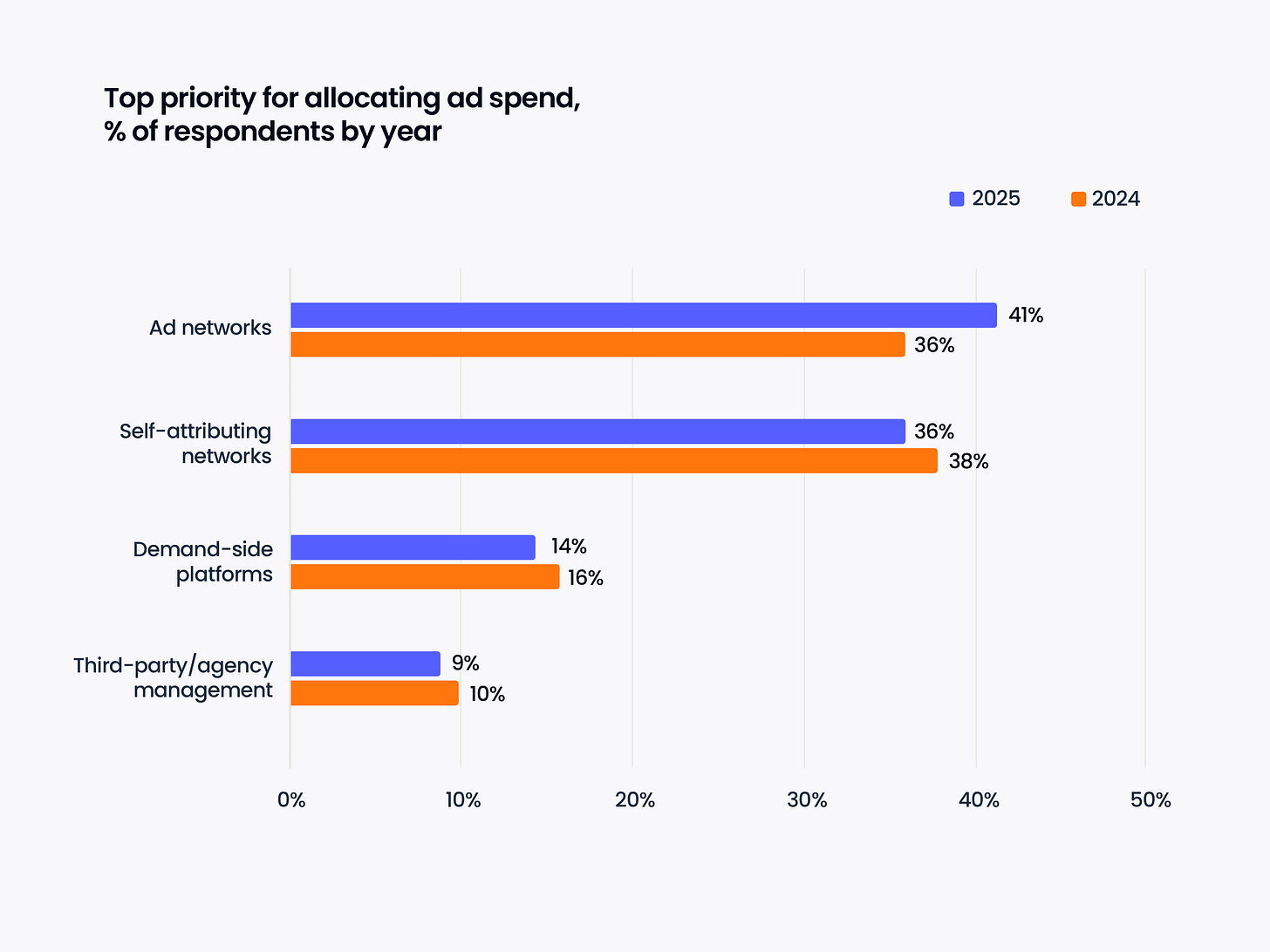

Most spending is planned in advertising networks (priority for 41% of respondents) and SAN (Self-Attributed Network – such as TikTok, Google Ads and others, priority for 36%).

-

However, compared to 2024, the popularity of advertising networks has increased, while all other advertising channels have slightly decreased.

-

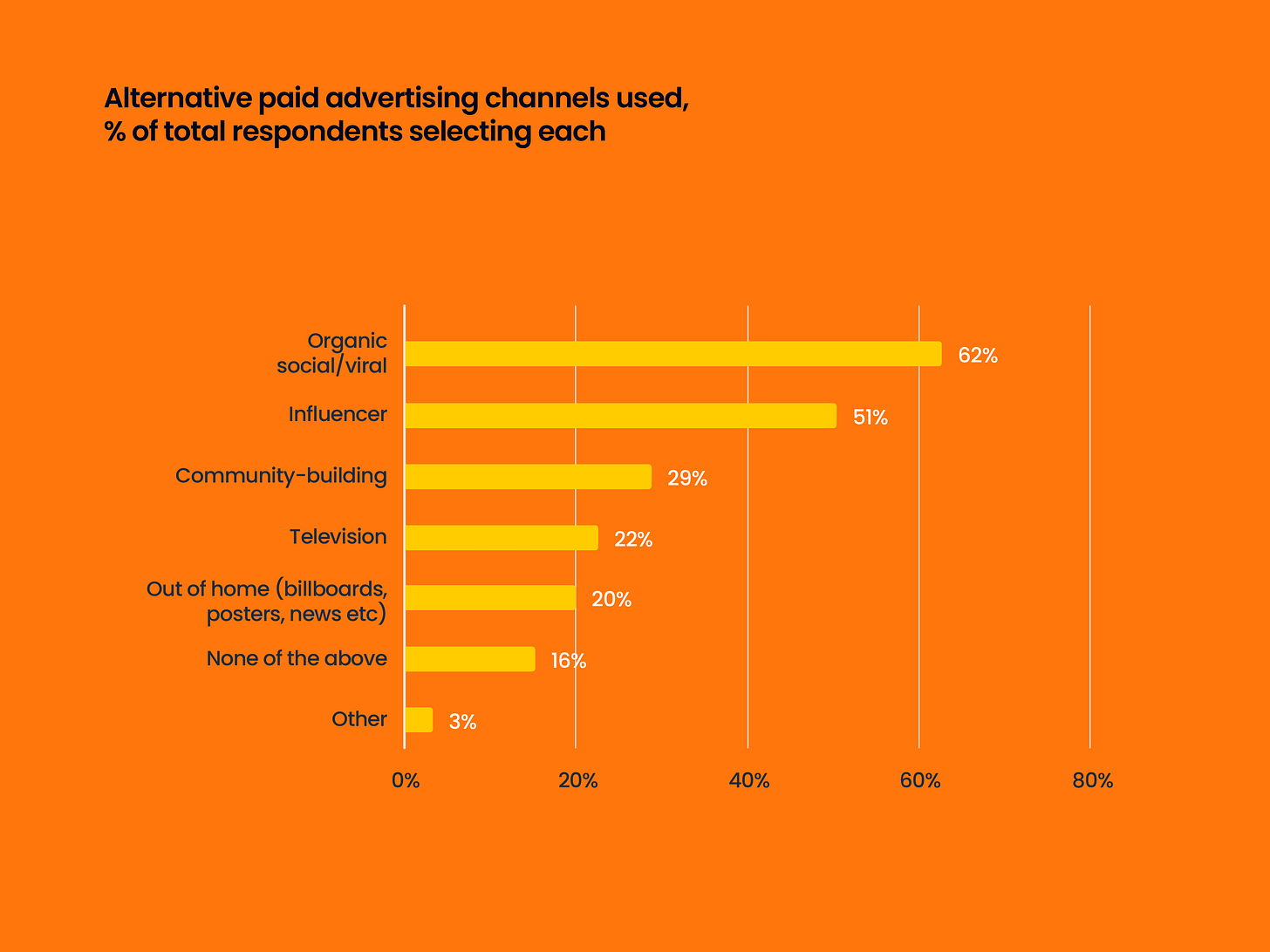

Companies are also interested in investing in the development of organic/viral traffic (62%), influencer marketing (51%), and community building (29%).

-

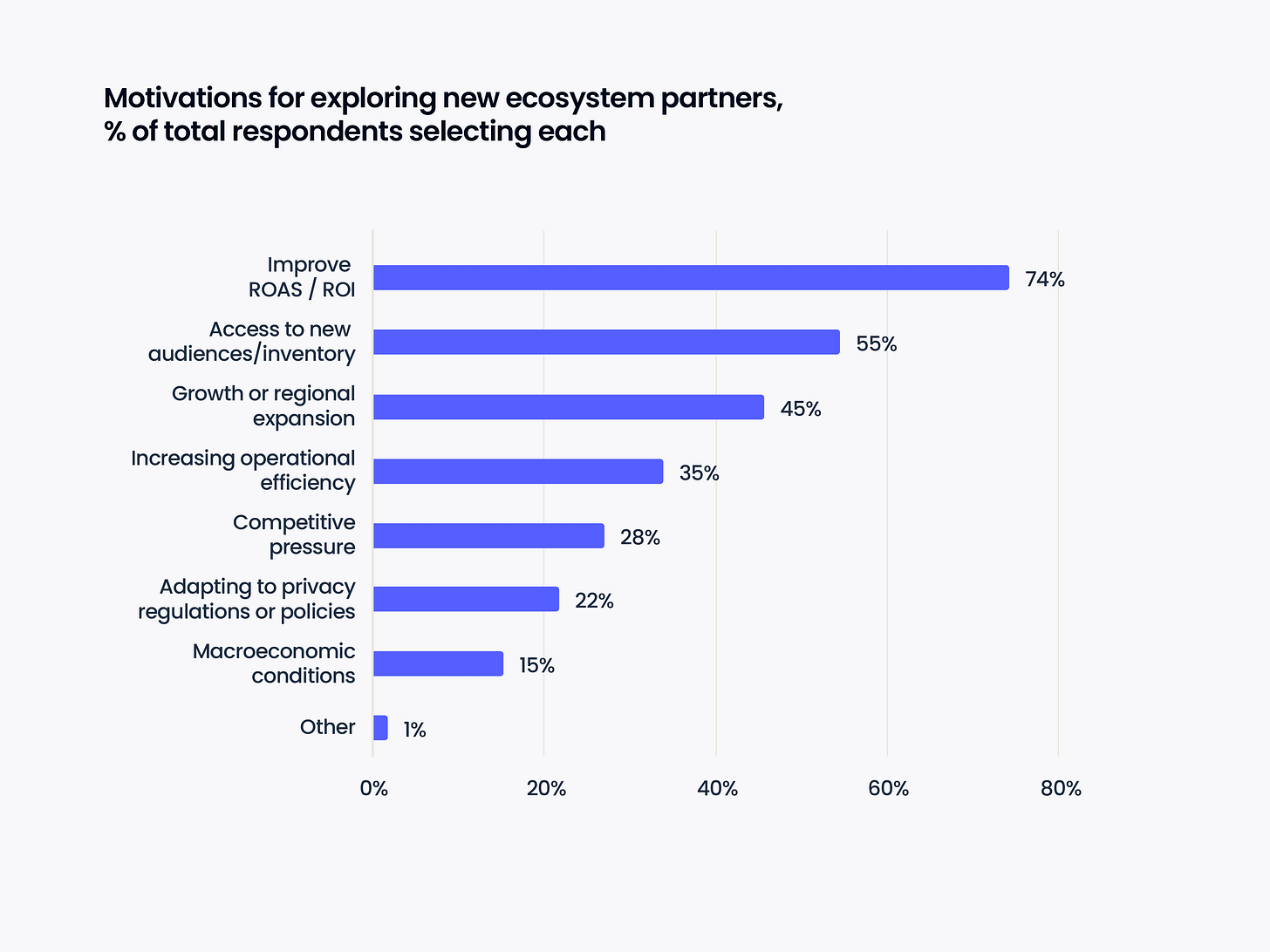

Improving ROAS/ROI, access to new audiences and inventory, growth in new regions are the main factors when working with new partners.