My top 10 things to watch Wednesday, Oct. 8 1. Nvidia CEO Jensen Huang told Investing Club members that Oracle’s cloud business renting Nvidia chips to customers will “be wonderfully profitable” over the life of the AI system. He was responding to a media report that said Oracle was seeing thin margins on the chips it buys, which hit the stock yesterday. 2. AI cloud provider CoreWeave is going to make a lot of money on its older Nvidia chips because they still power a huge amount of data and don’t get aged out contrary to what many think. That’s directly opposed to what the current wisdom says. A dagger in the heart of the CoreWeave bears. 3. Nvidia is investing $2 billion into Elon Musk’s startup xAI, part of a larger $20 billion funding round, Bloomberg News reported . The money will help xAI buy Nvidia chips, but I think Nvidia’s involvement, in particular, will make investing sense. If you call this xAI investment a circular deal, remember that Nvidia invested in OpenAI and that company immediately turned around and inked a chip-buying deal with rival AMD. 4. Melius Research stressed that Club name Broadcom will be just fine after questions were raised following OpenAI’s chip deals with AMD and Nvidia. The analysts, who kept their buy rating, said they don’t believe in the AI bubble talk, adding custom chipmaker Broadcom has at least three years of AI revenue visibility. 5. Gold topped $4,000 an ounce for the first time ever yesterday. In my new book, I talked about how it’s a necessity to own gold because of the U.S. government deficit. I’ll be talking with the CEO of the best gold stock, Agnico Eagle , on “Mad Money” tonight. That stock may still be the least expensive way to buy gold. 6. Barclays raised its price target on Club name BlackRock to $1,310 from $1,210 and kept its buy rating. The analysts cited solid organic growth. They see strength continuing in the third quarter, which is set to be delivered Tuesday morning. Fellow Club holdings Wells Fargo and Goldman Sachs also report that day. 7. Oklo has been moving higher again after last month’s big drop. The nuclear technology company needs a huge amount of cash. Only had only $227 million at the end of June. The stock move makes little sense. So, I am starting what I am calling “froth” watch for Club members. 8. Barclays lowered its Blackstone price target to $171 from $181 and maintained its hold rating on the private equity giant. This is important because people are taking these down, and they are supposed to be what you buy, because they have so many good stakes in things. Or at least we thought. 9. Guggenheim raised its price target on Club name Eli Lilly to $948 from $875 and kept its buy rating. Lilly has been dormant. The analysts see room for upside on Mounjaro, the drugmaker’s GLP-1 for treating Type 2 diabetes. This is a very important Club name. 10. Bernstein cut its McCormick price target to $93 from $102 on worries about margin shortfall from mounting tariff pressure. Bernstein did keep its outperform buy rating. This once supreme safety stock saw PTs lowered at many other Wall Street research firms, which maintained a mix of buys and holds. Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free (See here for a full list of the stocks at Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

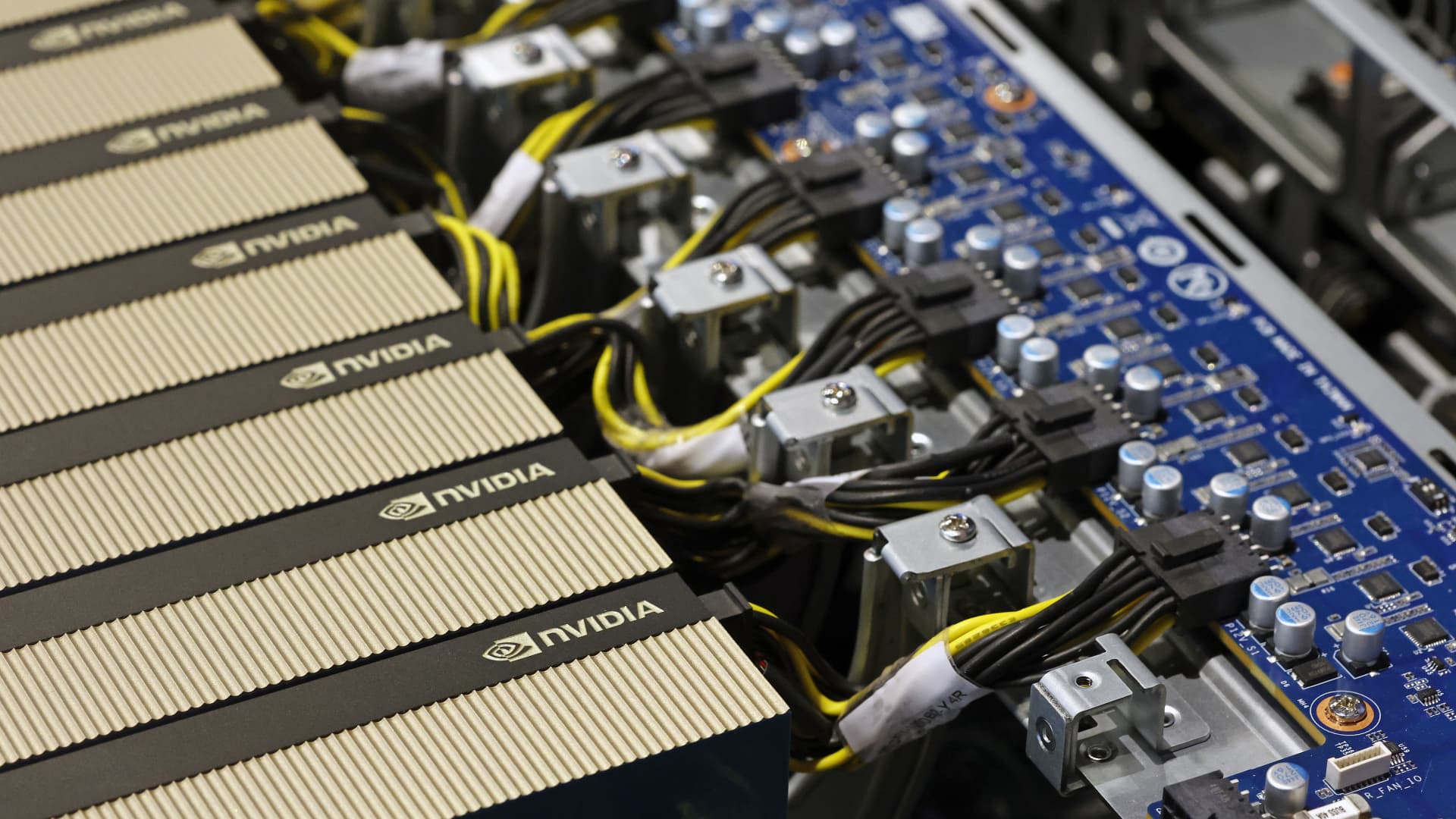

Jim Cramer’s top 10 things to watch in the stock market Wednesday