The stock has almost doubled in 2025.

The stock of Palantir Technologies (PLTR 2.59%) has been on an incredible run over the past few years. It has basically doubled so far in 2025 and is up more than 750% since 2024. This could lead some investors to believe they’ve missed the Palantir train. Still, many stocks have experienced significant growth in a short time, only to continue rising in subsequent years.

Is Palantir one of those businesses that can maintain its incredible performance for years to come? Or has the stock reached a top? Let’s see if investors are too late to the party or right on time.

Image source: Getty Images.

Palantir’s AI platform is seeing widespread adoption

Palantir’s AI-powered data analytics software platform has been in use for a considerable time. It began in the early 2000s as a government-focused software company and quickly expanded to work with both the U.S. government and various international governments.

In the late 2010s, it expanded outside its government footprint and started offering its platform to commercial clients. This expansion has largely been successful, but government revenue still makes up the majority of Palantir’s total.

With the generative AI boom, the stock has received a huge boost as investors have piled into it. Management has also leaned into this revolution with the launch of its Artificial Intelligence Platform (AIP), which enables the integration of large language models (LLMs) and AI agents.

AIP can significantly enhance worker productivity and expand the capabilities of Palantir, making it an increasingly popular platform that continues to grow rapidly.

These catalysts add up to a company that’s growing at a fairly rapid pace. In the first quarter, total revenue increased 39% year over year, and it provided guidance for 38% growth in the second quarter. Management has a history of setting low expectations for itself, allowing it to beat guidance every quarter, and the actual second-quarter growth rate is likely a few percentage points higher.

Some bright spots in the business include the U.S. commercial division, which saw revenue rise an outstanding 71% in the first quarter. The weak spot in results was its international commercial business, but this could easily see a boost as AI adoption becomes more widespread in Europe.

However, there is one red flag to be aware of, and it could signal that new investors may indeed be late to the party.

The price tag is outrageous

As mentioned above, Palantir’s revenue grew 39% year over year in the first quarter, while its stock has increased by over 750% since the start of 2024. Those two numbers are incredibly far apart, indicating that the valuation of the stock has risen dramatically compared to what its business is achieving.

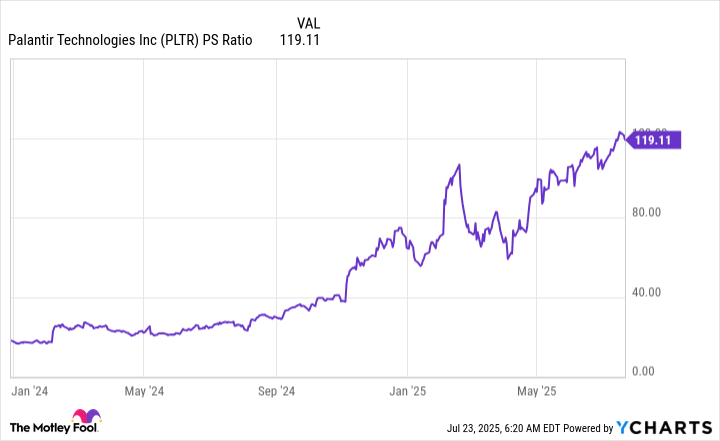

After looking at the price-to-sales ratio (P/S), this hypothesis is confirmed.

PLTR PS Ratio, data by YCharts.

At nearly 120 times sales, the stock is almost unimaginably expensive. Most software stocks trade for 10 to 20 times sales, with the most expensive reaching 30 times sales. Palantir’s stock is at least four times as expensive, yet the company isn’t producing growth numbers that are that impressive considering the price tag.

For the stock to return to a price tag of 30 times sales — very expensive but still far more reasonable — its trailing-12-month revenue would need to be $11.7 billion. For Palantir to reach that revenue in three years, it would need to deliver a 56% compound annual growth rate (CAGR), far higher than its current pace.

So, there is at least three to four years of growth already baked into the stock price, which doesn’t bode well for new investors. As a result, I think they should consider finding another AI stock to invest in, as Palantir’s price has risen too far, too fast.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.