In a survey conducted for BoF and McKinsey’s The State of Fashion 2025 report, fashion executives identified consumer spending appetite as their top risk for 2025 — a concern driven by today’s macroeconomic climate. Indeed, shoppers across income levels have traded down in their purchases — changing the types or quantities of products they buy in pursuit of better value.

This trend in behaviour is a key contributor to the ongoing challenges facing the global luxury e-commerce market today; businesses like LuisaViaRoma and Ssense were the latest to file for bankruptcy protection in August 2025 as they sought an overhaul of operations.

However, for luxury fashion and beauty brands, expanding their reach and broadening their consumer bases still requires diversifying retail channels and forging partnerships with wholesalers and multi-brand platforms. The challenge lies in identifying where luxury consumers are shopping today and how best to meet their evolving expectations.

Amazon entered this space with Luxury Stores at Amazon in the US in 2020 – followed by the EU launch in 2022. Today, Amazon Luxury in the US features labels such as Dolce & Gabbana, Stella McCartney, Balmain, Oscar de la Renta, Fear of God, Giambattista Valli, Rebecca Vallance, Irene Forte, Rodarte, and Dr. Barbara Sturm. The store illustrates how luxury brands are experimenting with new digital avenues to reach a wider audience of consumers, who increasingly prioritise reliable and convenient paths-to-purchase.

Earlier this year, when BoF Insights and Amazon Fashion & Sports surveyed EU5 customers (UK, Germany, France, Italy and Spain), what mattered most to them when shopping for fashion online was practical benefits like confidence in the size and fit of products and free returns. Among the frequent fashion shoppers surveyed (those who purchased fashion online more than five times in the last 12 months), 23 percent have changed their previous habits to now favour large, well-known retailers for their dependability and convenient services.

Amazon Luxury is looking to build upon the success of Amazon, which works with a roster of notable mainstream fashion and sports brands and retailers like Nike, Levi’s and Coach, leveraging well-known and trusted Amazon experience for luxury shoppers. The store offers a curated assortment of designer brands and streamlined product pages without ratings or reviews. Luxury partners can also tap into Amazon’s retail marketing networks, creator partnerships and advertising products.

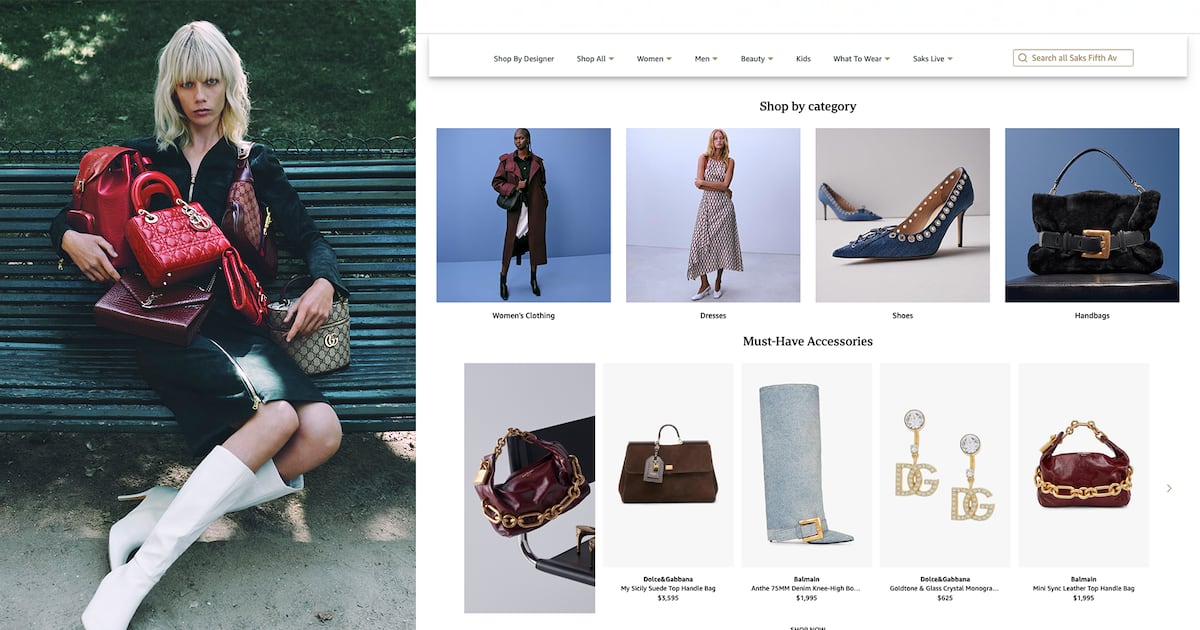

Last year, Saks also joined forces with Amazon Luxury Stores to debut a “shop-in-shop” feature. Hosted on Amazon.com, this curated storefront allowed Saks to retain full control over merchandise while offering customers the speed and convenience they expect from Amazon. The move reflects a broader trend of multi-brand platforms experimenting with new ways to connect new and existing luxury consumers with discovery and inspiration.

After all, multi-brand retailers were cited in the BoF Insights x Amazon Fashion & Sports survey as the leading online destination for fashion discovery, with 39 percent of EU5 customers citing multi-brand websites as their primary source of inspiration.

Brands and retailers seeking to diversify their consumer base across generations will also find the “Silver Generation” — those aged over 50 — to be active users of multi-brand platforms. According to The State of Fashion 2025, they show a clear preference for them, at a rate 17 percentage points above the EU average. With those aged over 55 accounting for 72 percent of total US household wealth, this cohort presents a new avenue of untapped potential for luxury brands.

Now, BoF sits down with Jenny Freshwater, vice president of Amazon Fashion and Fitness, to learn more about why and how Amazon is expanding into luxury, its aspirations to provide a new strategic channel for luxury businesses and how it collaborates with brands to strengthen their broader retail strategies and presence on its stores.

What makes Amazon a desirable platform for luxury brands today?

Launching in Amazon stores gives brands access to the vast Amazon customer base. Our consumer shops with convenience in mind, but we now also provide them with a curated, elevated storefront — to add to the luxury experience.

For some of our customers, we are offering their first luxury shopping experience. They may be more used to shopping contemporary brands on Amazon, like Michael Kors, Coach or Kate Spade. But they’re also interested in exploring high-end luxury and we allow for that discovery and the transition into luxury for special occasion investment pieces or for fun. And of course, we offer the elevated shopping experience that returning luxury shoppers expect.

We look at luxury as a place for experimentation, so we can evolve for what that luxury customer might want.

It is where all luxury brands — from emerging designers like Kate Barton to more legacy fashion houses such as Dolce & Gabbana or Oscar de la Renta — can showcase their unique identity and voice. We see Amazon as an extension of all the other digital and physical channels that those brands may already have or participate in, to complement their existing retail strategies with storytelling to Amazon customers.

How can luxury brands leverage the wider Amazon ecosystem?

When brands come to Amazon Luxury, they get full access to everything Amazon has to offer: marketing, streaming through Amazon Live, opportunities with Prime Video and more.

Take Prime Video: brands can show up on customers’ TV screens by dressing talent or featuring in ads. We also have live sports broadcasts — where tunnel walks and brand presence have become common. Outside of our core retail offering, Amazon can support brands in driving traffic and offering experiences that are unique to Amazon.

The Amazon Influencer Program is one of the world’s largest affiliate programmes, and we work with some of the biggest names in the game. At the high end, we have influencers that are driving millions in sales each month. Influencers are using their Amazon digital storefronts and unique audiences to tell each brand’s story. That can look like a content creator buying a product, loving it and sharing that with their audiences, but we also facilitate brands working with specific content creators on telling their story together.

We recently hosted a weekend-long celebration in the Hamptons with Saks, so we’re engaging in real-life experiences with brands — for consumers and content creators to attend.

How are you catering to Amazon customers’ behaviour through the luxury offering?

We know what our customers are looking for in Amazon stores and what they expect from luxury — an elevated shopping experience, with a highly curated selection of well-established and emerging brands. In effect, we are embracing their existing shopping behaviour.

We strive to make discovering new and emerging brands simple and convenient for customers. We want to offer every fashion customer the labels that they love. Our driving motivation today remains the same as when we launched in 2020 — focused on expanding our selection of brands to meet the Amazon customer expectations.

Some of our customers also want to see more parity across the core Amazon shopping experience and luxury, so we’re taking that feedback on board. We’re constantly testing new ways to elevate the shopping experience for our customers and we look at luxury as a place for experimentation, so we can continue to evolve for what that luxury customer might want.

Which luxury brands tend to perform well on Amazon?

It’s the brands that have a robust selection, those that find engaging ways to tell their brand story on Amazon Luxury, that resonate well with our customers.

One of the first brands that launched with us is Oscar de la Renta Their collections have consistently resonated with our customers. They have streamed runway shows on Amazon Live, participated in editorial shoots, worked with our luxury content creators, and constantly invest in their Amazon Luxury brand store, which is not only beautiful but looks authentic to their brand.

The Saks partnership on Amazon also exemplifies this. At launch we were able to give our customers a digital experience of the iconic windows of Saks on Fifth Avenue at their flagship store — something unique to their brand. We blended Saks’ expertise with our convenience and ease, offering brands another option to reach new customers on Amazon Luxury.

What are some of the new technical features brands can benefit from on Amazon?

We are integrating conversational AI and virtual try-on features for both core and luxury shopping experiences. Everybody wants the product ordered online to fit when it arrives, so we are investing in size and fit, so that our customer doesn’t need to enter the return cycle. That is consistent across core and luxury — you want it to fit, whether it’s a luxury item or not.

In relation to conversational AI features, we have developed Rufus — Amazon’s generative AI-powered shopping assistant. For example, if you wanted to type in “luxury gifts for your mum”, Rufus would intuitively ask the next follow-up questions like, “What brand does your mom gravitate to?” or “What’s your budget?”, which makes it easier to home in on those results. It is great for customers to find the products and the brands that they’re looking for — and maybe even discover new brands that they didn’t know existed on Amazon.

We have powerful tools we use to protect brands and our customers including Brand Registry, which gives brands the ability to grow their brand with Amazon while better protecting their brand and intellectual property rights. We also have Project Zero, which offers brands trademark protection and allows them to directly remove counterfeit listings of their products from our store.

Amazon’s automated technology and AI scans billions of attempted changes to product detail pages daily for signs of potential abuse, including the creation of new listings and changes to existing listings. Amazon’s proactive controls blocked more than 99 percent of suspected infringing listings before a brand had to find and report them.

Luxury growth today has become more complex. What are the core challenges facing brands?

Luxury brands, multi-brand retailers, department stores and brick-and-mortar, all must figure out how to reach customers who are practising more intentional purchase behaviour, while also shopping in a very crowded environment.

For example, we are seeing customers shopping much earlier for holiday gift items this year, which signals to us that customers are being very intentional about their purchases right now. Our selection from Rebag is also performing well, as it is aligning with some of our customers’ preferences for pre-loved luxury items.

We are seeing customers shopping much earlier for holiday gift items this year, which signals to us that customers are being very intentional about their purchases right now.

Brands need to offer engaging, creative, personalised experiences, and we need to meet customers where they are, where their passions are and inspire or entertain them. In general, we must be adaptable at this time.

How does Amazon support luxury brands infrastructurally?

We help these brands grow incrementally — they can leverage us for a variety of infrastructural support, such as fulfilment. They can lean on us for convenience, to meet consumer expectations around speed, and then, of course, scale.

We have a number of options around the fulfilment space. Brands can sell with us — we buy the inventory and we sell it as Amazon. They can also put their inventory in our fulfilment network, so we take care of all the fulfilment — or you can buy on Amazon and be fulfilled out of whatever the brand specifically uses for fulfilment.

We recognise that every brand may be in a different place and for different businesses, one of those models is most appealing. We allow customer selection, no matter the fulfilment technology.

What are you excited about for the near to medium-term at Amazon Luxury?

For Q4, we are leaning into how customers engage with more visual storytelling and more personalisation. For instance, different customers will like very different colour palettes or have different levels of interest in what’s trending. We recognise that we can improve our user experience through design, making it easier and more convenient for customers to shop. We’re testing out some visual styling assistance too.

I’m excited with the progress we’ve made in 2025 — we have increased our luxury selection just this year by 75 percent. We’re excited about what’s coming — today, you will largely see women’s fashion, although we do have men and a small amount of kids. But we’re excited about expanding into luxury beauty, jewellery and men’s. We see a huge potential in home, in kids, and we’re just getting started.

New style inspiration using AI, supporting our brands with AI-backed styling advice for our customers and some bespoke shopping experiences are all coming. And then, of course, international expansion. We are continuing to grow our luxury selection worldwide. It’s an exciting time at Amazon Luxury Stores.

This is a sponsored feature paid for by Amazon as part of a BoF partnership.