If you want to frighten yourself this Halloween, hole up in your home and rent scary movies.

If you want to terrify yourself about investing, hole up some place and read Andrew Ross Sorkin’s book “1929.”

These two experiences are similar, though: The movies are not real, and we are not on our way to a depression. But you can take some precautions with your investing.

Protect yourself by raising a little more cash. High-yield savings accounts are paying solid interest rates. If your savings are up to the FDIC limits, even a 1930s bank run won’t affect you.

Pick up some more bonds. In 1929, the Fed was raising interest rates to curb the massive speculative borrowing to buy stocks. Our current Fed has recently lowered rates to stimulate the job market. You can buy U.S. Treasuries or shorter-term Treasury bond funds which provide both yield and a state income tax exemption. The longer the bond maturity, the more susceptible it is to interest rates. Keeping maturities shorter means fewer price fluctuations.

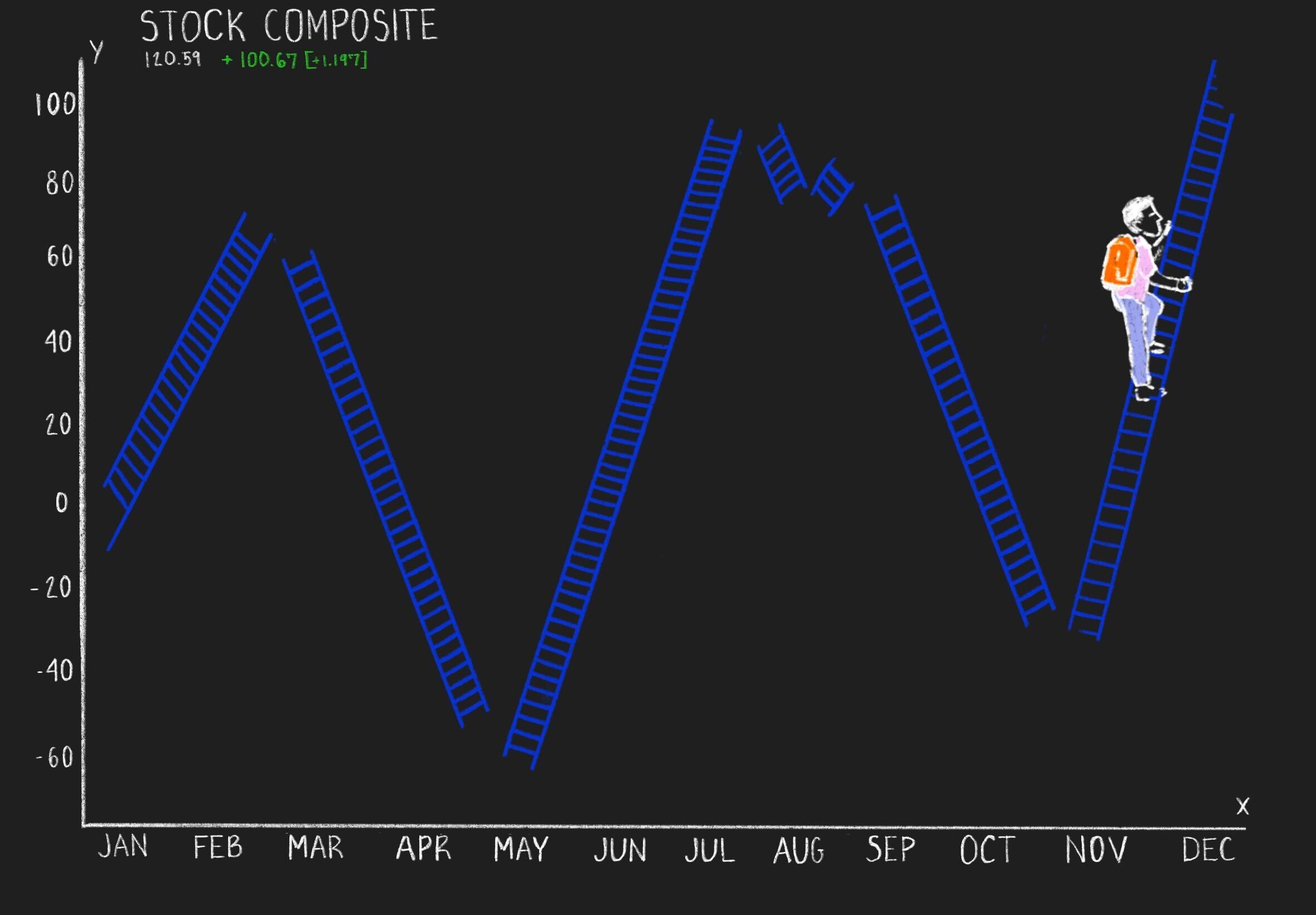

Consider protecting some of your stock or exchange-traded fund positions by using trailing stops. A trailing stop triggers a sale if your stock or ETF falls by a certain percentage. For example, if your stock was trading at $100, and you set a 12% stop, the stock would sell if it fell to $88. If the stock continued to advance, so would the stop (to retain that 12% buffer).

The higher stop does not change if the stock subsequently falls. The stop might not protect you if there is a huge whoosh down, though. If your stock opened 20% down, you would sell at that price.

Allow yourself to pay some taxes. You can use the above strategies in your retirement plans and avoid taxes, but if your investments are in taxable accounts, you might pay some tax. Taxes paid are a certainty, but market adjustments are not. Be willing to pay a little tax to lock in profits, but don’t get too aggressive with your sales.